Dell Technologies (NYSE: DELL) announced via an Aug. 15 press release that it will hold a conference call today, Thursday, Aug. 29, 2024, at 3:30 p.m. CDT / 8:30 p.m. GMT to discuss its fiscal 2025 Q2 financial results. The live audio-only webcast will be accessible to the public on their investor website, with a recorded version available for later viewing.

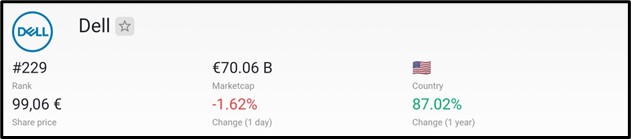

Market Cap

€70.06 billion in market cap places Dell as the 229th most valuable company globally, per August 2024 data from companiesmarketcap.com.

Dividend Information

With a 1.61% dividend yield and an annual dividend of $1.78, Dell’s payout ratio stands at 36.41%, with a quarterly payout frequency. Dividend growth is recorded at 16.43% over two years, and the company offers a buyback yield of 1.18%. The ex-dividend date was July 23, 2024, and overall shareholder yield reaches 2.79%.

Recent Developments At Dell

Here are some of Dell’s latest developments:

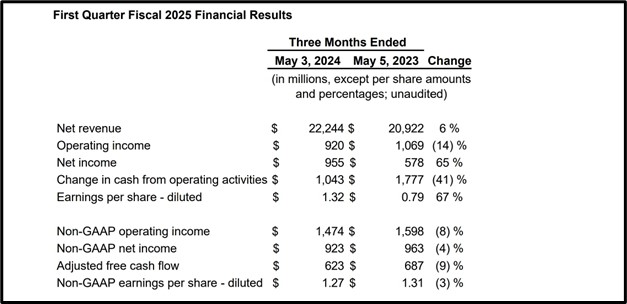

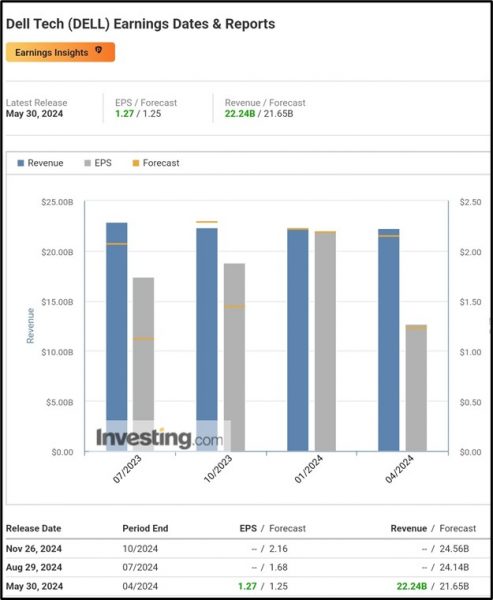

Q1 Earnings Report Recap

Dell’s Q1 FY25 net revenue rose 6% YoY to $22.2B while operating income dropped 14% to $920M.

Net income surged 65% to $955M, with diluted EPS increasing 67% to $1.32.

Cash flow from operations declined 41% to $1.04B; adjusted free cash flow was down 9%.

Non-GAAP operating income fell 8%, and non-GAAP diluted EPS slipped 3% to $1.27.

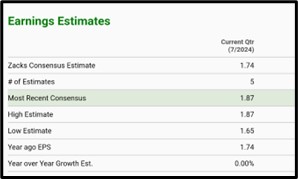

Q2 Earnings Report Analyst Forecast

For the current quarter, the Zacks consensus EPS estimate stands at $1.74, with the most recent consensus at $1.87, and a high estimate matching it. Sales estimates are projected at $24.29B, reflecting a 5.91% YoY growth, with a range between $24.07B and $24.66B. Last year’s sales for the same quarter were $22.93B.

According to Investing.com, Dell projects an EPS of $1.68 and revenue of $24.14B, aligning with market expectations for the upcoming quarter.

Tradingview.com projects Dell’s earnings per share (EPS) to hit $1.71, with revenue estimated at $24.14 billion.

Tradingview.com projects Dell’s earnings per share (EPS) to hit $1.71, with revenue estimated at $24.14 billion.

Technical Analysis

Dell nearing a potential upside breakout from downtrend line at $109.22 on the 4HR chart.

If the breakout is confirmed, target levels could be $124.50 and $136.49.

If the breakout fails, downside targets could be $89.81 and $65.11

Apply Risk Management

Conclusion

Dell Technologies has shown strong recent performance with a 65% increase in net income and a projected Q2 FY25 EPS of $1.68 to $1.87, reflecting continued growth. Despite a drop in operating income and cash flow, future forecasts suggest positive trends with potential revenue reaching $24.14 billion. However, technical analysis indicates a critical point for price movement, with potential targets ranging from $124.50 to $65.11, depending on the breakout’s success.

Source:

https://investors.delltechnologies.com/node/16641/pdf

https://companiesmarketcap.com/eur/dell/marketcap/

https://stockanalysis.com/stocks/dell/dividend/

https://images.app.goo.gl/7rknRrbzHDXAcZ4v6

https://www.zacks.com/stock/quote/DELL/detailed-earning-estimates