Dell Technologies (NYSE: DELL) will release its fiscal year 2025 first-quarter ( FY2025 Q1 ) results today, May 30, 2024, at 3:30 PM CDT.

Dell Technologies (NYSE: DELL) will release its fiscal year 2025 first-quarter ( FY2025 Q1 ) results today, May 30, 2024, at 3:30 PM CDT.

With a market cap of $127.32 billion as of May 2024, Dell ranks as the world’s 114th most valuable company, according to data from companiesmarketcap.com.

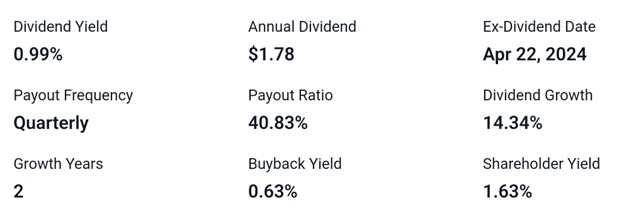

The dividend yield is 0.99%, with an annual dividend of $1.78. The ex-dividend date was April 22, 2024, and dividends are paid quarterly. The payout ratio stands at 40.83%, with a dividend growth of 14.34% over the past 2 years. Additionally, the buyback yield is 0.63%, resulting in a total shareholder yield of 1.63%.

Recent Development At DELL

Here are the latest developments at Dell:

Dell PowerEdge XE9680L Launch:

Dell introduces the PowerEdge XE9680L, featuring AI factory rack-scale architecture and liquid cooling.

Dell Precision Workstations Launch:

On February 26, 2024, Dell launched new Precision workstations to enhance AI capabilities for customers, helping them achieve greater technological and business success.

Dell Technologies World:

Focus on innovation for partners, with updates driven by partner feedback in AI, Dell APEX, storage, and client solutions.

New Machines for a New World:

Highlighting how AI transforms data into unprecedented insights.

Recap of FY24 Q4 Earnings Release of Dell

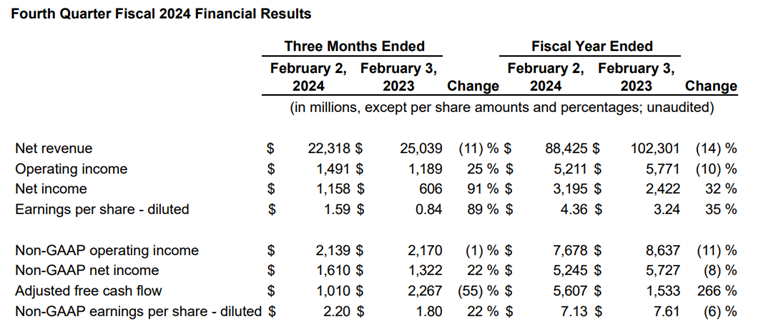

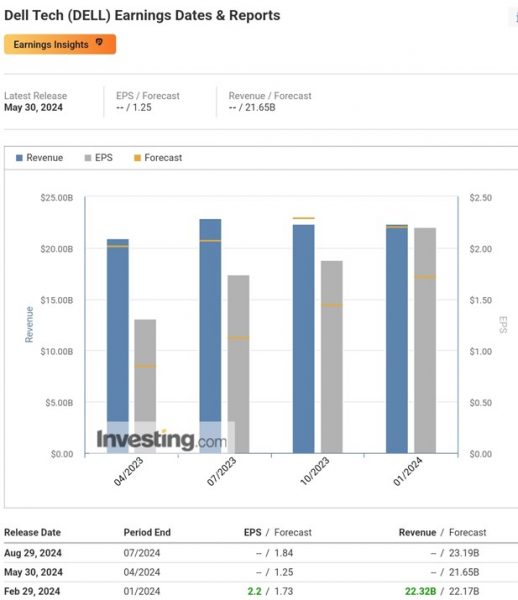

On February 29, 2024, Dell Technologies (NYSE: DELL) disclosed its financial outcomes for the fourth quarter and full fiscal year 2024. The fourth quarter registered revenue of $22.3 billion, with operating income at $1.5 billion and non-GAAP operating income at $2.1 billion, representing a 25% increase and a 1% decrease year over year respectively. Cash flow from operations for the quarter amounted to $1.5 billion. Diluted earnings per share stood at $1.59, and non-GAAP diluted earnings per share at $2.20, marking an 89% and 22% year over year increase respectively.

On February 29, 2024, Dell Technologies (NYSE: DELL) disclosed its financial outcomes for the fourth quarter and full fiscal year 2024. The fourth quarter registered revenue of $22.3 billion, with operating income at $1.5 billion and non-GAAP operating income at $2.1 billion, representing a 25% increase and a 1% decrease year over year respectively. Cash flow from operations for the quarter amounted to $1.5 billion. Diluted earnings per share stood at $1.59, and non-GAAP diluted earnings per share at $2.20, marking an 89% and 22% year over year increase respectively.

For the full fiscal year, revenue totaled $88.4 billion, a 14% decrease from fiscal year 2023. Operating income amounted to $5.2 billion, with non-GAAP operating income at $7.7 billion, down 10% and 11% year over year respectively. Cash flow from operations for the entire year reached $8.7 billion. Full-year diluted earnings per share stood at $4.36, and non-GAAP diluted earnings per share at $7.13, up 35% and down 6% year over year respectively.

Dell ended the fiscal year with cash and investments amounting to $9.0 billion and achieved its core leverage target of 1.5x. It announced a 20% increase in its annual cash dividend to $1.78 per common share, with the first quarterly distribution of $0.445 per common share payable on May 3 to shareholders of record as of April 23.

Yvonne McGill, Chief Financial Officer of Dell Technologies, expressed optimism about fiscal year 2025, citing the generation of $8.7 billion in cash flow from operations during the fiscal year and the return of $7 billion to shareholders since Q1 FY23. This increase in the annual dividend by 20% reflects confidence in the business and its ability to generate strong cash flow.

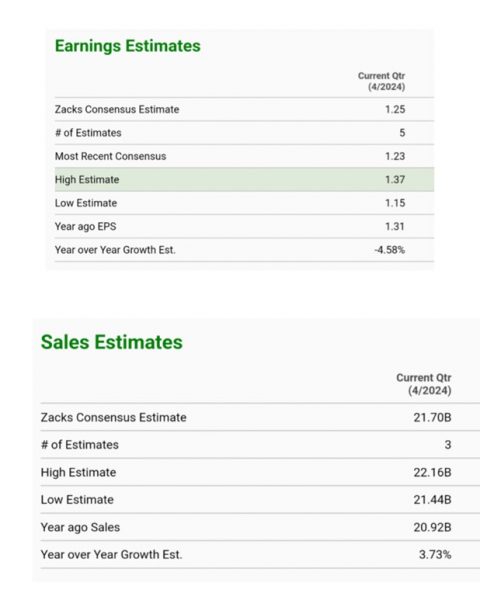

FY2025 Q1 Earnings Analyst Forecast

For the current quarter, the Zacks Consensus Estimate for sales stands at $21.70 billion, based on three estimates ranging from a high of $22.16 billion to a low of $21.44 billion, reflecting a year-over-year growth estimate of 3.73% from last year’s $20.92 billion. On the earnings front, the Zacks Consensus Estimate is $1.25, with five estimates varying between a high of $1.37 and a low of $1.15, and the most recent consensus at $1.23. This represents a year-over-year decline of 4.58% from the previous year’s EPS of $1.31.

According to Investing.com, Dell Technologies (NYSE: DELL) is projected to achieve an earnings per share (EPS) of $1.25 and an expected revenue of $21.65 billion.

According to Tradingview.com, Dell (NYSE: DELL) is projected to achieve an earnings per share (EPS) of $1.27 and an expected revenue of $21.69 billion.

Technical Analysis

From a technical analysis perspective on Dell’s 1-hour chart from Tradingview, the price is in an uptrend and currently hovers around $179.30. The resistance level is at $179.75. If this resistance is breached, the price could potentially rise to $206.77, and further gains are likely if this level is also broken. Conversely, if the price is rejected at resistance, it may decline to $170.66. A break below this support could lead to further downside.

Conclusion

As Dell Technologies prepares to announce its fiscal year 2025 first-quarter results, its strong financial performance and recent innovations position the company well for the future. With a market cap of $127.32 billion, Dell is among the top 114 most valuable companies globally. The company reported impressive Q4 FY24 figures, including $22.3 billion in revenue and $1.5 billion in operating income, and a full-year revenue of $88.4 billion. Dell’s strategic launches, such as the PowerEdge XE9680L and new Precision workstations, highlight its commitment to innovation. Analysts forecast Q1 FY25 revenues around $21.70 billion and earnings per share between $1.25 and $1.27. Technical analysis indicates the stock is in an uptrend, suggesting positive market sentiment. Investors can look forward to continued strong performance and growth potential based on these promising indicators.

Sources :

https://companiesmarketcap.com/dell/marketcap/

https://stockanalysis.com/stocks/dell/dividend/

https://www.dell.com/en-us/blog/the-new-precision-workstations-are-here/

https://www.dell.com/en-us/blog/dell-technologies-world-unleashing-innovation-for-partners/

https://www.dell.com/en-us/blog/new-machines-for-a-new-world/

https://www.zacks.com/stock/quote/DELL/detailed-earning-estimates

https://www.investing.com/equities/dell-inc-earnings

https://www.tradingview.com/symbols/NYSE-DELL/forecast/

https://www.tradingview.com/chart/DELL/VQFd9NIw-DELL-Resistance-Breakout-30-05-2024/