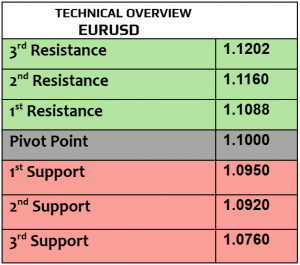

EURUSD

EURUSD traded slightly weaker today at $1.0809 amid tight volatility. This currency pair is unlikely to have stronger volatility before Wednesday with more economic numbers from EZ. In the meantime, weaker rates by ECB were already priced in, not to forget that the demand for USD remained robust. MoM, EURUSD fell by almost -3%, vs 3.5% gains in USD index.

The forecast poll indicated to more than 80% who were bearish, supported by bearish trend index in 1H chart. Price action remained slow, likely to remain between $1.0780 & $1.0840 for now.

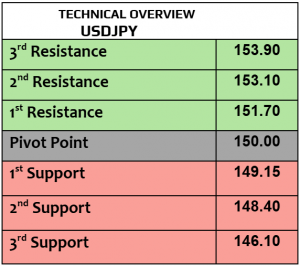

USDJPY

Unemployment in Japan dropped further to 2.4% in September from 2.5% in August, better than the estimates as well. USDJPY fell today by -0.20% to 152.83, waiting for busy week ahead from both, the US & Japan. As the major ruling party lost their parliamentary majority, the political instability is unlikely to happen in a country like Japan, however changing the economic policies (if happens) will have consequences on the Yen.

Price action started falling, targeting 152.50 then 151.75 with almost 40% in bearish bias & only 20% bullish.

GBPUSD

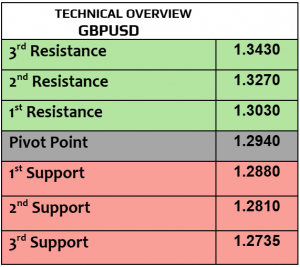

GBPUSD was little changed today at $1.2962. BoE was not in hurry to cut the rates, but BoE governor expressed his concerns about the sticky inflation in many sectors, mainly in services. Consumer credit & mortgage approvals in the UK will be due later today, the markets are likely to focus more on the US numbers that include consumer confidence & housing price index.

The technical bias is not showing much support to markets’ bulls with almost 60% in a bearish attitude. $1.2940 is support, $1.30 is resistance for day-traders.

Gold

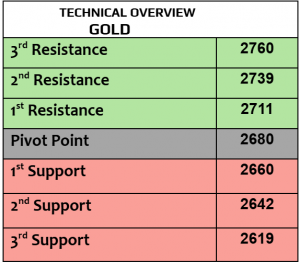

Everyone has an undeniable question: Is the rally in gold going to stop or slow? The markets found the answers & it was no. Gold traded higher today & advanced again to $2753 per ounce. China’s gold consumption in the first three quarters of 2024 decreased by -11% YoY, however such a drop didn’t really matter to markets’ participants who kept betting higher. Keep an eye on PCE numbers from the US on Thursday, PCE is the Fed’s favorite indicator for inflation.

1H RSI kept advancing, heading higher to overbought point. $2760 is the major resistance, $2730 is a minor support for day-traders. Technical diagram supports short-lived profit taking.

Silver

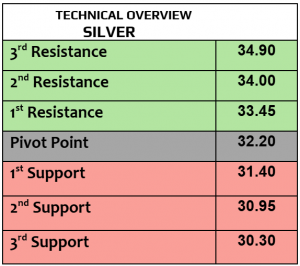

Silver traded higher for two consecutive days, increasing to $33.76 per ounce this morning. Before China’s PMI manufacturing later this week, data showed that the industrial profits in China declined at the fastest pace since the pandemic in the first 9 months of this year, that’s not a promising outlook for demand expectations in silver.

Technical chart kept repeating the same scheme, which means that the correction to $33.30 is possible. Trend index remained bullish in 1H & daily.

Oil – WTI

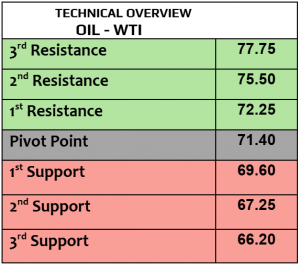

After falling by almost -6% on Monday, oil prices kept falling on Tuesday, WTI traded weaker at $67.31PB, Brent $73.38PB, yesterday’s loss was the largest daily loss in two years, confirming our view that the geopolitical tensions in the ME were not enough to bet higher, and the global energy transformation will have serious consequences on the demand outlook. In the meantime, API will release the weekly crude oil inventories later today, and more PMI manufacturing data this week will be considered as well.

Not far from the execution of the 2nd major support, with 60% bearish in forecast poll. Profit taking (if happens ) will be short-lived .

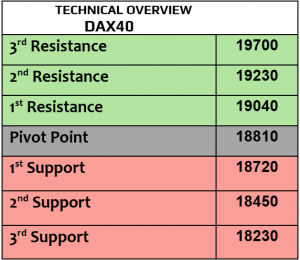

DAX

Germany’s DAX index closed higher on Monday by 0.3%, supported by 1.5% in Puma, 1.3% Bayer, & 1.1% Deutsche Bank while heavy-auto stocks fell, Porsche -4.9%, BMW -0.63% & Mercedes -0.62%. not to forget that Volkswagen is planning to close three German factories & slash wages by -10%, that’s going to be a big hit to EZ biggest economy & jewel of the German industry, that’s why ECB may start reducing the rates sooner than later.

Our bullish bias didn’t fail the traders with bullish price action heading to the last major resistance. 19400 is support, then 19340. Next higher target will be at 19600.

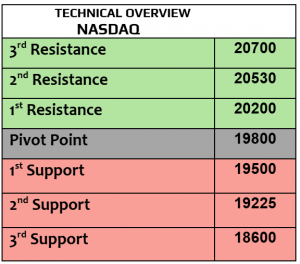

Nasdaq

US stock futures were mixed today after closing higher on Monday, Dow Jones 0.65%, SPX 0.27% & Nasdaq 0.26%, waiting for a busy week ahead from the US in the economic data & Q3 earnings. Ford Motors dropped by -6% after issuing soft full-year guidance. Keep an eye on the US consumer confidence, housing price index & Job openings later today. Apple, Amazon & Meta will report the earnings this week.

1H trend index is bullish. Price action is still showing signs of progress to 20420 then 20500. 19960 is support. Stronger volatility ahead. 20000 is an important psychological support.

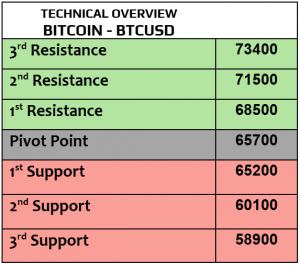

BTCUSD

Bitcoin surged above $71K, the highest since June 2024, other cryptocurrencies followed the trend, Eth $2616 & Solana $180.25. While there was no major incident in crypto market, the approaching of the US presidential election with Trump’s campaign was the major catalyst, Trump announced his support to the digital & crypto assets.

While 1H RSI is fully overbought now, the momentum remains robust, targeting $72K then $73400 which is likely considering the velocity of the price action. $66700 is important support on the daily chart.