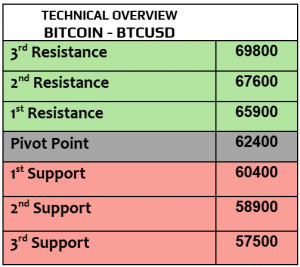

EURUSD

After falling by -0.28% in a week, EURUSD started a new trading week weaker at $1.0787, three-month low. As the US economic data kept improving, & showed the resilience of the US economy, the demand for USD remained intact while EZ economy has not yet fully improved, mainly in Germany, EZ’s biggest economy. The USD index increased by 0.55% in a week.

The forecast poll indicated to more than 80% who were bearish, supported by bearish trend index in 1H chart. Price action kept falling, targeting the last major support.

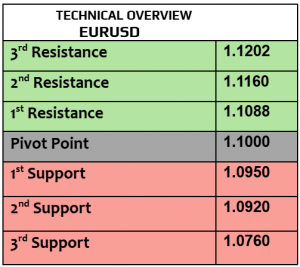

USDJPY

Five consecutive weeks of the bullish performance in USDJPY that traded higher today at 153.60, adding another 0.88%. What happened in Japan this weekend was that the Liberal Democratic Party & its coalition partner lost the majority in the lower house, the first time since 2009, so the Yen remained under domestic political pressure & USD strength as well. Unemployment from Japan will be due later today.

Last major resistance was executed, new one was added. 1H RSI is almost overbought, so the correction to 152.80 is possible then 152. Momentum remained positive.

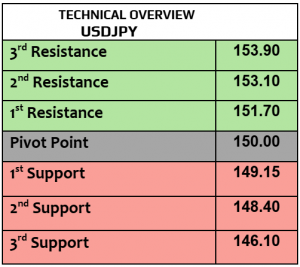

GBPUSD

The traders’ sentiments remained bearish in GBP for the last five consecutive weeks after GBPUSD fell by -0.29% in the last week, trading weaker today at $1.2946. It was very clear that inflation remained sticky in many domestic sectors including services, that was another reason not to cut the rates immediately. In other words, the UK economy still faces big dilemma in both growth outlook & government spending.

Edging lower to $1.2910 will not be a surprise with the bearish hourly index. Price action kept falling with negative momentum.

Gold

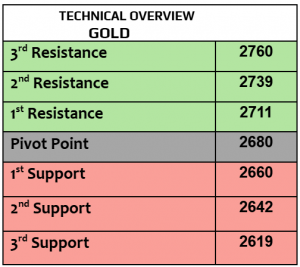

Gold traded lower today & fell by -0.58% to $2731 per ounce after it increased by 0.38% in a week, three consecutive weekly gains. The focus will start shifting to more US economic data later this week, including US PCE numbers (Thursday) and nonfarm payrolls on Friday. Keep in mind that both gold & USD index increased on a weekly basis.

As the chart shows, correction started from $2760 (major resistance) , $2714 is support then $2702 ( speculation) . According to the forecast poll, the sentiments became fully bearish, so be careful as the technical chart may not always reflect the fundamentals.

Silver

How was the performance of silver in the last week? Silver lost by -1.6% in the last week, trading lower today at $33.35 per ounce. According to many sources, the gap between the physical silver & silver derivatives contracts kept expanding in the last few weeks which means that the volatility will remain strong & prices may increase as well. Keep an eye on the US economic numbers later this week.

Markets’ sentiments became mixed. Price action is edging lower to $33.10 then $32.50 . Technical channel remained positive (above the pivot) but daily trend is bearish & strongly bearish in 15M index.

Oil – WTI

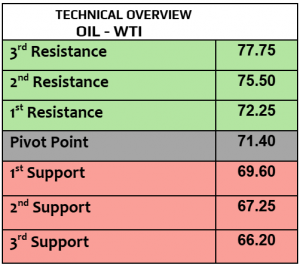

Crude oil prices started new trading week negatively, falling by more than -4% in WTI & Brent crude oil, WTI $68.43 PB, Brent $72.61PB after Israel avoided to attack the Iranian oil sites and only attacked the military targets on Saturday. The fragility of gains in oil market continued as the ongoing geopolitical tensions were already priced in, crude oil needs stronger growth outlook, not only short-term tensions. Is OPEC going to intervene, that’s an important question?

Price action kept falling, it broke the 1st major support, targeting the second one. Markets’ sentiments were bearish by 60% & only 20% were bullish.

DAX

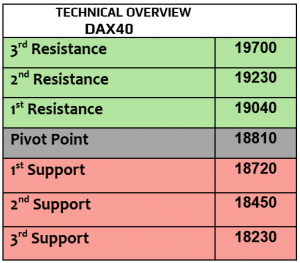

After closing higher on Friday by 0.1%, DAX futures traded higher today & advanced to 19500. IFO numbers from Germany came stronger on Friday in the economic expectations & business climate. Consumer confidence from Germany will be released tomorrow.

We have said that the trend index was bullish, but volatility remained slow. Keep an on 19340 (support- 1H chart), and 19590 (resistance) . In the meantime, 1H RSI is sideways.

Nasdaq

US stock futures traded higher today after mixed performance in the last week, SPX fell by -0.37%, Dow Jones lost -1.59% and Nasdaq gained by 0.60%. Very busy week ahead, big tech firms like Apple, Amazon & Alphabet will report Q3 earnings this week, not to forget the US PCE on Thursday & Nonfarm payrolls on Friday. In the meantime, almost one week before the biggest event of the year, the US presidential election.

1H trend index is bullish. Price action is still showing signs of progress to 20420 then 20500. 19960 is support. Stronger volatility ahead.

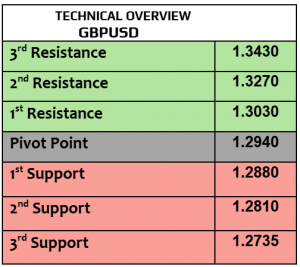

BTCUSD

Major cryptocurrencies are falling this morning, BTC at $67843, Eth $2484 & Solana $174.34. Mixed weekly performance in the crypto market, BTCUSD gained by only 0.52% while Eth lost -6.8%, Cardano fell by -7.6% and Solana increased by 4%. According to many media sources, Bruce Lee family partners with 1inch to launch crypto campaign, and Russia is pushing to use cryptocurrencies for international trade.

1H RSI is trading at neutral level, without higher bullish bets for now. The daily chart is more bullish than the hourly one. Technical diagrams may reverse again to a lower level at $64K.