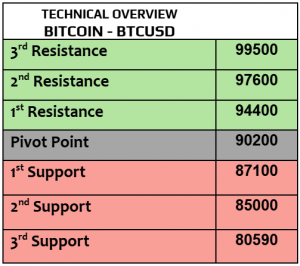

EURUSD

After losing more than -1% in a week, EURUSD resumed the trading on Monday higher at $1.0477 after USD index fell. Even if EURUSD traded higher today, this level remained the lowest in more than a year due to weakness in EZ economy & considerable political tensions ahead as well. PMI services & manufacturing in EZ weakened in November, both remained below 50 (contraction).

Improvement in price action started this morning, heading higher again to $1.0530. Technical channel remained bearish – negative (below the pivot).

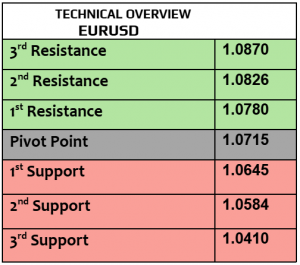

USDJPY

USDJPY fell today & traded at 154.10 after it fell by -0.36% in a week. Japan’s Prime Minister is considering $90 billion stimulus package, such a plan ( if materializes) is likely to keep the Yen under pressure, while hiking the rates remained uncertain. Leading economic index from Japan will be due later today. Weaker US bond yields will have bearish impact on this pair.

153.90 is support, then 153.50. Volatility is slow but it is likely to increase throughout the day. 155 is resistance.

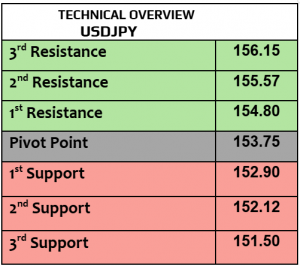

GBPUSD

How was the weekly performance of GBPUSD? It dropped by -0.66% before trading higher today at $1.2594. Gains in GBP this morning are mainly due to USD weakness & technical correction. Markets’ participants expect the BoE to keep the rates unchanged in December as UK inflation remained elevated & sticky in service sector.

$1.26 is resistance (correction, if any) which is happening now, then $1.2650. 1H RSI is heading higher as well.

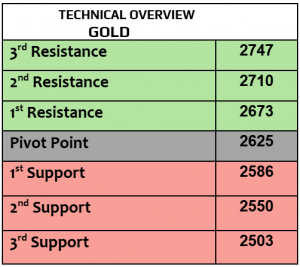

Gold

Aggressive volatility in gold persisted since last week & continued today after gold fell by more than -1.5% this morning & traded at $2673 per ounce, gold increased by 2.3% in a week. Volatility in gold increased in the last three weeks, reflecting a fact that the traders remained anxious about the near future of the US rate policy, Trump’s economic priorities & rising tensions in EU. US PCE numbers will be due on Wednesday.

Price action still supports further weakness & correction to $2634 then $2620. Higher volatility ahead.

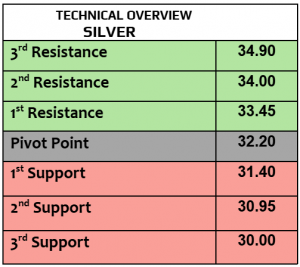

Silver

Loss in silver was even higher than in gold today after silver fell by -1.86% & traded at $30.75 per ounce. On a weekly basis, silver dropped by -1.1%, unlike gold that remained higher. Global manufacturing PMI from the UK, EZ, Germany & the US weakened further in November, that’s not the best scenario for silver & short-term demand outlook.

Technically speaking, price action broke the 2nd major support, still supporting further drop to $30.25. Momentum indicator is negative now.

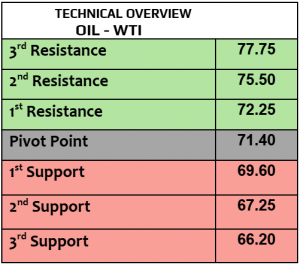

Oil – WTI

Crude oil prices traded weaker today, WTI $70.70PB, Brent $74.70PB, after weekly gains by 2%, last week was the first weekly increase in three weeks. China’s crude oil imports rebounded in November, China remains the World’s largest oil importer, not to forget that the escalation of the war between Russia & Ukraine has not yet ended.

$69.50 & $68.80 are support levels, but the technical diagram may not support massive selloff.

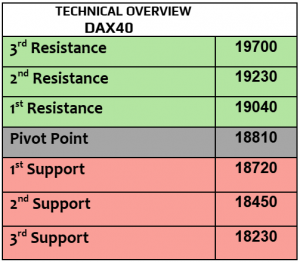

DAX

German DAX index increased 1.1% in a week; DAX futures traded higher today at 19420. German PMI in services & manufacturing remained below 50 in November, confirming the status of contraction in EZ biggest economy, German IFO index in business climate & expectations will be released later today.

Price action and markets’ sentiments were somehow mixed. 19290 is resistance (executed) then 19500. 19120 is support, 1H RSI is still heading higher.

Nasdaq

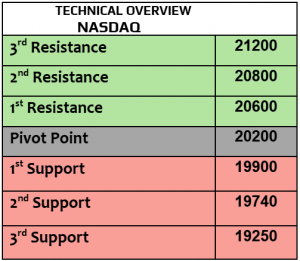

US stock futures traded strongly higher today after weekly gains by 1.6% in SPX, 2.6% in Dow Jones & Nasdaq rose 1.67%. President-elect Trump nominated Scott Bessent as new Treasury Secretary; such a nomination supported the risk appetite. In the meantime, markets are likely to watch PCE numbers & FOMC minutes later this week.

Price action kept improving, heading higher to 20750 (executed) then 20900. 20400 & 20300 are support for day-traders. 1H RSI shows the potential for further gains.

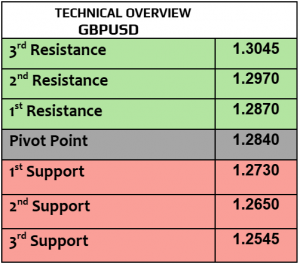

BTCUSD

Four consecutive weeks of the strong performance in BTC that kept breaking new records, Bitcoin gained more than 8% in a week, followed by 5.8% in Eth, 42% in Cardano , 31.5% in Ripple & 5.9% in Solana. BTCUSD traded higher today at $98200. Crypto market cap increased to $3.35 trillion, new historical record-high with 58% dominance in BTC, 12.2% Eth & 30% others. Crypto market’s euphoria is still having momentum.

Price action showed no appetite for profit taking, still heading higher to new record at $100K. $96600 is support (profit taking, if any).