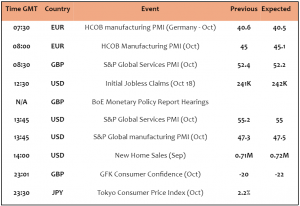

EURUSD

EURUSD traded slightly higher today after it fell yesterday to $1.0760, the lowest since early July, stable now at $1.0791. Consumer confidence in EZ remained negative in October at -12.5. Busy way ahead from EZ

with the release of PMI numbers in services & manufacturing from Germany, France & EZ. USD strength

remained robust.

Traders started buying from the last support, targeting $1.0810 which is doable, then $1.0836

( 1H chart). Such a technical correction is highly probable, supported by bullish 1H trend index.

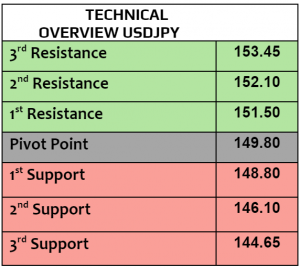

USDJPY

USDJPY fell today by -0.41% & traded lower at 152.15 after it increased yesterday above 153, the highest in three months. Pressure on the Yen intensified due to higher US bond yields & strong DXY that traded at

104.130, the strongest in almost three months. We keep an eye on Tokyo’s inflation numbers later today. In the meantime, Japan’s PMI services & manufacturing fell more than the estimates in October 2024.

Traditional behavior by day traders started after 1H RSI was overbought, further correction to 151.75 is highly probable, however be careful as the trend index has not yet become bearish .

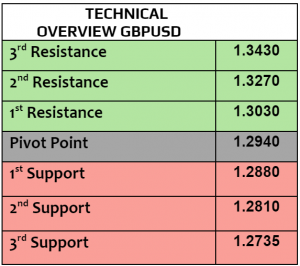

GBPUSD

As the traders kept watching BoE’s governor Bailey comments, the attention is likely to start shifting to more

macroeconomic numbers today that include services & manufacturing PMI, consumer confidence in the UK and BoE monetary policy report hearings by the House of Commons. GBPUSD traded slightly higher today at $1.2929, not far from the weakest level in more than two months.

Mixed sentiments persisted, bearish trend index in 15 minutes, but the forecasts show more bullish bets than bearish ones . $1.2950 is the target for day-traders.

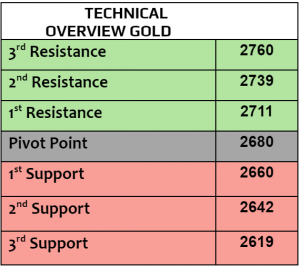

Gold

Aggressive volatility in gold continued after gold fell by more than 1% yesterday, started recovering today & traded higher again at $2726 per ounce. Both, strength of USD & higher US bond yields kept the pressure on the assets including US equities & commodities. No major change in markets sentiments or positioning. US PMI numbers later today will be important to track the performance of the US economy. As the chart shows, correction started from $2760 ( major resistance) , $2714 is support then $2702 ( speculation) . Markets’ sentiments may change quickly , so be careful in your exposure.

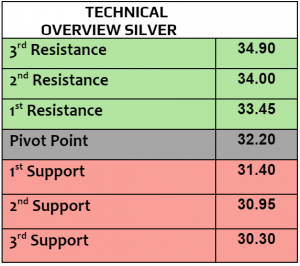

Silver

Volatility in silver was even more aggressive than in gold. Silver dropped by more than 3% on Wednesday, traded slightly higher today at $33.91 per ounce. After nine consecutive days of the rally, such a correction will not be a surprise to us. If the global manufacturing PMI numbers miss the estimates, then silver will remain under pressure. Remember that silver is less sensitive to Fed’s rate cut than gold.

Recovery started at $33.50, aiming higher to $34.20 . Volatility may become less aggressive than yesterday. Momentum indicator remains positive.

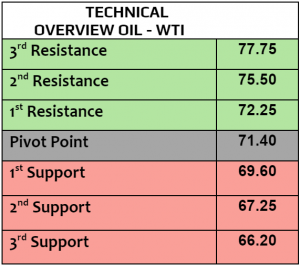

Oil – WTI

Crude oil prices gained today, trading higher by more than 1%, WTI $71.67PB, Brent $75.85PB after oil declined in the previous session due to higher than expected oil inventories in the US that increased by 5.4 million barrels last week according to EIA. In other words, today’s gains could be short-lived. US , UK & EZ manufacturing PMI numbers will be due later today, that’s another important news in oil market.

Since last Friday, the advance was slow but continuous with bullish daily trend index aiming higher to $72.50 then $73.65 in mid-term outlook. $70.25 is the support level .

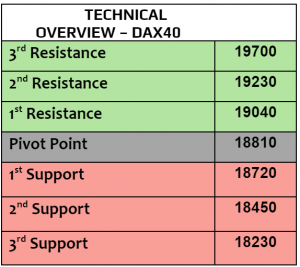

DAX

DAX futures were little changed today at 19363 after DAX index slightly fell on Wednesday, with three consecutive days of the negative closing. German 10Y bond auction indicated to higher yields , services & manufacturing PMI numbers will be due later today, Germany’s manufacturing PMI remained negative under 50 . Yesterday, Adidas fell by -1.9%, SAP gained 1.5%.

Technically speaking,the hourly trend index is bearish now, with low volatility. 19315 is support, 19570 is an important resistance. Trading my stay in sideways bias for today.

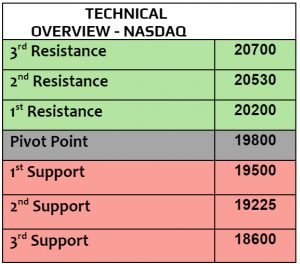

Nasdaq

US stock futures were mixed today, Dow Jones fell by -0.21% while both SPX & Nasdaq gained after the three major indexes fell on Wednesday, Dow Jones -0.96%, SPX -0.92% and Nasdaq lost -1.6% . Tesla surged 12% on better than expected Q3 profits, but IBM dropped -3% . US 10Y bond yields increased to 4.25% , giving another pressure on equities. Busy day ahead from the US with services & manufacturing PMI numbers, initial jobless claims and new home sale.

1H RSI is sideways now, but 15H index is bullish. The technical correction to 20200 could be short-lived, if it breaks then 20460 . 19900 is an important support ( not a major one).

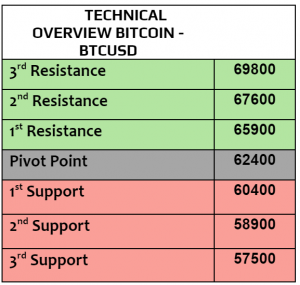

BTCUSD

Bitcoin traded higher today by 1% at $67301, trying to recover after three consecutive days of losses, followed by 1.19% in Eth, 0.4% Cardano & 0.78% in Solana. Denmark is likely to implement crypto tax on the unrealized gains in 2026, and Hong Kong targets global fintech with new virtual asset strategies.

Markets’ poll still show 50% bullish, 25% bearish, with bullish bias. Such an attitude is supported by 1H RSI that keeps advancing & targeting $67900 .