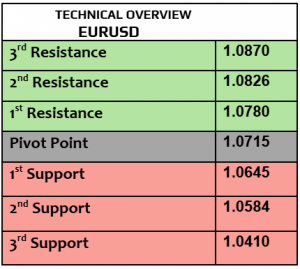

EURUSD

EURUSD was little changed today, trading at $1.0466, the lowest since October 2023, highly correlated to strong USD index & rising tensions in EU. Busy day ahead from EZ with the release of PMI numbers in services & manufacturing from Germany, France & EZ, not to forget ECB’s president Lagarde speech. ECB financial stability review indicated to geopolitical tensions & policy uncertainty. EURUSD is still down by -0.67% in a week.

All major support levels have been executed. 1H RSI is trading at almost oversold (re-entry level), correction may happen to $1.0530, however price action remains fragile.

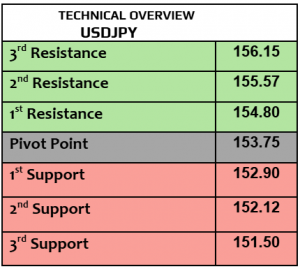

USDJPY

USDJPY advanced & traded higher today at 154.82. Japan’s national CPI increased by 2.3% in October, weaker than September of 2.5% which means that BoJ may not be in hurry to raise the rates even if BoJ governor signaled to possibility of another rate hike as early as December. As long as the US bond yields remain elevated, this currency pair will maintain the current gains. Keep an eye on the US data later today.

Price action supports further advance to 155.30. 153.90 is support, then 153.50. Volatility is slow but it is likely to increase this afternoon.

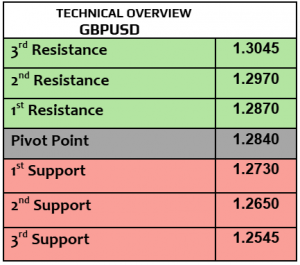

GBPUSD

Three consecutive days of loss, GBPUSD fell today to $1.2570, the lowest level since last May, such a weakness in the British pound was due to strong USD, weak UK data & ongoing geopolitical tensions in EU after Ukraine launched UK cruise missiles into Russia for the first time. In the meantime, busy day ahead from the UK with retail sales, PMI numbers in services & manufacturing. The improvement of the UK data may support GBP that fell by -0.4% vs USD in a week.

Last major support was executed. Even if price action approached oversold level, markets’ behavior still supports further weakness. $1.26 is resistance (correction, if any).

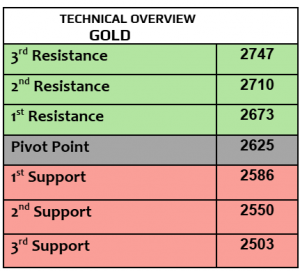

Gold

Gold proved to everyone that patience pays back with more than 4.5% gains in a week, gold traded higher today at $2686 per ounce, recovering most of the losses that happened two weeks earlier. US economy is still doing very well, PMI numbers in services & manufacturing later today will give us more clarification about the health of US economy. Keep an eye on the US bond yields & ongoing war in EU.

1st major resistance was executed, heading higher to the second one. Price action remained bullish. Correction may happen & target again $2648.

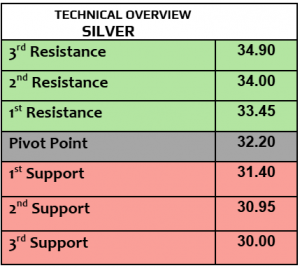

Silver

Silver is on the way to the first weekly gains after four consecutive weeks of loss, silver rose today 1% to $31.04 per ounce. Busy day ahead for silver traders who are likely to keep an eye on manufacturing PMI numbers from the US, Germany & UK. In the meantime, silver is less exposed to geopolitics than gold, and China’s economic policies matter the most.

Still heading higher to $31.30 then $31.50. $30.70 is support. While price action remains bullish, volatility is slow. 1H RSI is sideways now.

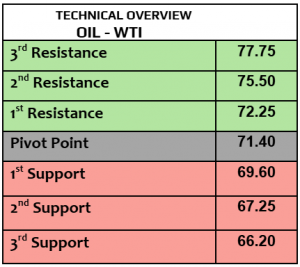

Oil – WTI

Crude oil prices are likely to close higher this week, first weekly gains after two weeks in row of loss, WTI traded today at $70.13 PB, Brent $74.22PB. It was not a surprise to us that the escalation of the war between Russia & Ukraine will have positive impact on oil prices. OPEC+ meeting on December 1st will be important as well.

$69.50 & $68.80 are support levels, but the technical diagram still advances & targets $70.50 amid more bullish bets than bearish ones.

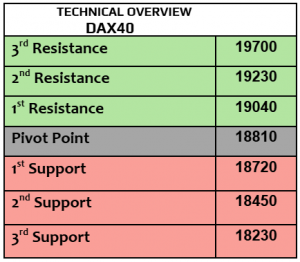

DAX

Busy day ahead from Germany with PMI numbers in services & manufacturing, GDP numbers in Q3/2024 and German Bundesbank president speech. DAX index closed higher on Thursday by 0.7%at 19146, DAX futures traded higher today. SAP gained 1.8%, Siemens fell -0.32% and Airbus rose 1.2%. Geopolitical tensions in EU & political instability in Germany remained the most important factors for now.

Price action and markets’ sentiments were somehow mixed. 18900 is support (executed) then 18700 (still valid) , 19290 is resistance.

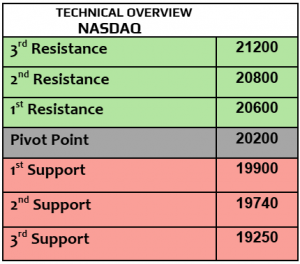

Nasdaq

US stock indexes closed higher on Thursday, Dow Jones 1%, SPX 0.5% & Nasdaq 0.03%. Busy day ahead from America with PMI numbers in services & manufacturing & Michigan consumer sentiment index. Yesterday, weekly initial jobless claims fell to 213K from 219K, & existing home sales in October increased to 3.9 million from 3.8M, so the US economy is still doing well with resilience.

Price action kept improving, heading higher to 20750. 20400 & 20300 are support for day-traders. 1H RSI shows the potential for further gains with slow volatility.

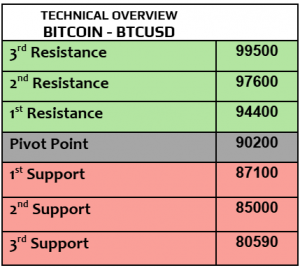

BTCUSD

Major cryptocurrencies gained today. Bitcoin gained 0.57%, traded at new record-high $99189, on the way to the most important psychological level at $100K. Eth $3381, Solana $260 % Ripple $1.386, Ripple gained more than 50% in a week, trading at the highest level since May 2021. According to crypto news, Bitcoin Spot ETFs See $1B Inflows as BTC Price Inches Near $100K.

Price action showed no appetite for profit taking, still heading higher to new record at $100K. $96600 is support (profit taking, if any).