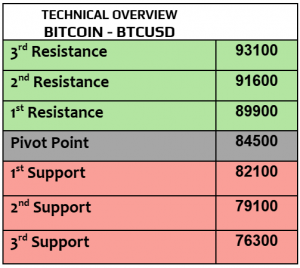

EURUSD

Will EZ inflation change the trend of EURUSD? EURUSD was little changed today, trading at $1.0585 amid low volatility. Inflation in EZ is likely to remain unchanged in October at 2%, which matches ECB target of 2%. The only thing that really matters for the traders now is the tariffs which Trump intends to implement on many trading partners including EZ ones.

$1.0590 remained short-lived resistance then $1.0635, but price action showed no strong bets. The correction in USD index may trigger further but slow correction to higher level.

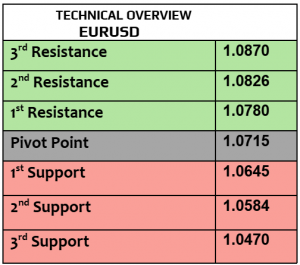

USDJPY

USDJPY slightly fell this morning & traded at 154.42. According to MUFG, Japan may accelerate interest rate hikes due to persistent inflationary pressures, however BoJ has not yet decided on more rate hikes. Exports & imports from Japan will be due later today. Higher rates in Japan (if any) will support further Yen strength.

Price action started showing the appetite for correction, 154 then 153.50. 155.25 is resistance. Keep in mind that the correction in USD index matters more than other factors.

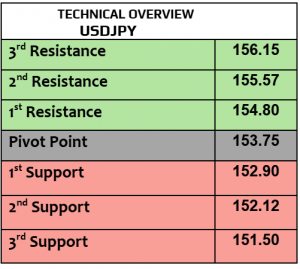

GBPUSD

GBPUSD was little changed today, trading at $1.2670, waiting for BoE monetary policy report hearings later today. UK economy is still in contraction, which means that BoE will keep cutting the rates in the coming months. UK inflation will be released tomorrow.

The improvement in price action was fragile, still targeting $1.26 ( support ) , $1.2690 & $1.2750 are resistance levels.

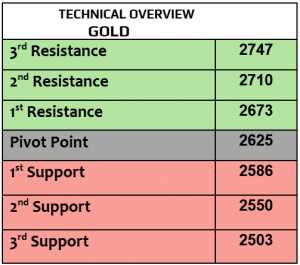

Gold

Recovery in gold continued for the second day, trading higher today at $2622 per ounce, one- week high. What happened in the last two days was a common re-positioning after more than -3.6% loss in a month. In the meantime, the pressure of gold remains intact due to high US bond yields and pricing of cutting rates by the Fed that might be less aggressive than the estimates.

Price action is trying to recover, heading higher to $2612/$2620 (both targets were executed) then $2658. $2560 & $2540 are important support, if broken then no major support before $2510.

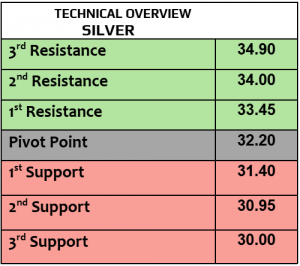

Silver

While silver is still down by -7.2% in a month, it gained by 2.2% in a week, trading higher today at$31.34 per ounce with two consecutive days of recovery. All eyes will be on global manufacturing PMI numbers on Friday, and PBoC rate decision on Wednesday (tomorrow).

$30.20 and $29.75 are support levels, $31 remains short-term resistance (executed) then $31.75. Volatility is low & 1H RSI is approaching an overbought level.

Oil – WTI

Crude oil prices were little changed today, WTI $69.20PB, Brent $73.35PB, waiting for API weekly crude oil inventories later today. Oil production from Norway’s largest oil field was halted due to onshore power outage & the production from Kazakhstan’s biggest oil field reduced as well by 30% due to maintenance, which means tighter oil supply.

Price action kept increasing, approaching overbought level on 1H RSI. $70.50 is the next target. $67.60 & $66.90 are important support.

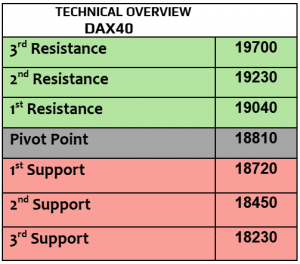

DAX

DAX futures were little changed today after it closed lower by -0.2% on Monday. Political instability in Germany continued, and supporting Ukraine with more sophisticated arms became very controversial among the German legislators. German Bundesbank president will deliver speech later today. Yesterday, Siemens fell by -1.8%, followed by -2.2% in Merck. Major auto stocks were mixed.

Price action and markets’ sentiments were somehow mixed. 18900 is support (executed) then 18700, 19290 is resistance. Volatility is low.

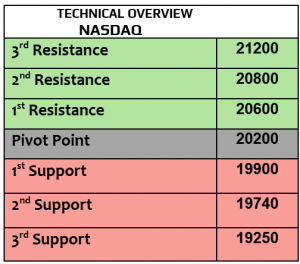

Nasdaq

US stock futures traded higher today after mixed closing on Monday, Dow Jones was down by -0.13%, SPX gained 0.39% and Nasdaq increased by 0.6% as well. Walmart gained 1.5% ahead of its earnings release, and Alphabet fell -1% after the US Department of Justice plans to ask judge & force Google to divest its Chrome browser. US building permits & housing starts will be due later today.

Price action kept improving, heading higher to 20750. 20400 & 20300 are support for day-traders. 1H RSI shows the potential for further gains.

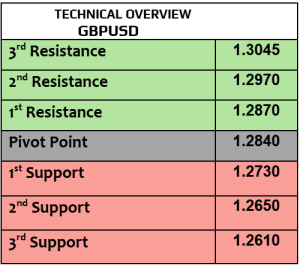

BTCUSD

Rally in BTC didn’t show weakness nor reluctance as Bitcoin kept advancing to record-high at $92030, with market cp that increased to $1.820 trillion in BTC alone. Eth traded down today at $3135, both Solana & Cardano kept advancing. According to FT, Donald Trump’s social media company is in advanced talks to buy Bakkt, a cryptocurrency trading venue owned by Intercontinental Exchange. MicroStrategy shares surged 13% on Monday, after the company revealed it had acquired $4.6 billion worth of Bitcoin.

Price action showed no appetite for profit taking, still heading higher to $93K. $88900 & $86500 are support. Further higher volatility ahead.