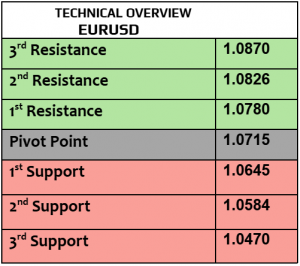

EURUSD

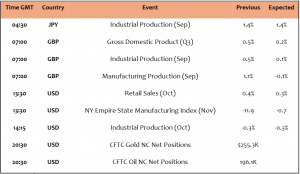

It was rough week for EUR bulls as EURUSD is still down by more than -1.6% in a week, trading slightly higher today at $1.0542. GDP in EZ grew by 0.4% in Q3/2024, matching expectations, while industrial production fell by -2% in September, worse than the estimates, and weaker than August that increased by 1.5%. This level in EURUSD is still the lowest in a year (October 2023).

As said before, sentiments remained bearish with falling price action to new lows. $1.05 is not far from execution. $1.0590 is short-lived resistance.

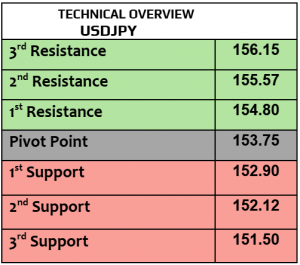

USDJPY

USDJPY was little changed today, trading at 156.37 after Japan’s GDP in Q3/2024 grew by 0.2%, falling from 0.5% in Q2/2024. In the meantime, traders’ main focus was Powell’s comments as the Fed chair said yesterday that the Fed is not in a hurry to lower rates. Industrial production from Japan will be due later today. Yen’s excessive weakness is Japan’s main challenge.

As clarified, price action remained positive. Keep in mind, 155.35 & 154.50 are support levels. Markets’ perception aims higher to 160 (June 2024) but beware of over-exposure.

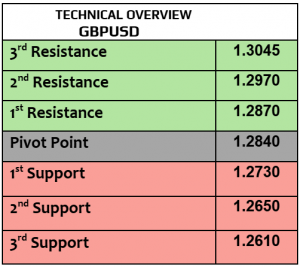

GBPUSD

BoE governor Bailey wished that the UK is not going to impose new tariffs nor protectionism, will the British government listen to what he said? GBPUSD was little changed today at $1.2675, still down by -1.8% in a week. Busy day ahead from the UK with GDP, industrial & manufacturing numbers. UK economy grew by 0.5% in Q2/2024.

While price action started improving, targeting $1.2710 then $1.2750, bullish bets are not yet fully materialized.

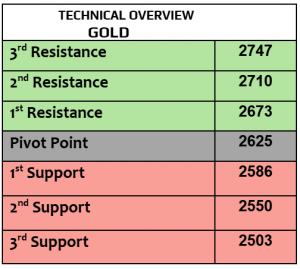

Gold

What a week in gold market, aggressive with high volatility, gold is still down by more than -4% in a week, trading unchanged today at $2566 per ounce. Fed chair Powell signaled that there was no immediate need to cut the rates, that’s exactly what gold’s bulls don’t like to hear. US bond yields remained elevated as well, adding more pressure on gold in the short term.

Markets’ sentiments remained negative with bearish behavior that is still betting on lower level to $2500 after it broke the 2nd major support (was vital) before trying to recover gain. $2540 is support, $2575 is resistance.

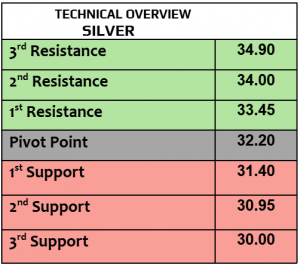

Silver

Silver traded higher today at $30.44 per ounce after the retail sales from China improved in October but the industrial production came slightly below the expectations after it grew by 5.3%, it was 5.4% in September. Silver still lacks the strong demand outlook from China & the US, while more tariffs on China’s exports may curb the demand for silver.

Gold/silver ratio still shows that silver is undervalued. Price action started recovery, heading higher to $31. $29.85 is support, volatility is likely to remain slow.

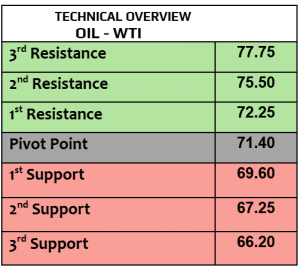

Oil – WTI

Crude oil prices fell today, WTI $68.09PB, Brent $71.85PB, still down by more than -3% in a week. US crude oil inventories increased by 2.1 million barrels last week according to EIA, surpassing the expectations of 1.5 million barrels. China’s industrial production didn’t help oil prices after it increased slightly weaker than the estimates. Mixed sentiments ahead, until Trump starts his 4-year term officially. All eyes will remain on Trump’s oil policies.

$67 is important support, with bearish price action that is falling now. $68.80 & $69.25 are resistance (day-traders target), tight range of trading is likely to continue.

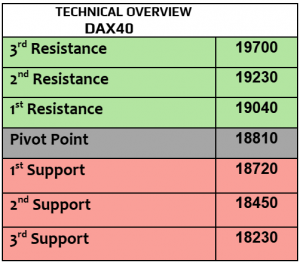

DAX

DAX futures traded weaker today after closing higher by 1.4% on Thursday, supported by 4.9% in Siemens, 2% Mercedes, 2.5% BMW and 3.3% in Deutsche Telekom. Equity indexes in EZ remained highly exposed to Trump’s new tariff policies, mainly Germany, EZ biggest economy & exporter with almost $1.6 trillion of exports, 24.4% of the total exports in EU.

Price action is mixed, but the markets’ sentiments were somehow bearish. 18900 is support, 19290 is resistance. Weaker volatility ahead.

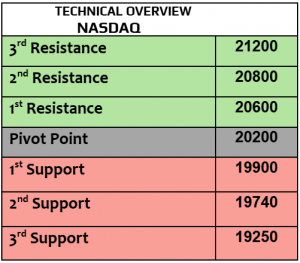

Nasdaq

US stock futures traded lower today after Nasdaq fell by -0.64% on Thursday, followed by -0.47% in Dow Jones & -0.6% in SPX. The main reason for negative closing yesterday was the Fed chair comments as Powell said that there was no rush to lower the rates, which means that the rates may stay higher for longer. In the meantime, US retail sales & industrial production will be due later today. Initial weekly jobless claims fell last week to 217K, and PPI increased by 2.4% in October, higher than September of 1.9% which means that the inflation in production sector remained elevated.

After being totally overbought, profit taking started, targeting 20900 (executed) then 20750. 1H RSI is approaching from support level.

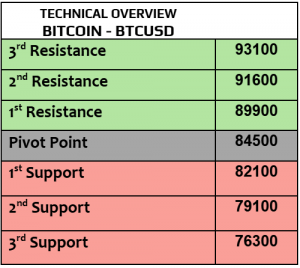

BTCUSD

BTC traded higher today at $87800, Eth $3062, Solana $208 & Cardano gained 6.4% to $06118. Crypto market cap hits new record yesterday at $3.2 trillion according to CoinGecko. Market cap reached $3 trillion in 2021. Trump’s trade remained the most volatile incident & catalyst in crypto market as the markets still bet on de-regulations & less corporate tax.

Profit-taking would be highly expected, targeting $86100 then $84K. Trend & market sentiments remained bullish. Technical channel remains bullish, supported by traders’’ bullish sentiments.