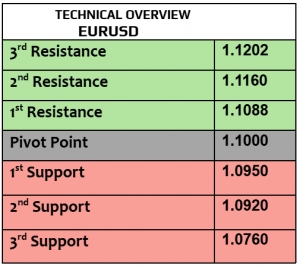

EURUSD

Manufacturing PMI numbers improved in EZ & Germany in October, however the numbers remained below 50 which means that the contraction persisted, only Spain PMI was higher than 50, at 54.5 in October. In the meantime, investor sentiment in EZ slightly improved in November, EURUSD was little changed today, trading at $1.0876, waiting for a big day ahead from America & ECB’s President Lagarde speech as well.

Daily volatility remained limited, with bullish daily trend index. $1.0860 & $1.0830 are support levels, while $1.0915 is resistance (short-term target). Higher volatility ahead.

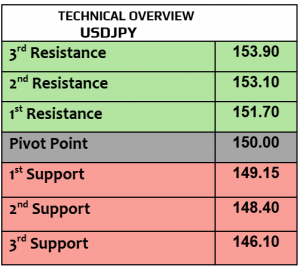

USDJPY

USDJPY traded slightly higher today at 152.52 as the traders remained cautious about the outcome of today’s US presidential election. We think that this currency pair is likely to be one of the most highly correlated pairs to the US elections, mainly because of the US bond yields. Remember that higher bond yields are likely to keep the support for USD.

151.50 was support where the traders started buying again, targeting 153 then 153.30. In the forecast poll, traders showed more bearish bias than bullish, but sentiments may change.

GBPUSD

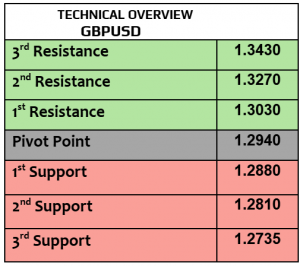

GBPUSD was little changed today at $1. 2960.British Retail Consortium numbers showed weaker retail sales in October than before. S&P global services PMI will be due later today. Volatility is likely to increase gradually, mainly on Thursday with BoE rate decision. BoE’s August forecast predicted UK inflation at 2.4% in one year, 1.7% in two years, the expectations revised higher.

Price action showed mixed sentiments, still targeting $1.2980 then $1.30. $1.2940 & $1.2911 are support levels.

Gold

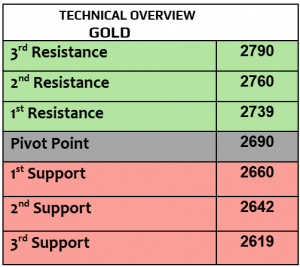

Before the US presidential election, no one is really interested in betting higher or lower on gold that traded unchanged today at $2736 per ounce. Keep in mind that after Tuesday’s US elections, the Federal Reserve rate decision will be on Thursday, so be prepared for higher volatility that may become aggressive. One more thing, protectionism if happens (mainly by Trump) is likely to keep the inflation higher, that’s gonna be double-edged sword.

There was profit taking in the last few sessions, the daily trend index is bullish again, heading higher to $2755. $2733 is short-term support (executed) then $2720.

Silver

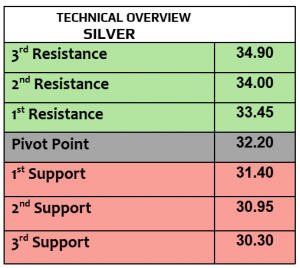

Silver traded slightly higher today at $32.46 per ounce after China’s service PMI increased to 52 in October. In the meantime, traders remained cautious before the Fed rate decision (Thursday) and China’s ruling party meetings between 4th / 8th November, aiming for more stimulus packages from the Chinese policy makers.

Mixed sentiments prevailed. $32.30 is support, with weaker volatility in 1H chart. In the meantime, price action is bullish, heading higher to $33.

Oil – WTI

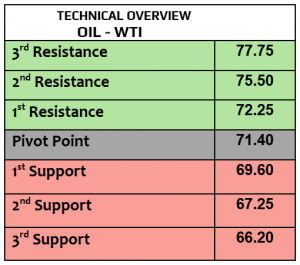

Crude oil prices were little changed today, WTI $71.42 PB, Brent $75.03PB, with full attention to close race in the US presidential election. What Trump said before was that he will support the US oil industry with more oil production to control the higher prices, so be ready to considerable change in the US oil policy if Trump wins. US factory orders fell in September and API will release the US weekly crude oil inventories later today.

Finally, WTI advanced & traded higher than the pivot (positive channel) , $72.25 is the next target. Traders’ behavior remained cautious & reluctant with bearish trend index (1H).

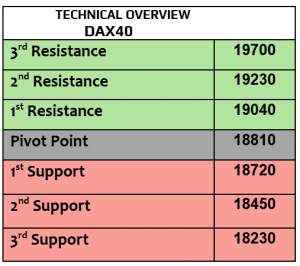

DAX

DAX futures slightly increased today, trading higher at 19167 after falling by -0.5% on Monday with its European peers. Manufacturing PMI in Germany improved in October, but it remained below 50. In the meantime, the traders remained cautious & in waiting mood before the US presidential elections on Tuesday, Fed rate decision on Thursday. Yesterday, SAP was down by -1.3%, Airbus -0.9% and Adidas -0.72%.

19000 is an important support, if broken then 18700. Price action is still somehow bearish. 19300 is the next target.

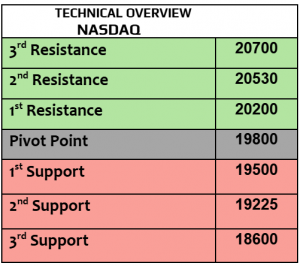

Nasdaq

US stock indexes fell on Monday, Dow Jones -0.61%, SPX -0.28% & Nasdaq declined by -0.33%, one day before the big Tuesday, US Presidential election. It is important to say that the biggest tech firms in the US that include Amazon, Apple, Nvidia & Google were the main contributors to Democratic candidate Harris, and only Tesla fully supported Trump. The focus will be on the winner and the majority in Congress, who will control the US Congress? ISM services PMI will be released later today.

While 1H RSI is neutral level, 1H chart is mixed. 19960 & 19880 are short-term targets for speculators. 20280 is resistance

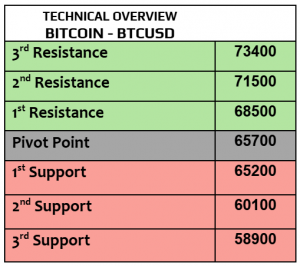

BTCUSD

All Bitcoin’s supporters hope that Trump will be the winner, simply because Trump said many times before that he will support the digital & crypto assets. Bitcoin traded slightly higher today at $68549, Eth $2424, Cardano $0.330, and Solana $160. History proved to everyone that what the candidate said before may not be the same when this candidate becomes a senior government officer, and in this case the US president, so be careful in your bet.

1H RSI is heading higher, supported by bullish index 15M. $69770 is the next target, $68200 is support. Higher volatility ahead and may become very aggressive.