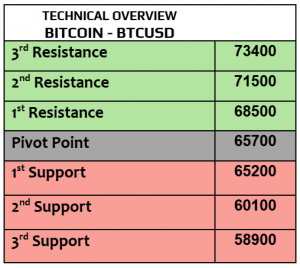

EURUSD

EURUSD is on the way for the first weekly positive closing after four consecutive weeks of loss. EURUSD was little changed today at $1.0875. Such a positive performance was mainly due to weaker USD, more than strength of EZ fundamentals. Inflation in EZ increased by 2% YoY in September, higher than before of 1.7%, Such an increase in CPI will complicate ECB mission in reducing the rates soon. Busy day ahead from the US, no major data from EZ for today.

Price action kept advancing, creating new support levels at $1.0775 & $1.0815, cementing re-entry point for market bulls. Next target will be at $1.0870 which is doable (executed) then $1.0895.

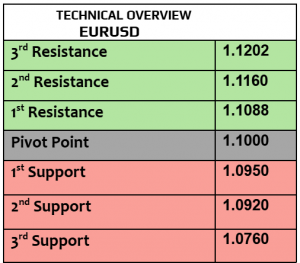

USDJPY

USDJPY traded higher today & advanced to 152.58 after BoJ kept the monetary policy unchanged while the markets are speculating that the BoJ could raise the rates to 0.5% as early as January, however we don’t think that BoJ will raise the rates anytime soon due to fragility of the Japanese economy. This currency pair is highly correlated to the US job numbers, keep in mind that stronger nonfarm payrolls may support further USD strength.

Price action is fully bullish now, heading higher to 153. 152 is support, then 151.60. Volatility could become aggressive later today.

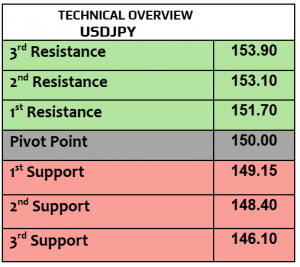

GBPUSD

With three consecutive days of loss, GBPUSD was little changed today at $1.2891, the lowest level since mid-August. Labor Party government’s budget in the UK was the main concern for the investors as the UK government has an intention to increase the borrowings and GBP40 billion in tax hikes. Nationwide housing prices in the UK will be due later today.

The technical bias is not showing much support to markets’ bulls with almost 60% in bearish attitude. Both targets at $1.2940 & $1.2910 were executed, the next target is $1.2850, $1.30 is resistance for day -traders then $1.3030. Price action is bearish.

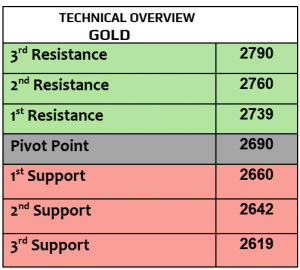

Gold

After falling by more than 1% yesterday, gold traded higher today & increased to $2753 per ounce after the US personal spending increased by 0.5% in September which means that the inflation may stay higher. Long-term inflation risks are gold’s best scenario. US job market numbers & wages later today will be important as well. Stronger US payrolls could send the USD higher.

Our technical view was accurate where our targets at $2772 & $2748 were executed yesterday. 1H RSI is at re-entry point, heading higher to $2770. There is an important support between $2720/$2729.

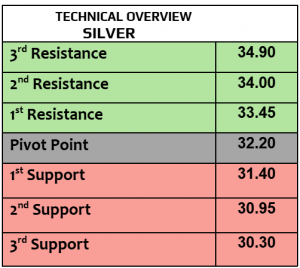

Silver

Silver remained down by -2.8% in a week, biggest weekly loss since last September. Silver gained today & traded at $32.74 per ounce after China’s manufacturing PMI increased in October to 50.3, the most in four months. While the recovery in China’s manufacturing is crucial for sliver’s bullish trend, all eyes will focus on China’s government decision after few days if they decide more stimulus measures or not.

Our target at $33.30 was achieved. While the price action showed bearish attitude, 1H RSI is almost at support. There is no important support before $31.50 (1H chart).

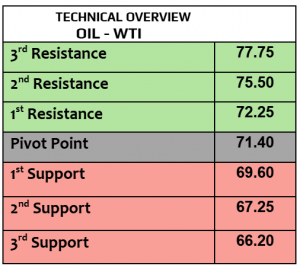

Oil – WTI

Crude oil prices advanced today & gained by almost 2%, WTI $70.62PB, Brent $74.15PB, third consecutive session of increase. There was no major change in demand outlook, that’s why such gains could be short-lived rather than strategic positioning. One of the reasons behind the gains was that the traders are expecting that OPEC+ may postpone the planned increase in oil production scheduled for December. Higher manufacturing from China supported the prices a well.

Technical channel remained negative (below the pivot) but the price action started improving & aiming higher to $70.25 (executed) then $71. 1H trend index is bullish now.

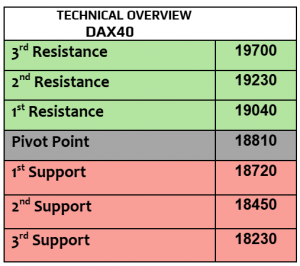

DAX

DAX futures traded unchanged today at 19072, after losing -1.3% on Thursday. Retail sales from Germany increased by 1.2% in September, better than before but the focus was mainly on Q3 earnings & US equities that fell yesterday as well. DAX fell by almost -1% in October.

15M trend index is extremely bearish, however 1H RSI is at 30 and it may support further advance to 19170 then 19300 . DAX is still trading in positive technical channel. Keep in mind, 18900 is support.

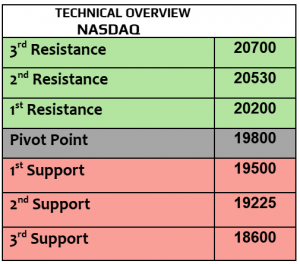

Nasdaq

US stock futures traded higher today after yesterday’s loss, Dow Jones was down by -0.9%, SPX -1.8% and Nasdaq dropped by -2.7% after disappointing earnings guidance from Meta & Microsoft. Amazon rallied nearly 6% after better-than-expected Q3 results. Busy day ahead from the US with job market numbers in nonfarm payrolls, unemployment rate, hourly earnings & ISM manufacturing PMI. Job market is one of the most important economic data the Fed watches closely. Keep in mind that stronger numbers may send the bond yields higher with stronger USD.

Out targets for profit taking at 20350 & 20180 were executed, price action remained bearish & still targeting 19780. 20270 is the resistance (day-traders)

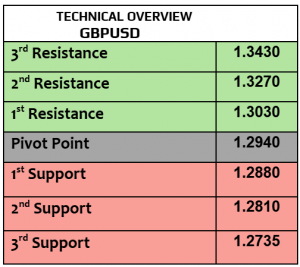

BTCUSD

Bitcoin fell today by -1.5% to $69370K, Eth $2501 & Solana $165.72, three consecutive days of loss in BTC. As the US presidential election is approaching, volatility may become more aggressive than before. In the meantime, Trump’s victory (if he wins) will be market’s bulls best wishes, Trump announced his support to cryptocurrencies.

1H chart keep falling, $68400 is an important support. $70300 is resistance. The daily chart shows that $66500 is strong support. Markets’ attitude was & still more bullish than bearish recently.