Rates as of 04:00 GMT

Market Recap

It was a “risk-on” day as the Trump regime reached a deal with Moderna to buy 100m doses of its coronavirus vaccine if it gets approved, with an option for more. The company’s vaccine began late-stage human trials in July.

US stocks challenged the record high and Treasury yields continued to rise. The S&P 500 hit an intra-day high of 3,387.89, which beat the record high close of 3,386.15 set on 19 February but was still a bit below the intraday high that day of 3,393.52.

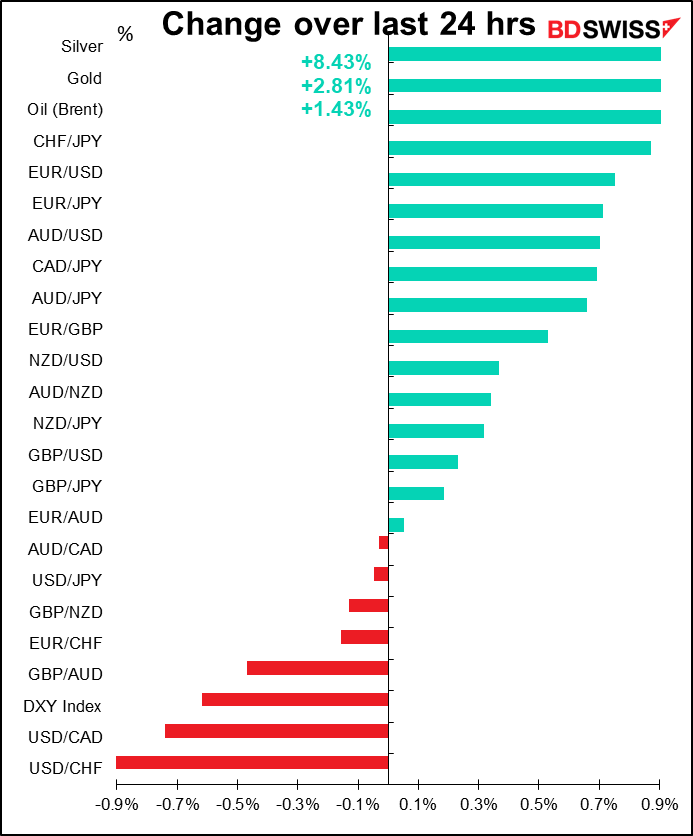

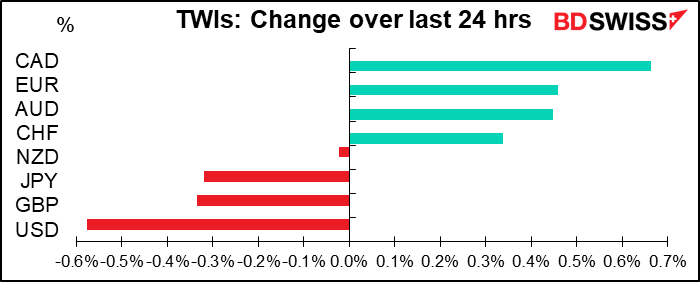

In this risk-on environment, USD and JPY were natural losers. CHF was fairly stable overall though as USD/CHF moved lower (unfortunately for me as I have bills to pay in Switzerland).

EUR/USD was unable to break through 1.18 on the upside during European and US trading but managed it overnight and has gradually gained further this morning.

CAD was once again the top performer as oil rose once again. I bet you’re getting tired of seeing this graph.

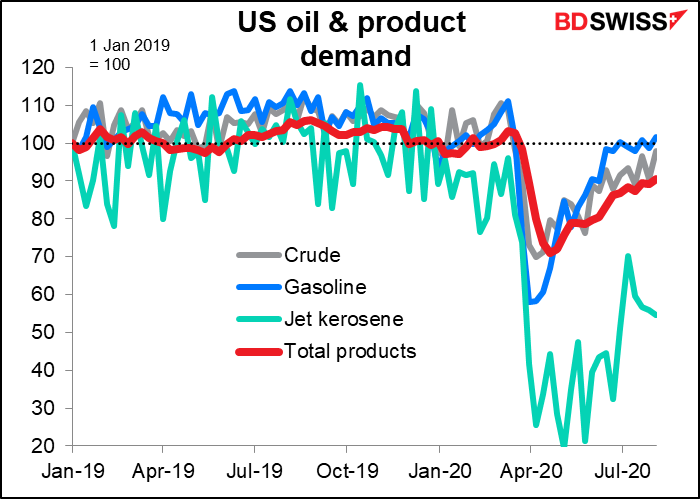

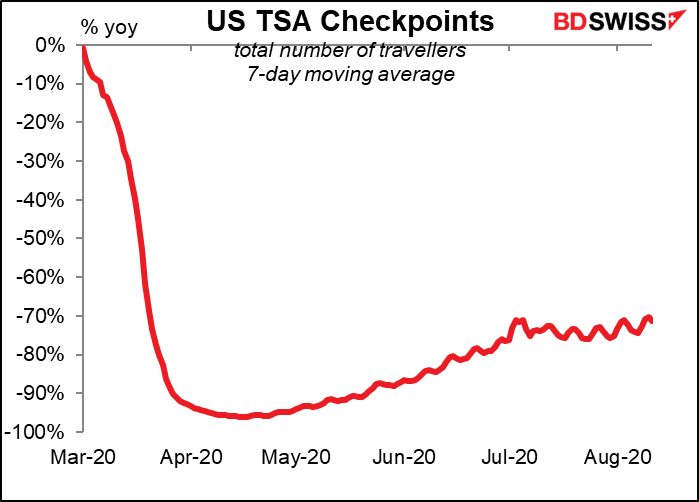

Oil was up thanks to the third consecutive weekly drop in oil inventories, according to the US Energy Department’s data out yesterday. In fact the decline was about twice what the market expected (-4.5mn bbls vs -2.2mn). Gasoline demand is now slightly higher than it was at the beginning of the year. Jet fuel though hasn’t recovered as flights are still well below normal levels.

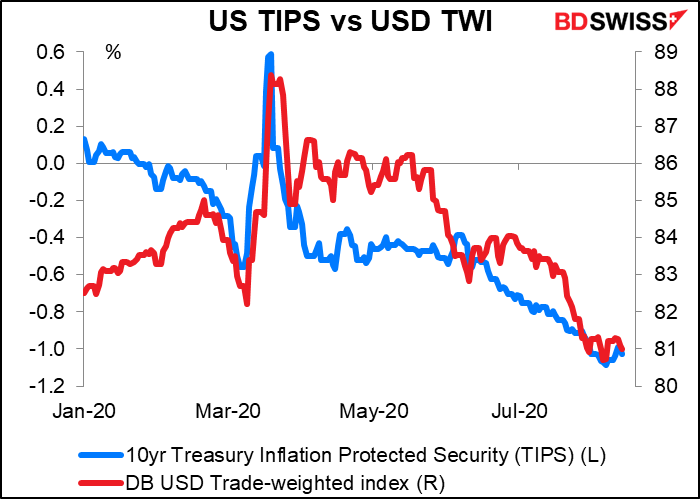

I was wrong about the US producer price index on Tuesday and therefore also wrong about the US consumer price index (CPI) on Wednesday. The market is still interested in inflation even if the Fed isn’t. The headline CPI rose 0.6% mom, double what was expected and the largest mom increase since January 1984. It wasn’t all just oil, either – core CPI also rose +0.6% mom vs +0.2% expected, the largest mom increase there since January 1991. It’s significant that the dollar dropped after the news – in days gone by, currencies used to rise when inflation accelerated because the news made a subsequent rise in interest rates more likely. Now when central banks (the Fed in this case) are on hold indefinitely, any acceleration in inflation just means a decline in real interest rates, which is negative for the currency.

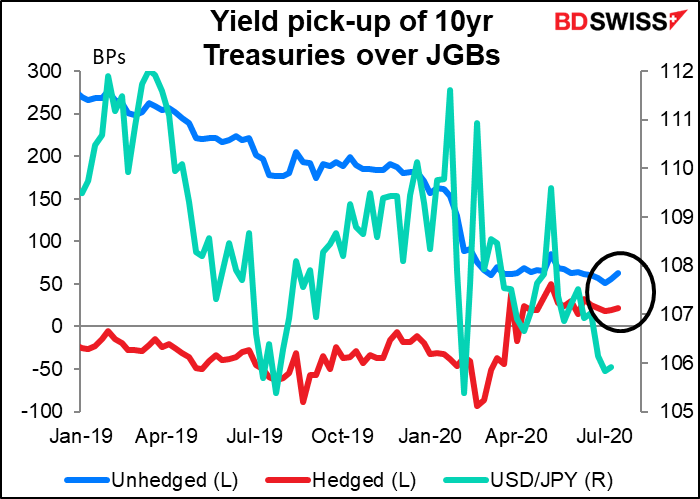

The exception here might be USD/JPY. As US yields rise, the spread over JGBs widens too. That could entice some Japanese real money investors into the Treasury market and push USD/JPY higher.

AUD benefited from the risk-on environment during the European and US days but has started to trend lower this morning in Asia. It got a brief boost this morning when the employment data was much better than expected – employment rose by 115k vs 30k expected and the unemployment rate only rose to 7.5% from 7.4% vs 7.8% expected, and that despite a larger-than-expected rise in the participation rate, which should cause the unemployment rate to rise even more. Nonetheless that just caused a spike up and the downtrend quickly resumed.

Silver and gold rebounded sharply. As a fundamental analyst I have nothing to say about this market as it’s not moving according to any fundamentals – it’s pure animal spirits. Good ol’ greed and fear.

Today’s market

Nothing on during the European morning.

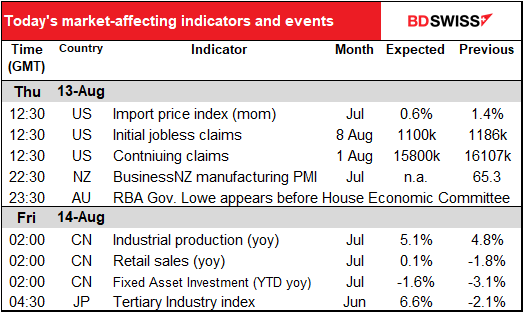

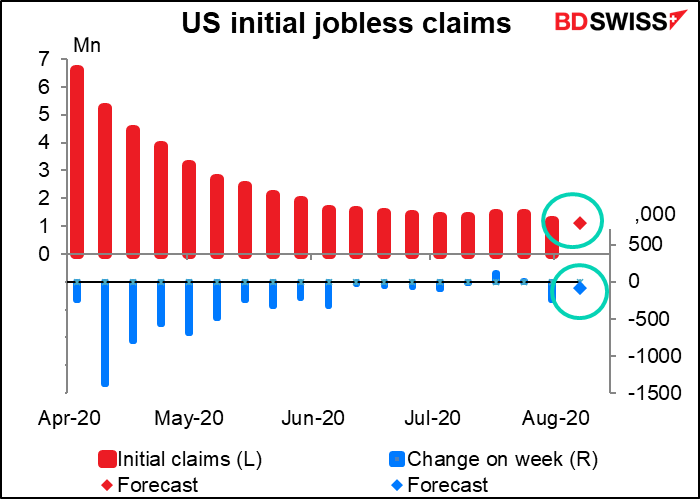

US jobless claims are the big announcement every week. They’re expected to continue the modest decline that we saw in the previous week. Initial claims were down 248k then, they’re expected to be down 86k this week. Not much but it’s better than being up 86k, I suppose.

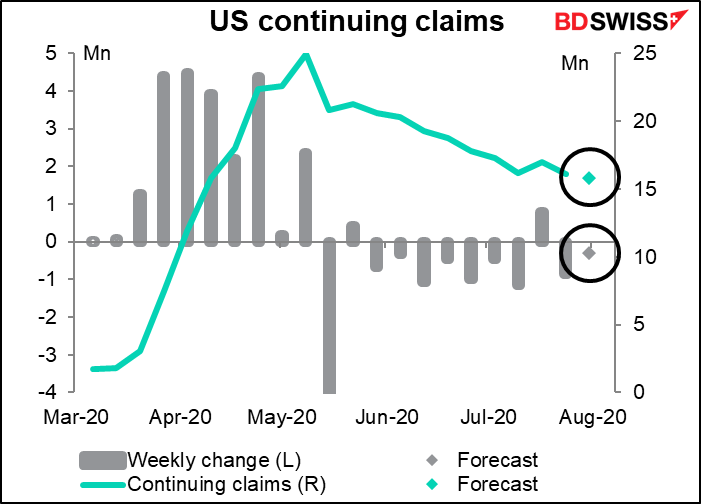

Continuing claims are expected to be down 307k on the week, following the previous week’s 844k fall. This is the more important figure, from my point of view – it’s the equivalent of the “weekly oil inventory” data. The change in inventories sums up two difficult-to-ascertain figures: production and demand. The continuing claims figure sums up the number of people losing their jobs and the number getting new jobs. A decline here indicates that more people are getting jobs than are losing them – a good sign, however the number is just a drop in the bucket compared to the number of people still unemployed.

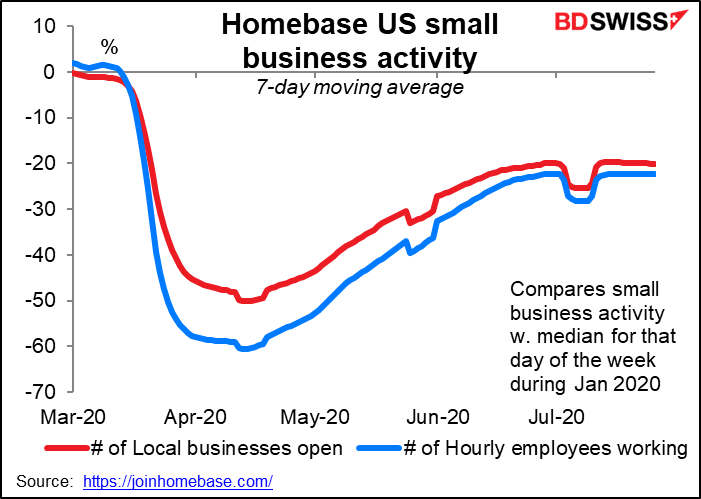

In any event, I don’t think anyone is going to take even two consecutive weeks of decline in jobless claims to signal a turnaround in the US economy. As the Homebase data shows, as of 26 July, business was plateauing then – I’m not sure it’s gotten much better since then, what with the virus exploding (today’s IJC is for 8 August and CC for 1 August).

(Although I have to mention that US VP Pence was on TV yesterday bragging that the Administration “created more jobs in the last three months than Joe Biden and Barack Obama created in their eight years in office.” I think this is the new definition of chutzpah, which was previously defined as “that quality shown by a person who kills both his parents and then pleads for mercy from the court because he’s an orphan.”

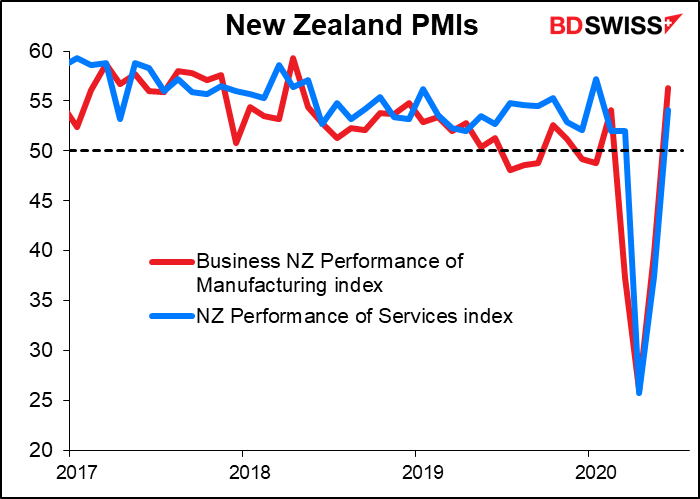

Overnight, New Zealand finally announces its July manufacturing purchasing managers’ index (PMI). Everyone else announced theirs last week. I’m just looking at this for the first time, to be honest. It’s not among the Markit ones and New Zealand isn’t known as a manufacturing powerhouse, so I’m not sure how important it is to the market, although the manufacturing index at least has a fairly high Bloomberg score (87). (Not so the service-sector index.) No forecast available.

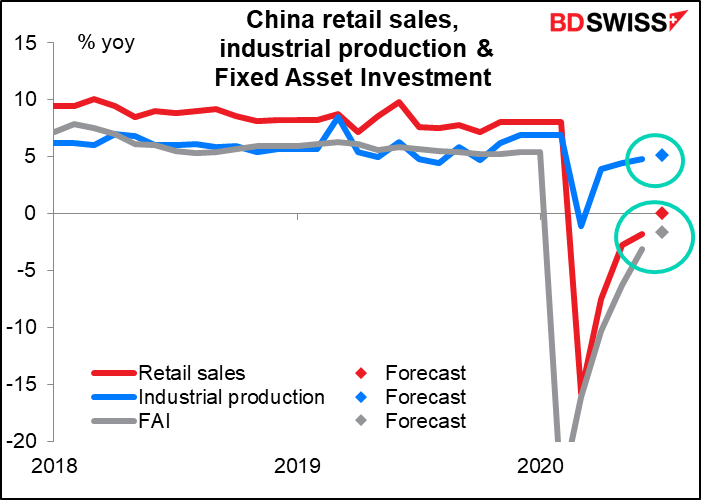

China announces its usual monthly trio of retail sales, industrial production, and fixed asset investment. These are important for setting a general “risk-on” or “risk-off” tone for the markets globally. The forecasts imply that the “V”-shaped rebound has largely run its course and progress from here will be slower.

Retail sales is probably the key as people elsewhere try to get a feel for when things might get back to normal in their country. It doesn’t seem like China had either the pre-lockdown stockpiling nor the surge of pent-up demand post-lockdown that we’ve seen in other countries. Retail sales flat year-on-year, as the market predicts, would be an achievement, in my view, and could help to boost investor sentiment in a “risk-on” fashion.

Industrial production didn’t dip significantly into negative territory and is now almost back to normal – in Q4 it averaged 5.9% yoy growth, in July it’s forecast to be up 5.1% yoy. Meanwhile, fixed-asset investment is expected to contract further, but at a slower pace.

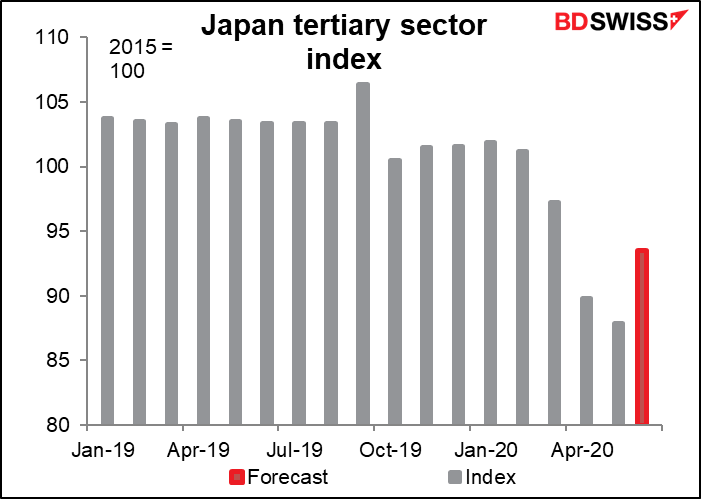

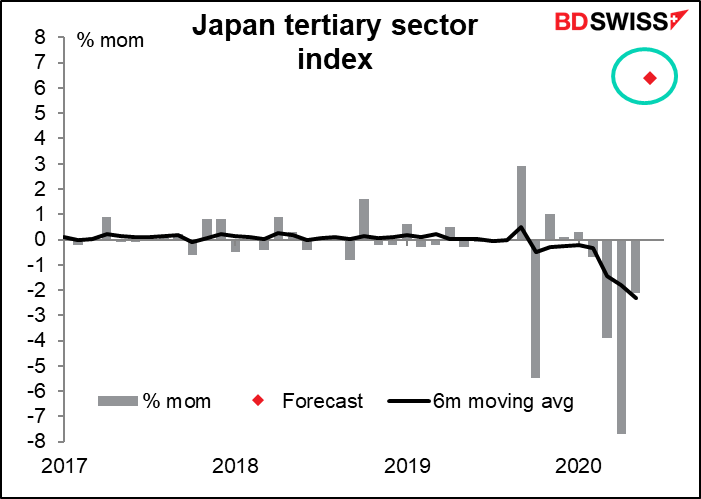

Finally, Japan’s tertiary sector index is forecast to jump – not surprising seeing as it fell for four consecutive months, including a record -7.7% plunge in April (worse than either he Kobe earthquake, the Fukushima explosion or for that matter the aftermath of the consumption tax hikes).

Nonetheless, the bounce will still leave the index about 8% below the pre-pandemic level, which itself was not so great in the wake of the October 2019 consumption tax hike.

The question of course is whether a bounce in the index will be positive or negative for the yen. It’s often the case that good news boosts the stock market, which is generally negative for the yen as it supports a “risk-on” environment in Tokyo. So even if we get the index right, it’s hard to estimate its impact on the currency.