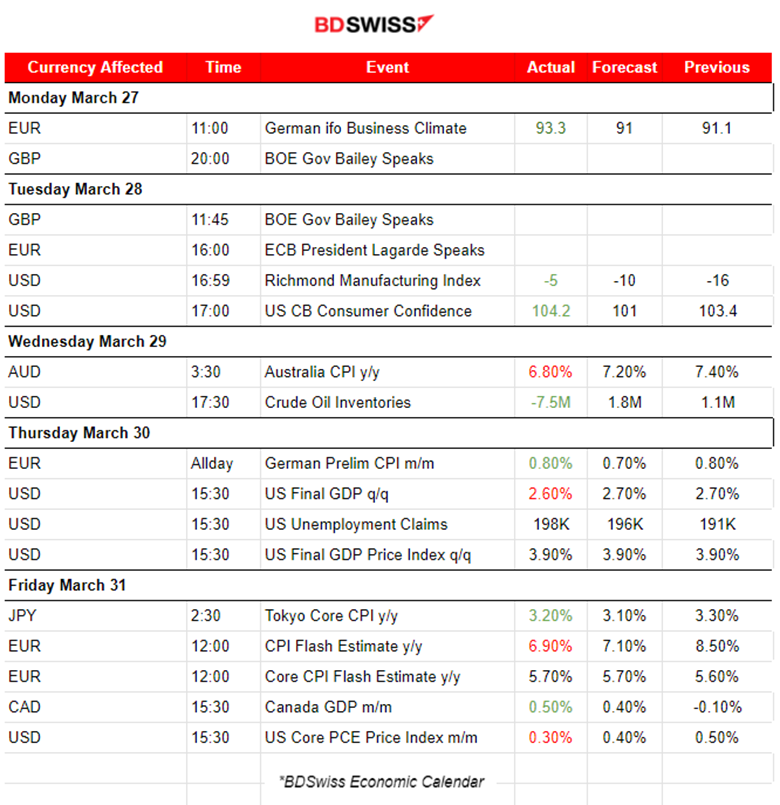

PREVIOUS WEEK’S EVENTS

Announcements:

U.S. Banking Crisis

During the past week, we have seen several statements from the U.S. carrying an optimistic view regarding the recent bank failures and a reassuring character towards addressing the problem.

According to the FSOC (Council) on the 24th of March, the U.S. banking system remains sound and resilient. The regulators are obviously seeking to stabilise the markets and calm the depositors. Other officials are looking to find the source of the problems. The Federal Reserve Vice Chair for Supervision, Michael Barr, demanded answers for the bank failures. The blame, he said, goes from bank management to supervisors and to the whole regulatory system. The bank run that followed was of an extraordinary scale and speed, he noted. SVB and Signature banks became the second and third largest bank failures in U.S. history. After the sale of Credit Suisse to UBS, and after SVB’s assets were sold to First Citizens Bancshares, the markets started to stabilise.

Michael Barr further stated: “We will continue to closely monitor conditions in the banking system and are prepared to use all of our tools for any size institution, as needed, to keep the system safe and sound”.

Source: https://www.reuters.com/business/finance/fed-was-discussions-with-silicon-valley-bank-use-discount-window-before-collapse-2023-03-29/

Source: https://home.treasury.gov/news

Source: https://www.bloomberg.com/news/

Source: https://bdswiss.com/economic-calendar/

Source: https://www.bloomberg.com/news/articles/2023-03-27/

The United Kingdom has also made interesting and optimistic statements that the U.K.’s banking system has sufficient capital, liquidity and that it remains resilient and well-prepared to support the economy. Even in a period of higher interest rates, it remains strong. However, U.K. household finances are still being stretched by increased living costs and mortgage payments.

Later on the 29th of March, the UK’s Financial Policy Committee (FPC) made several announcements in their statement showing that there is a need to increase resilience in certain areas such as market-based finance. It recommends that TPR takes action as soon as possible to mitigate financial stability risks by specifying the minimum levels of resilience for the Liability Driven Investment (LDI) funds.

There is also a need to implement an exploratory scenario. The Bank’s system-wide exploratory scenario will investigate the behaviours of banks and non-bank financial institutions, following severe but plausible stress to financial markets. This will be an exploratory exercise focused on market resilience and its importance for financial stability.

Source: https://www.bankofengland.co.uk/financial-policy-summary-and-record/2023/march-2023

_____________________________________________________________________________________________

Inflation

The U.S. Federal Reserve has raised rates by 4.75 percentage points to counter inflation while most economists estimate that a recession is coming.

The U.S. CB Consumer Confidence report was released on the 28th of March stating that the Conference Board Consumer Confidence Index® increased slightly in March to 104.2 (1985=100), higher than 103.4 in February. Although it improved, it remains below the average level reported in 2022 (104.5). Consumer expectations of inflation over the next 12 months remain elevated—at 6.3 per cent.

The Bank of Japan’s latest release on the CPI (change in the price of goods and services purchased by consumers, excluding food and energy) shows a 2.7% inflation rate against the expected 3%. Japan’s economy may be finally recovering from Covid but it all depends on consumer confidence, consumption and exports.

Source: https://files.constantcontact.com/668faa28001/0831ba1c-0892-413e-9206-e7dc139dc4ca.pdf

Source:https://www.boj.or.jp/en/research/research_data/cpi/index.htm

Source: https://www.conference-board.org/topics/consumer-confidence

_____________________________________________________________________________________________

Rate Hikes

Regarding the recent banking crisis, BoE Governor Bailey said that the U.K. banking system is “resilient” enough to withstand further shocks and that authorities are ready to counter problematic institutions. The decisions on rates won’t be affected by the crisis hitting the global banking system. He further points out that rate hikes will possibly stop and the monetary policy and financial stability functions will operate separately.

Bailey says no stress was generated in the UK banking system from the recent banking turmoil that started in the U.S. However, global markets are testing the banking sector for signs of trouble after the failure of Silicon Valley Bank and the rescue of Credit Suisse Group AG

Further statements involve warnings that if firms keep raising prices, this would be critical for the economy, hurting many people and rate hikes might start again.

Source: https://www.bloomberg.com/news/articles/2023-03-27/

Source: https://www.bloomberg.com/news/articles/2023-03-28/boe-governor-says-global-markets-are-testing-banks-for-weakness#xj4y7vzkg

_____________________________________________________________________________________________

Stock Market

The U.S. Stock market has been experiencing a long rally which presumably started on the 28th of March and lasts until today. It seems that the market no longer sees the recent U.S. banking crisis as a problem. Recent positive PMI data continue showing strong business activity regardless of the rate hikes.

Economists are still trying to predict how stocks will move in the future while it is still uncertain if the Federal Reserve (FED) is going to increase rates. Banks are stabilising, inflation is still high and the labour market is strong. Consumers expect inflation to remain high according to the CB Consumer Confidence survey released on March 28th.

_____________________________________________________________________________________________

Energy Market

The price of U.S. oil has been experiencing a steady upward trend since the 27th of March. This is mainly due to various factors, including the U.S. government’s promises to protect the bank depositors, U.S. announcements attempting to calm the markets and Russia’s announcement to proceed with oil production cuts at the end of June. Furthermore, the most recent factor explaining why the price moved further upwards was the Iraq-Turkey oil pipeline dispute that caused disruptions in the oil supply.

Source: https://www.investing.com/news/commodities-news/explainerwhat-is-the-iraqturkey-oil-pipeline-dispute-and-whos-on-the-hook-3046421

Source: https://www.bloomberg.com/news/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases:

- The German Info Business Climate: Germany’s most prominent leading indicator increased for the sixth month in a row, coming in at 93.3 from 91.1 in February. This led to a small intraday upward shock affecting

- The statements from the BoE governor did not have much impact on the The Market was mostly driven by the USD. GBP volatility and appreciation were generally the overall long-term result.

- US consumer confidence improved in March despite concerns about bank failures with the index showing 104.2. The figure affected the USD

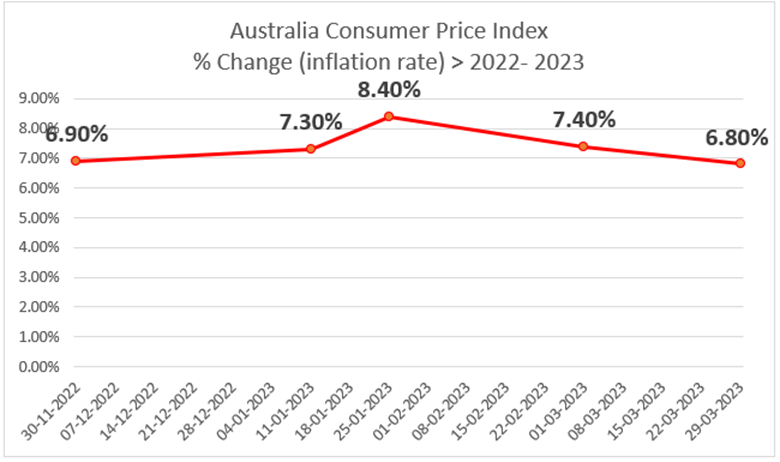

- The monthly Australia CPI indicator rose 6.8% in the twelve months to February. The released figure caused a downward intraday shock at that time, with AUD depreciation, even though the AUD pairs had soon corrected the move.

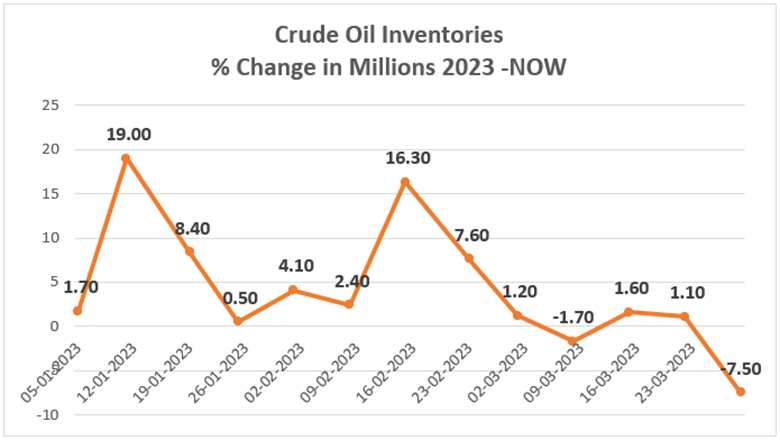

- US Crude Inventory Data showed 5M Barrels draw, larger than expected, which explains the rise in price last week.

- German headline inflation dropped in March to the lowest level since last summer. EUR was affected negatively but still, USD is driving the markets.

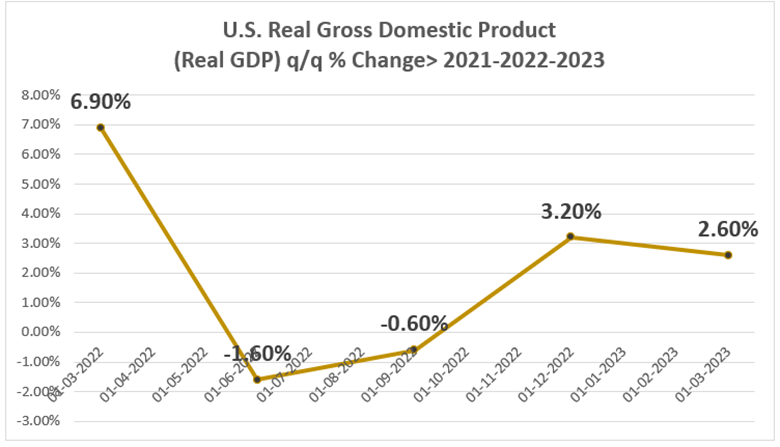

- The U.S. economy maintained its resilience from October through December despite rate hikes, growing at a 2.6% annual pace. When the Final GDP figure was released it led to a short USD depreciation with no significant intraday shock. US Unemployment Claims were released at the same time, slightly higher than expected.

- Inflation in Tokyo slowed further in March at 3.2% compared to February’s 3% figure. At the time of the release, the JPY appreciated for a short time causing a small intraday shock.

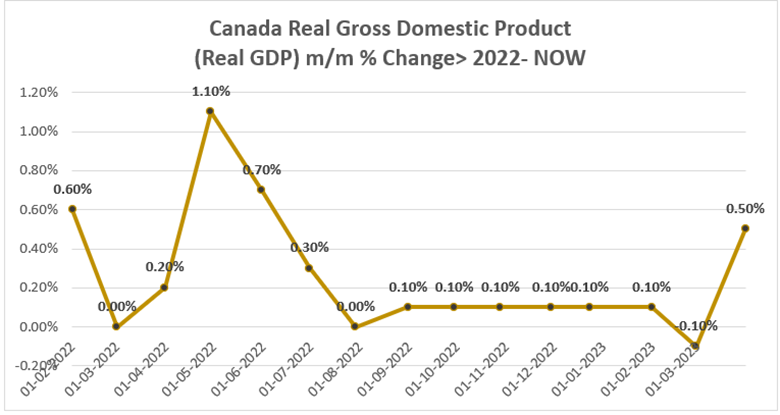

- GDP for Canada was released showing a 0.5% increase. This led to a small intraday shock with CAD appreciating for a while. Core PCE Price Index m/m was released at the same time affecting The lower number caused the USD to depreciate but not significantly and for a very short period of time.

_____________________________________________________________________________________________

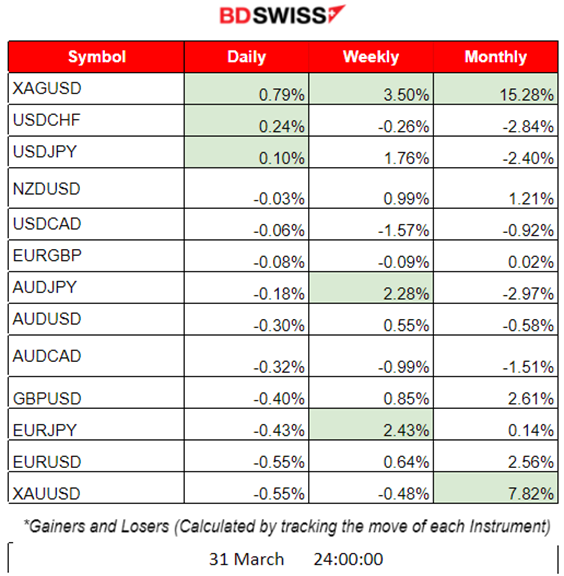

Summary Total Moves – Winners vs Losers (Week 27-31 March 2023)

- The week ended with Silver being on top with a 3.5% change, followed by EURJPY and AUDJPY having changes near 2.5%.

- The month ended with Metals having the biggest increase. Silver ended the month with 15.28% in value and Gold ended it with a 7.82% increase.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

The previous week found EURUSD moving upwards over the 30-period MA until it found resistance near 1.093 on the 30th of March. This level was tested again on the next day, during the Asian session and after that the price experienced a reversal, crossing below the 30-period MA and moving further downwards.

Trading Opportunities

As per the chart, on the week’s view, we see that the reversal could be estimated using the RSI. While the price has the same highs, the RSI oscillator is slowing down with lower highs signalling a reversal.

More opportunities were identified intraday because intraday shocks occurred, because of the figure releases, followed by retracements. This happened mostly in the last three days.

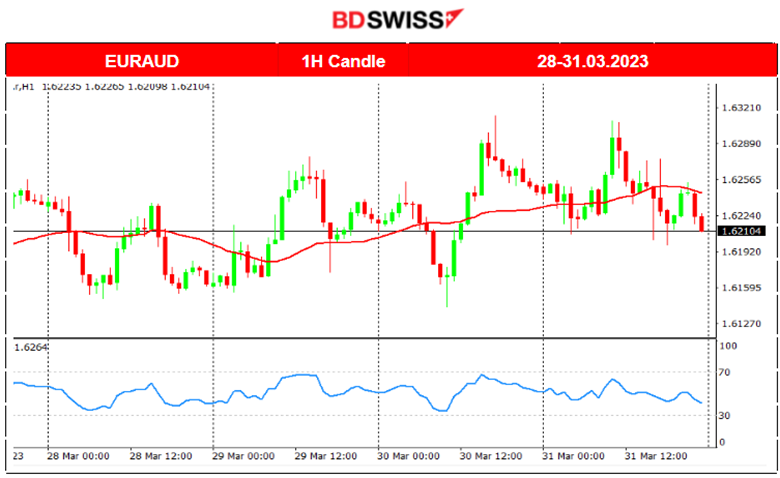

EURAUD

Trading Opportunities

Since the USD was affected greatly this week creating upward trends for USD pairs having the USD as the quote currency, others were moving sideways experiencing high volatility. EURAUD was moving around the 30-period MA 60-80 pips deviation from the mean with reversal after reversal.

Perfect for retracement opportunities.

Related Technical Analysis on TradingView:

https://www.tradingview.com/chart/EURAUD/Y9xExyis-EURAUD-Reversal-and-Back-30-03-2023/

AUDUSD

Even though it is a major pair with USD as the quote currency, the overall increase this week was minimal. The AUD was experiencing reversals, volatility and moving sideways around the 30-period MA. On the 29th of March, the inflation-related figure for AUD pushed the pair downwards as the AUD suffered depreciation. Reversals followed due to USD depreciation from the figure releases and so on.

Trading Opportunities

In such market conditions where no clear trends occur and there is high volatility, retracements are more probable. That is why for example on the 28th, after a rapid unusual shock, we expect a retracement to happen, at least at 61.8% with high probability.

Our Technical Analysis here on TradingView:

https://www.tradingview.com/chart/AUDUSD/wIE7EBSH-AUDUSD-Might-Reverse-28-03-2023/

DXY (US Dollar Index)

According to the DXY, the USD has been indeed depreciating generally from the beginning of the week, from the 27th of March until the 31st of March when it reversed and moved significantly upwards.

_____________________________________________________________________________________________

Australia Consumer Price Index (CPI)

The monthly CPI indicator annual movement rose 6.8% in February, down from 7.4% in January.

_____________________________________________________________________________________________

U.S. Final GDP q/q

Real gross domestic product (GDP) increased at an annual rate of 2.6% in the fourth quarter of 2022. The U.S. economy maintained its resilience despite rising interest rates. The figures are promising for the U.S. economy as it shows growth. The latest PMI figures also showed a recent growth in business activity. The number of unemployment claims remained stable close to 200K. We are waiting for the next week’s PMIs to show us if the picture will remain the same.

_____________________________________________________________________________________________

Canada GDP m/m

The latest monthly change in real GDP was 0.5%. Canada’s economy is rebounding. The economy over Q4 and Q1 is outpacing the Bank of Canada’s forecasts and continuing to showcase trend resilience. The figure was higher than expected, however, intraday shocks are rather small with these figure releases.

_____________________________________________________________________________________________

Crude Oil Inventories

According to the data, the number of barrels drawn from inventories of commercial firms this year is growing. The latest report of Crude Inventory data shows 7.5M barrels draw which is way larger than expected. These shifts though are not enough to explain the whole picture of why the price of U.S. crude has significantly risen recently. The latest supply disruption caused the recent rise.

-Russia announced a production cut in June.

-Turkey halted pipeline exports. Update: Iraq’s federal government and the Kurdistan Regional Government (KRG) have reached an initial agreement to resume northern oil exports this week.

Source:https://www.aljazeera.com/news/2023/4/2/iraq-krg-reach-deal-to-resume-oil-exports-kurdish-official

-OPEC+ unexpectedly announced crude output cuts this Sunday.

_____________________________________________________________________________________________

NEXT WEEK’S EVENTS

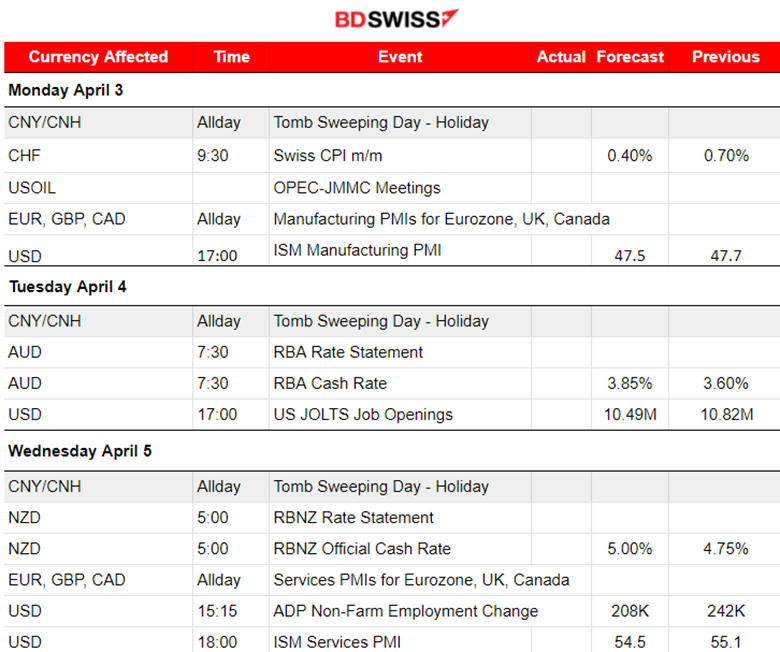

This week, we have

Currency Markets Impact:

- On the 3rd of April, at 9:30, the Swiss Consumer Price Index (CPI) increased by 0.2% in March 2023 compared to the previous month. It had an impact on the CHF as it depreciated with a small intraday shock.

- OPEC+ announces surprise cuts of around 1.16 mbpd from May to year-end. This of course affected the crude’s price (USOIL) significantly, increasing its price.

- PMI figures released this week will show how purchasing managers responded to the questions of the surveys and give a general picture of the recent economic performance for the Eurozone, the UK, Canada and the U.S. The impact will be more-than-usual volatility creating retracement opportunities for markets moving sideways.

- The Reserve Bank of Australia is going to release the RBA rate figure that is going to affect the AUD on the 4th of April.

- The Reserve Bank of New Zealand is going to release the Official Cash rate figure on the 5th of April and undoubtedly, the NZD will be affected.

Interest rate releases usually create intraday shocks. Depending on the time of release, retracement opportunities arise. Both will be released during the Asian Session and that is good for retracements as the market is moving early.

- The U.S. ADP, Non-Farm Employment Change which is the estimated change in the number of employed people during the previous month, excluding the farming industry and government, is going to be released on the 5th of April and anticipated to fall. This will cause a shock for the USD pairs and depending on the figure it will be big or small. What matters is the deviation from the intraday 30-period MA.

- Canada’s Employment Change and the unemployment rate announcements are taking place on the 7th of April. CAD pairs will be affected at 15:30, expecting intraday shocks. Depending on the USD direction, the impact will be high or low deviations from the mean.

- The most important figures of the month are going to be released on the 7th of April at 15:30. The Non-Farm Employment Change and the Unemployment Rate figures are estimated to have a huge impact on USD Because of the expectation of these releases, the market will be less volatile for USD-related pairs on the days before the announcements. Retracement/reversal “catchers” will have to be cautious as these figures might cause medium-term trends and no retracements intraday.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

USDCHF

The pair is generally moving around the 30-period MA unless some fundamental factors push the pair to deviate further for the mean now and then as on the 30th of March. Expecting intraday shocks to cause retracement opportunities, however, the main driver with this pair is usually USD and it is good to keep track of the releases. The RSI is good at providing information on the expected reversal as per the chart’s divergence indicator example. Price: Lower lows, RSI: Higher lows.

We have the most important figure releases affecting the USD in the upcoming week so any long-term forecast should take this into account.

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

US Crude Oil

Crude has been following an uptrend with all the developments regarding disruption in supply. While demand is keeping its pace, the price goes up. Today, oil prices surged after OPEC + producers announced surprise cuts. On the chart, there is a gap in the price recorded because the announcement took place during the weekend when trading operations were closed, CFD market is closed. Upon market opening, the price was elevated by nearly 6 Dollars.

Gold (XAUUSD)

Within a week, Gold has been showing increased volatility, moving sideways with 10-15 USD maximum deviations from the mean. Gold experienced an increase in price after the recent US banking sector turmoil reaching near 2000 USD.

On the 31st there was a decrease in price, near 30 USD, followed by retracement the next day. While investors switch more and more to risky assets such as stocks, metals price goes down.

EQUITY MARKETS MONITOR

US30 (Dow Jones)

Clear upward trend for the week. All U.S. indices show the same upward movement above the 30-period MA. For the quarter, the Nasdaq jumped 16.8% in its biggest quarterly percentage increase since the three months ended June 2020. The S&P 500 gained 7% and the Dow rose 0.4% in the quarter, based on the latest available data as of 31st March.

Analysts remain cautious about the rally. We could soon see a reversal, signalling the end of the trend.

______________________________________________________________