PREVIOUS TRADING DAY EVENTS – 03 April 2023

Announcements:

- The Organisation of Petroleum Exporting Countries and Allies (OPEC+) unexpectedly announced output cuts, causing a boost in expectations of rising inflation affecting the world economy. Along with Russia, they pledged to make cuts exceeding 1 million barrels a day, starting next month and lasting until the end of the year. Price forecasts were lifted for this year and 2024. U.S. oil futures are also up.

After the banking sector turmoil, the price had already started to rise again, following supply disruptions. As a result, this surprise intervention pushed the price significantly higher. While Central banks are trying to fight inflation with rate hikes, rising oil prices threaten to add to inflation creating stress to the banks’ efforts.

Source: https://www.bloomberg.com/news/articles/2023-04-02/oil-surges-after-opec-makes-unexpected-crude-production-cut?srnd=markets-vp

- The Swiss Consumer Price Index (CPI) increased by 0.2% in March 2023 compared to the previous month. Even though inflation eased by more than expected last month, the central bank will likely increase interest rates again in June.

“Looking at these numbers, the Swiss National Bank is still not done, but can take a breath,” said Karsten Junius, chief economist at Bank J Safra Sarasin Ltd. in Zurich. “A further interest-rate hike in June will come, but officials can now leave it at 25 basis points.”

“The core reading shows that price pressures are significantly lower in Switzerland than in the rest of Europe,” Junius said. “It’s astonishing how different the development compared to the Euro area can be.”

The country’s purchasing managers’ index declined further below the threshold of 50 indicating contraction, reaching 47 last month.

Source: https://www.bloomberg.com/news/articles/2023-04-03/swiss-inflation-slows-to-weakest-level-in-three-months#xj4y7vzkg

- The U.S. ISM Manufacturing Index fell to 46.3 in March, which is lower than the estimated 47.5, an index below 50, showing U.S. factory activity contraction. Investment activity saw a drop because of the recent market conditions that involve expected rising interest rates, fears of an upcoming recession and the tighter lending conditions.

“New order rates remain sluggish as panellists become more concerned about when manufacturing growth will resume,” Timothy Fiore, chair of ISM’s Manufacturing Business Survey Committee, said in a statement. “Price instability remains, but future demand is uncertain as companies continue to work down overdue deliveries and backlogs.”

Fiore further stated that employment data indicate contraction as factories stop hiring and laying off workers. Meanwhile, manufacturer inventories shrank at the fastest pace in nearly two years.

______________________________________________________________________

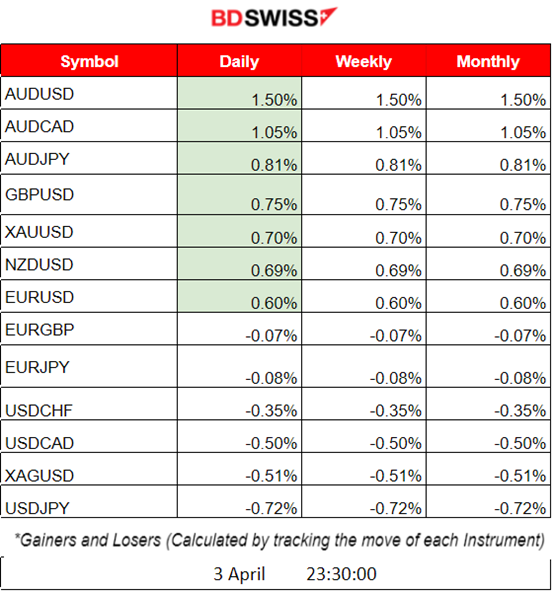

Summary Daily Moves – Winners vs Losers (03 April 2023)

- The month started with USD depreciation and AUD appreciation. This caused the AUDUSD to move upwards with a steady pace after 9:00, reaching a deviation from the price at that time of nearly 130 pips when the day ended. The overall change in price was 1.5%. AUDCAD follows with a 1.05% change.

- The rest of the big winners of the day are mostly USD pairs, with USD as the quote currency, with changes within the range of 0.60%-0.75%.

______________________________________________________________________

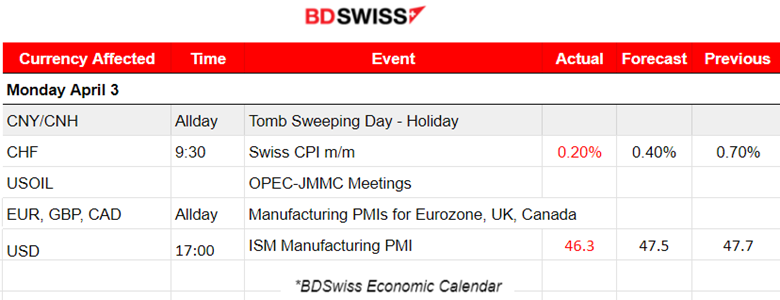

News Reports Monitor – Previous Trading Day (03 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Just before the European Markets opened at 9:30, the monthly Swiss CPI figure was released. The CPI increased by 0.2% in March 2023, compared to the previous month and at the time of the release, it did not have much impact on the CHF pairs. The USDCHF experienced a small upward move that was immediately corrected.

- Morning – Day Session (European)

OPEC+ producers announced oil production cuts causing its price to soar, causing a gap in the chart for USOIL of almost 6 USD/barrel. This, of course, affects consumer expectations about the cost of living. The USD experienced a surprisingly high depreciation almost all day.

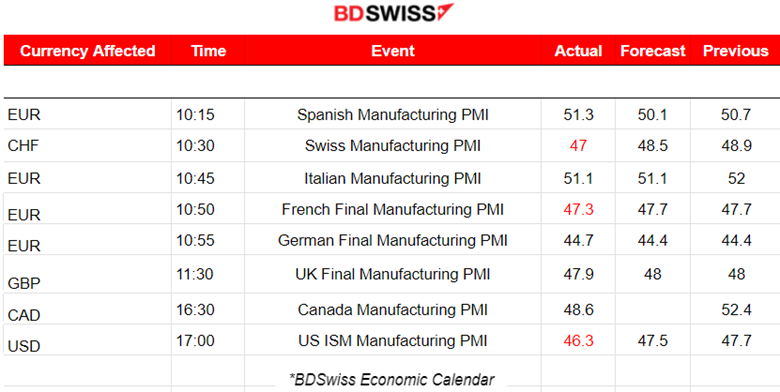

Manufacturing sector PMIs figures were released during the day:

Eurozone PMIs show mixed results. Overall, manufacturing production across the Euro area grew marginally during March.

The U.K. manufacturing falls back into contraction; the figure is 47.9, lower than expected and than the previous month. The same goes for Canada.

The U.S. ISM Manufacturing March dropped to 46.3 from 47.7 and below the 47.5 expectations.

General Verdict:

- The market experienced volatility with the USD suffering depreciation against major currencies.

- Manufacturing PMIs still show contraction for the U.K. and Canada. Since the figure for the major Eurozone countries is below 50, business activity is still stalled. U.S. economic activity in the manufacturing sector contracted in March. Major pairs with the USD as quote currency have been moving upwards with no significant retracement.

- DXY confirms dollar depreciation as per the chart. It started at 9:00 and continued to drop until the end of the day.

FOREX MARKETS MONITOR

EURUSD 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD has been moving upwards and above the 30-period MA until the 31st of March, with USD being the main driver. On that day, the price reversed significantly, with the pair crossing the MA and moving downwards at a steady pace until the 3rd of April. With the recent USD depreciation, the price reversed again almost in full, crossing over the MA and moving upwards pushed by the important figure releases such as the lower ISM Manufacturing PMI.

EURUSD (03.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A quite volatile price path for the EURUSD, as USD started depreciating heavily at 9:00. Negative news on the U.S. manufacturing activity for last month pointed to further signs of a slowing economy. There are elevated renewed inflation concerns following OPEC+’s surprise output cuts. All these had an impact.

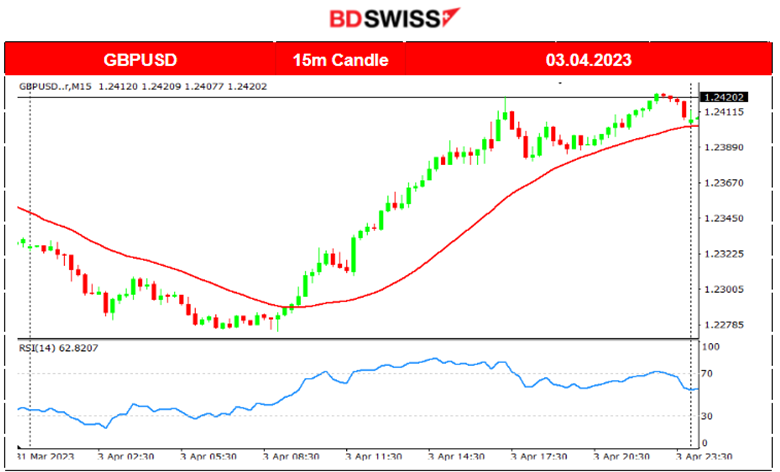

EURUSD (03.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

GBPUSD shows a similar path since the USD was the main driver of the upward movement.

______________________________________________________________________

EQUITY MARKETS MONITOR

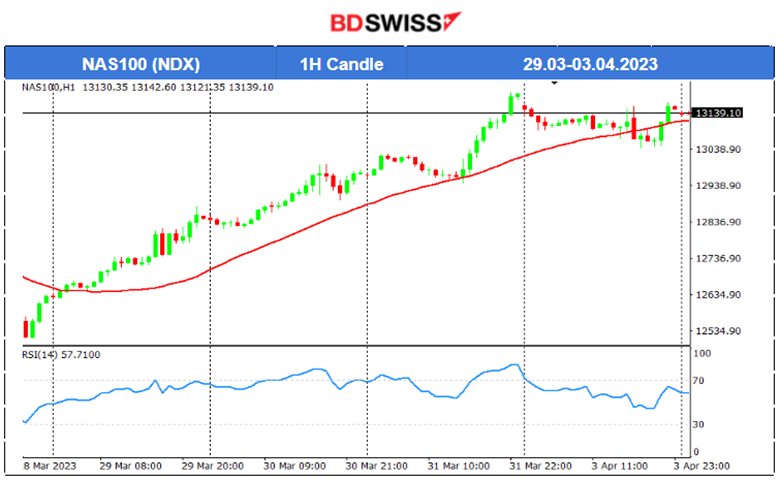

NAS100 (NASDAQ – NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A clear upward trend for the NAS100 as U.S. stocks recently had a boost. The index moves upward for days and over the 30-period MA. However, on the 3rd of April, we see that the index moves sideways. Will this be the end of the upward trend? No price reversals took place so we do not have strong evidence for that yet. In addition, according to the movement of other indices, U.S. Stocks are still on the uptrend.

NAS100 (NASDAQ – NDX) (03.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

NAS100 stocks were moving sideways yesterday, indicating that they might have started to stabilise. The index was overall moving around the 30-period MA. High volatility took place after the NYSE opening.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

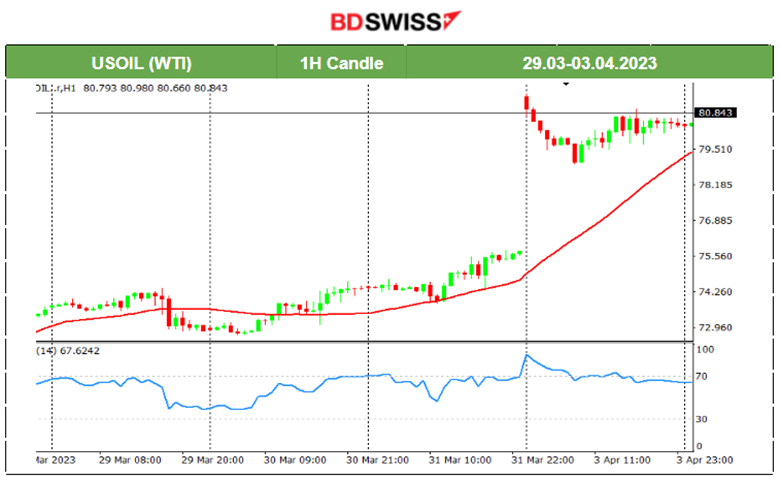

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price of U.S. Crude Oil was moving sideways at first and around the price of 73 USD/barrel when, on the 30th of March, it started to rise further due to disruptions in supply. While the price was moving further upwards and over the 30-period MA, OPEC+ surprisingly announced production cuts that caused the price to jump over the 81 USD level. After some volatility experienced on the 3rd of April, it closed the day at nearly 80 USD.

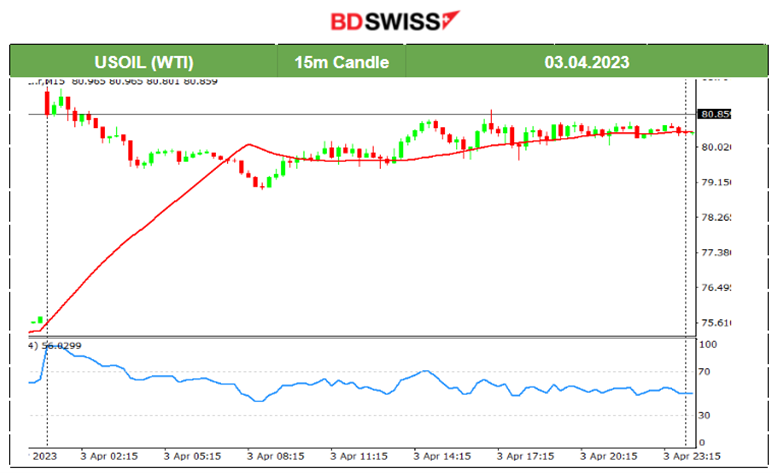

USOIL (WTI) (03.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Yesterday, the price settled after the price experienced a retracement near the 79 USD level, closing the day at nearly 80 USD.

Trading Opportunities

A retracement opportunity was identified after the jump. The price retraced during the Asian session.

______________________________________________________________

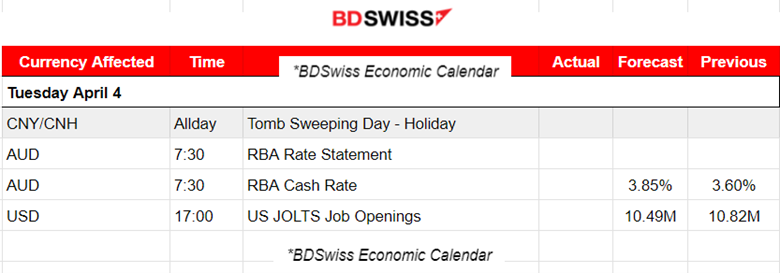

News Reports Monitor – Today Trading Day (04 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 7:30, the Reserve Bank of Australia (RBA) is going to release the Cash Rate figure. It is expected that RBA will increase the cash rate by 25bps in April to 3.85%. The announcement will probably cause an intraday shock for the AUD pairs during that time and depending on if the actual figure is a surprise, the deviation will be high or low.

- Morning – Day Session (European)

The Bureau of Labor Statistics will release its report for JOLTS Job Openings, the number of job openings during the reported month, excluding the farming industry. It is an important economic indicator concerning the U.S. labour market and if the actual figure deviates significantly from the expected one, then there will be an intraday shock affecting the USD pairs creating retracement opportunities and/or price reversals. A higher-than-expected figure should cause USD appreciation.

General Verdict:

- The week started with large moves following the USD depreciation. On the contrary, the AUD actually experienced an appreciation. That is the reason now most pairs experienced volatility and large deviations from their 30-period MA (H1 charts). Reversals are quite possible and they will create retracement opportunities after they are confirmed.

- Intraday shocks are expected with the RBA rate release and the U.S. JOLTS Job Openings but not enough impact to create long trends as the markets are waiting for NFP on Friday.

______________________________________________________________