Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

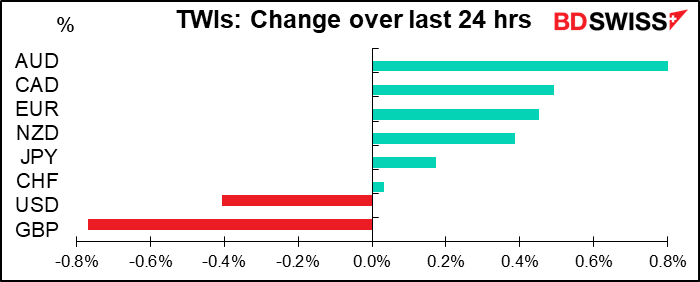

It was a big day yesterday in the EU. EU leaders meeting in Brussels resolved their dispute with Poland and Hungary over the “rule of law” mechanism. The settlement, the details of which I won’t bore you with, mean the EU can go ahead with its €1.8tn budget and €750bn post-pandemic recovery fund. That’s positive for the euro.

The European Central Bank (ECB) meeting also turned out to be positive for the currency. They unveiled a slew of measures, but significantly they were all “recalibrations” of existing measures, as the Governing Council had said back in October: the existing programs were extended and more money was made available for them. There were no new programs put into place. Keeping the current programs in place longer for longer means more support for the economy and therefore an earlier recovery, but it doesn’t necessarily mean more downward pressure on the euro now. Furthermore, ECB President Lagarde noted that the additional funds “need not be used in full,” meaning that there was possibly less than meets the eye here. EU sovereign bond yields rose after the announcement, signaling the market’s disappointment.

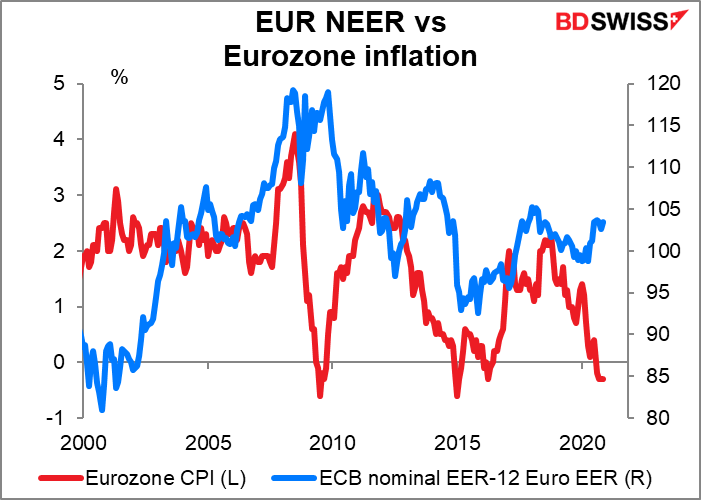

While ECB President Lagarde repeated the Bank’s boilerplate comments on the euro, she didn’t seem particularly piqued at its recent appreciation. All she said was “We will continue to monitor it very carefully going forward.” “Monitoring” doesn’t necessarily imply doing anything about it. She repeated the usual explanation about how the exchange rate “plays an important role and exercises downward pressure on prices,” disregarding as always the fact that for most of the time since the euro came into existence, the relationship has been the exact opposite: that inflation has risen as the euro has strengthened and fallen as the euro has weakened.

I originally had “US government shutdown” on the schedule for midnight tonight, but Washington managed to scrape together a stopgap measure to keep the lights on for one more week while they haggle over the fiscal stimulus bill to replace all the CARES Act programs that will expire at the end of the month (about 24 relief provisions plus 30 tax extenders). That agreement looks increasingly impossible though. Will they managed to figure out some longer-lasting way to keep funding the government regardless? Tune in again next week and find out!

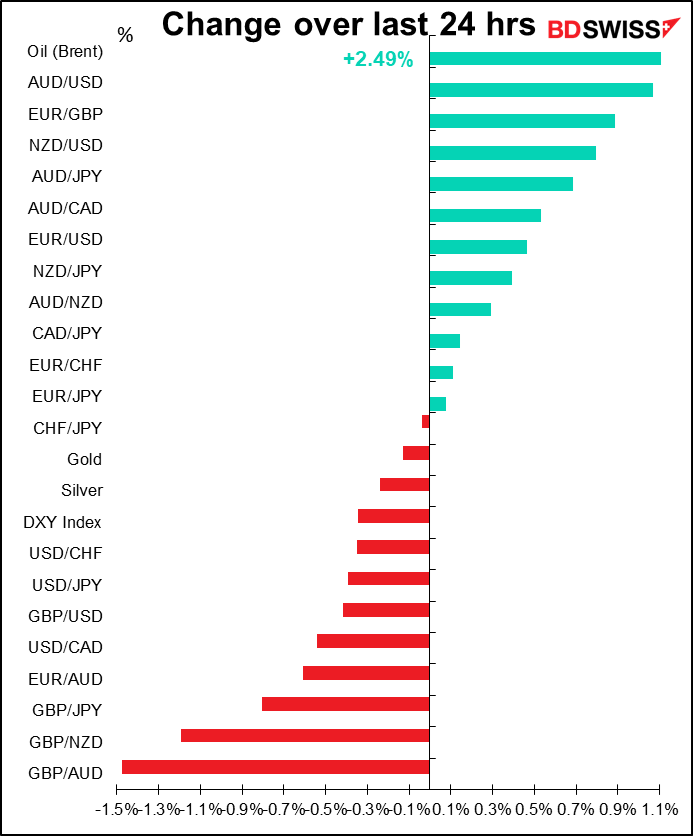

GBP was the big loser on the day as UK PM Boorish Johnson warned everyone to prepare for a “no-deal” Brexit. Thanks for the warning, which should’ve come four years ago. Meanwhile, Johnson said he was ready to go on a Grand Tour of European capitals to try to get a deal done, but EU leaders were too busy hashing out tough new climate targets to take up Brexit yesterday and leaders weren’t even briefed on the discussions. The delay makes a decision by the new deadline of Sunday night even less plausible. The negotiators are continuing to meet, but without fresh political direction they don’t have any way to overcome the impasse that’s stymied them up to now.

Of course we all expected everything to happen Sunday night five minutes before the markets reopen, as usual with the EU, but as the time approaches, I’m getting increasingly nervous. This situation makes it extremely difficult to take a position ahead of time because even if you set stops, if the talks do break up definitively on Sunday night without an agreement, then GBP is liable to gap lower at the opening Monday and you may not be able to get filled at your stoploss level.

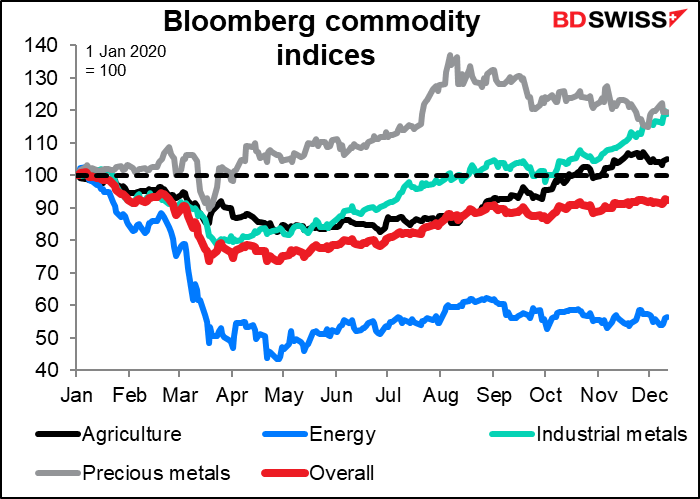

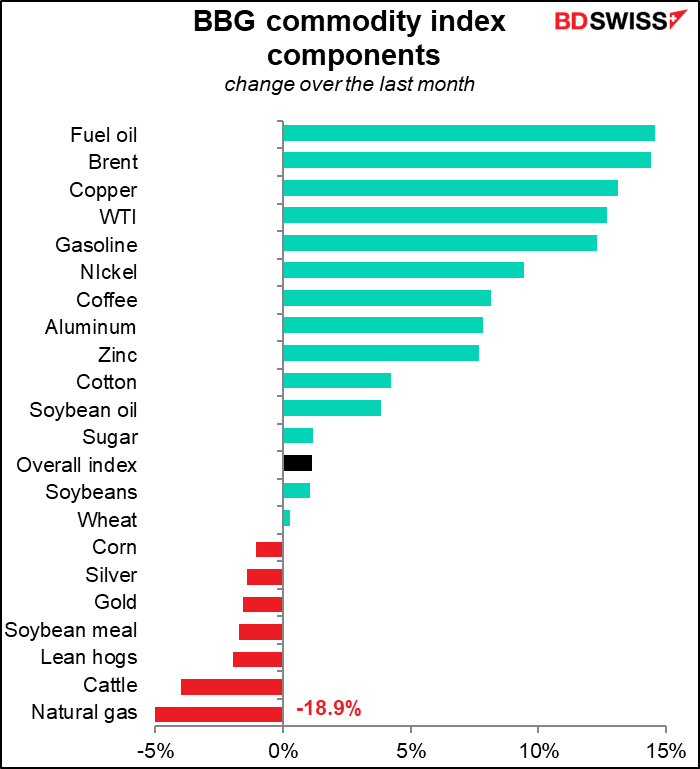

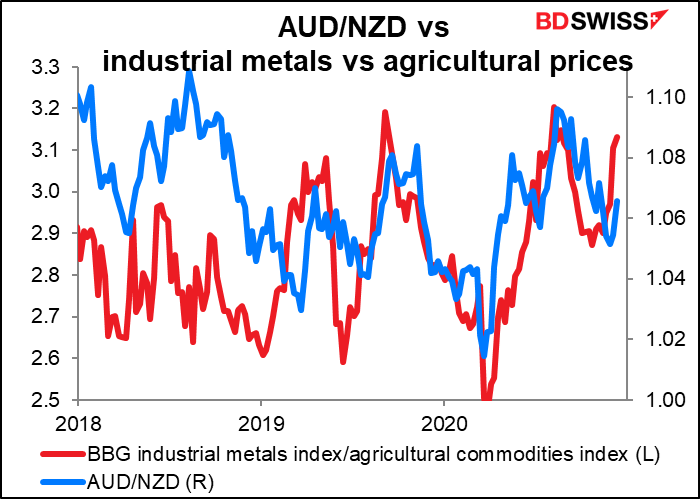

On the other hand, the commodity currencies gained, led by AUD, as hopes for global growth improved and commodity prices gained. Industrial metals, such as nickel and copper, have been particularly strong recently as speculators expect the rollout of vaccines around the world will get economies going again. Oil prices rose to a post-pandemic high for both Brent and West Texas Intermediate (WTI), the US benchmark crude.

The change in commodity prices may also help to explain the recent rise in AUD/NZD, as industrial commodities, which Australia specializes in, are gaining much more than agricultural commodities, which are New Zealand’s specialty.

Today’s market

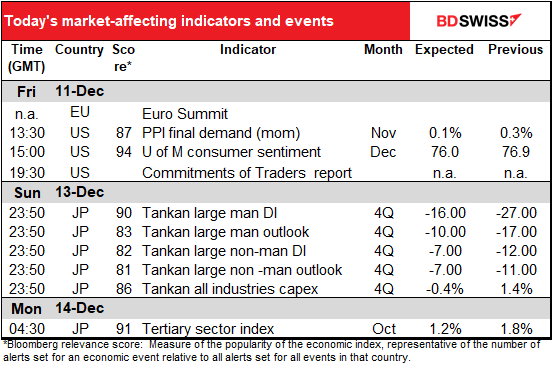

The US producer price index probably isn’t that important for FX investors so I’m not going to bother with a graph.

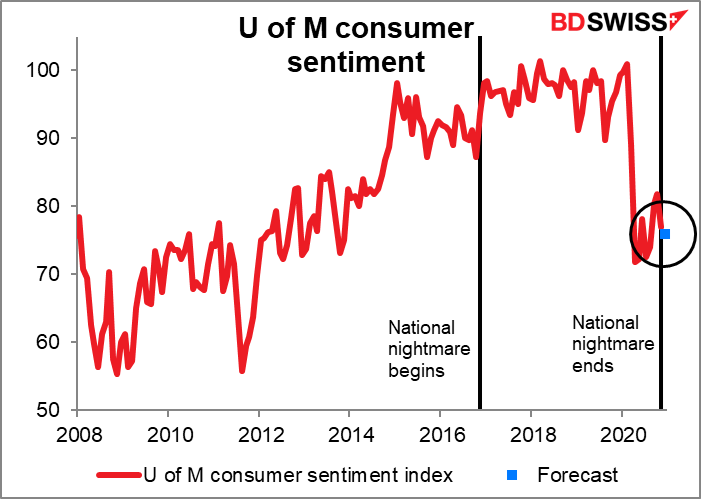

The U of Michigan consumer sentiment index is expected to remain pretty much unchanged. The euphoric sense of relief and liberation from the crushing nightmare that has pressed down on the American spirit for the last four years is not expected to show up in the data yet, probably because hope for the future is being offset by the immediate crisis of exploding virus cases.

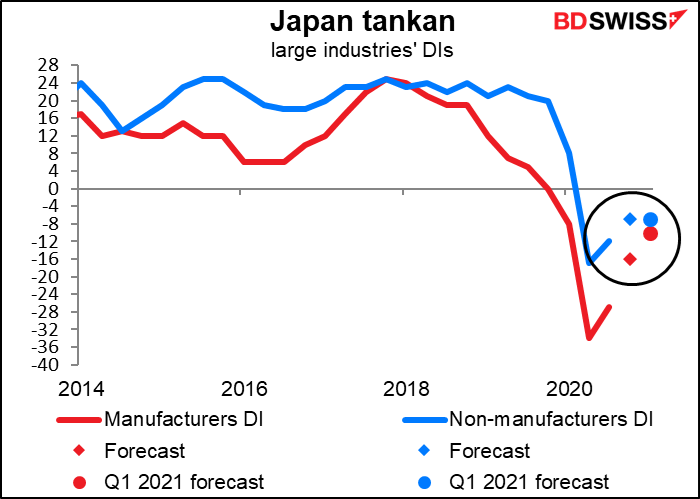

Then on Monday morning, while you’re still counting sheep or sawing logs, or whatever you do in bed (I won’t pry), Japan releases the Bank of Japan’s short-term survey of economic conditions, universally known by its Japanese acronym tankan. This is one of the most important indicators out of Japan. It’s expected to show a significant improvement, particularly for manufacturers, and hopes that the improvement will continue in Q1 next year. Non-manufactures though are expected to improve less and not at all from Q4 to Q1 next year. Nevertheless, I think these results could encourage equity market participants. Whether that’s good or bad for the yen is another question – a “risk-on” mood in Tokyo tends to lead to a weaker yen.

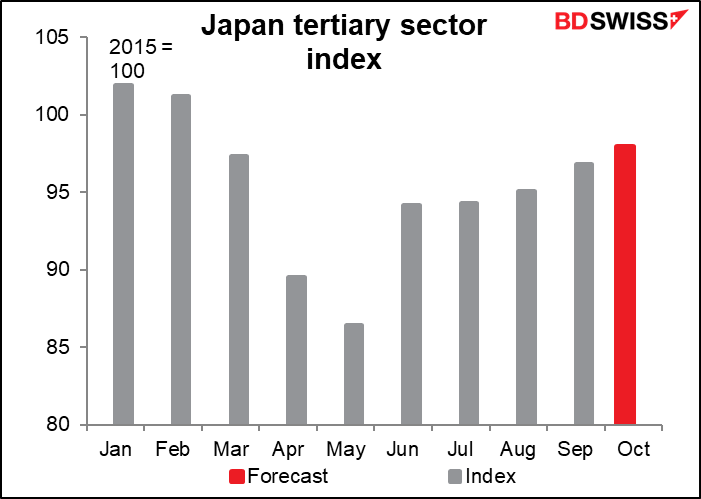

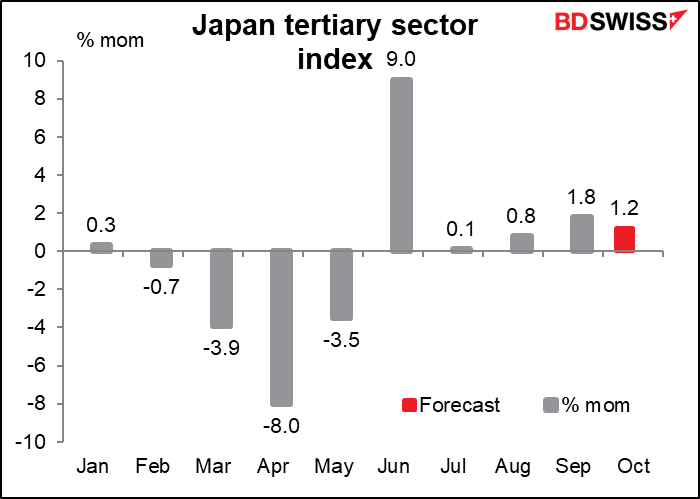

Japan also releases the tertiary sector index. The tertiary sector is the service sector (the others are the primary sector, ie agriculture and mining, and the secondary, which is manufacturing). I think people should pay more attention to the Eco Watcher’s Survey, which is a good predictor of the tertiary sector index, but apparently I’m the only one who thinks that. The tertiary sector index is probably more important than usual nowadays, because the service sector is affected by the pandemic more than manufacturing is and so it’s going to determine the business cycle at this time.

Unfortunately, activity in the tertiary sector seems to be levelling off before it’s even returned to pre-pandemic levels. This is not good – but it’s not unusual, either. Most countries’ service sectors are like this, as the service-sector purchasing managers’ indices (PMIs) show. We’ll know more about that next Wednesday, when the preliminary PMIs for the major industrial economies are released.