Rates as of 05:00 GMT

Market Recap

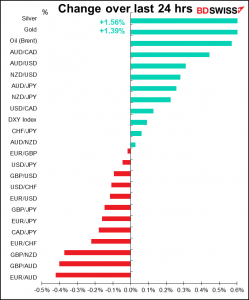

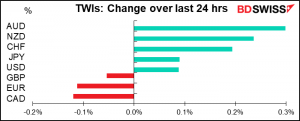

Not much worth writing about in the FX market today! Very small movements except in AUD and NZD.

It seems that the blowout US data yesterday has improved the “risk-on” sentiment. US retail sales were up 9.8% mom vs +5.8% forecast, jobless claims fell an enormous 168k (vs -44 expected) to a post-pandemic low, and the Empire State and Philly Fed indices both beat expectations too. (Industrial production didn’t however, although it did still rise mom.) Despite this, US Treasury yields fell (10 years -5.6 bps). Was it in continued reaction to the dovish comments from Fed Chair Powell and Vice Chair Clarida on Wednesday? Or the renewed demand from Japanese investors with the start of the new fiscal year, as I mentioned in yesterday’s comment? Plus earnings were generally good and forecasts revised up. The combination took US stocks higher to a new record high on the S&P 500 (but not yet on the NASDAQ, although it’s close) while the VIX index fell to a new post-pandemic low.

The good mood continued in Asia, where most markets were up modestly, helped by strong Chinese growth (+18.3% yoy vs +18.5% expected, although qoq growth was disappointing: +0.6% qoq vs +1.4% expected).

The signs of strong global growth helped commodity prices as well as the commodity currencies. AUD and NZD were the winners. CAD was the exception, falling on weaker Canadian manufacturing sales (-1.6% mom vs -1.0% expected). CAD is recovering this morning though, boosted by the rise in oil, apparently.

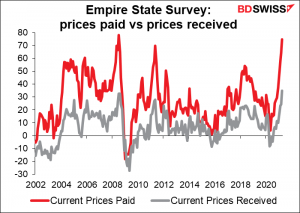

We’ve been talking a lot about inflationary pressures. One worrisome indicator from yesterday: the Empire State manufacturing survey “prices received” index hit a record high while the “prices paid” index was the highest since July 2008 (data back to July 2001).

Today’s market

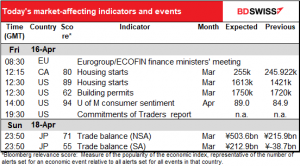

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

During European time, the Eurogroup (finance ministers of the countries that use the euro) and Economic and Financial Affairs Council (ECOFIN) (the economic and finance ministers from all EU member states) meet. Their discussions will include: the economic recovery in the EU, the European financial architecture for development, and the capital markets union.

The contentious parts will be when they discuss the financing of the Next Generation EU plan, which involves borrowing EUR 750bn (the first EU-wide borrowings, as opposed to borrowings by individual countries) to dish out to countries hit by the pandemic, and the implementation of the Recovery and Resilience Facility, which will make EUR 672.5bn of that money available to member counties in the form of loans and grants.

The problem is, things aren’t going according to plan. As of the end of March, only 13 of the 27 EU countries had ratified the decision. All 27 have to do so before the EU can start raising funds from the market. Some of these situations are complex, such as in Germany, where the Constitutional Court has delayed ratification. As for the implementation, the deadline for submitting national plans is April 30th and most countries have not yet published their plans as far as I can tell.

What with delays in ratifying the joint borrowing power and slow progress in developing national recovery plans, it looks likely that the first tranche of the fund won’t be disbursed until Q4. That could push back expectations for when the EU might return to “normal” growth, which would be negative for the euro.

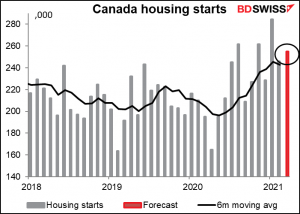

After that, it’s basically housing starts day, with Canadian starts followed by US starts.

Canadian housing starts have been going pretty strongly recently (the Bank of Canada last month said housing market activity was “much stronger than expected“) and are forecast to continue to do well. The consensus view for today’s figure is for an above-trend number of starts. That would tend to be positive for CAD.

US housing starts are expected to jump 13.4% mom to more than reverse the previous month’s decline, which was caused by unusually cold weather throughout the country. At 1.611mn, the forecast is close to the post-Global Financial Crisis high of 1.67mn set in December. Building permits are expected to be down just slightly. They hit a post-GFC high in January. Permits are expected to exceed starts for the eighth consecutive month, indicating a continued backlog of demand.

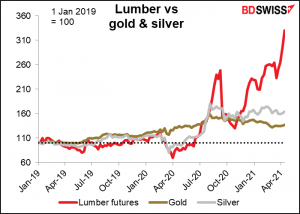

Remember the star of the show: lumber futures! This is also another reason to be bullish CAD.

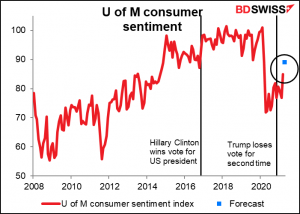

The U of M consumer sentiment index is expected to rebound sharply. Rising employment is no doubt behind the improvement in sentiment, which is closely linked to the job market. This should just confirm the positive consumption picture that emerged from yesterday’s blowout US retail sales figure.

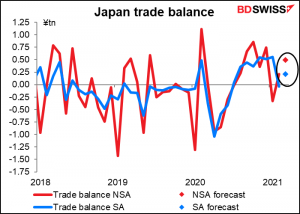

Then early Monday morning, Japan’s trade balance is expected to rise in both unadjusted and seasonally adjusted terms. That’s a sign that the global economy is recovering. In theory it could be positive for the yen, but if it boosts the Japanese stock market, then it would increase “risk-on” mood and the yen would be likely to weaken.