Rates as of 04:00 GMT

Market Recap

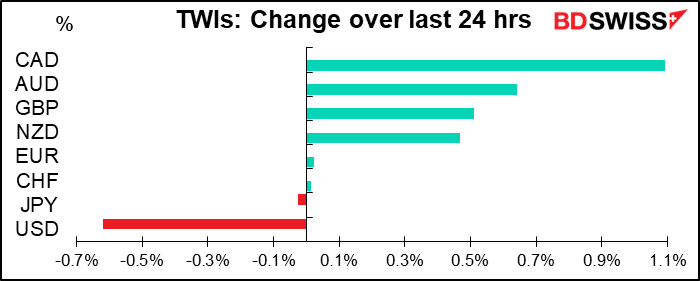

A “risk off” day proves extremely negative for USD! US stocks closed up 1.23%. The S&P 500 spent most of the day above the 3,000 level, although the opening proved to be the high for the day and the index closed below 3,000. The futures indicate it opening above that level this morning, however. Optimism about the prospects for the global economy as the world emerges from lockdown was the major force, rather than any specific news.

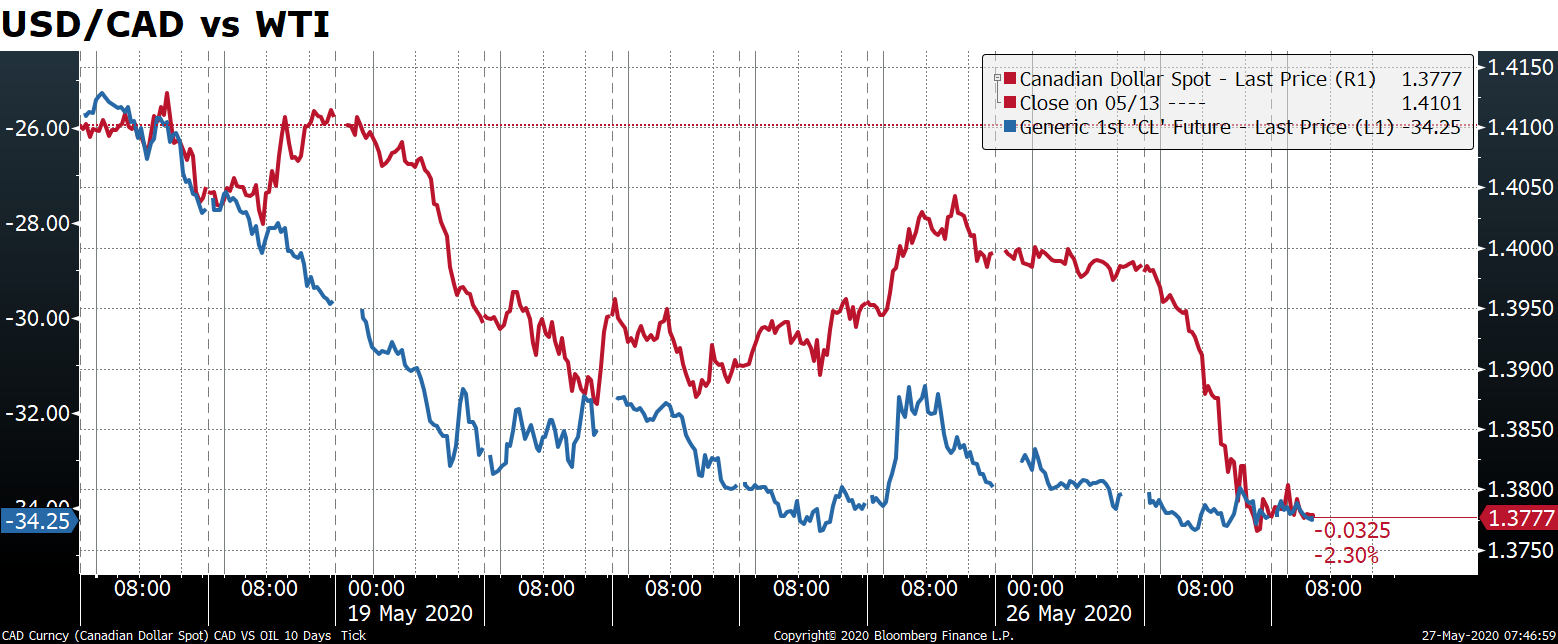

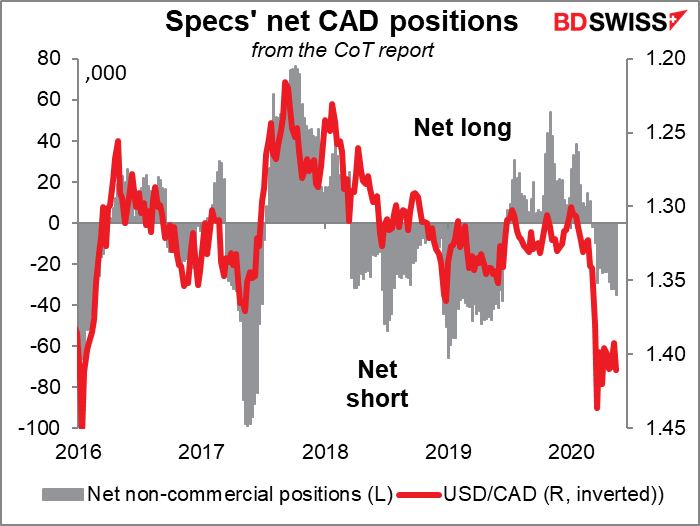

CAD finally caught up to the recent rally in oil with an explosive move higher.

The fact that speculators were relatively short CAD may have helped, although they certainly have been shorter in the past.

With growth prospects improving, emerging market currencies generally rallied. The beaten-down BRL led the move, rallying for the second day in a row. Mexico’s Q1 GDP was revised up (well, revised to be down less than initially estimated), which helped Latam currencies.

Note though that USD gained vs CNH and CNY. USD/CNY hit a record high yesterday of 7.1293 (official mid-rate), although it’s back down a bit to 7.1092 today. Note though that the close (blue line) is higher than the mid rate, which implied continued pressure to move higher (= weaker). The Chinese authorities usually let CNY weaken for one of two reasons: one, to offset USD strength, or two, to send a signal. Yesterday’s weakness clearly was not to offset USD strength, so it was probably a signal that further interference in HK would be met with further trouble on the economic front. That could lead to more volatility down the road.

The ECB is apparently planning to ignore the German constitutional court’s ruling against its bond-buying policy, according to the FT. They interviewed Isabel Schnabel, the German economist who joined the ECB board in January, who said, “We are not adjusting our monetary policy in any way in response to this ruling.” She added that the court ruling “does not directly affect us” and instead was likely to be dealt with by the Bundesbank. Other reports suggested that the ECB is working on a contingency plan to continue its bond-buying program without the Bundesbank if necessary. If worst comes to worst, the European Commission can launch an infringement procedure against the Bundesbank if it stops participating in the bond-buying plan. That would really set up a constitutional crisis in Europe!

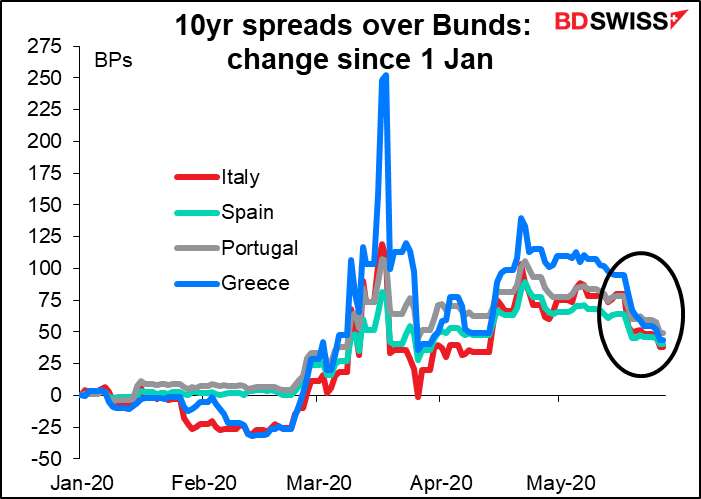

The reports are positive for the euro in that they imply the ECB will continue to backstop the peripheral bond markets and keep Italy afloat. While bond-buying programs could be considered negative for a currency, in that they lower interest rates and expand the money supply, in this case it’s positive for the euro because without the program, Italian bond spreads would blow out and the risk of Italy leaving the euro would increase. On the contrary, the continued narrowing of spreads shows increasing confidence in the European monetary system.

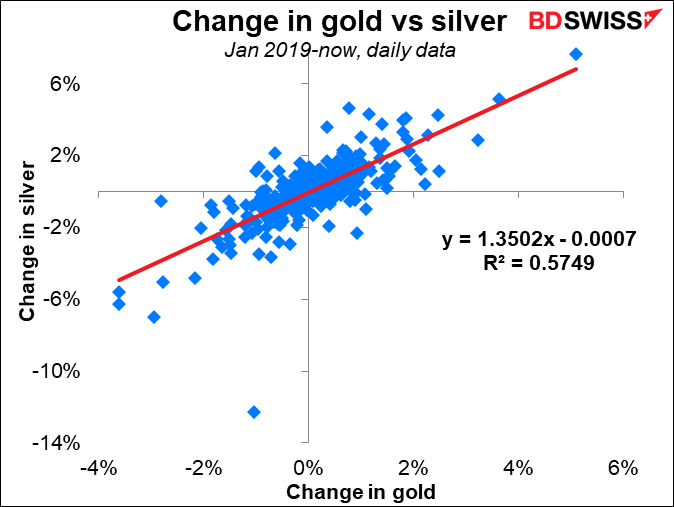

CORRECTION: gold vs silver movement

Yesterday I included a graph of the change in the price of gold vs the change in the price of silver and said there was no connection between the two. I’m afraid this was a big Excel mistake. I finally figured out what the mistake was and re-ran the graph. Contrary to what I said, there is a robust relationship between the movement of gold and the movement of silver, as the r-squared of 0.57 shows (meaning the change in one price explains 57% of the change in the other price). In general, for every 1% the price of gold changes, silver changes 1.35%.

In fact, today is an excellent example of this relationship: gold was down 1.61% and silver fell 2.25%, not far off the -2.17% that would be predicted by the historical relationship.

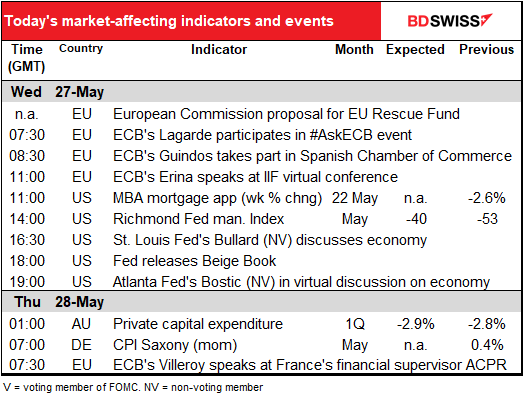

Today’s market

The big event today: European Commission (EC) President von der Leyen presents the EC’s revised Multiannual Financial Framework (the seven-year budget) and the EC’s proposal for the EU Recovery Fund to the European Parliament. The proposal is expected to build on last week’s joint French-German proposal for a EUR 500bn fund financed by joint issuance and distributed as grants. The French-German proposal was a bold move that crosses a previous red line in Europe: joint fiscal responsibility. However, four northern European states — Austria, Denmark, the Netherlands and Sweden – have tabled an alternative proposal that would only offer loans, rather than grants. The so-called “frugal four” are also against debt mutualization or any “significant increases” in the EU’s budget. Instead they proposed a “temporary, one-off emergency fund” to support the recovery and health sectors.

Given the absence of any common ground between the two plans, all eyes will be on the EC to see how they square the circle or instead come down on one side or the other – or fail to, as the case may be. How to weight the views of the two sides? If we look at the EU’s 2018 budget (the latest one they have available) and take out the UK’s contribution, France and Germany together account for 40.9% while the “frugal four” account for 7.4%. Are you familiar with “the golden rule”? It’s “he who has the gold, makes the rules.” I think if the countries responsible for 41% of the money support their proposal, and Italy and Spain are in favor too, then the EC will probably go with that.

The problem is that under EU law, the decision has to be unanimous. So those four countries can indeed veto the proposal when it comes up for a vote at the 18/19 June EU leader’s meeting.

If the EC does approve the French-German proposal and does manage to get it to pass – which is by no means certain — it would reduce the risk of a slump in peripheral Europe, notably Italy, and increase the likelihood of a synchronized recovery across the Continent. Over time it would reduce the pressure on national budgets and the ECB and increase the likelihood of some kind of enhanced pan-European fiscal capacity. It would be positive for the euro. However, a further fudge, delay or “kicking the can down the road” – which is the usual EU modus operandi – would be negative, in my view.

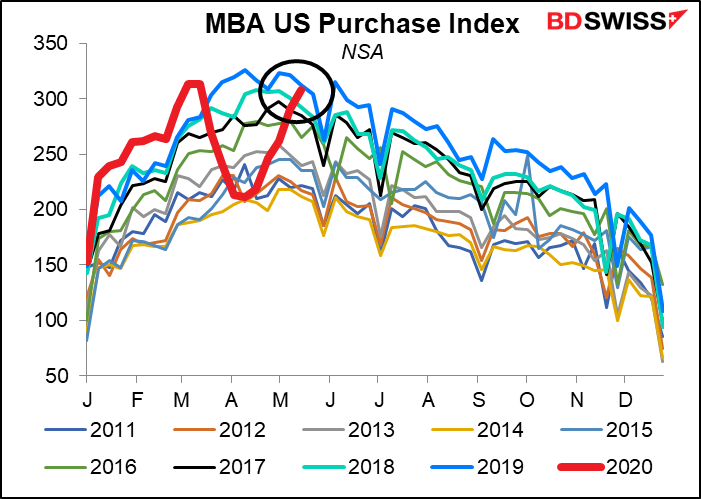

I’ve been following the MBA mortgage applications recently. They’re a timely indication of the state of the US housing market, which has been doing better than people expected: yesterday’s US new home sales for April were actually up from the previous month (623k vs a revised 619k). As the lockdown eases, it seems people are taking advantage of the lower interest rates. The mortgage application figure that usually gets reported is the percentage change from the previous week, using the seasonally adjusted data. But seasonally adjusting weekly data is hard. Many people (including me) prefer to look at the unadjusted data and just see how it compares to previous years. In that respect, 2020 is now shaping up to look pretty good. Mortgage applications collapsed in March and April, as you’d expect, but have rebounded nicely since then.

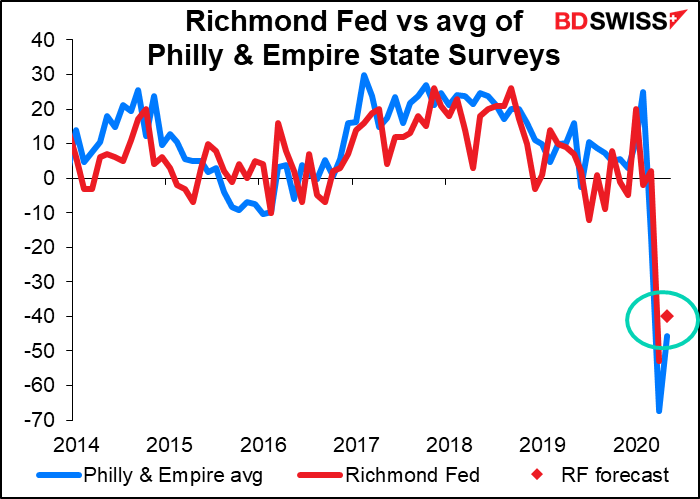

The Richmond Fed survey is expected to bounce back somewhat, as indicated by the rebound in the Philadelphia and Empire State surveys as well as yesterday’s Dallas Fed index. Note though that the market forecast of -40 was the same as last month – my guess is that people really have no clue and are just guessing. I wouldn’t be surprised to see it rebound somewhat though. Things can scarcely get any worse, so by default they have to get better eventually.

We’ll get an impressionistic look at the US economy when the Fed releases the “Summary of Commentary on Current Economic Conditions,” aka The Beige Book as always two weeks before the next FOMC meeting. It’s significant for the market because the first paragraph of the statement following each FOMC meeting tends to mirror the tone of the Beige Book’s characterization of the economy. The book doesn’t have any number attached to it that quantifies its contents, but many research firms do calculate a “Beige Book index” by counting how many times various words appear, such as “uncertain.” In any case, the book is largely anecdotal so you’ll just have to watch the headlines as they come out.

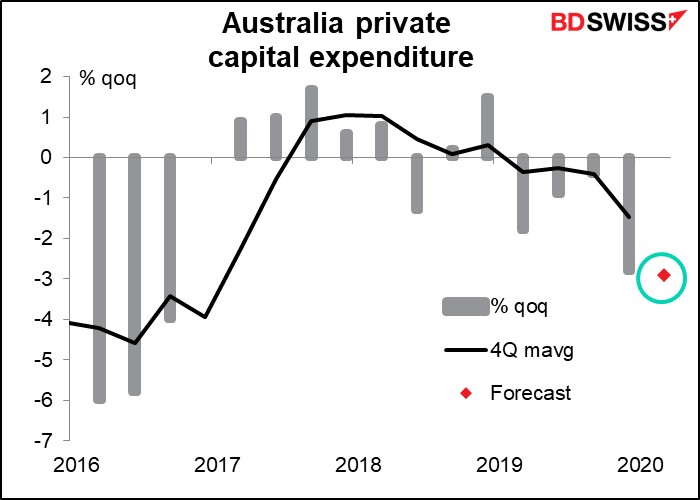

Overnight we get Australia’s private capital expenditure for Q1. I don’t think this will attract any more attention than yesterday’s Australia Q1 construction work data. The data are likely to confirm that capital spending was already falling before the virus hit, and the Q2 figure will probably show a collapse, depending on just how quickly firms could delay or cancel orders.

The more interesting part of the data will be the update on capital spending plans, both for the current (2019/20) fiscal year and the 2020/21 fiscal year. The survey was conducted in April and May and so is likely to present a pretty pessimistic picture as companies cut any non-essential investment to conserve cash and survive. The update three months from now should be a bit better, after the lockdown has been lifted and companies have a clearer view of how the global recovery is likely to proceed.

Watch Marshall Gittler Market Preview video here: