Rates as of 04:00 GMT

Market Recap

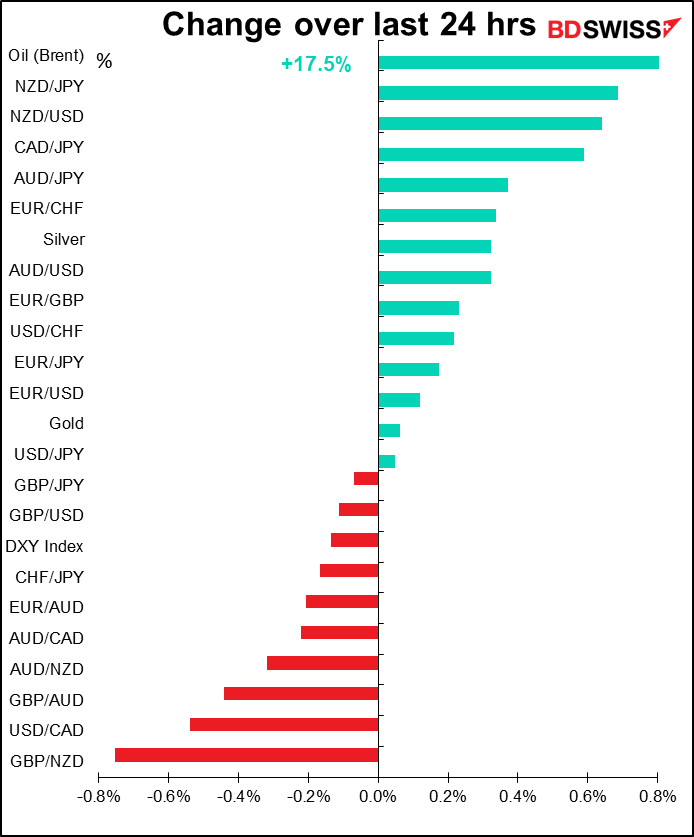

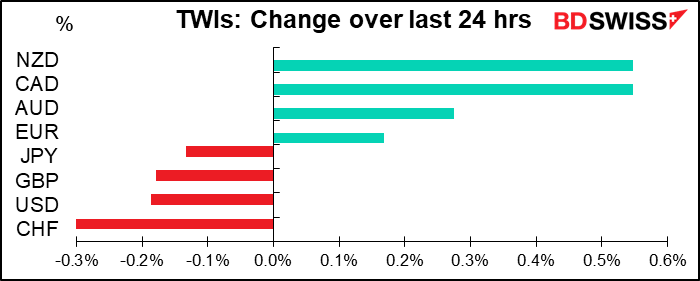

Commodity currencies once again led the way in a “risk on” market driven by sentiment about the virus. Investors totally ignored devastating US Q1 GDP figures and pessimistic comments by Fed Chair Powell and focused on the news that the experimental treatment remdesivir reduced recovery times for virus patients in a US trial. (Note though that the trial did not demonstrate that remdesivir cures COVID-19 or that it has any impact on the mortality rate.) US stocks closed higher and all Asian stock markets are higher this morning.

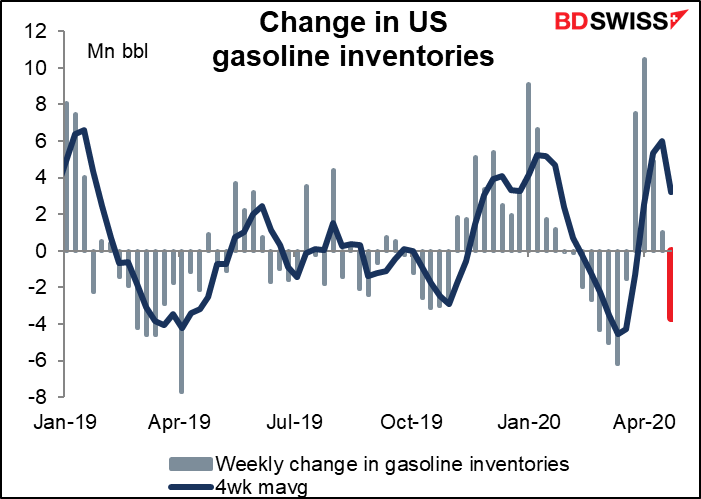

Commodity currencies were also helped by another sharp rise in oil. The weekly figures from the US Department of Energy showed a surprising decline in gasoline inventories and an increase in demand. In addition, Norway said it would cut output, and Russia indicated that its production would fall by around a fifth.

US Q1 GDP fell 4.8% qoq SAAR, marking the end of the longest expansion in US history. Personal consumption fell 7.6%, the biggest decline since 1980. Remember that the stay-at-home orders were only issued beginning on 17 March in a few California counties. New York state began on 20 March. Other states followed in the days afterward. So this huge decline in activity took place with only some places under lockdown and mostly for 10 days or less. By contrast, Q2 GDP will include 35 states under lockdown for most of a month at least. It will probably be an unparalleled figure.

Reflecting the poor outlook, the Fed was fairly negative. There were no new policy measures announced, but the tone was “we can still do more if necessary.”

The statement following the meeting said that “The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.” The phrase “considerable risks to the economic outlook over the medium term” is quite significant, because “considerable risks” is strong language from central bankers (believe it or not) and it’s unusual for the Fed to talk about the medium term. Although the Committee left its forward guidance unchanged (“The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals”), the implication was clear: we’re not going anywhere until this is through. In his press conference, Powell several times mentioned that the current stance was “appropriate,” but he also mentioned that “we can do more.”

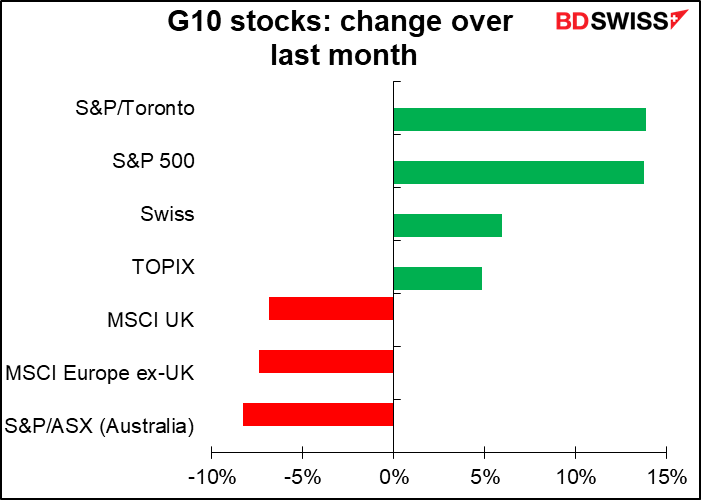

USD was little moved after the meeting, but could be weaker today. First off, the Fed’s commitment to remaining accommodative indefinitely may calm some of the fears of a longer-term “dollar shortage” and make investors hesitant to buy dollars. More immediately, as we approach the month end, stock market investors who rebalance their portfolios every month will find that their allocations to the US market have increased noticeably, thanks to the outperformance of US stocks this last month, and may have to hedge their increased USD longs that result.

Today’s market

So many indicators today! Fortunately I get paid by the word – unfortunately I have nowhere to go to spend all the money I’m going to make today.

The main event of the day is of course the European Central Bank (ECB) Governing Council meeting. I wrote about it in excruciating depth and detail in my weekly comment, which you are more than welcome to read – I’d like to think it’s “re-read” – here.

I’ll just summarize the findings for those who’ve “forgotten” what I said last week:

The ECB

The ECB has already taken a number of significant actions (as have all the other central banks, too). At this meeting I would expect it to stand pat but to reaffirm its willingness to “do whatever it takes” to keep the Eurozone together.

The most important action the ECB has taken was the establishment on 18 March of its EUR 750 Pandemic Emergency Purchase Programme (PEPP). As it currently stands, the PEPP will run at least until the end of this year, perhaps longer if necessary.

What more could the Governing Council do at this meeting? The most basic thing I would expect would be to reinforce their message of 18 March that “the ECB stands ready to adjust all of its measures, as appropriate, should this be needed to safeguard liquidity conditions in the banking system and to ensure the smooth transmission of its monetary policy in all jurisdictions.”

The “all jurisdictions” part of that is important, because one of the problems they face is widening spreads in the Eurozone periphery. With Eurozone governments unable to decide how to fund the recovery once countries emerge from lockdown, the pressure will be on the ECB to act further, probably by increasing the size of the PEPP or continuing it after the end of the year. Eurozone governments have running bigger deficits and issuing more bonds this year, which may exhaust the PPEP’s target ceiling earlier than expected. They could announce as early as this meeting their intention to expand the PPEP, although I don’t expect that.

I would not expect any further rate cuts, which were rejected at the 12 March and 18 March meetings.

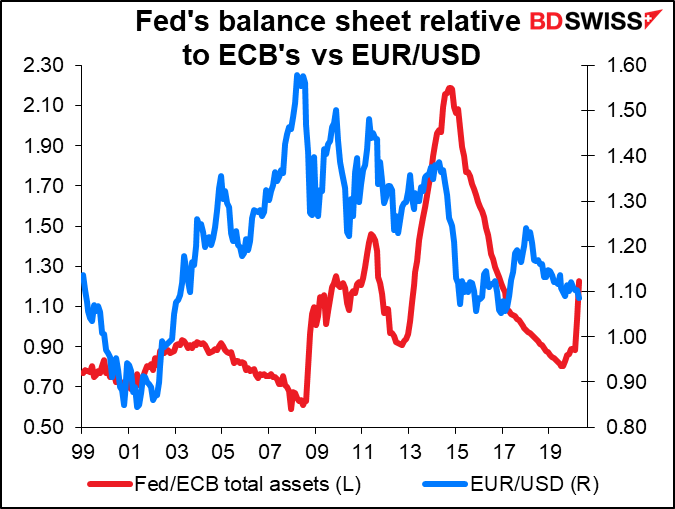

FX market implications: The Bank of Japan’s change Monday to take the limit off its JGB purchases (even though it wasn’t buying anywhere near the limit recently) opens up the prospect of a much faster expansion of its balance sheet. The Fed yesterday didn’t say anything about accelerating its bond purchases, but indicated that it wasn’t anywhere near to turning down its injections. If the ECB fails to keep pace with the others, then the euro could begin to appreciate, making the ECB’s job even tougher.

Although I have to admit – over the longer term, there’s little evidence that the size of the ECB’s balance sheet relative to the Fed’s has any connection with EUR/USD.

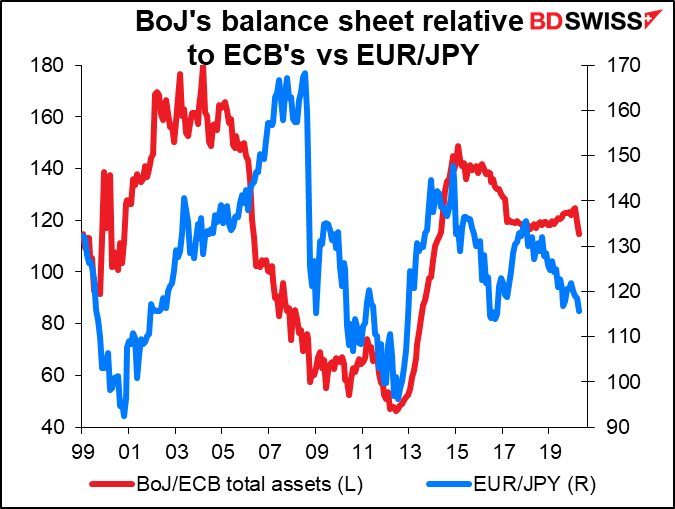

There does seem to be more connection with EUR/JPY, although that may just be a coincidence.

Today’s indicators

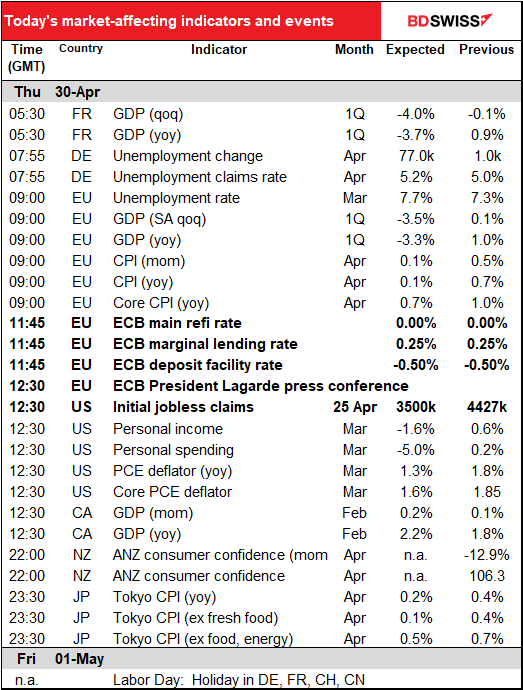

The day starts out with German employment for March and EU-wide employment for February (also Italy employment for February too).

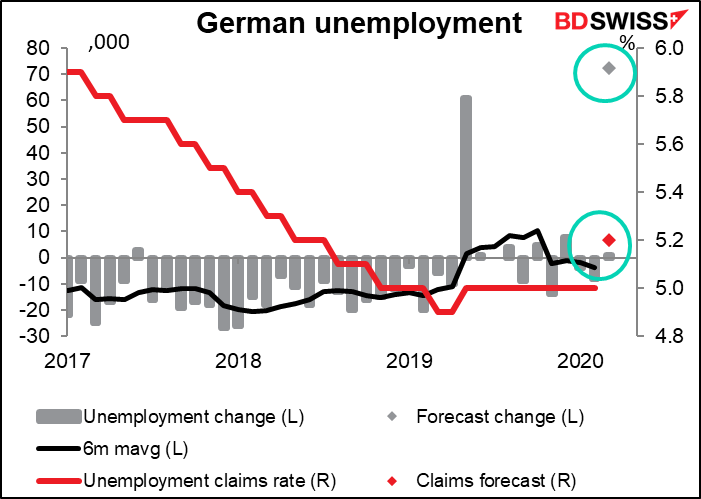

It’s no surprise that Germany is expected to see a big jump in the number of unemployment claims. The unemployment rate however is expected to rise only a little bit, although that’s after several months of (somewhat suspicious, I’d say) stability.

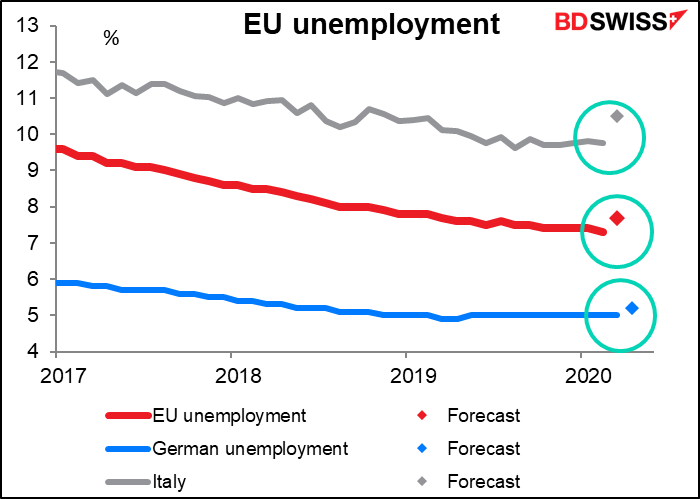

The EU-wide employment number isn’t usually market-moving, because it’s a month behind. Nowadays especially no one is interested in two-month-old data. Germany is seen as a leading indicator of EU-wide employment.

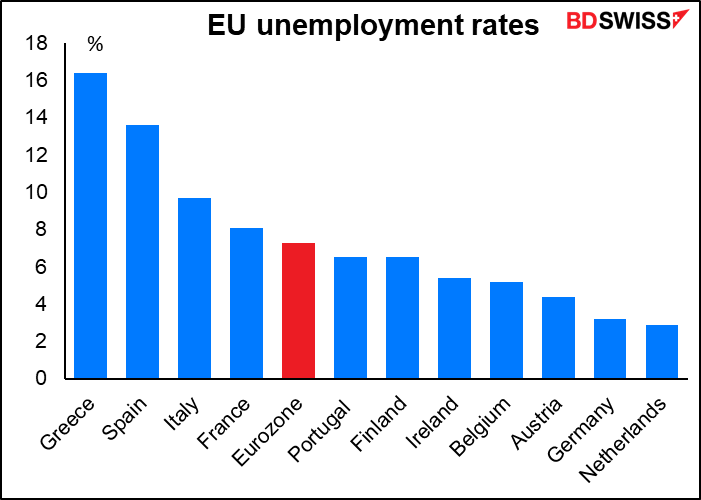

The fact is though that there’s a wide range of national unemployment rates, ranging from 16.4% in Greece to 2.9% in the Netherlands. So talking about “EU-wide unemployment” may be pointless to begin with, especially since there is no EU-wide fiscal policy to counter unemployment.

In any event, the European figures are likely to be far behind reality. An article in the Financial Times estimated that in the five largest Eurozone economies alone, over 30mn people in Europe had applied for wage support from their governments – amounting to nearly 20% of the workforce. This is more than the number in the US who have filed for unemployment insurance. These Europeans will not show up as unemployed, because the European governments subsidize their salaries so that the companies can keep them employed. However were it not for these schemes, they’d probably have been let go already.

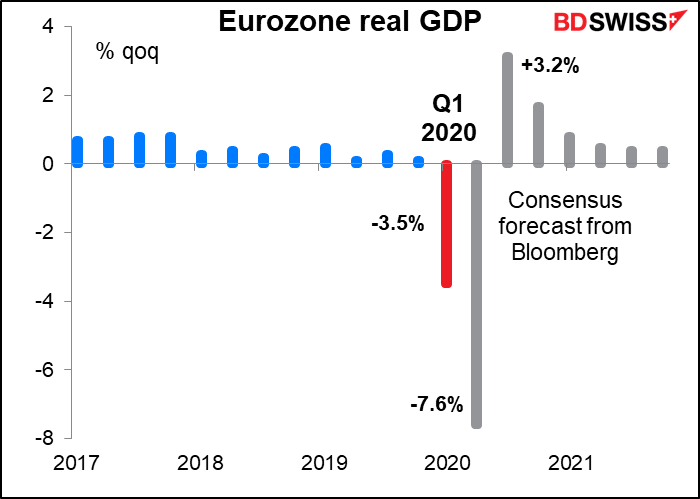

Next up is EU-wide GDP. This is more closely watched, as for some reason it comes out before all the constituents do – in particular, before Germany releases its preliminary estimate.

Like the US figure yesterday, this is expected to be bleak, and only get more bleak next quarter. Data like this will be among your memories of your investing days. I didn’t say your “good” memories, I said your memories. But economists assume it’ll all be over by Q3.

Also like the US figure, the estimates are all over the place. The range on Bloomberg for the qoq figure is from -0.2% to -6.2%, with a standard deviation of 1.11%. Last quarter the standard deviation of the estimates was 0.05%.

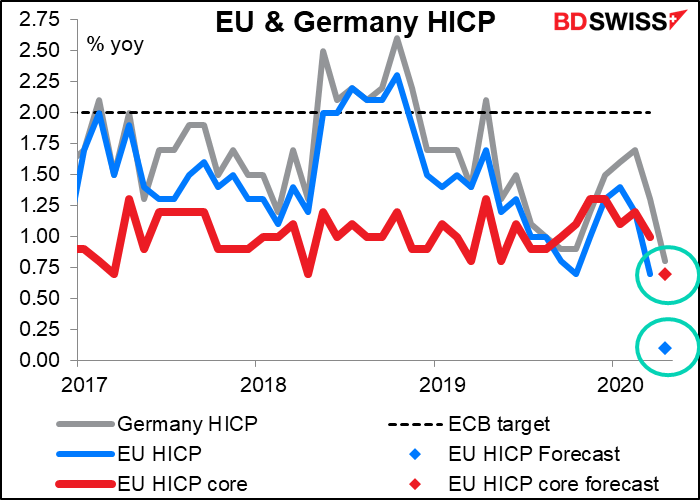

Next up is the EU-wide consumer price index (CPI). We discussed this somewhat yesterday along with German CPI, which in the event was up more than expected on a mom basis and therefore down less than expected on a yoy basis, but still down (+0.8% yoy vs +1.3% yoy previously) On a headline basis, the market is looking for virtually no change in EU-wide prices over the year as falling oil prices keep overall inflation down. Core CPI, which excludes oil, is also expected to slow noticeably. The total lack of demand in some areas is causing prices to plummet (oil being Exhibit A in this regard), although the lack of supply in other areas is causing some prices to rise (eg air freight – with fewer passenger planes flying, there’s less capacity and therefore rates have gone up).

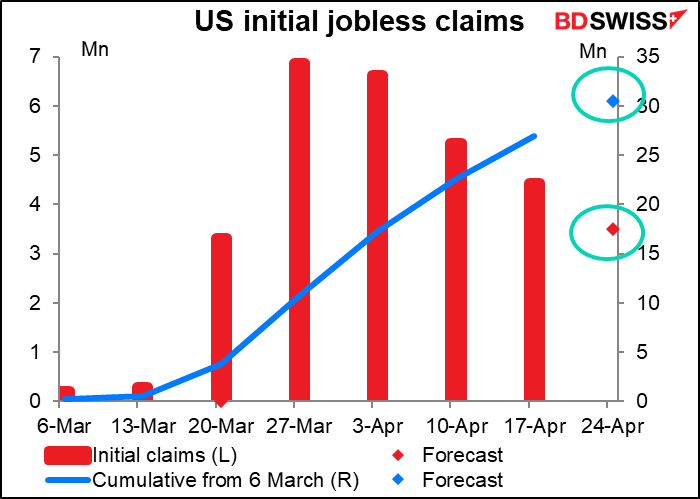

The US initial jobless claims are now the big event every week. They’ve declined for three weeks in a row and are expected to continue to decline, although still at a rate that would once have been unimaginable. We’re looking at unemployment north of 20%, easily.

As usual, I recommend you take a look at Len Kiefer’s animated graph of the jobless claims to get a good idea of how it’s developed.

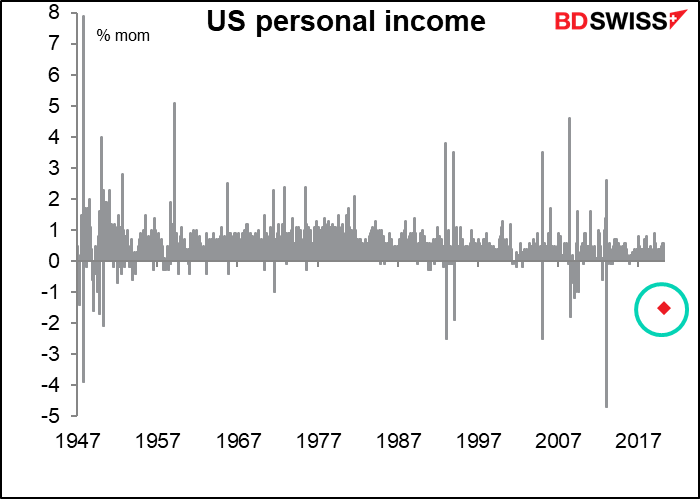

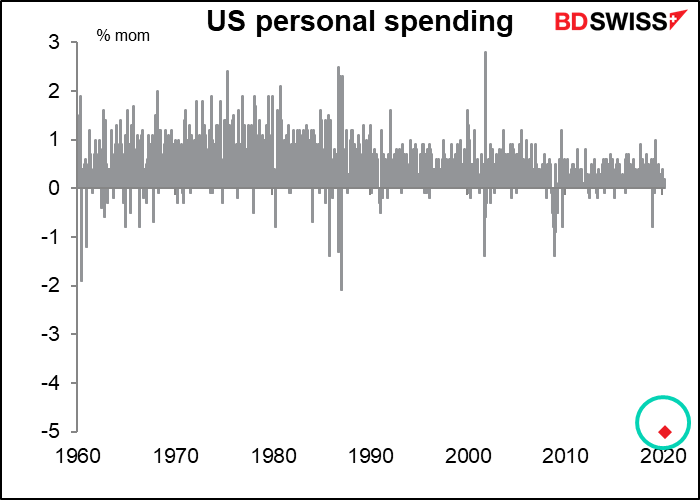

US personal income and spending for March are going to be horrendous, and April is likely to be even worse.

Incomes are not going to show the biggest drop on record by any means. However, note that in most cases when there was a large drop in a month, it was preceded by a large rise in the previous month. Probably these were episodes having to do with tax changes. For example, a lot of companies paid out bonuses in December 2012 because of changes in income tax rates in 2013; that caused Dec incomes to rise 2.6% mom but Jan incomes to fall 4.7% mom. Since this is the month-on-month change, incomes the following month naturally would show a sharp decline.

Personal spending on the other hand is forecast to show a drop of more than double the previous record fall (-2.10% in Jan 1987). And I’ll bet it’s even less in April. I know from my own life, except for groceries and my contractual obligations (such as rent, internet, Netflix etc) I’ve barely spent anything in the last month. Not even a liter of gasoline.

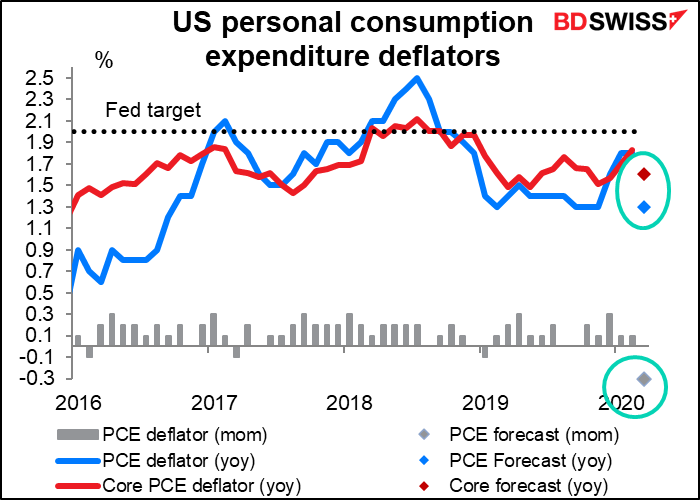

The personal consumption expenditure (PCE) deflator is the Fed’s preferred inflation gauge (more specifically, the core PCE deflator) and so I like to make a big deal out of it normally, but inflation isn’t anyone’s worry at this point. I present it here just FYI. Core inflation is expected to slow, but within the recent trend. You might have to bear that in mind if we ever get back to “normal.”

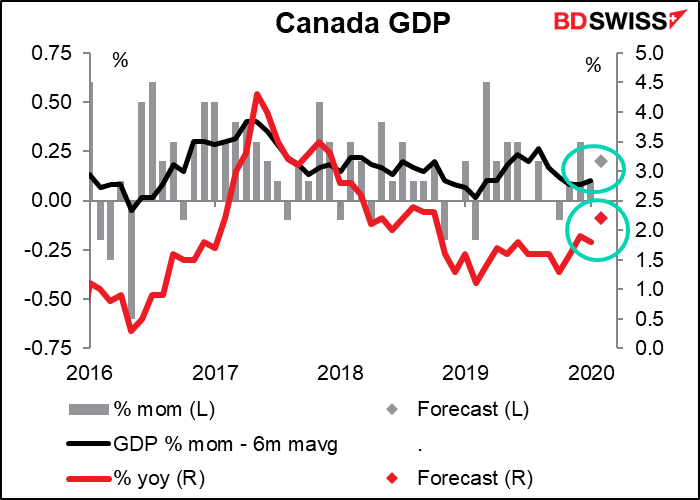

Canada’s GDP was growing nicely in February – expected to be up +0.2% mom, vs the recent trend of only +0.1%. Spoiler alert: it won’t be that good in March, and just wait until April!

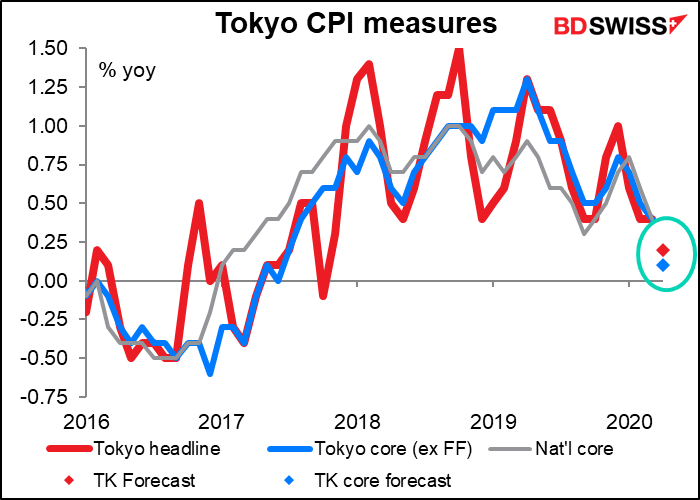

Finally, overnight we get the Tokyo consumer price index. This can now be officially declared USELESS. Everyone recognized that the Bank of Japan (BoJ) had long ago stopped trying to achieve its 2% inflation target, but since it was politically impossible to admit that publicly, they replaced it with a vague dedication to continuing “momentum toward achieving the price stability target,” without ever defining what “momentum” was. This month though they even dropped that meager reference.

Furthermore, in the quarterly “Outlook for Economic Activity and Prices” report, they cut their growth and inflation forecasts, as was widely expected, and did so without making any comment at all on the aforementioned “momentum for inflation.” And they even eliminated the usual section on “Conduct of Monetary Policy” in which they “assess the economic and price situation from two perspectives” and then outline their “thinking on the future conduct of monetary policy.” This despite the fact that the Policy Board members’ new core CPI inflation forecasts for FY2022 ranged from 0.4% to 1.0%, meaning that they don’t expect to hit their 2% inflation target by the appointed time. All told, it looks like the Bank of Japan has given up on inflation and they’re going to disregard it in conducting monetary policy for the foreseeable future. This is not to say that they’re likely to start tightening any time soon, but rather than if prices do start falling again – as seems likely at this point — they won’t necessarily have to act.