Rates as of 05:00 GMT

Market Recap

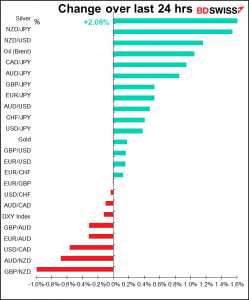

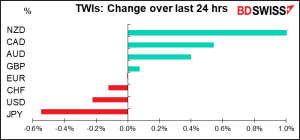

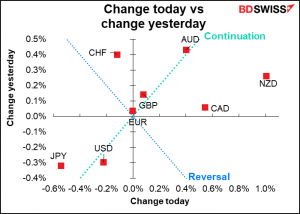

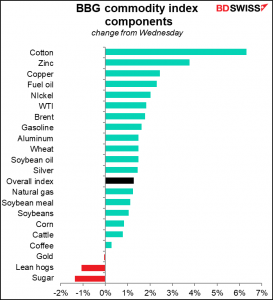

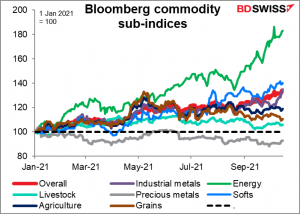

The commodity currencies were on a roll this morning as commodity prices soared further. The Bloomberg spot commodity index moved further into record territory as energy and industrial metals prices continued to rise.

All the major sub-categories of commodities are up this year except for precious metals.

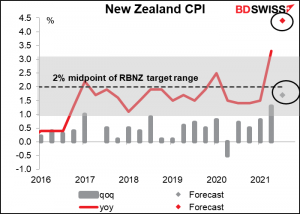

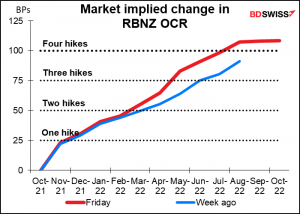

NZD particularly outperformed as Reserve Bank of New Zealand (RBNZ) Deputy Gov. Geoff Bascand said he expected inflationary pressures to last “for some time.” Asked about inflation pressures, says: “Foreign supply, global supply chains aren’t fixing themselves quickly, that’s going to go on for some time.” “We’ve started to see a little bit more flow into core underlying inflation and into wages, which gives us a little bit of confidence that we think we are going to see some sustainability in our inflation pressures, which is obviously leading to believing that we don’t need to retain emergency monetary policy settings and can start to adjust interest rates on a path upwards over time.” (I didn’t see the word “transitory” in there.)

I don’t think his comments will have shocked anyone as the RBNZ has been saying for some time that it expects to normalize policy, but it was a salubrious reminder of their stance. See below for the outlook for NZ inflation, which will be announced Monday morning.

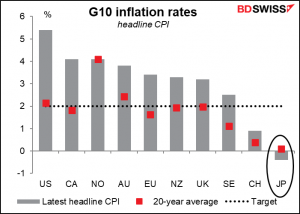

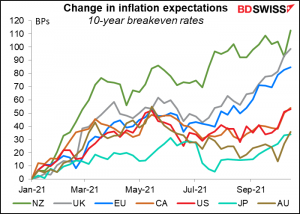

On the other hand, JPY was the main loser. It’s the global outlier when it comes to inflation and therefore is likely to be the global outlier when it comes to normalizing monetary policy, too. The underperformance of JPY warms the cockles of my heart as the payment date for my daughter’s university tuition approaches.

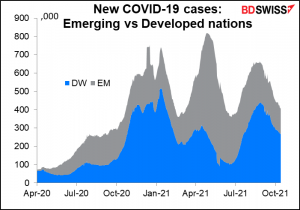

Higher commodity prices didn’t discourage stock markets, which were up sharply. The Euro Stoxx 50 gained 1.6% yesterday while the S&P 500 and NASDAQ were both up 1.7%. Good corporate earnings – all the banks reporting yesterday beat estimates — a decline in real yields, a positive surprise in the US jobless claims, and a further fall in global COVID-19 cases all encouraged investors.

With commodities rallying, inflation took center stage despite somewhat weaker-than-expected US producer prices. Inflation expectations moved higher.

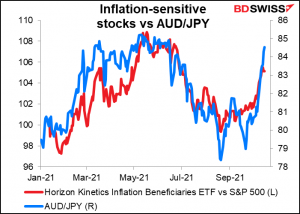

Stocks benefiting from higher inflation outperformed. Inflation fears also tend to go along with the outperformance of the commodity currencies.

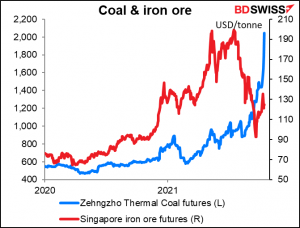

NZD outperformed today, but I’d watch AUD too. It’s being held back by a dovish Reserve Bank of Australia, in contrast to the hawkish RBNZ, but the way prices for Australia’s two main commodity exports are going, I can’t see AUD lagging for long. The Zehngzho coal futures are up 42% this month and iron ore futures up 9%. These two commodities account for 53% of Australia’s exports (40% iron ore, 13% coal).

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

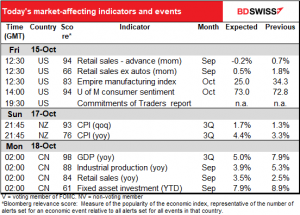

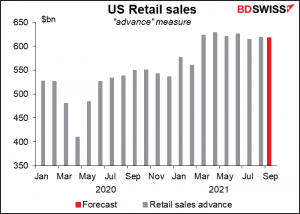

Nothing major on during the European morning. The excitement doesn’t start until the US comes in. Then, the big indicator is the US retail sales.

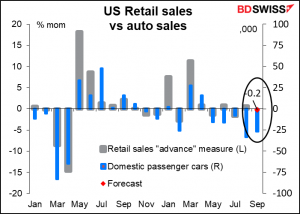

The 15.3% mom drop in auto sales during the month – due more to supply problems than to demand – suggests that the headline retail sales figure is likely to fall.

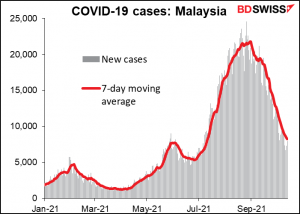

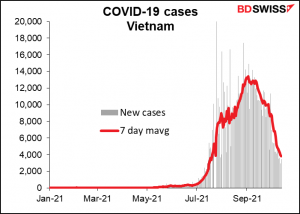

Why are auto sales down? Probably because auto production is down. You can’t sell cars that you haven’t made. And why is auto production down? Reason: COVID-19 in Southeast Asia. Malaysia and Vietnam have seen surges in virus cases recently. This has shut down entire factories making auto plants and semiconductors and caused shortages of auto parts worldwide, leading automakers worldwide to cut production.

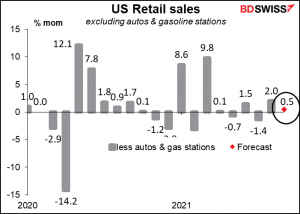

Excluding autos, sales are expected to be up slightly.

Even if we get that slight dip in the headline figure, sales would still be 17.3% higher than before the pandemic. That’s quite high. I worry about what will happen as the impact of the Federal government’s largess wears off and people have to rely on their incomes from jobs for spending. How can you keep spending 17.3% higher when there are 3.2% fewer people working? And with gasoline something like $1/gallon higher, that will subtract an estimated $120bn from consumers’ spending power.

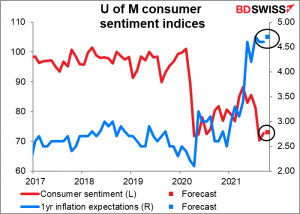

That may be why the U of Michigan consumer sentiment index isn’t expected to show much increase in the month. That, plus rising inflation.

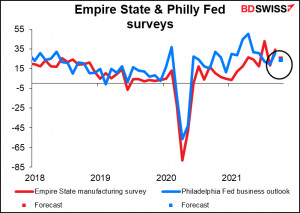

We’ll also get the Empire State manufacturing index. (The Philly Fed business outlook index is next week.) Both leaped last month, but this month they’re expected to fall back to around the middle of their recent range (eg, the Empire State index was 18.3 in August and 34.3 in September for an average of 26.3; the market consensus for today is 25.0). That would still be robust growth, but would take into account the high cost of energy and supply bottlenecks that are restraining output.

Then early Monday, New Zealand releases its consumer price index (CPI). NZ only announces its CPI quarterly, which means there’s more riding on each announcement than usual in most countries. The NZ CPI was already above the Reserve Bank of New Zealand’s target range and this time is expected to leap higher. Nor can it be attributed to base effects, as the qoq increase is expected to be a stunning 1.7% qoq – not the highest on record (that was 8.9% qoq in Q4 1986) but the highest since +2.3% qoq in Q4 2010.

The market has been revising up its estimates of how quickly the RBNZ might normalize policy. A further rise in inflation could push these expectations up even further. That could be beneficial for NZD.

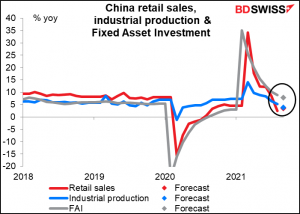

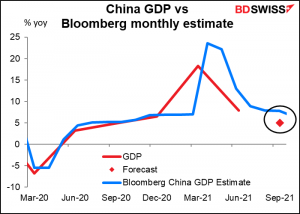

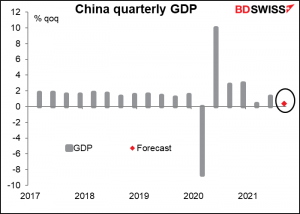

China comes out with its three major monthly economic indicators (industrial production, retail sales, and fixed asset investment) plus this month the all-important GDP figure.

The annual rate of growth in GDP is expected to slow to +5.0% yoy, Bloomberg’s monthly GDP estimate for August was +5.3% yoy, so the forecast is reasonable.

Quarterly GDP growth is expected to slow to +0.4%, which is practically a recession for China. From 2011 until end-2019, the average was 1.7% qoq and the median was 1.8%. The lowest was +1.2% qoq.

The other indicators are all expected to slow, but since all we have are year-on-year estimates, it’s hard to tell the implications – a year ago China was still recovering from the pandemic.