PREVIOUS TRADING DAY EVENTS – 19 June 2023

Announcements:

The Reserve Bank of Australia (RBA) board initially considered leaving rates unchanged since consumer spending was slowing. However, it took the decision for a hike during the last meeting in June since inflation risks were feared.

Jobs data released for May were strong. Data taken into account also involved rising electricity prices, high rents, stubborn services inflation and a rebound in national house prices. Headline inflation is high at 7.0% while unemployment is down near 50-year lows of 3.6%. In addition, there is low productivity and rising wages.

The risk that inflation would not return to the RBA’s 2-3% target prevailed, eventually leading to a hike.

Source:

______________________________________________________________________

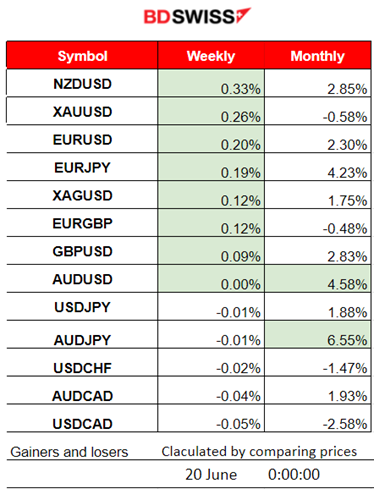

Summary Daily Moves – Winners vs Losers (19 June 2023)

- The NZDUSD moved upwards the most this week so far having 0.33% change.

- This month AUDJPY and AUDUSD remain on the top of the gainers list with 6.55% and 4.58% gains respectively.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (19 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

No significant news announcements, no special scheduled releases.

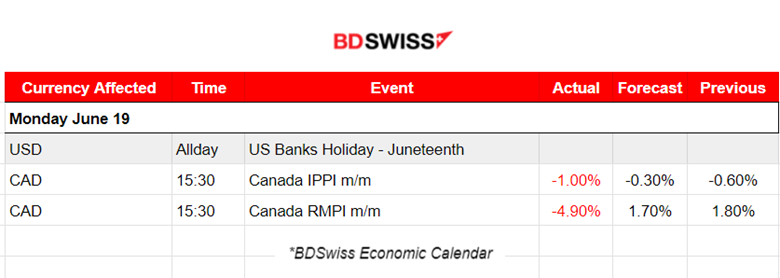

Canada’s monthly changes in the price of goods sold by manufacturers were reported much lower than expected. Despite the negative figures, there was no major impact on the CAD pairs.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

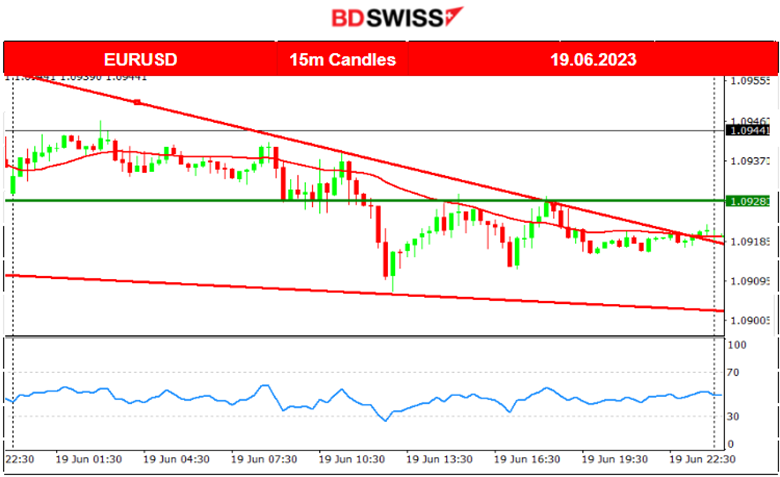

EURUSD (16.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The major pair was moving with low volatility until the European sessions started. After 10:00 the pair moved more to the downside but in a short period of time it continued with the sideways movement. No significant scheduled releases yesterday, so no significant shocks took place.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Stocks were climbing for days but at a diminishing rate. High retracements take place intraday. The index has just signalled a stop for the upward trend as the price moved downwards crossing the 30-period MA and remaining below. A stop of the uptrend is not a start of the downward trend. What recent data suggest is market resilience and probably the index will experience a sideways movement for now. The price below is the CFD’s price derived from the futures that were actually traded yesterday. The NYSE was actually closed for trading due to a holiday in the U.S.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

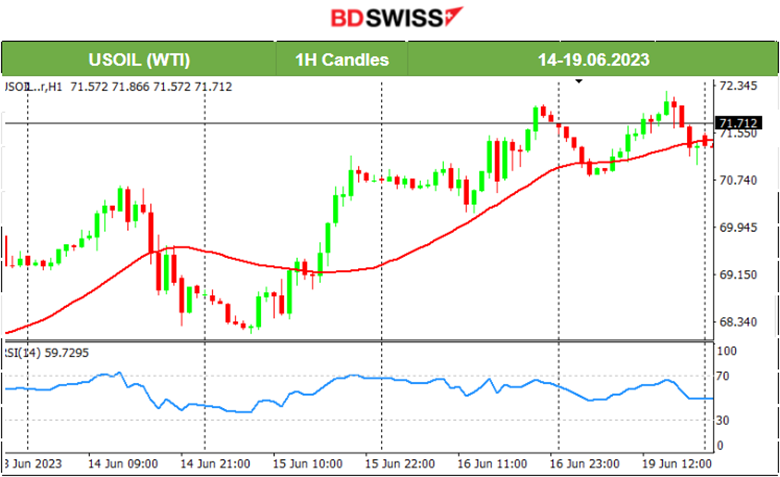

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude remained above the 30-period MA for days but climbed with high volatility. It eventually found resistance at nearly 72.10 and difficulty to break levels near that. It remains on a sideways path for now. The RSI slowed showing lower highs indicating that the price might reverse, eventually crossing the MA as it moves downwards. Reverse will only happen considering that the sideways movement will continue and no significant fundamental factors will push the price upwards starting a new short-term trend.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold reversed significantly during the week, specifically on the 15th of June. The price moved upwards crossing the 30-period MA and remained above it. It later moved to higher levels but after finding strong resistance it retraced and moved back, crossing the MA again and remaining under it. Currently, the path is sideways and estimated to remain as it is with moderate volatility until news affecting the dollar kicks in.

______________________________________________________________

News Reports Monitor – Today Trading Day (20 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Two weeks ago, the RBA shocked markets by hiking rates. There is particular interest in the RBA (and BOC) because it had paused hikes earlier in the year but they resumed them. In the RBA monetary policy meeting, policymakers discussed that inflation in many economies remained well above central banks’ targets. Core inflation had remained sticky, not decreasing significantly. After 4:30 during this release, the AUD depreciated heavily against other currencies. AUDUSD moved downwards sharply by near 50 pips.

- Morning – Day Session (European)

No significant news announcements, no special scheduled releases.

General Verdict:

______________________________________________________________