Tomorrow, Wednesday, August 14, 2024, at 1:30 PM PT / 4:30 PM ET, Cisco (NASDAQ: CSCO) will hold an earnings call to release its Q4 and FY 2024 financial results for the period ending July 27, 2024.

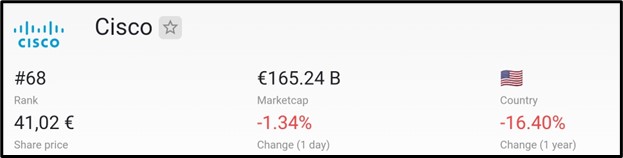

Market Cap

€165.24 billion is Cisco’s market cap as of August 2024, ranking it as the 68th most valuable company globally by market capitalization, per companiesmarketcap.com data.

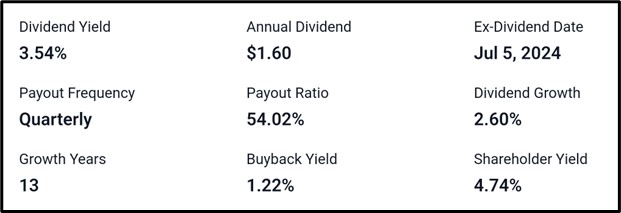

Dividend Information

Cisco offers a 3.54% dividend yield with an annual dividend of $1.60, paid out quarterly. With a payout ratio of 54.02% and 13 years of growth, the dividend has shown a 2.60% growth rate. The ex-dividend date was July 5, 2024, while the buyback yield stands at 1.22%, bringing the total shareholder yield to 4.74%.

Recent Development At Cisco

Here are some of the latest updates at Cisco :

Cisco named as an official partner for the LA28 Olympic & Paralympic Games and Team USA.

Ekta Singh-Bushell joins Cisco’s Board of Directors.

Cisco and Splunk introduce a unified observability solution for enterprises.

Cisco announces a $1B global AI investment initiative.

Cisco unveils AI-driven insights for self-hosted observability.

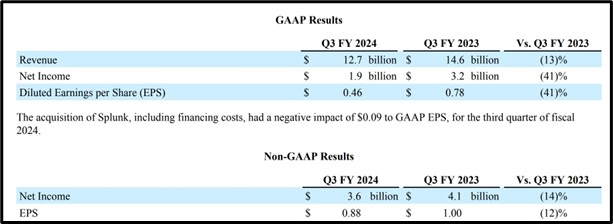

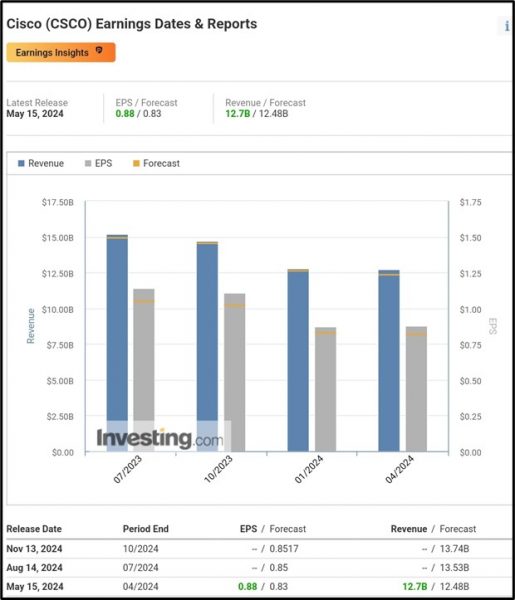

Q3 Earnings Report Recap

Revenue Drop: Cisco’s total revenue hit $12.7B, down 13%, with product sales plunging 19% but service revenue rising 6%. Splunk’s acquisition added $413M.

Geographic Performance: Revenue dipped across regions—Americas down 15%, EMEA 9%, and APJC 12%. Security surged 36%, Observability 27%, while Networking sank 27%.

Margins: GAAP gross margins improved slightly to 65.1%. Non-GAAP total gross margin was 68.3%, up from 65.2% last year, with service gross margin hitting 71.6%.

Profit Metrics: GAAP operating income dropped 44% to $2.2B, while non-GAAP was down 12% at $4.3B. Net income fell 41% to $1.9B, with EPS at $0.46, a 12% decline.

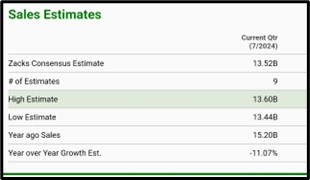

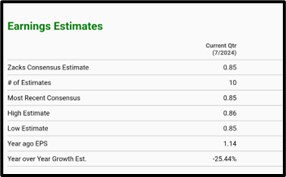

Q4 Earnings Report Analyst Forecast

For the current quarter , Zacks Consensus points to a revenue forecast of $13.52B, with an estimated year-over-year sales decline of 11.07%. EPS is projected at $0.85, representing a significant drop of 25.44% compared to last year. The estimates reflect a tightening range with high-end revenue at $13.60B and low-end at $13.44B, while EPS estimates vary slightly between $0.85 and $0.86.

Cisco (NASDAQ: CSCO) is projected to hit an EPS of $0.85 with revenue forecasted at $13.53 billion, per Investing.com estimates.

According to TradingView, Cisco (NASDAQ: CSCO) is projected to report an EPS of $0.85 and revenue of $13.53 billion.

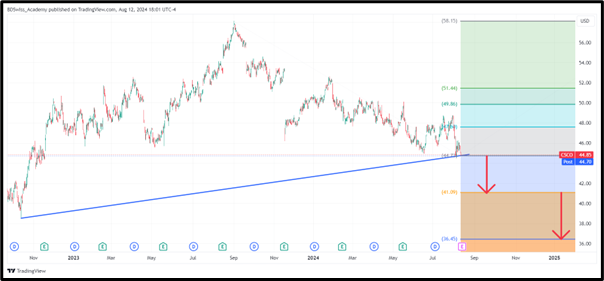

Technical Analysis

– Cisco (NASDAQ: CSCO) shows potential for a bearish breakout on the 4HR chart at $44.73.

– If the breakout is confirmed, the price could decline to $41.09 and $36.45.

– If the breakout fails, the price could rally to $47.60 and $49.86.

Apply Risk Management

Conclusion

Cisco’s recent performance has shown a decline in revenue and profit metrics, with a projected EPS of $0.85 and revenue of $13.53 billion for Q4 2024. Historically, Cisco’s financial results have been variable, but current forecasts suggest a potential price drop to $41.09 and $36.45 if bearish trends continue. Conversely, a breakout failure could lead to price increases toward $47.60 and $49.86. The company’s strong dividend yield and strategic investments indicate potential resilience despite short-term challenges.

Sources:

https://companiesmarketcap.com/eur/cisco/marketcap/

https://stockanalysis.com/stocks/csco/dividend/

https://s2.q4cdn.com/951347115/files/doc_earnings/2024/q3/earnings-result/Q3FY24-Press-Release.pdf

https://www.zacks.com/stock/quote/CSCO/detailed-earning-estimates

https://www.investing.com/equities/cisco-sys-inc-earnings