Previous Trading Day’s Events (08 Feb 2024)

The labour market resilience is a major factor contributing to the delay of the anticipated interest rate cuts this year. U.S. central bank officials signalled on Wednesday that they were in no rush to lower borrowing costs until they were confident inflation was headed down to the Fed’s 2% target.

“As long as the labour market remains stable, the economy will continue to grow, and inflation will have some challenges during this last mile toward the Fed’s target,” said Jeffrey Roach, chief economist at LPL Financial in Charlotte, North Carolina.

______________________________________________________________________

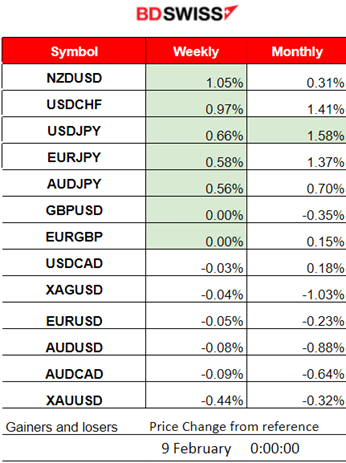

Winners vs Losers

NZDUSD moved to the top of the week’s winners list with 1.05% gains so far. This month finds the USDJPY again on the top, leading with 1.58% gains so far. Bank of Japan (BoJ) Deputy Governor Uchida Shinichi’s dovish remarks on Thursday, saying that the central bank will not hike aggressively upon ending negative rates. The JPY saw a significant depreciation yesterday against the dollar. 125 pips movement upwards for the USDJPY overall.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (08 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

China’s inflation is coming dangerously lower, Consumer Prices drop at the fastest pace since the global financial crisis. China’s producer prices also declined for a 16th month in January. No major impact was recorded at the time of the release at 3:30.

- Morning–Day Session (European and N. American Session)

Unemployment claims for the U.S. were reported lower suggesting that the majority of workers are holding on to their jobs. Employment growth was reported way higher than expected in January, however the unemployment claims are experiencing mixed results. The market reacted with moderate volatility and the USD was affected with further appreciation. The EURUSD dropped 15 pips at that time. After the news the USD experienced strong depreciation.

General Verdict:

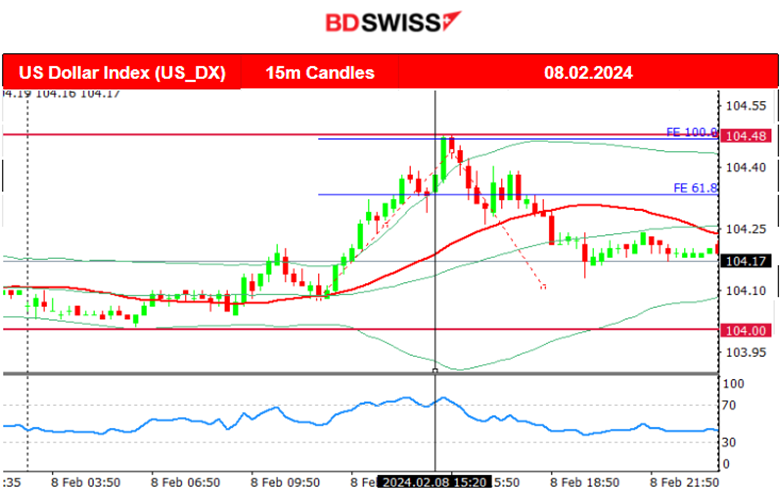

- High volatility for FX pairs, market activity and relevant U.S. reports caused the USD to be affected greatly and the related pairs to move. The dollar index experienced volatility only to close just a bit higher.

- Gold price was affected as the dollar had an impact but it also closed the trading day almost flat.

- Crude oil moved higher after breaking a significant upward channel, trading over 76 USD/b.

- U.S. Indices experience volatility but there is no clear direction at the moment, remaining in a state of consolidation for now.

____________________________________________________________________

FOREX MARKETS MONITOR

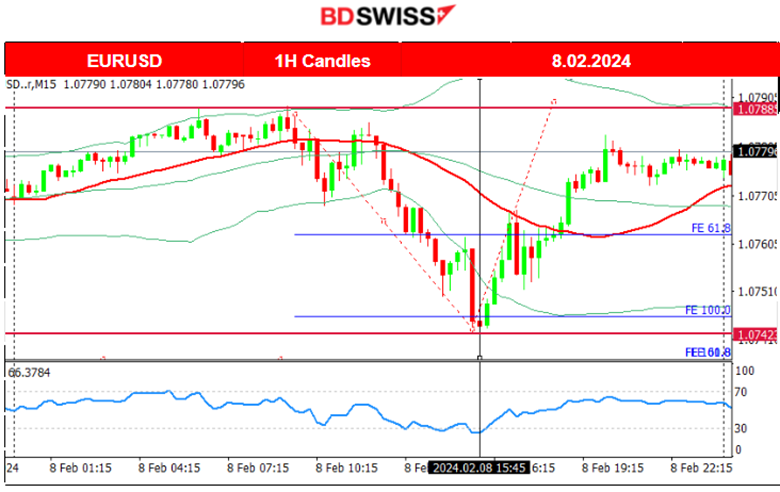

EURUSD (08.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved fairly sideways before volatility kicked in near the start of the European session. During that session the USD started to appreciate greatly and volatility levels increased. After the Unemployment claims news the USD experienced a moderate shock and appreciated momentarily bringing the pair further downwards. The pair dropped rapidly to the support 1.0742 before it retraced to the 30-period MA.The upward movement continued as the USD was further depreciating, resulting in the pair to close the trading day almost flat.

___________________________________________________________________

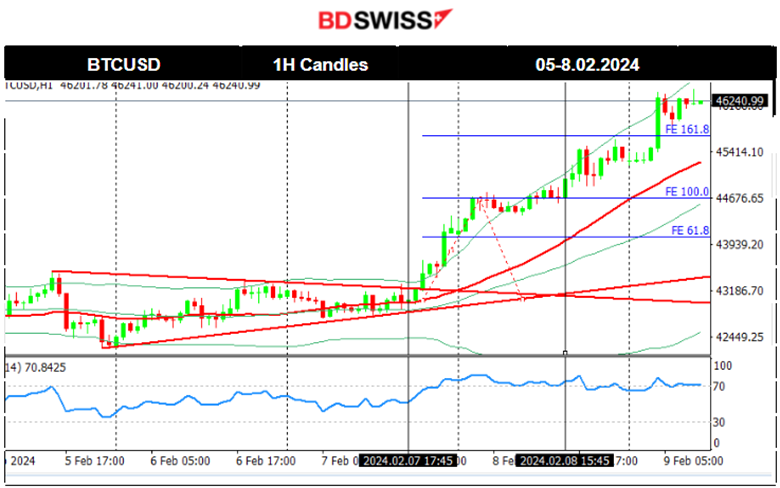

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

After breaking the triangle on the 7th Feb, Bitcoin moved to the upside aggressively. The momentum is quite strong as it seems to break all the fibo levels, 100 and 161.8 without any significant retracement. It has the potential to reach even the previous high in January, 49,000 USD, if the exponential increase continues. A more conservative forecast would be that the next resistance is near 48,000 USD.

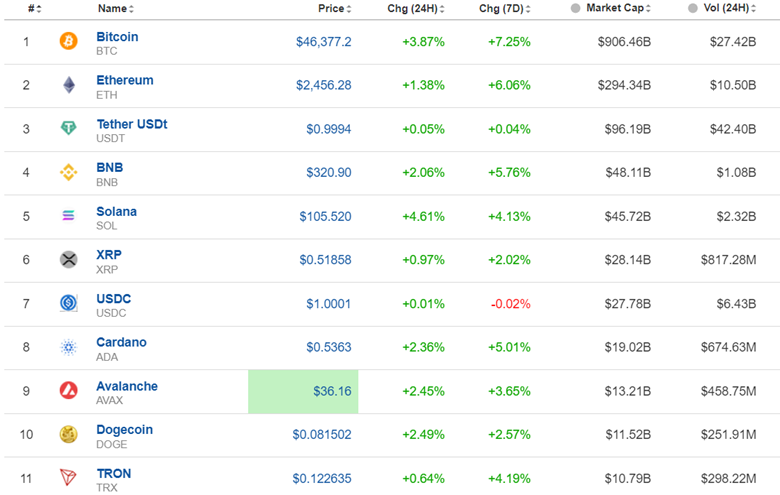

Crypto sorted by Highest Market Cap:

Strong gains for Cryptos as the market corrects from the recent unusual drop after the regulator’s spot Bitcoin ETF approvals. 7.25% gain for Bitcoin the last 7 days, trading over 46,000 USD currently.

Source: https://www.investing.com/crypto/currencies

_____________________________________________________________________

EQUITY MARKETS MONITOR

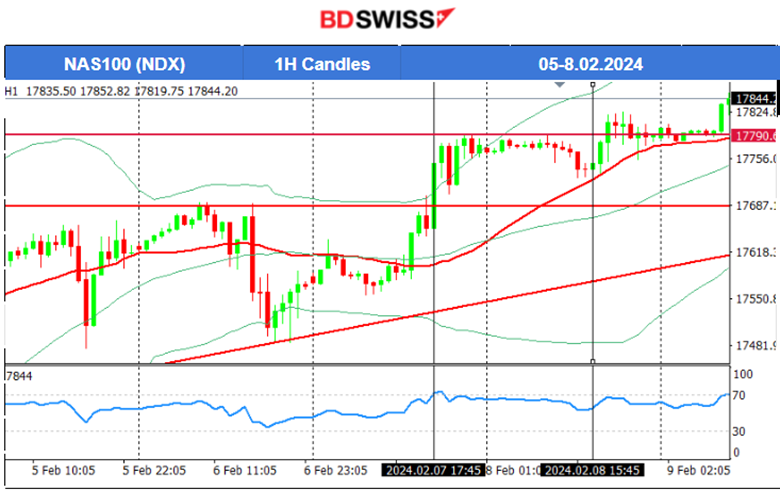

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 6th Feb, the index did not manage to break the resistance at near 17,700 USD and a reversal again followed back to the support at near 17,500 USD. Another reversal sent the index back to the mean. A clear consolidation phase kept the index on the sideways, however experiencing high volatility on the way. On the 7th Feb, the index moved higher breaking the triangle as depicted on the chart and settling near 17,790 USD. On the 8th Feb, the index did not experience strong volatility closing the trading day almost flat. However, today it signals further upside movement.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

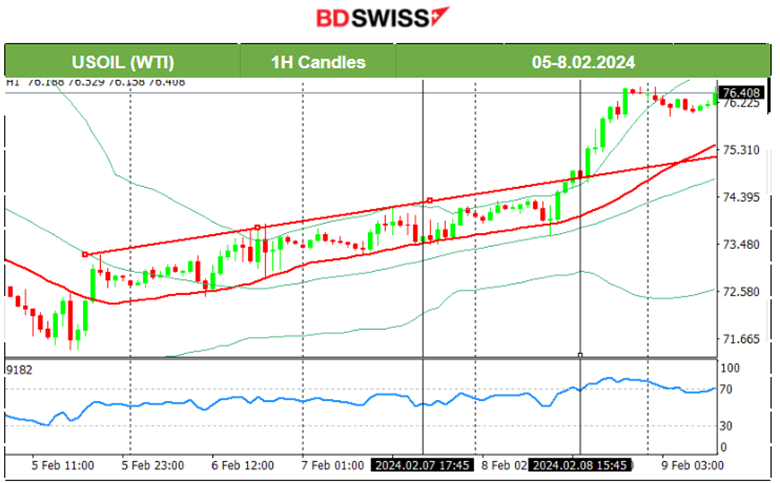

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude’s price reversed from the downtrend following the RSI’s signals of bullish divergence, as mentioned in the previous analysis. After it reached 74.5 USD/b on the 5th Feb, it reversed to the upside, crossing the 30-period MA on the way up and finding resistance at near 73.2 USD/b before retracing. On the 6th Feb, the price moved steadily upwards while being above the 30-period MA. The same happened on the 7th Feb. Surprisingly, crude oil moved significantly higher on the 8th Feb after it broke the apparent channel, as depicted on the chart, reaching the resistance near 76.5. The momentum is strong and now tests higher levels, signalling that it might climb further.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 8th Feb, Gold broke the upward channel moving to the downside and reaching the support 2020 USD/oz after the USD experienced strong early appreciation. It closed the trading day almost flat since the USD lost strength significantly causing Gold’s price to reverse fully. Currently, it is trading near 2033 USD/oz.

______________________________________________________________

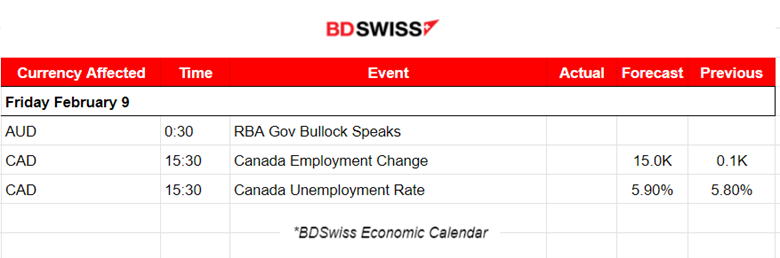

News Reports Monitor – Today Trading Day (09 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

RBA: “Rate cuts possible even if inflation outside 2-3% target band” as stated by the RBA Governor Michele Bullock before the House of Representatives Standing Committee on Economics, in Canberra. Probably justifiable considering that: unemployment is high at 3.9% and the latest employment change data showed a huge decline. Inflation dropped from Oct 2023, 5.4% to 3.4%. It would be a challenge for every central bank this year to keep the balance between fighting inflation and causing less damage to the economy.

No major market reaction was recorded at the time of the event.

- Morning–Day Session (European and N. American Session)

Canada’s labour data is going to be reported at 15:30. An improvement in employment change is expected while the unemployment rate is expected to be reported higher. The market could see CAD intraday shock during that time when activity is high. The Bank of Canada kept the policy range unchanged and awaits to see cooling. It might be the case where the market will be faced with lower-than-expected employment growth.

General Verdict:

- Low volatility for the moment, however, non-USD currencies seem to be affected greatly, early today. The dollar index remains stable for now.

- Gold recovered from a drop mid-day yesterday and now remains stable at near 2033 USD/oz.

- Crude oil is signalling further movement to the upside.

- U.S. Indices show upward momentum currently.

______________________________________________________________