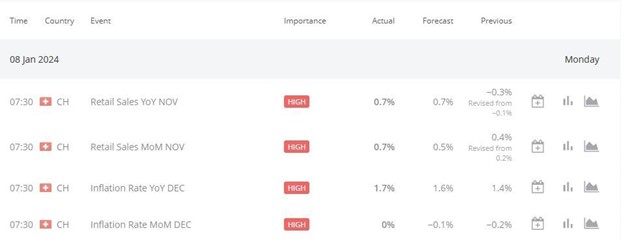

On Monday, January 8, 2023, at 7:30 GMT, the Consumer Price Index (CPI) news, a key measure of inflation, was released for Switzerland. The result was a 0% inflation rate, which proved favourable for the Swiss Franc (CHF). This outcome was particularly positive compared to the forecasted -1%, which would have been detrimental to the CHF had it been the actual result. The impact of this news extended to CHF currency pairs.

Applying technical analysis to the USDCHF pair in the weekly timeframe, a significant event occurred on December 26, 2023, when the established support , 0.85511 , was breached, and the price descended to 0.83292. This breached support level has now transformed into a new resistance level to be tested.

Following the release of the favourable CPI news for CHF, the analysis suggests a higher probability of USDCHF experiencing selling pressure and indicating a potential takeover by bears. Currently, the price is fluctuating within the range of 0.85509 and 0.83292. The resistance at 0.85509 was tested and resulted in price rejection. Coupled with the robust CPI news for CHF, there is an increased likelihood of USDCHF selling, possibly targeting at least the support level of 0.83292. If this support fails to hold and the price breaks below, traders may observe a more substantial bearish takeover in the USDCHF pair.

For traders analyzing the charts, what insights do you gather regarding the potential future movements of USDCHF?