PREVIOUS TRADING DAY EVENTS – 28 June 2023

The market reacted with high AUD depreciation as the expectations of future hikes are now shifted to a pause instead. However, the labour market data are closely being monitored by analysts who suggest that a hike is actually more probable to happen.

“The number is at the very lower end of the range of economists’ expectations which ranged from 6.9% to 5.6% and is soft enough by a good margin to see the RBA halt its series of rate hikes in July and possibly beyond,” said Tony Sycamore, market analyst at IG

“With the labour market still very tight, unit labour cost growth surging and the housing market bouncing back with a vengeance, we suspect that the Bank will press ahead with another rate hike next week,” said Marcel Thieliant, a senior economist at Capital Economics.

Source: https://www.reuters.com/markets/australias-consumer-inflation-hits-13-month-low-2023-06-28/

U.S. Federal Reserve Chairman Jerome Powell kept consecutive interest rate hikes on the table while the European Central Bank President Christine Lagarde cemented expectations for a ninth consecutive rise in Eurozone rates in July.

Bank of England Governor Andrew Bailey expressed the same policy plan, considering that the U.K.’s fight to lower inflation is harder. Even the governor of the Bank of Japan, Kazuo Ueda, mentioned that there is a possibility of a change in policy.

“Policy hasn’t been restrictive enough for long enough,” Powell told an annual gathering of central bankers hosted by the ECB in the Portuguese mountain resort of Sintra. “I wouldn’t take moving in consecutive meetings off the table at all,” he said.

Lagarde: “We still have more ground to cover,” she said of the fight against inflation. “We are not seeing enough tangible evidence of the fact that underlying inflation, particularly domestic prices, are stabilising and moving down.”

Bailey said the BoE will “do what is necessary”. “They’ve got a number of further increases priced in for us,” Bailey added. “My response to that would be: ‘Well, we’ll see.'”

BOJ chief Kazuo Ueda: “If we become reasonably sure the second part will happen, this will be a good reason to shift policy,” he said.

______________________________________________________________________

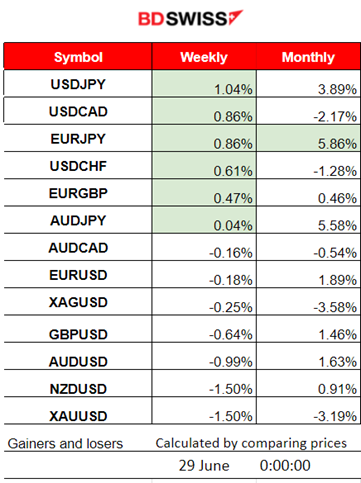

Summary Daily Moves – Winners vs Losers (28 June 2023)

- USDJPY reached the top this week, with a 1.04% price change so far.

- EURJPY and AUDJPY fight side by side having close to a 6% price change this month.

______________________________________________________________________

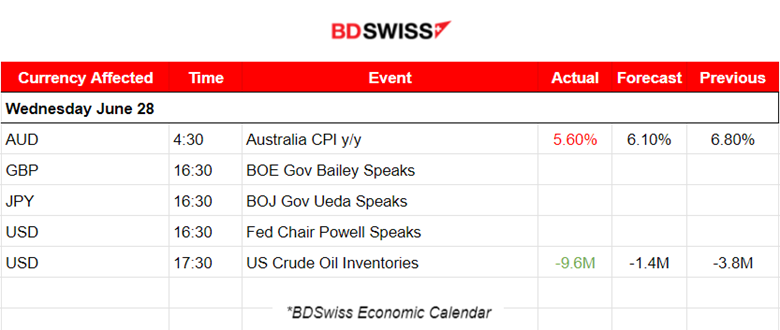

News Reports Monitor – Previous Trading Day (28 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The monthly CPI change rose to 5.6% annually in May. The figure was lower than the 6.8% in April. It seems that the surprise increases from the RBA had the desired effect. AUD depreciated at the time of the release, as expected. AUDUSD dropped more than 40 pips.

- Morning – Day Session (European)

Central Bank governors were participating in a panel discussion titled “Policy Panel” at the ECB Forum on Central Banking, in Sintra. Several said that resilient economies are keeping inflation too high, and more monetary tightening will be needed. “Although the policy is restrictive, it may not be restrictive enough and it has not been restrictive for long enough,” Federal Reserve Chair Jerome Powell said.

At 17:30, the U.S. Crude oil inventory changes were released, surprising the market with a highly negative change of -9.6M, which was more negative than expected. It seems that way more barrels were demanded last week, however, the price did not experience any significant uptrend. Yesterday, investors reacted to the figures by pushing the price upwards near 2 USD after the release.

General Verdict:

______________________________________________________________________

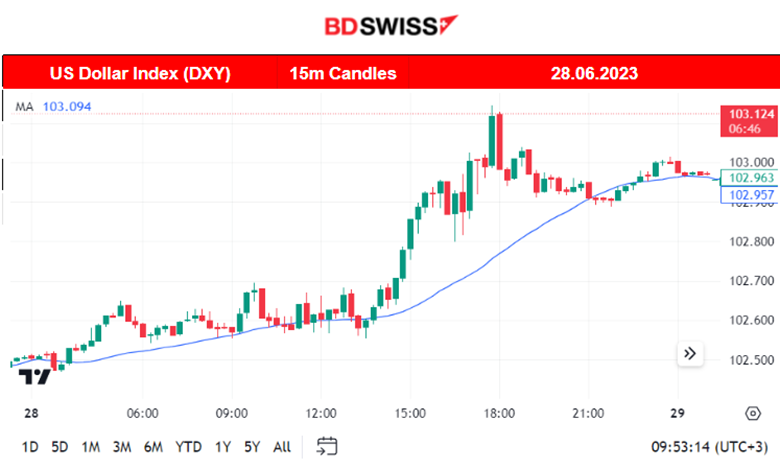

FOREX MARKETS MONITOR

AUDUSD (28.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced an intraday shock due to the lower-than-expected inflation rate figure released at 4:30. The figure caused the pair to drop rapidly until it found support at 0.66200. It retraced quickly after that, back to the 30-period MA and the 61.8% Fibo level. For the rest of the trading day, it moved steadily downwards below the MA forming an intraday downward trend.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index has rebound with surprise. It reversed on the 27th of June after the NYSE opening significantly moving above the 30-period MA. The U.S. Stock Market recently showed signs that it is reversing. However, it is clear that volatility is high enough and support levels are causing it to rebound. The Dow Jones index experienced more volatility than the rest of U.S. benchmark indices and its path remains more sideways than upward. NAS100 remains close to the 15000 resistance level. The RSI signals a slowdown with a potential bearish divergence.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude moved significantly lower breaking 67.60 and reaching 67.10 before reversing. On the 28th of June, it moved significantly higher crossing the MA and remained near 69.80 USD/b. The jump was caused by the news at 17:30, showing way fewer barrels in Crude oil inventories.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was moving sideways around the mean with high volatility, close to a 7-9 USD deviation from the mean. On the 27th, the price moved lower breaking supports and moving with high volatility downwards until the 28th, when it finally stopped at the support of 1903 USD/oz. The market is currently testing that level.

______________________________________________________________

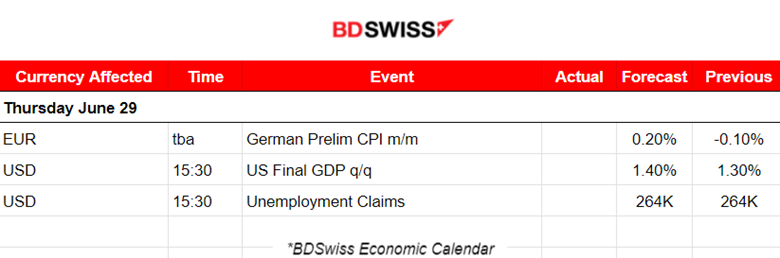

News Reports Monitor – Today Trading Day (29 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European)

At 15:30, GDP figures for the U.S. are expected to cause an intraday shock. The USD pairs will probably be affected and retracement opportunities might arise. Jobless claims are being released at the same time. This is important data to be taken into account by the Fed for July’s meeting for the decision on rates. The market will definitely react greatly to it.

General Verdict:

______________________________________________________________