PREVIOUS TRADING DAY EVENTS – 29 August 2023

The survey from the Conference Board showed that consumers’ perceptions of the labour market cooled in August. Nevertheless, labour market conditions remain tight, with 1.51 job openings for every unemployed person in July, compared to 1.54 in June.

“Although the labour market is still tight, the degree of excess demand is declining and is coming about through companies reducing the number of vacancies rather than increasing layoffs and unemployment,” said Conrad DeQuadros, senior economic advisor at Brean Capital in New York. “There is plenty here to make the case that not only is the labour market rebalancing but at this point it is doing so without pushing up unemployment.”

At the Jackson Hole economic conference in Wyoming on Friday, Fed Chair Jerome Powell said that the U.S. central bank “will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data.” Financial markets expect that the U.S. central bank will leave its benchmark overnight interest rate unchanged at its policy meeting next month.

“With reports like this, the Fed can most likely keep rates unchanged in September,” said Jeffrey Roach, chief economist at LPL Financial in Charlotte, North Carolina.

“The labour market is slowly cooling and this helps make the case for an economic soft landing where inflation can be brought under control without triggering the massive job losses seen in recessions,” said Christopher Rupkey, chief economist at FWDBONDS in New York.

Source: https://www.reuters.com/world/us/us-job-openings-july-post-third-straight-monthly-drop-2023-08-29/

_____________________________________________________________________

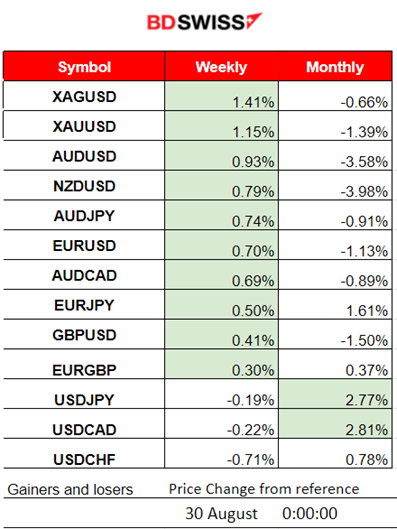

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (29 August 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements or special scheduled releases.

- Morning–Day Session (European and N. American Session)

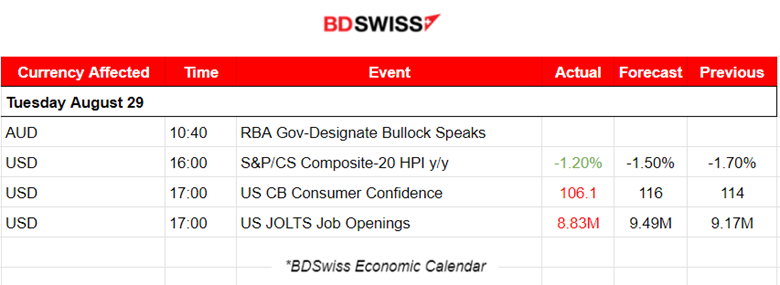

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a figure of -1.20%, which is an improvement from the previous month (released 60 days after the month ends). The impact of the release was not great.

The report at 17:00 showed that the U.S. CB Consumer Confidence index declined 106.1 points from a downwardly revised 114.0 in July. The Expectations Index, which is based on consumers’ short-term outlook for income, business and labour market conditions, declined to 80.2 in August, reversing July’s sharp uptick to 88.0. Expectations were just above 80, the level that historically signals a recession within the next year.

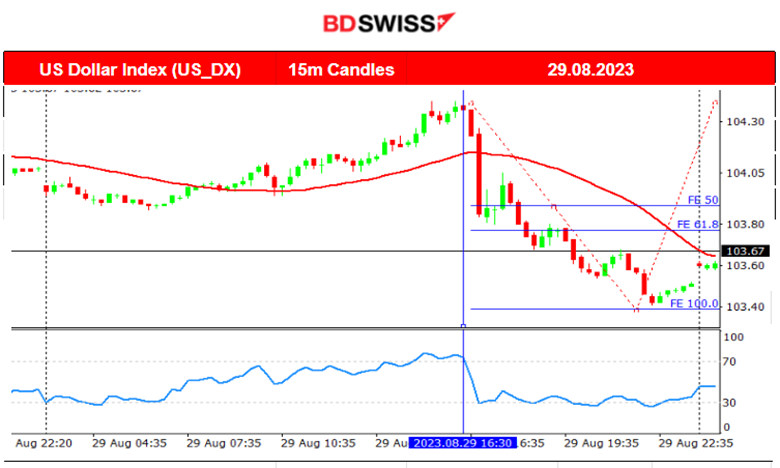

At the same time, at 17:00 the U.S. Job Openings (JOLTS Report) showed a decline by more than the forecast to 8.83M. Both reports were in favour of Dollar depreciation and this actually happened: the Dollar took a hit as the market reacted to these figures greatly, causing the dollar to depreciate heavily against other currencies. EURUSD moved rapidly upwards just a little more than 100 pips.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (29.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving to the downside since the early European session and under the 30-period MA at a steady pace. It found support near 1.07820 and, when the U.S.-related scheduled figures came out, it jumped. The market reacted with USD depreciation since the Consumer Confidence index declined and fewer job openings were reported, indicating cooling of the labour market. The pair moved quite a lot to the upside after the reversal. It was hard for someone to guess the end of the move but it eventually happened near the 1.08920 resistance. Retracement followed although the activity on the same day was not high enough to see the expected retracement back to the 61.8 Fibo level. It was eventually completed today, 30th of August.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

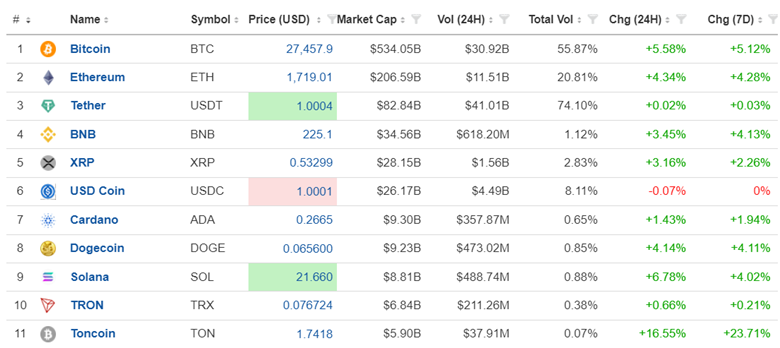

The price of Bitcoin (and of other major Cryptocurrencies) jumped yesterday, breaking the boundaries that it experienced in the past few days. We see that the jump took place after the USD-related news releases at 17:00. Since the USD depreciated, Bitcoin, which is denominated in USD, jumped. It found resistance near 28132 before retracing.

Crypto sorted by Highest Market Cap:

Most assets, with their prices being denominated in USD, moved to the upside yesterday. The 17:00 U.S. figure releases concerning consumer expectations and labour market data have caused the USD to depreciate. Bitcoin and Ethereum increased significantly in value, and so did Solana and Toncoin.

Part of the value increase of Crypto was also due to the fact that the U.S. Court of Appeals for the DC Circuit ruled that the Securities and Exchange Commission was wrong to deny Crypto investment giant Grayscale permission to convert its popular Bitcoin trust into an ETF. Grayscale won the case against the SEC and the market reacted with an apparent rally.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

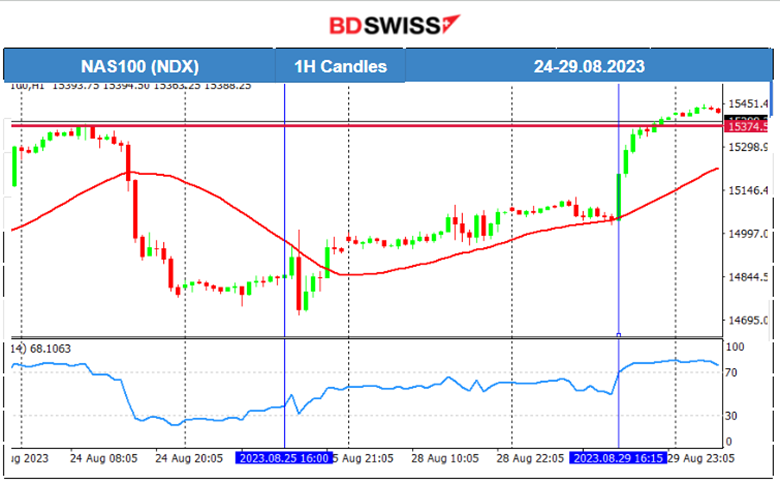

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index started to move to the upside after a strong reversal. The steady movement while being above the 30-period MA was interrupted by yesterday’s news. It was obvious that the U.S.-related reports at 17:00 have affected the U.S. Stock market as well. All the benchmark indices jumped. The expected retracement after the movement upwards never took place on the same day. We should, however, see the index return to the MA, as shown below.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USD weakening yesterday caused by the market reacting to the reports has pushed the price of Crude to the upside. A steady upward movement is currently in place. There are no apparent signs indicating price reversal, however, some movement back to the 30-period MA should be expected due to the asset’s volatile nature.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A rising wedge was visible on the chart and we were waiting to see if the trend would continue or not. The support of 1911 USD/oz broke eventually and the price reached the next support yesterday, near 1915 USD/oz. However, it was not meant to stay there. The news at 17:00 caused the Gold price to jump, reversing and breaking the triangle’s upper band and moving higher to 1938 USD/oz before eventually retracing.

______________________________________________________________

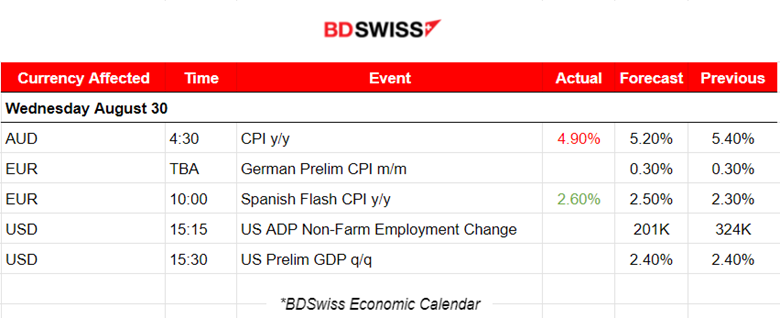

News Reports Monitor – Today Trading Day (30 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The latest Consumer Price Index (CPI) figures, released by the Australian Bureau of Statistics, showed the annual inflation at 4.9% in July, down from 5.4% in June. The market reacted with AUD depreciation at the time of the release. AUDUSD dropped nearly 20 pips before retracing shortly after.

- Morning–Day Session (European and N. American Session)

The Spanish Flash annual CPI figure was reported higher, at 2.6%. The EUR started to see more volatility after that time and the German Preliminary figure is expected to cause intraday shock for the EUR pairs, even though it might not be great.

At 15:15 and 15:30, the USD pairs are expected to see great volatility and probably intraday shocks because of these releases. The USD was hit by yesterday’s news and the market reacted greatly to the Job openings data. The same reaction and impact are expected as well today since we have the ADP Employment Change report today, which is considered important too. The GDP for the quarter is expected to be reported unchanged. Considering the recent U.S. labour market resilience and business activity, I find this unlikely.

General Verdict:

______________________________________________________________