Caterpillar Inc. (NYSE: CAT) announced in a July 23 press release that it will report Q2 2024 financial results today, August 6 at 5:30 a.m. CDT. The full release will be available at investors.caterpillar.com/financials/quarterly-results and on PR Newswire at the same time

Caterpillar Inc. (NYSE: CAT) announced in a July 23 press release that it will report Q2 2024 financial results today, August 6 at 5:30 a.m. CDT. The full release will be available at investors.caterpillar.com/financials/quarterly-results and on PR Newswire at the same time

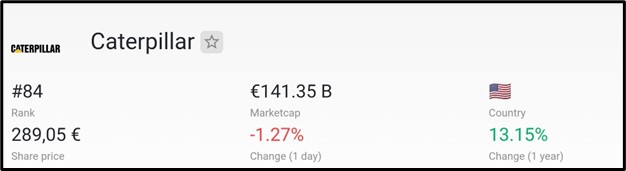

Market Cap

€141.35 billion marks Caterpillar’s market cap as of August 2024, ranking it as the 84th most valuable company globally by market capitalization, according to companiesmarketcap.com.

Dividend Information  Caterpillar’s stock offers a dividend yield of 1.78% with an annual dividend of $5.64, paid quarterly. With a payout ratio of 25.49%, the company has consistently grown dividends for 31 years, reflecting an 8.37% dividend growth rate. The ex-dividend date was July 22, 2024. Additionally, it features a buyback yield of 4.33% and a shareholder yield of 6.11%, making it an attractive option for investors.

Caterpillar’s stock offers a dividend yield of 1.78% with an annual dividend of $5.64, paid quarterly. With a payout ratio of 25.49%, the company has consistently grown dividends for 31 years, reflecting an 8.37% dividend growth rate. The ex-dividend date was July 22, 2024. Additionally, it features a buyback yield of 4.33% and a shareholder yield of 6.11%, making it an attractive option for investors.

Recent Development At Caterpillar

Here are the most recent updates from Caterpillar :

– Caterpillar Inc. contributes $500,000 to the AED Foundation’s Vision 2025 initiative.

– Caterpillar unveils the ‘Pathways to Sustainability’ program, focusing on energy transition.

– Caterpillar allocates $90 million for investment in Texas.

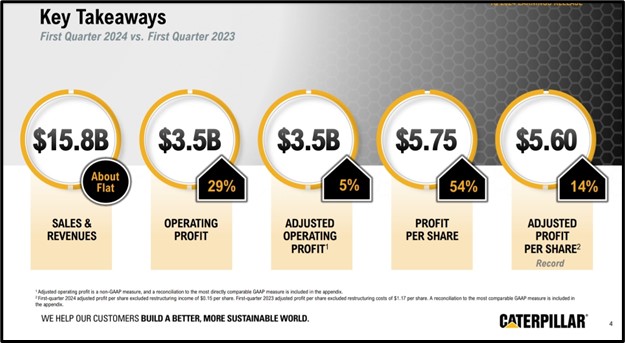

Q1 Earnings Report Recap

Revenue & Earnings: Caterpillar’s Q1 2024 sales and revenues were $15.8 billion, flat compared to Q1 2023; profit per share rose to $5.75, up from $3.74 in Q1 2023.

Operating Margins: The operating profit margin increased to 22.3% in Q1 2024 from 17.2% in Q1 2023, with an adjusted margin of 22.2%, compared to 21.1% last year.

Cash Flow & Capital Allocation: The company generated $2.1 billion in operating cash flow and deployed $5.1 billion in share repurchases and dividends, supported by $5.0 billion in enterprise cash.

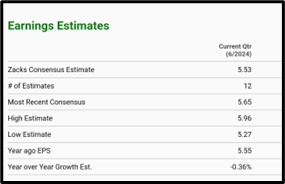

Q2 Earnings Report Analyst Forecast

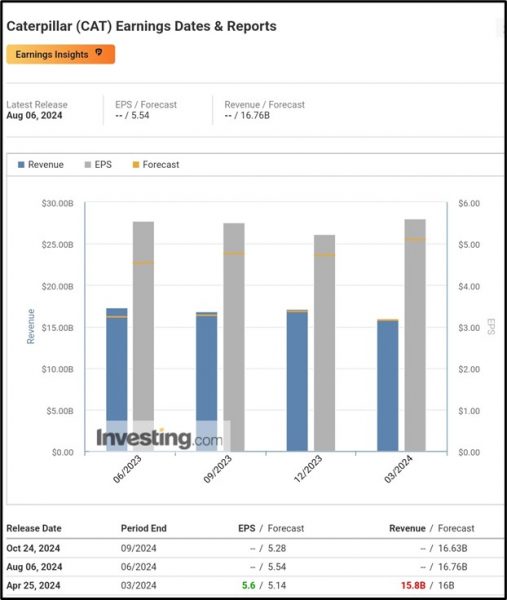

For the current quarter (Q2 2024), Caterpillar’s earnings per share (EPS) consensus estimate is $5.53, based on 12 analysts’ forecasts, with a range between $5.27 and $5.96. This reflects a slight year-over-year decline of -0.36% compared to last year’s EPS of $5.55. On the sales front, the consensus estimate is $16.76 billion, with projections ranging from $16.40 billion to $17.18 billion, representing a year-over-year sales decrease of -3.20% from $17.32 billion in the same quarter last year.

Investing.com projects Caterpillar Inc. (NYSE: CAT) to report earnings per share (EPS) of $5.54 and forecast revenue of $16.76 billion.

Tradingview.com forecasts Caterpillar Inc. (NYSE: CAT) to report EPS of $5.56 and projected revenue of $16.91 billion.

Tradingview.com forecasts Caterpillar Inc. (NYSE: CAT) to report EPS of $5.56 and projected revenue of $16.91 billion.

Technical Analysis

Support Rejection: The 1-hour chart of Caterpillar Inc. (NYSE: CAT) shows a rejection of support at $311.08, indicating a potential upward movement.

Bullish Scenario: If the rejection holds, prices could rally to $326.31 and $338.26.

Bearish Scenario: If the rejection fails, prices may decline to $291.74 and $267.13.

Apply Risk Management

Conclusion

In conclusion, Caterpillar Inc. has demonstrated robust performance in recent quarters, with a significant increase in operating margins and strong cash flow generation. Despite a slight decline in expected EPS and revenue for Q1 2024, the company’s consistent dividend growth, solid market capitalization, and strategic investments position it favorably for the future. Analysts forecast a modest decrease in earnings and revenue compared to the previous year, but technical indicators suggest potential upward movement in stock prices, making Caterpillar a notable candidate for investor consideration.

Source :

https://www.caterpillar.com/en/news/corporate-press-releases/h/2q24-earnings-advisory.html

https://companiesmarketcap.com/eur/caterpillar/marketcap/

https://stockanalysis.com/stocks/cat/dividend/

https://images.app.goo.gl/yZtj9oTdSFBUp3QQ7

https://www.caterpillar.com/en/news/corporate-press-releases/h/donation-vision-2025.html

https://investors.caterpillar.com/financials/quarterly-results/default.aspx

https://www.zacks.com/stock/quote/CAT/detailed-earning-estimates

https://www.investing.com/equities/caterpillar-earnings