Previous Trading Day’s Events (24.05.2024)

“The waning of momentum over the quarter reflects consumer caution as mortgages come up for renewal at higher interest rates, and sales look even worse in per-capita terms, with volumes well below year-ago levels,” Katherine Judge, Director & Senior Economist at CIBC Capital Markets, wrote in a note.

The Bank of Canada (BoC) is likely to cut interest rates at its June 5 monetary policy decision announcement as a sustained drop in inflation.

These data add more evidence that the economy is losing steam under a near-23-year high-interest rate of 5%.

“Despite elevated borrowing costs and stricter loan standards, U.S. business investment could pick up in the second quarter,” said Sal Guatieri, a senior economist at BMO Capital Markets. “However, the manufacturing sector, as a whole, is expected to remain in low gear until interest rates ease, the greenback weakens, and the global economy strengthens.”

Core capital goods orders jumped 1.2% on a year-on-year basis in April. Shipments increased 0.4% after a 0.3% drop in March. Non-defense capital goods orders fell 1.5% in April after advancing 1.3% in the prior month. Shipments of these goods rose 2.4% after dropping 1.5% in March.

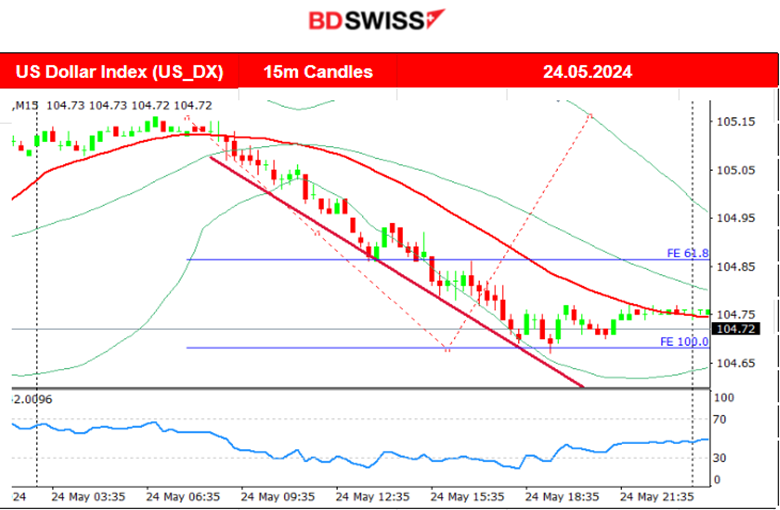

The Fed is expected to start lowering borrowing costs in September. It has kept its policy rate in the 5.25%-5.50% range since July. The prospect of policy easing by the end of the third quarter received a boost from a University of Michigan survey on Friday showing consumers’ inflation expectations improved in late May after deteriorating early in the month.

“While growth remains positive for now, uncertainty about the rate path may weigh on orders going forward,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics. “However, a push from fiscal spending could be positive for orders and investment over time.”

Source; https://www.reuters.com/markets/us/us-core-capital-goods-orders-shipments-rebound-april-2024-05-24/

______________________________________________________________________

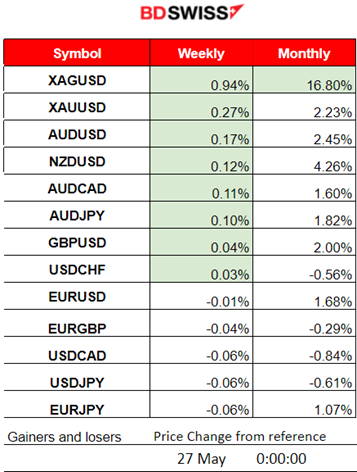

Winners vs Losers

Metals are on the top, recovering this week from a long downward path. Silver remains the top gainer for the month with 16.80% performance. The dollar weakened causing the dollar pairs (USD as the base) to move to the bottom of the list.

______________________________________________________________________

______________________________________________________________________

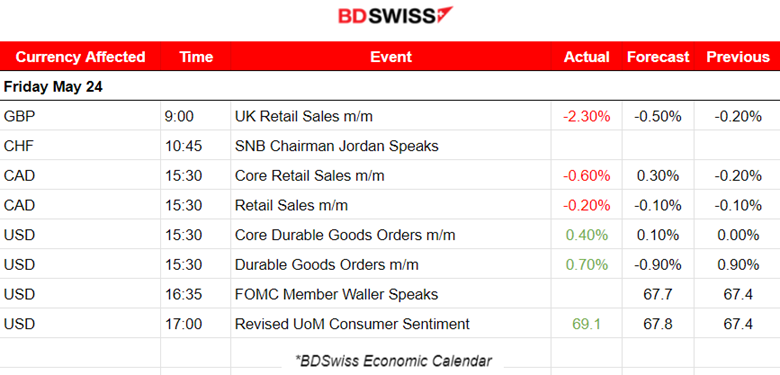

News Reports Monitor – Previous Trading Day (24.05.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news, no special scheduled figure releases.

- Morning – Day Session (European and N. American Session)

Retail sales volumes (quantity bought) fell by 2.3% in April 2024, following a fall of 0.2% in March 2024 (revised from 0.0%). Sales volumes fell across most sectors, with clothing retailers, sports equipment, games and toys stores, and furniture stores doing badly as poor weather reduced footfall. The market did not react heavily but only with a slight depreciation of the GBP currency. GBPUSD dropped only near 20 pips at the time of the release and reversed.

Retail Sales for Canada were reported weaker than expected at 15:30. With a larger-than-forecast decline in March, retail sales were down 0.2% overall in the first quarter. Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were down 0.6% in March. The market did not react heavily to the news, only with a low-level shock that caused CAD depreciation that did not last long.

At the same time, the number of durable goods orders in the U.S. got released. The reports showed that they went up by 0.7% in April. Excluding transportation, new orders grew 0.4% in the reported month. In addition, shipments of manufactured durable goods increased by 1.2%. Despite the fact that the numbers beat expectations the U.S. dollar kept on weakening for the whole session.

The University of Michigan consumer sentiment final for May showed a 69.1 figure vs 67.5 estimate and 67.4 preliminary. No major impact on the market was recorded. The Preliminary release is the earliest and thus tends to have more impact.

General Verdict:

__________________________________________________________________

FOREX MARKETS MONITOR

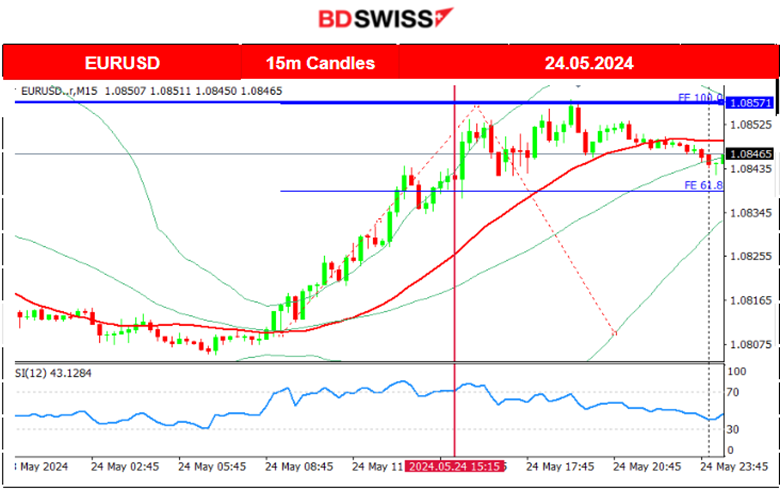

EURUSD (24.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced a steady upward movement since the start of the European session obviously mainly from USD depreciation that lasted until near the start of the N.American session. The pair slowed down as it hit near the resistance 1.08570 and retraced to the 30-period MA and the 61.8 Fibo level.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

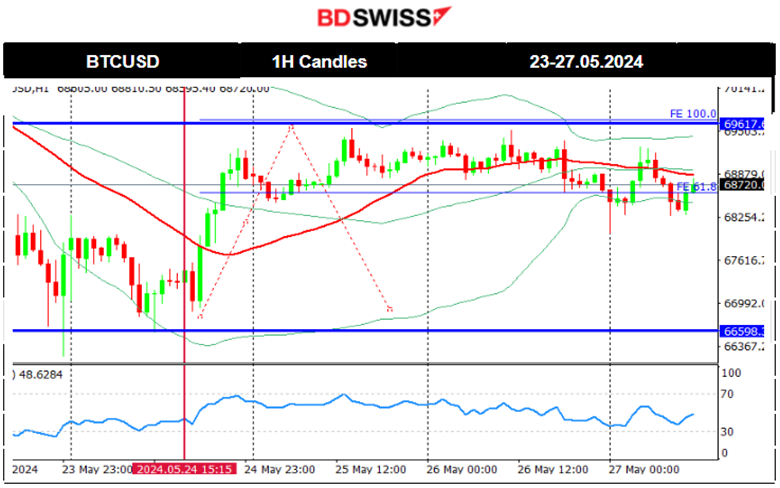

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin settled near 70K USD on the 22nd of May. That changed later with Bitcoin moving rapidly to the downside on the 23rd after 16:00. Many assets including stocks and commodities got affected negatively after that time. The price returned back and settled near the 67K USD level wiping out the gains since the jump on the 20th of May.

The price eventually jumped on the 24th of May and continued its upward movement until the resistance at near 69,600 USD. It retraced during the weekend when volatility levels lowered.

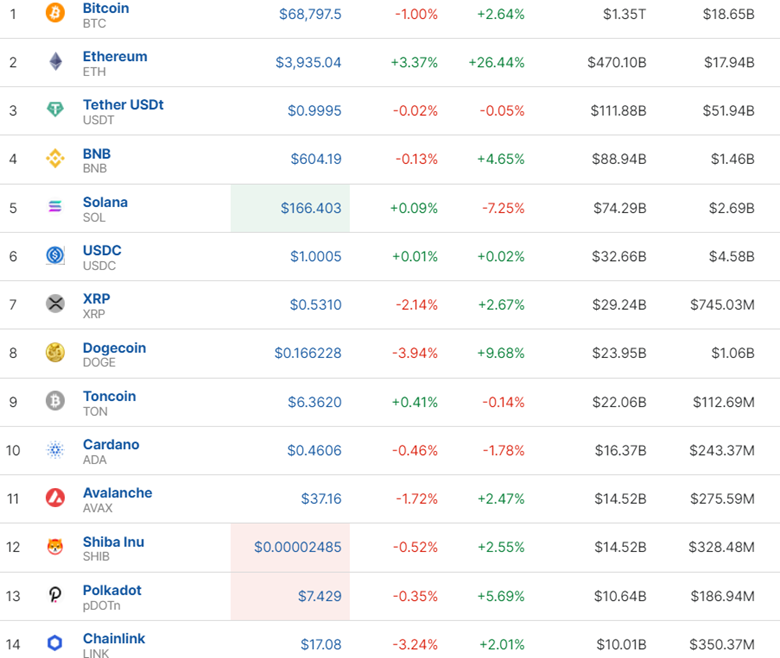

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

After a boost seen on the 20th of May, the market reversed, eliminating the performance gained the previous week. However, the market got a boost from the approval of ETH ETFs by the SEC. Ethereum gains remain high and now at 26.44% for the last 7 days.

Sources:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The triangle formation that was highlighted in our previous analysis was broken on the 22nd of May and the index moved downwards to the support near 5,290 USD before a full reversal took place. This high volatility depicted on the chart was taking place during the FOMC meeting minutes release. All U.S. indices experienced a pre-market aggressive movement to the upside and broke the resistance at near 5,330 USD reaching only near the peak at near 5,350 USD. Then, after the stock market opening and the release of the U.S. PMI figures all indices dropped heavily on the 23rd of May. S&P500 reached support at near 5,258 USD before a strong retracement took place with an upward steady movement on the 24th of May. The index reached the 5,314 USD resistance that day before it retraced to the 61.8 Fibo level.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

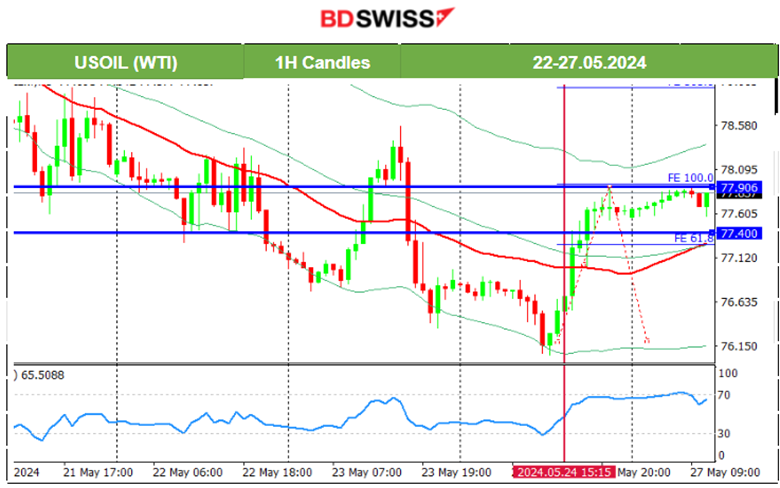

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 21st of May, the price stayed below the 30-period MA and moved even lower today forming lower lows. The bullish divergence was valid as mentioned in our previous analysis. The price eventually jumped on the 23rd of May crossing the 30-period MA on its way up and indicating the possible end of the downtrend. However, that changed when the price experienced a sudden drop after the U.S. PMI release. The momentum was so strong that a new downtrend was created. The price broke an important support near 76.40 USD/b and sparked expectations for a further downward movement to the next support. On the 24th that support was at nearly 76 USD/b. After that, the price reversed to the upside, crossing the MA on its way up and reaching the resistance at near 77.90 USD/b. Retracement has not taken place yet but it could be the case even though the RSI does not show strong bearish signals yet (bearish divergence).

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The support on the 22nd of May was broken and the price dropped heavily reaching the support at near 2,355 USD/oz. The downtrend continued until the price reached another important support at near 2,325 USD/oz on the 23rd of May and the potential for a retracement now is apparent with the target level at near 2,360 USD/oz. On the 24th of May, the price has moved only slightly upwards but the potential for a further upward movement still remains.

______________________________________________________________

______________________________________________________________

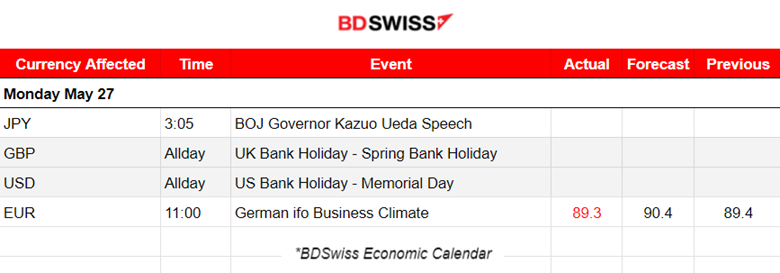

News Reports Monitor – Today Trading Day (27 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The Bank of Japan (BOJ) will proceed cautiously with inflation-targeting frameworks, according to Governor Kazuo Ueda, noting that some challenges are “uniquely difficult” for Japan after years of ultra-easy monetary policy. Ueda said Japan has “made progress in moving away from zero and lifting inflation expectations.” To achieve 2% inflation in a sustainable and stable manner, the BOJ “will proceed cautiously, as do other central banks with inflation-targeting frameworks,” he said.

- Morning – Day Session (European and N. American Session)

Memorial Day and Spring Bank Holiday: UK and US shares closed today.

German business morale stagnated in May, missing forecasts, putting a stop to three consecutive months of increases. The Ifo Institute said its business climate index remained constant in May at 89.3, compared with a reading of 90.4 forecast by analysts. No major impact was recorded in the market at the time of the release.

General Verdict:

______________________________________________________________