PREVIOUS TRADING DAY EVENTS – 17 Oct 2023

The RBNZ this month maintained the Official Cash Rate at 5.5% and said policy may need to be restrictive for a sustained period of time to get inflation back into its 1-3% target range by the second half of 2024.

“We are winning the war on inflation,” said Jarrod Kerr, chief economist at Kiwibank in Auckland. “Today’s numbers significantly reduce the likelihood of any further hikes from the RBNZ. Whatever probability there was before today’s numbers, it’s closer to zero now.”

“It’s pretty clear that the central bank won’t be raising rates when it announces its policy decision on Oct. 25”, said Jules Boudreau, senior economist at Mackenzie Investments.

At 3.8%, inflation is still nearly double the bank’s 2% target.

Given the bleak business survey “and inflation coming in below expected, look for expectations to solidify around the BoC holding policy steady next week,” said Benjamin Reitzes, managing director and macro strategist at BMO Capital Markets. “There’s no need for further rate hikes in Canada,” Reitzes said.

The central bank, however, does not anticipate inflation slowing to its 2% target until mid-2025. The bank will issue new forecasts alongside its rate announcement next week.

“The inflation risk is skewed higher on a trend basis, but for now the Bank of Canada can be opportunistic and skip next week’s meeting,” said Derek Holt, vice president of capital markets at Scotiabank.

Source: https://www.reuters.com/markets/canada-annual-inflation-rate-edges-down-38-september-2023-10-17/

The value of retail purchases, unadjusted for inflation, increased 0.7% after an upwardly revised 0.8% gain in August. Excluding gasoline, September sales advanced 0.7%.

Consumers are still powering ahead despite the recent energy-driven pickup in inflation. The labour market remains generally strong, offering Americans resources for spending.

“The death of the US consumer has been greatly exaggerated,” Omair Sharif, president of Inflation Insights LLC, said in a note. Including control group sales revisions, “this is a good all-around report that shows continued strength in consumer spending.”

While inflation is still running well above the Fed’s 2% target, the prices of key consumer goods including apparel and furniture fell sharply last month.

“Solid September retail sales overstate the degree of consumer resilience. Though consumer spending is indeed looking very strong for 3Q, it’s due to a temporary burst in activity that’s unsustainable.”— Eliza Winger, Bloomberg.

______________________________________________________________________

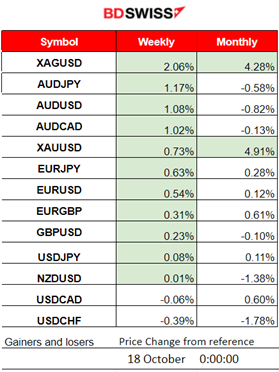

Winners and Losers

Metals have regained momentum moving rapidly to the upside. Silver (XAGUSD) has reached the top of the week’s gainers list with a 2.06% price change. For the month it has 4.28% gains so far. Gold is leading this month with a bit higher figure, 4.91% gains.

News Reports Monitor – Previous Trading Day (17 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

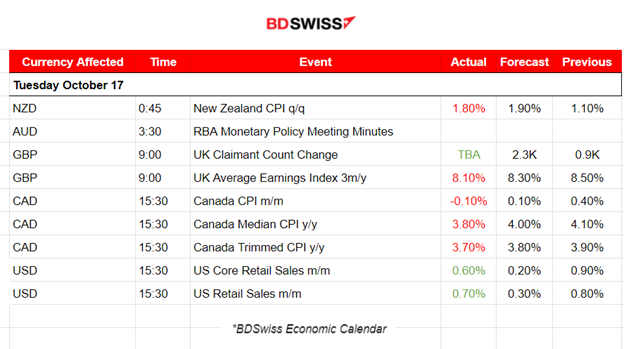

- Midnight – Night Session (Asian)

The quarterly CPI change for New Zealand was reported 1.80% slowing more than what economists expected in the third quarter. The annual inflation rate fell to 5.6%, a two-year low, from 6% in the second quarter. NZD depreciated at the time after the shock with NZDUSD dropping near 20 pips before retracing to the mean.

- Morning–Day Session (European and N. American Session)

The average weekly earnings figure for the U.K. was reported at 9:00 showing that annual growth in employees’ average total pay (including bonuses) was 8.1% from June to August 2023. The previously reported figure was higher at 8.5%. The impact on the GBP was minimal, GBP experienced some depreciation that still lasts.

Canada’s CPI data were reported at 15:30 as scheduled and showed that inflation has lowered significantly. The market reacted with a shock for the CAD pairs and with an initial CAD depreciation. The USDCAD jumped near 60 pips before retracing fully.

U.S. Retail Sales figures were reported at the same time showing that consumers boosted retail sales well above expectations despite high interest rates and worries over a weakening economy. Retail sales rose 0.7% on the month, well above the 0.3% estimate. At the time of the release, the USD appreciated but the impact of the news was not so great. The market soon reversed.

General Verdict:

____________________________________________________________________

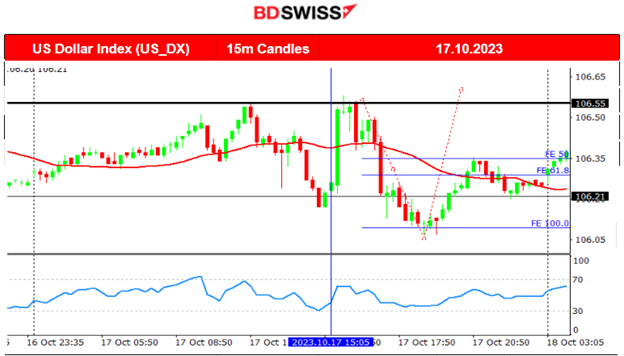

FOREX MARKETS MONITOR

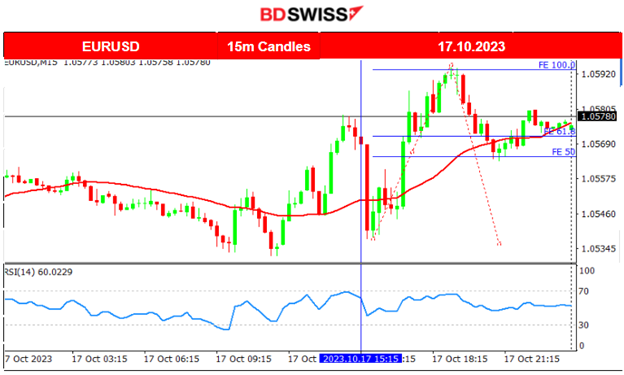

EURUSD (17.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD started to show high levels of volatility soon after the start of the European session and during the trading day it was affected by the scheduled figure releases since the USD was affected greatly. Once more we see that the USD is the main driver of the path. After 15:30 the pair dropped from the retail sales report and soon came back. There were quite a few reversals yesterday that created retracement opportunities as depicted in the chart.

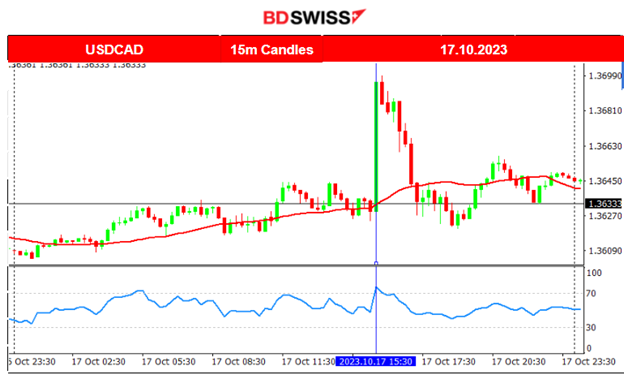

USDCAD (17.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USDCAD started to move with low volatility leaning more to the upside until the news came out at 15:30. At the time of the CPI data release the CAD pairs experienced a shock with CAD depreciation at the beginning, causing the pair to jump, followed by a quick 100% retracement to the mean soon after.

___________________________________________________________________

CRYPTO MARKETS MONITOR

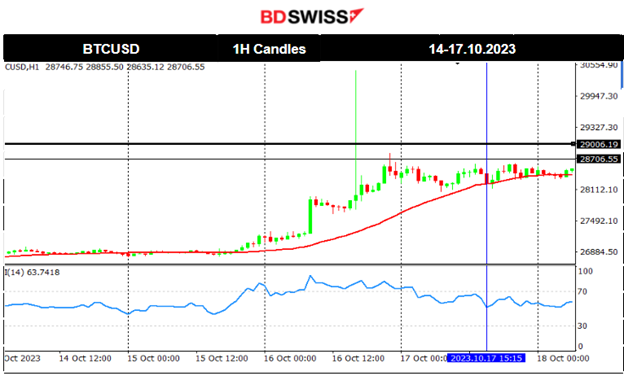

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Surprisingly there was movement on the 15th and yesterday morning with bitcoin jumping and breaking the resistance at 27000 and later at 27300 moving significantly upwards over 700 USD. A retracement back at 27650 eventually happened during the day but later a storm took place. Bitcoin surged over 30K USD as a false report took place of a spot ETF approval that was posted on social app X, formerly Twitter, leading to nearly $100 million in liquidations. The post was deleted soon after it was publicly available but had already sparked enough interactions to have that major impact on prices. Bitcoin has since fallen from 30K USD to 28K USD following scepticism from analysts and reporters. Yesterday, we saw that it remained in range; currently near 28700 but the next resistance is at 29000.

Source: https://finance.yahoo.com/news/bitcoin-jumps-30k-then-dumps-135714532.html

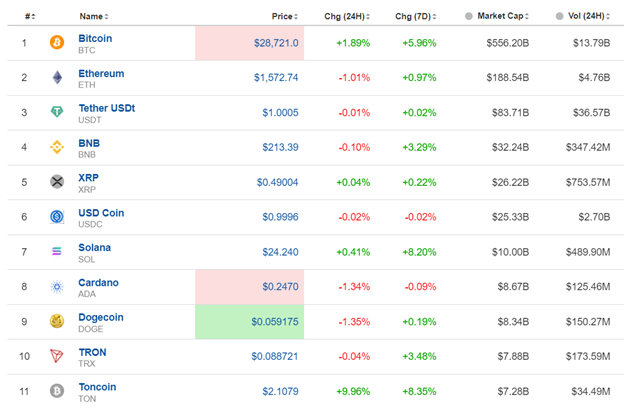

Crypto sorted by Highest Market Cap:

Mixed figures for Crypto in the last 24 hours. After the false report related to bitcoin, it remained at higher levels even showing gains of 1.89% for that period and 5.96% for the last 7 days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index was showing signs of a trend reversal or a sideways but volatile path this week. The most possible path was to the downside as technicals were suggesting. Eventually, the index showed amazing resilience and even moved rapidly to the upside crossing the 30-period MA on its way up on the 16th Oct. This signalled that the path is sideways for the moment but volatile. On the 17th Oct, the index eventually dropped heavily until the support at 14940 USD before a remarkable full retracement that took place soon after.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

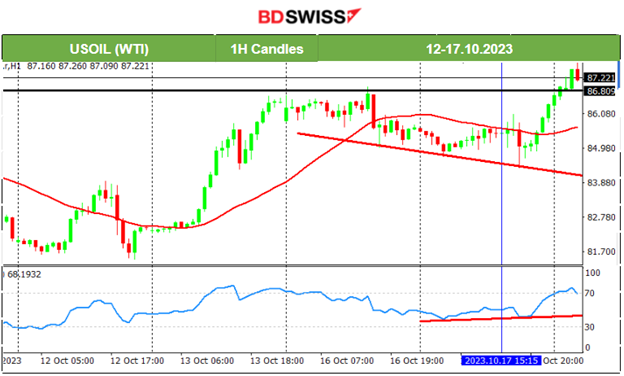

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude’s price reached the highest peak for this week at 87 USD/b. After the 16th Oct, the price settled at around 86 USD/b. At that time a bearish divergence was formed, as per the RSI, it shows higher lows while the price was showing lower lows. On the 17th Crude’s price moved rapidly higher, eventually passing over 87 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was on an uptrend last week but on the 13th it experienced a rapid movement to the upside near 60 USD. The 1885 level was broken and its price was boosted to the upside before retracing. It later tested significant resistance levels, broke them and after breaking consolidation, it moved even higher reaching now at 1940 USD/oz.

______________________________________________________________

______________________________________________________________

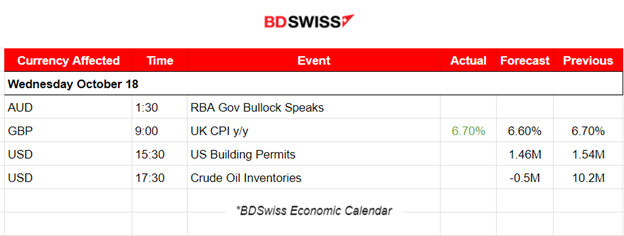

News Reports Monitor – Today Trading Day (18 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

The Consumer Prices Index (CPI) rose by 6.7% in the 12 months to September 2023, the same rate as in August. This better-than-expected figure caused GBP to appreciate significantly at the time of the release.

At 15:30 the Building Permits scheduled figure for the U.S. is going to be released. It is possible that we will see rising volatility or a moderate shock affecting the USD pairs during the time of the release.

Crude oil Inventory figures are released later at 17:30. We saw lately that the price of Crude oil started to reverse to the upside, so fewer barrels in inventories are expected to be reported, indicating that demand has gained momentum again.

General Verdict:

______________________________________________________________