Rates as of 04:00 GMT

Market Recap

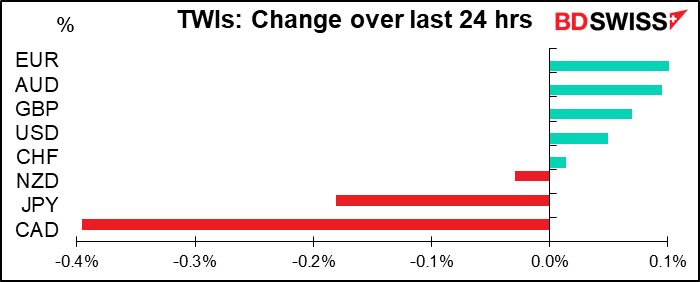

A quiet day in FX as stock markets moved further into record territory, boosted by hopes of a virus vaccine brought about by the mendacious musings of the US Liar-In-Chief. With little data to influence FX rates, there was little reason not to go along with the trend.

Market participants are probably holding off on taking any big views on USD until they hear what Fed Chair Powell has to say on Thursday.

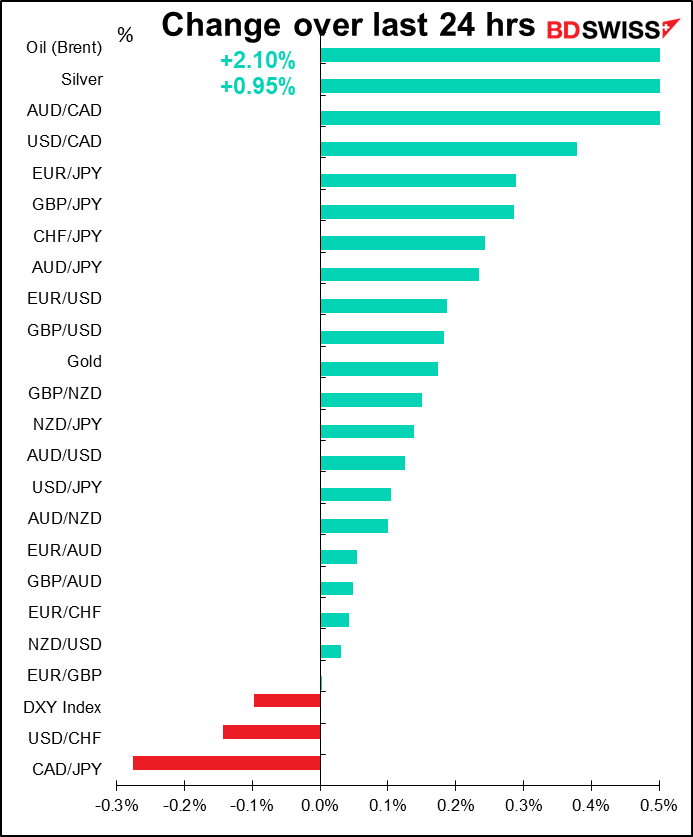

CAD was the only currency showing a significant move. Most of it was technical. A break below 1.3150 – the low yesterday was 1.3135, not far off the post-COVID low of 1.3113 seen last Wednesday – brought in buying interest and pushed the pair back above 1.3200, aided by a generally stronger dollar.

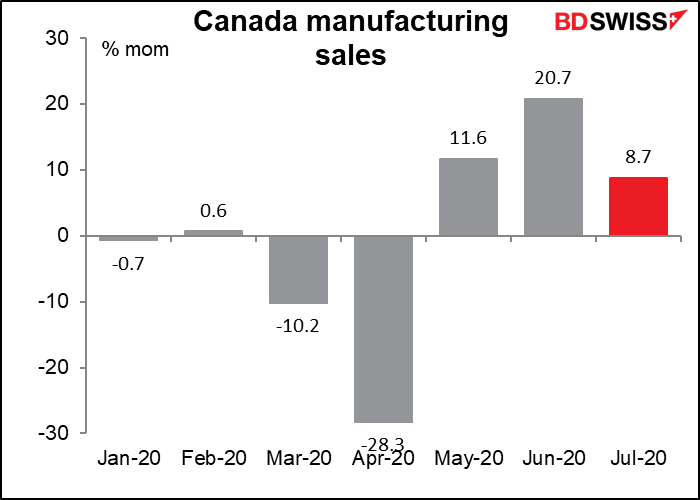

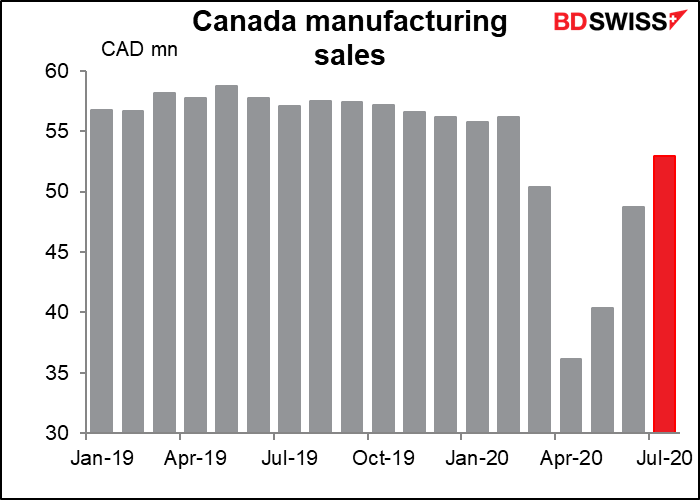

The USD/CAD rally took off about 40 minutes after Statistics Canada published a flash estimate of July manufacturing sales showing that the pace of recovery slowed from a 20.7% mom leap in June to a more sedate 8.7% mom rise in July.

That left sales still a disappointing 5.3% below the Jan/Feb average.

USD/CAD stabilized in the New York afternoon as the S&P 500 closed at a record high and Brent erased its losses from Friday and recovered over $45/bbl.

Other than that, not much worth discussing today. The weaker JPY was simply a reflection of a general “risk-on” attitude, there was nothing much going on on the JPY side of the equation.

Commodity broking service CLS reported unusually high volume in EUR/CHF at around 10:00 GMT, although looking at the chart the pair was quite stable then at 1.0762. That could indicate the Swiss National Bank (SNB) was intervening in the market at that time to keep the price there. It held in a range for a little less than two hours before dropping to an intraday low of 1.0744.

Short-term economic indicators

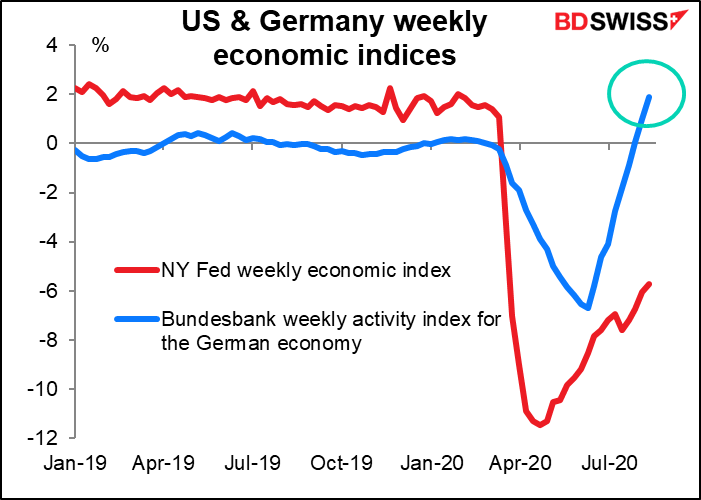

The Bundesbank’s weekly activity index for Germany moved further into positive territory. We get the updated Fed index today. But so far, despite the fears of an increasing second wave of virus infections in Europe, the German economy seems to be continuing to expand.

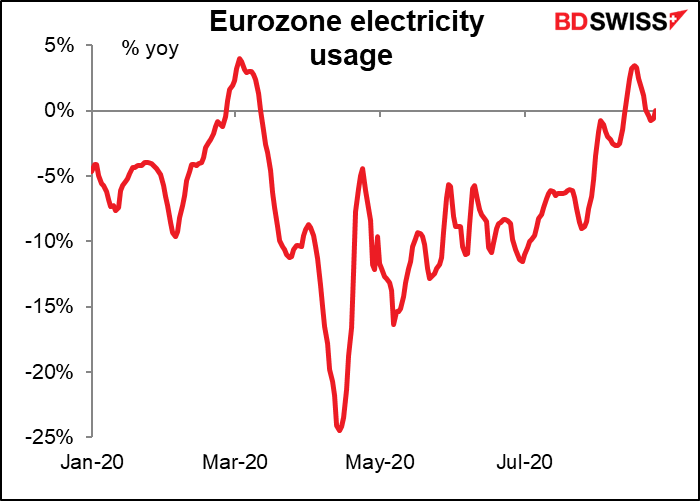

Eurozone electricity usage (daily data) is however showing a slowdown recently. But that could just be cooler weather affecting air conditioning.

Today’s market

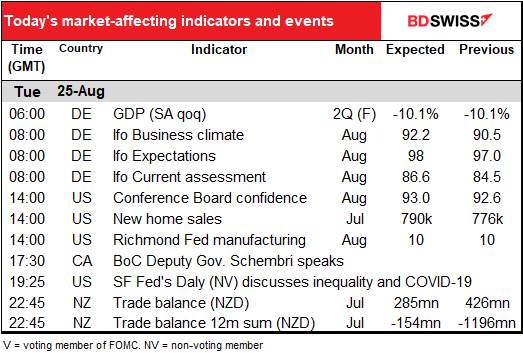

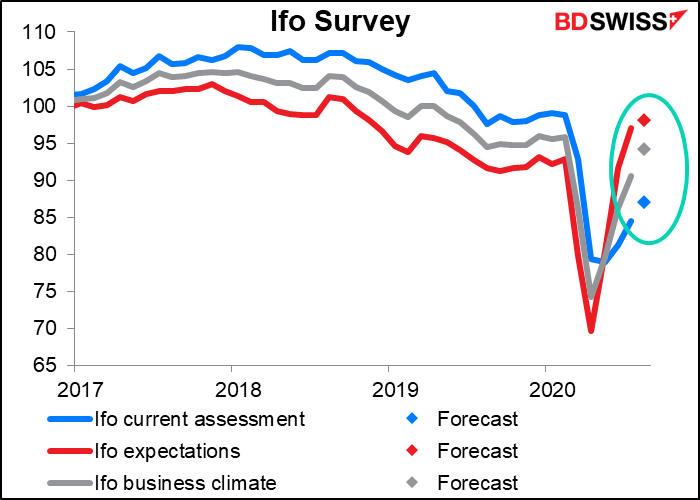

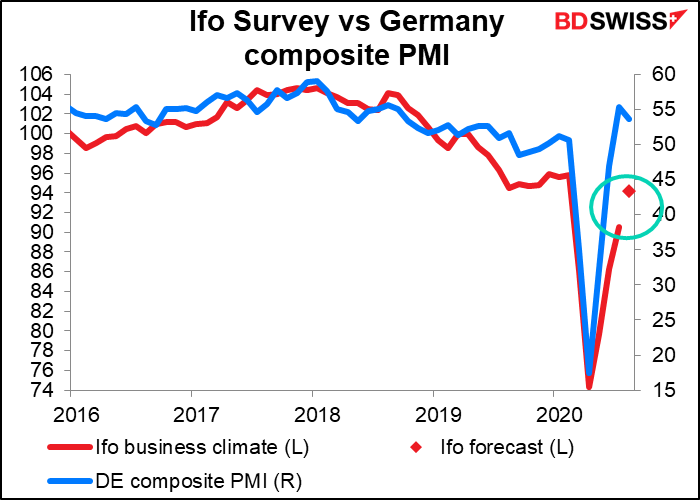

This morning’s Ifo survey is the only major Eurozone indicator out this week. It’s expected to be relatively optimistic. That may help to revive the outlook for the Eurozone after Friday’s disappointing purchasing managers’ indices.

Although having said that, it seems that the PMI has bounced back better than the Ifo survey has.

The Conference Board consumer confidence index is expected to be up a bit but not to regain the level it hit in June, in line with the performance of the U of M consumer sentiment index and consumer sentiment indices from other countries as well. No surprise there as millions remain unemployed and the death toll from the virus keeps mounting, both in the US as elsewhere. In my case, I’m an American and I will have zero confidence until, I hope, 4 November, the day after the Presidential election.

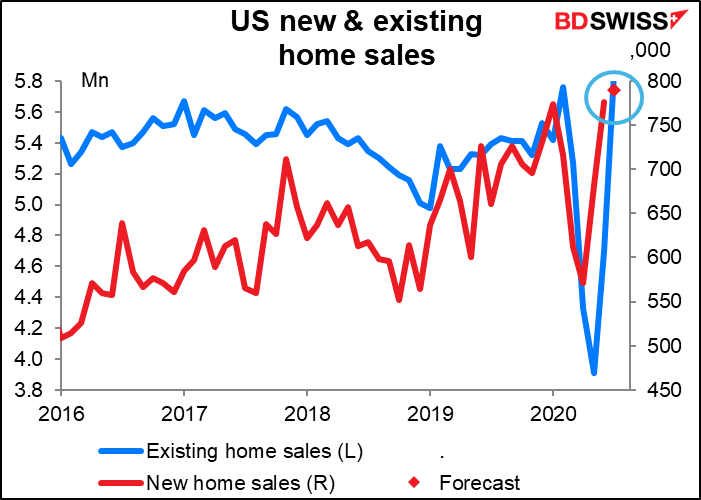

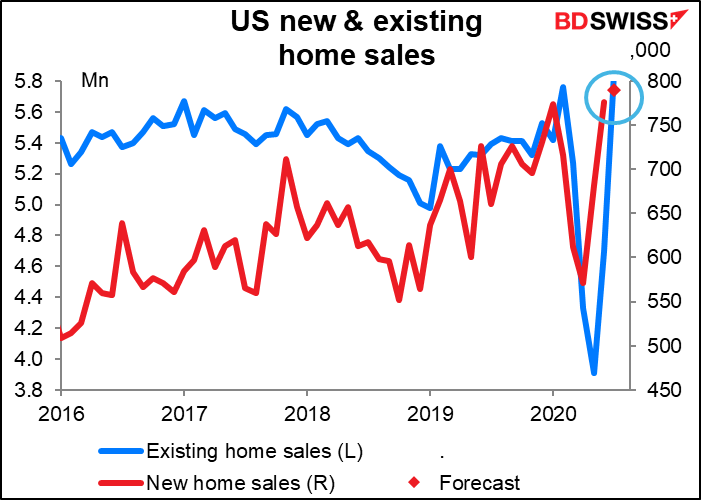

US existing home sales had the biggest one-month jump ever (24.7% mom) in July. In that light, even though the market consensus forecast for today’s US new home sales has been steadily moving up, the expected 1.8% mom increase seems rather cautious. Like consumer confidence, housing is following a similar pattern globally as interest rates crash to record lows and millions of people simultaneously discover that they don’t have to live near their offices. Furthermore there were a lot of people who couldn’t look for a house for a few months while they were huddling inside wrapped in Saran wrap and breathing through HEPA filters to avoid inhaling virus particles (notice the sharp drop in sales in April and May). People who fail to buy a coffee for a month or two aren’t suddenly going to go out and buy 30 or 60 of them once they can, but people who intended to buy a house in April or May can put it off until July.

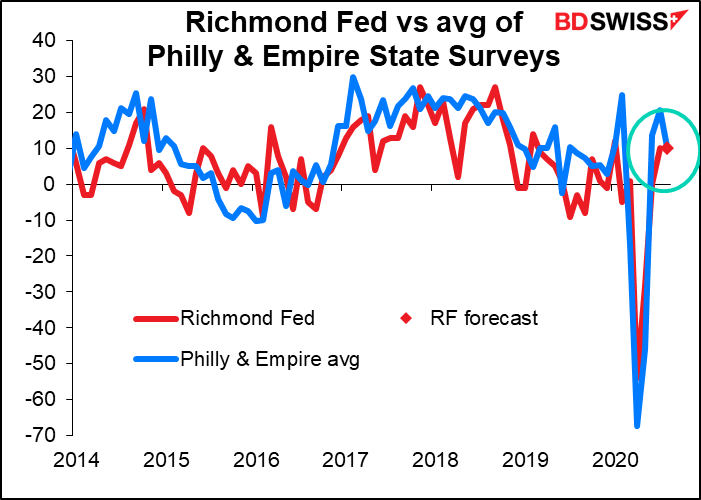

The Richmond Fed manufacturing index is expected to be unchanged from the previous month, which would be good news; the Empire State index plunged and the Philadelphia Fed index fell more than expected. Both remained in positive territory though, signifying that although the expansion may be slowing, it’s still expanding. The Richmond index doesn’t get as much attention as the two, because they’re released earlier, but it correlates better with the all-important Institute of Supply Management (ISM) manufacturing purchasing managers’ index (due out 1 Sep) and so is probably the most important of the five regional Fed indices.

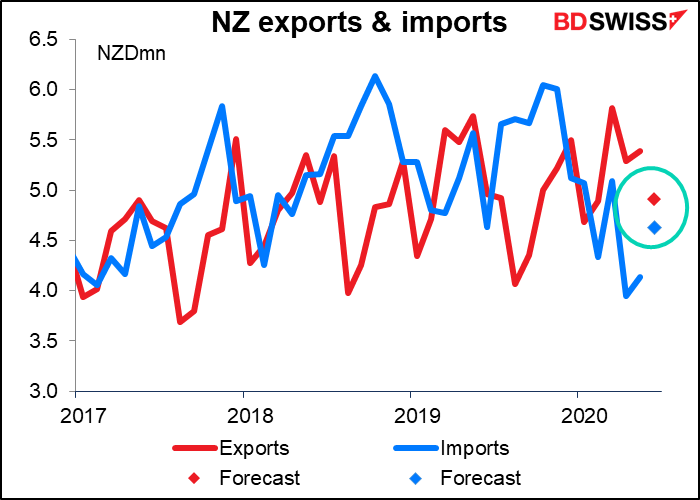

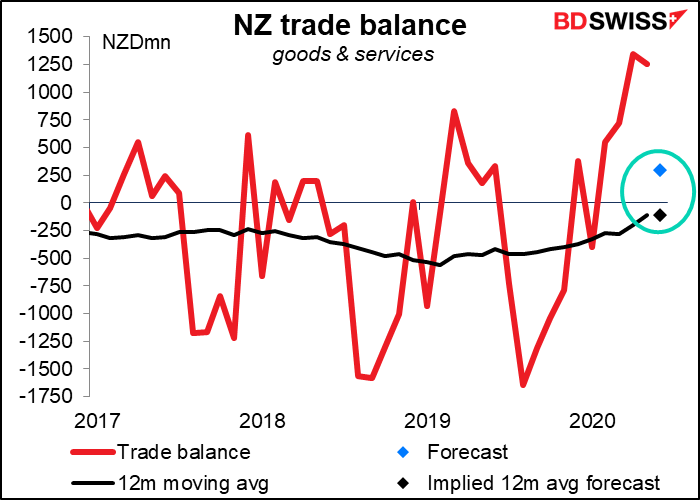

The New Zealand trade surplus is expected to fall precipitously. The 12m moving average however would hardly be disturbed, falling only to NZD -114mn a month on average from NZD -111mn.

The expected move is based on the assumption that exports fall while imports rise – a predictable result for a country that pulled out of the pandemic a lot earlier than most other countries (although it seems to have suffered a reversal recently).