Rates as of 04:00 GMT

Market Recap

Another day, another decline. Following on from Wall Street’s 3.4% fall on Friday, most Asian stock markets are down this morning, although a couple of indices – most noticeably Australia – are bucking the trend. S&P futures were indicated -0.6% when I started writing this comment but are now +0.6%. This would normally be considered quite volatile but is nothing in the context of recent moves.

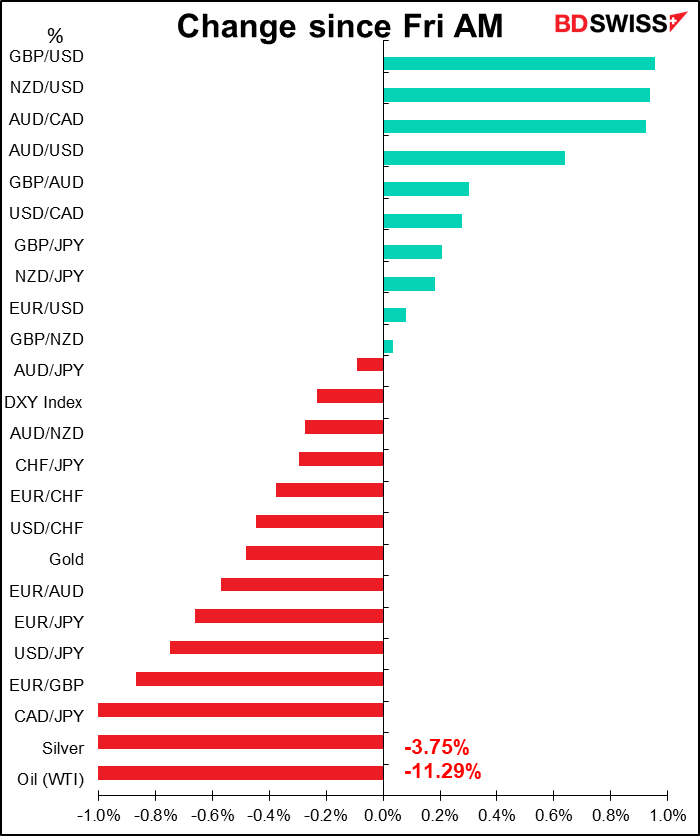

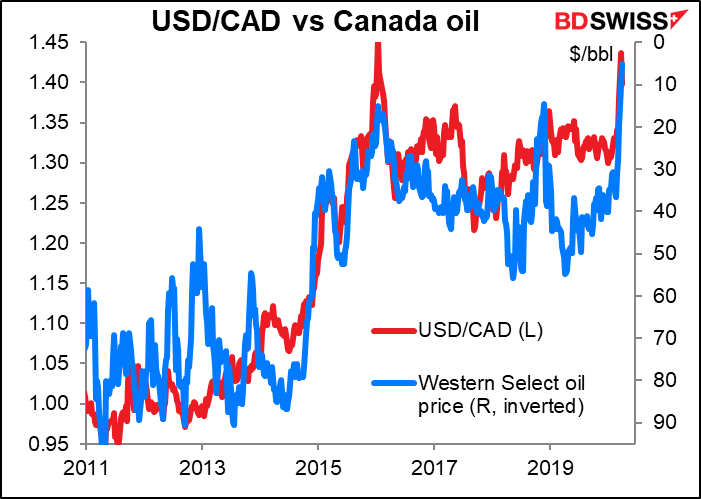

Oil started the week down sharply (-11.3% from Friday morning!). The near contract on West Texas Intermediate (WTI), the benchmark US crude, is now trading at around $20.50 barrel. You have to go back to November 2001/January 2002 to find a sub-$20/bbl price. That was of course during the dot-com bubble burst. Saudi Arabia and Russia continue bickering, with neither showing any sign yet of backing down in their fight for a bigger share of a rapidly shrinking market. The OPEC+ pact expires soon, but OPEC members rejected a request from the group’s president for emergency consultations. The next meeting isn’t scheduled until June, so in theory the price war could continue until then.

The Saudis and Russians are winning in one respect: US oil companies shut down 44 oil and gas rigs during the latest week. That’s the most they’ve shut since February 2016, a period when US oil inventories were massively in surplus. At least one pipeline company last week asked suppliers to cut production as it’s running out of places to store the oil.

Plunging oil prices are bound to be negative for CAD, which remains closely linked to oil. The only good news for CAD is that unlike interest rates, oil prices probably can’t go negative. However as the rig count above shows, oil producers can simply shut down. That would add to the overall decline in economic activity in Canada and be further damaging for CAD.

(NOK too, but I don’t really follow NOK.)

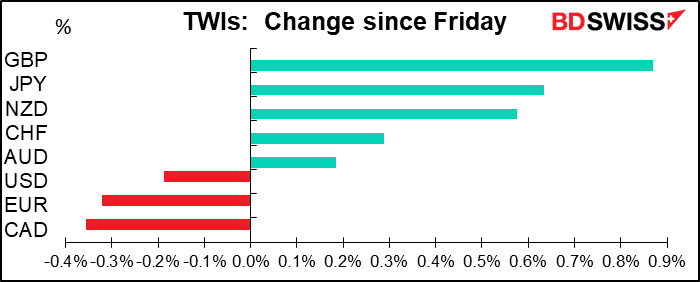

GBP was the best performing currency, although it was weakening this morning after Fitch cut the country’s credit rating after the close Friday in New York, citing the weakening of public finances caused by the virus outbreak as well as the uncertainty about the post-Brexit trade relationship with the EU. The pound had a very good week last week (+6% vs USD, 3.7% on a trade-weighted basis)) as the government is showing much more resolve in coming to grips with the virus.

The market’s reaction to Britain’s new strategy confirms to me that the prospects for each currency depend largely on how well the market expects the country to weather the virus: how quickly the country will emerge from lockdown and how much of its economy will remain intact when it does. In that respect, Britain looks pretty good as its measures for supporting businesses and employment, including the self-employed, look fairly solid, even if they will cost a lot of money (over GBP 100bn), as Fitch points out. As for Brexit…I wonder if the negotiations will be put on hold temporarily while officials are preoccupied with more urgent matters.

There have been several sovereign downgrades recently, most notably Moody’s cut South Africa’s long-term ratings to Ba1 from Baa3, with the outlook to remain negative. That pushed the country’s bonds from “lower medium grade” to “non-investment grade speculative.” ZAR was pummeled as a result, falling 3.4% vs USD from Friday as a result and momentarily hitting a record low of over 18.00. Mexico has also seen its rating cut recently. I don’t know what the rating agencies would prefer. Is it better that these countries just let their businesses go bust? Would that improve the future ability of the Treasury to raise the taxes necessary to repay debt?

In the US, Trump is now saying Americans should practice social isolation until 30 April, a big change from his recent hopes that churches would be packed again on Easter (12 April). This change of heart comes after Dr. Fauci, who is perhaps the only trusted member of the administration at this point, said more than 200k people could die in the worst-case scenario.

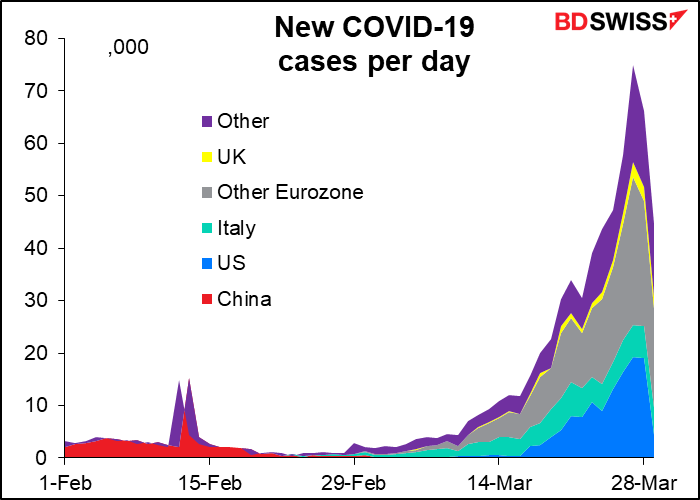

The rate of growth in the number of new cases seems to be slowing, but that may just be because of the weekend disrupting reporting.

Meanwhile, China joined the loosening trend Monday as it added $7bn to its banking system and cut interest rates on loans.

Commitments of Traders (CoT) report

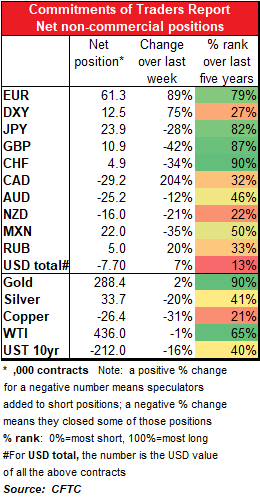

Once again, the main theme in the CoT report was reducing risk. In most cases, speculators reduced their outstanding positions.

Oddly enough, both EUR and DXY longs rose. The only other currencies to show an increase in positioning were CAD, where shorts increased, and RUB, where longs increased. Go figure. Given that both of those currencies are sensitive to oil (although RUB modestly more), it doesn’t make sense to me now that specs would be adding to longs in RUB and shorting more CAD, unless of course they think RUB has been pummeled enough — at -21% this year it’s the worst-performing currency YTD in the “expanded majors” basket, whereas CAD is down only 7.1%.

Today’s market

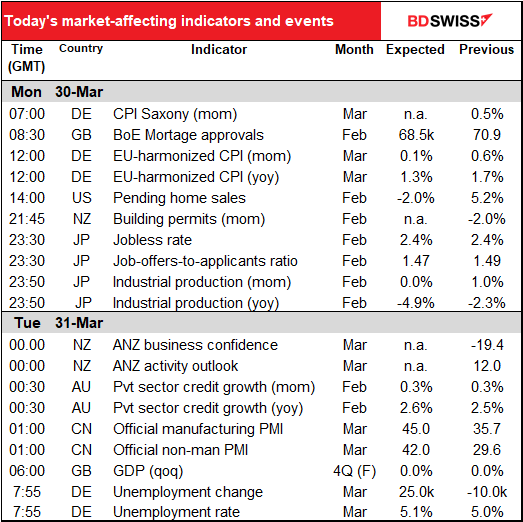

The word for the day when it comes to indicators is liminal. One of its meanings is “of, relating to, or situated at a sensory threshold: barely perceptible.” In this sense it’s often used as “subliminal.” Its other meaning is “of, relating to, or being an intermediate state, phase, or condition.” We are now in a liminal period as we slowly transition from the sluggish but gradually accelerating global economy of January 2020 to the unheard-of disaster that awaits us in April 2020 (and beyond, I fear). Accordingly, I’m going to write less about the indicators for the time being, because I just don’t think that they’ll play as big a part in determining FX direction as usual. Who cares if some indicator for February was OK if we already know that March is going to be the worst on record? I may also skip some of the indicators that were less important even in regular times.

(By the way, don’t confuse “liminal” with “limnal,” which means “pertaining to lakes.”)

Having said that…

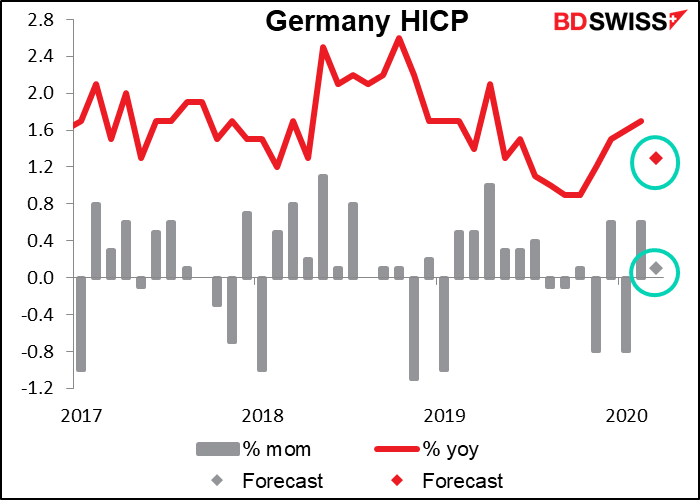

German inflation is expected to slow noticeably, as is tomorrow’s EU-wide inflation. It’s not just a matter of falling oil prices, because core inflation is slowing too. Ordinarily this might be negative for EUR, but I don’t think inflation is the biggest worry on the ECB’s mind right now.

Overnight we get the usual end-of-month data dump from Japan. The focus will be on the employment data, but unlike the US, the consensus here is for no big change this month – the unemployment rate is forecast to remain at a historically low 2.4% while the job-offers-to-applicants ratio is expected to fall only slightly to a still-healthy 1.47.

However, this can change rapidly. Although many people still think of Japan as the Land of Life-Time Employment, that social contract is fading fast, and in any case was limited mostly to men at large companies. An astonishing 32% of the workforce is comprised of part-timers who have no employment rights at all. They can be terminated at will, and most likely will be, too. I expect to see Japan’s unemployment rate swelling quickly.

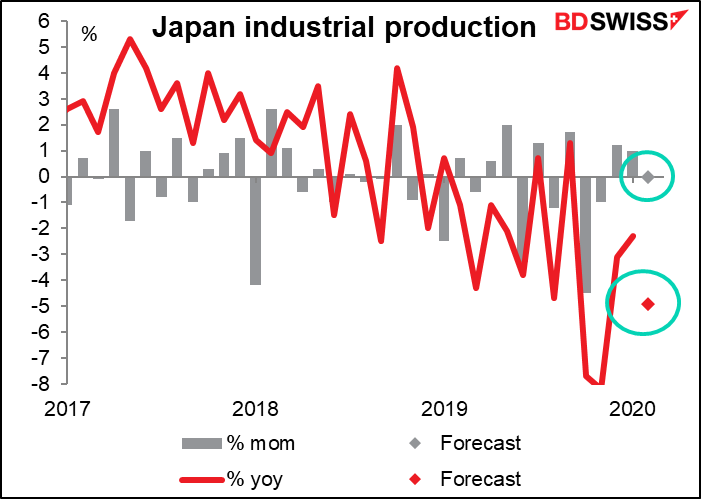

Japan’s industrial production is forecast to show change in February. The calm before the storm?

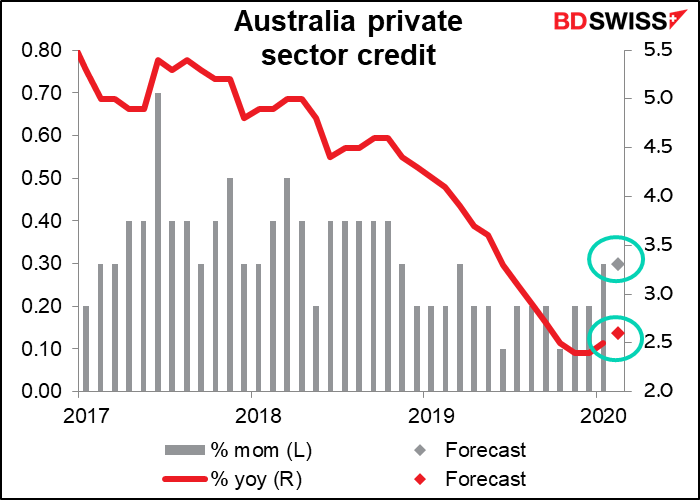

Growth in Australia’s private sector credit seems to have bottomed in Q4 last year and was picking up in the early months of 2020. Ordinarily, the fall in interest rates might be expected to prolong that trend. Alas…

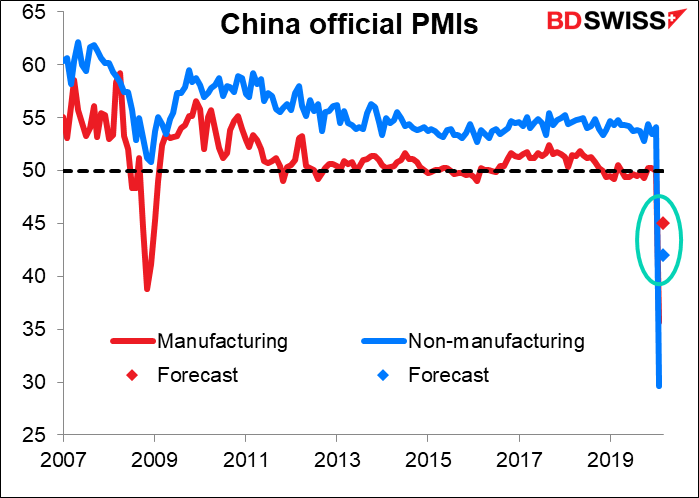

The official China purchasing managers’ indices (PMIs) are expected to be bad, but not as bad as they were in February. Still, the service-sector PMI is forecast to be much much worse than it was during the 2008/09 Global Financial Crisis. The figures indicate how slow the recovery is likely to be even with a lockdown much more severe than what can be imposed in Western societies.

Early in the European day Tuesday, perhaps before I get Tuesday’s comment launched, Germany will announce its employment data. The number of unemployed is expected to rise more than it usually does (in fact, it usually falls), but nothing spectacular. Similarly, the unemployment rate is forecast to rise a bit but just back to where it was towards the end of 2018, which was no big deal.

We’ll have to see how long Germany (and Japan) can maintain employment. I suspect that they’ll do a better job in this respect than the Anglo countries, which is likely to mean a faster recovery as well. That’s going to be an interesting comparison of the different employment systems. Even after the Hartz reforms in the early 2000s, the German labor market is much more protected than the US market, where “at will” contracts remain the norm.