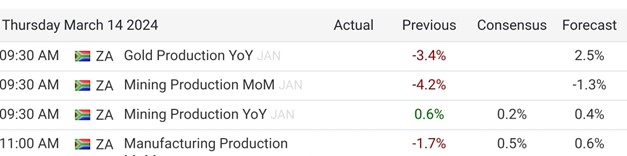

Today, South Africa anticipates releasing crucial figures that could sway the gold price and impact the mining industry. Gold production Year over Year (YoY) is forecasted to rise by 2.5%, contrasting with the previous decline of -3.4%. Meanwhile, Mining production Month over Month (MoM) is expected to decrease by -1.3%, following a previous downturn of -4.2%. Additionally, Mining production YoY is projected to inch up by 0.4%, slightly lower than the previous figure of 0.6%.

In 2022, South Africa emerged as the world’s 5th largest exporter of Gold, with exports totaling $22.7 billion, solidifying its influence on gold price dynamics. Gold ranked as the country’s top export commodity, underscoring South Africa’s pivotal role in shaping global gold market trends.

Nevertheless, geopolitical tensions, exemplified by conflicts like the Israel-Gaza dispute, can have a profound impact on gold prices. Currently valued around $2,100 per ounce, gold recently shattered its previous all-time high of $2,144, soaring to a new pinnacle of $2,194, purportedly influenced by the ongoing turmoil in the region. The South African government’s position regarding its citizens’ involvement in the conflict adds another layer of complexity to the geopolitical landscape. Foreign Minister Naledi Pandor’s recent declaration, warning South African nationals engaged in the Israeli armed forces or Gaza conflict of imminent arrest upon their return, underscores a deepening divide between the nations. Her stern assertion, “When you come home, we are going to arrest you,” underscores South Africa’s resolute stance amidst escalating tensions.

Nevertheless, geopolitical tensions, exemplified by conflicts like the Israel-Gaza dispute, can have a profound impact on gold prices. Currently valued around $2,100 per ounce, gold recently shattered its previous all-time high of $2,144, soaring to a new pinnacle of $2,194, purportedly influenced by the ongoing turmoil in the region. The South African government’s position regarding its citizens’ involvement in the conflict adds another layer of complexity to the geopolitical landscape. Foreign Minister Naledi Pandor’s recent declaration, warning South African nationals engaged in the Israeli armed forces or Gaza conflict of imminent arrest upon their return, underscores a deepening divide between the nations. Her stern assertion, “When you come home, we are going to arrest you,” underscores South Africa’s resolute stance amidst escalating tensions.

Gold production constitutes 16 percent of South Africa’s total mining production.

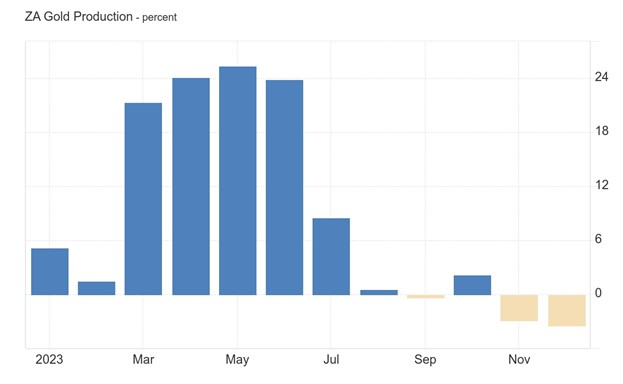

In December 2023, gold production in South Africa declined by 3.4% compared to the previous year, marking the most significant decrease since November 2022. This drop, following a downward revision of 2.9% in November, had a negative impact on the volume of mining production, reducing it by 0.5 percentage points. On a seasonally adjusted basis, gold output decreased by 3.3%.

In South Africa, the mining production volume index serves as a statistical gauge of production volume changes.

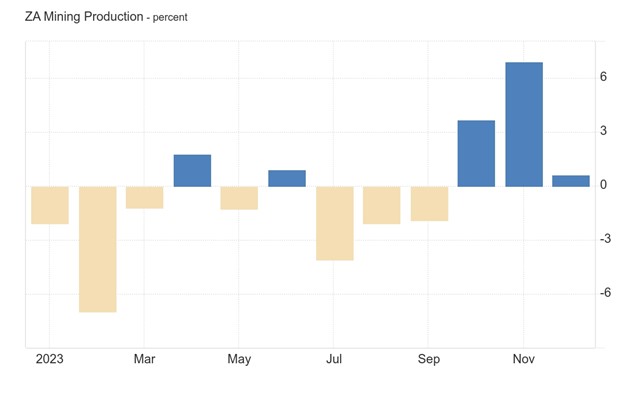

In December 2023, the overall mining production in South Africa increased by 0.6% compared to the previous year, following a revised upward jump of 6.9% in the prior month, exceeding market expectations of a 4.9% rise. Despite marking the third consecutive month of growth in industrial activity, it represented the weakest growth in this period. Key increases were observed in Platinum Group Metals (PGMs) by 9.4%, coal by 5.8%, chromium ore by 19.9%, nickel by 31.1%, and other non-metallic minerals by 10.3%. Conversely, significant output declines were seen in iron ore by 18%, other metallic minerals by 16.9%, manganese ore by 13.1%, and gold by 3.4%. On a seasonally adjusted monthly basis, mining production contracted by 4.2% in December, following an upwardly revised 2.7% increase in November. Overall, total mining production in 2023 was 0.4% lower compared to 2022.

From a technical analysis perspective on the 1-hour timeframe, XAUUSD has been consolidating within a range bounded by $2179.83 as resistance and $2150.54 as support, with the current price at approximately $2,170.43. A breakdown below the support level suggests a potential further downward movement in price. Conversely, if the support level holds, there is a likelihood of the price rebounding towards the resistance. Furthermore, a breach of the resistance level indicates a probable continuation of the upward price momentum.

Sources:

Statistics South Africa https://www.statssa.gov.za/

https://oec.world/en/profile/bilateral-product/gold/reporter/zaf