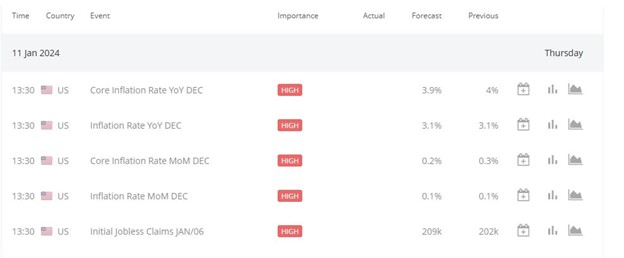

Today is expected to be a bustling day for USD currency pairs due to the impending release of crucial economic indicators, including CPI m/m, CPI y/y, Core CPI m/m, Core CPI y/y, and unemployment claims. The Consumer Price Index (CPI) gauges the fluctuation in the prices of goods and services acquired by consumers. If the actual CPI figure surpasses the forecast, it bodes well for the USD currency.

Similarly, the unemployment claims statistic, which measures the number of individuals filing for unemployment insurance for the first time in the previous week, can influence the USD currency. A release figure lower than the forecast is considered favorable for the USD.

Now, examining the USDJPY pair in the 4-hour timeframe, we observe a price range between 145.983 as the resistance and 143.403 as the support. The price has faced rejection at the resistance level, raising the likelihood of a downward movement towards the support at 143.403.

Before the news release scheduled for 13:30 GMT, traders may opt to engage in range trading. There is a significant probability of either the support or resistance being breached. If the support is breached, it signals a potential takeover by bears in the USDJPY market. Conversely, if the resistance is breached, there is a high probability of bulls dominating the market.

As a trader, it’s imperative to analyze your chart for insights into the USDJPY movement today and anticipate potential market shifts during the upcoming news release. What signals does your chart provide, and how are you preparing for the news impact on USDJPY?

Source : BDSwiss Economic Calendar