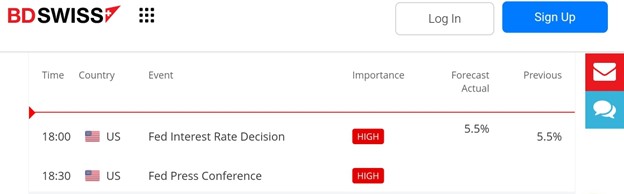

Brazil, located in South America, and the United States of America, situated in North America, have similarities within the wider geographic area known as the Americas. Both countries have important events today: the United States is set to announce its Federal Funds Rate, predicted to be 5.50% at 18:00 GMT, while Brazil will reveal its interest rate decision, expected to be 10.75%, at 21:30 GMT.

Amidst these financial developments, both nations have grappled with accusations against former presidents regarding election malpractices. In the United States, Donald Trump faces 4 indictments on felony charges including his alleged involvement in overturning the 2020 election results, while in Brazil, former President Jair Bolsonaro is accused of presenting a plan to reverse the outcome of the 2022 presidential election.

Furthermore, beyond politics and economics, soccer serves as another common thread between Brazil and the United States. The upcoming 16-team Copa América men’s soccer tournament, featuring top squads from both South America and North America, is scheduled to take place from June 20 to July 14, highlighting the shared passion for the sport across the Americas.

Furthermore, beyond politics and economics, soccer serves as another common thread between Brazil and the United States. The upcoming 16-team Copa América men’s soccer tournament, featuring top squads from both South America and North America, is scheduled to take place from June 20 to July 14, highlighting the shared passion for the sport across the Americas.

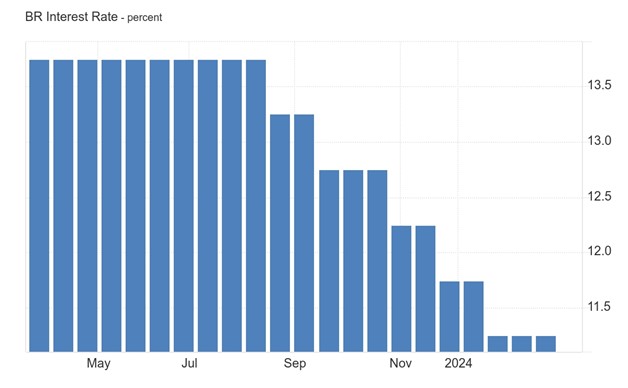

If the Brazil interest rate, forecasted to be 10.75%, is left unchanged, it may stabilize the economy and currency. If increased, it could attract foreign investment but might slow down economic growth. Conversely, if decreased, it could stimulate economic activity but may lead to currency (Brazilian real ) depreciation.

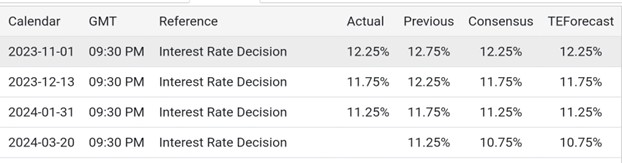

In its January meeting, the Central Bank of Brazil decreased its key SELIC rate by 50 basis points to 11.25%, in line with expectations. Economic indicators reflect the anticipated slowdown, while consumer headline inflation continues on a disinflationary trajectory. Inflation expectations for 2024 and 2025 stand at approximately 3.8% and 3.5%, respectively, according to the Focus survey. The Committee unanimously foresees similar reductions in upcoming meetings to sustain necessary contractionary monetary policy. The magnitude of the total easing cycle over time depends on factors like inflation dynamics, long-term expectations, and the balance of risks.

In Brazil, interest rate decisions are made by the Central Bank of Brazil’s Monetary Policy Committee (COPOM). The official interest rate is the Special System of Clearance and Custody rate (SELIC), which serves as the overnight lending rate.

From a technical analysis perspective using the 4-hour chart of USDBRL, an upward trend is evident. A trendline originating from an exchange rate of 4.9514 acted as support, rejecting the exchange rate at 4.9817 after retracing from 5.0010. Following this rejection, the exchange rate resumed its upward trajectory, reaching a resistance level of 5.0554 before retracing to the current level of 5.0309.

If the trendline is breached downward, there is a higher probability of further downward movement in the exchange rate. Conversely, if the exchange rate is rejected by the trendline, there is an increased likelihood of it moving towards the resistance level. Should the resistance level reject the exchange rate, there is a greater chance of it declining, but if the resistance is breached, there is an elevated possibility of further upward movement in the exchange rate.

Sources :

https://global.bdswiss.com/economic-calendar/

https://www.nytimes.com/2024/03/19/us/trump-supreme-court-immunity.html

https://www.foxsports.com/stories/soccer/2024-copa-america-odds-picks-favorites