Previous Trading Day’s Events (23.08.2024)

BOJ Gov Ueda Speaks: Bank of Japan Governor Kazuo Ueda said in his National Diet testimony that the central bank could adjust monetary policy if its economic projections materialize, indicating a willingness to hike rates again.

Core Retail Sales m/m: Retail Sales Ex Autos in Canada saw a bullish shift in June 2024, rebounding to a 0.30% increase from the prior month’s bearish dip of -1.20%.

Retail Sales m/m: Canada’s retail sales for July 2024 matched the forecast at -0.3%, showing no deviation from expectations, yet managed to gain momentum, ticking up by 0.5% compared to the previous month’s reported figure of 0.8%.

Fed Chair Powell Speaks: Federal Reserve Chairman Jerome Powell delivered strong dovish signals at the Jackson Hole Economic Symposium, indicating that the central bank is poised for a rate cut in the September FOMC meeting, aligning with expectations of easing monetary policy to support market liquidity.

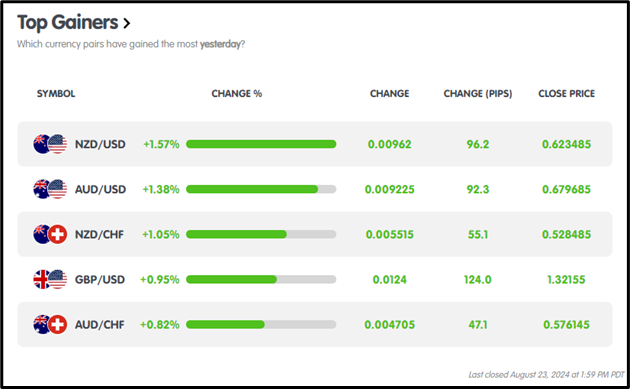

Winners Vs Losers In The Forex Market

On August 23, 2024, NZDUSD surged as the top performer, posting a +1.57% rally, gaining 92.6 pips, while USDJPY led the losses, sliding -1.31% and shedding 192.3 pips.

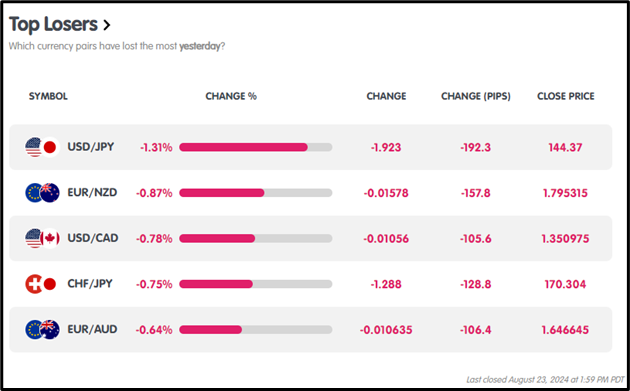

News Reports Monitor – Previous Trading Day (23.08.2024)

Server Time / Timezone EEST (UTC+03:00)

Tokyo Session:

BOJ Gov Ueda’s speech at 12:30 AM GMT: Bullish JPY impact as policy adjustment hinted, signalling potential rate hike.

London Session: No significant news

New York Session:

Core Retail Sales m/m at 12:30 PM GMT: Bullish CAD with a 0.30% rise, reversing the previous -1.20% decline.

Retail Sales m/m at 12:30 PM GMT: Bullish CAD despite matching forecast at -0.3%, uptick to 0.5% from 0.8%.

Fed Chair Powell’s speech at 2:00 PM GMT: Bearish USD as dovish tone suggests potential rate cut in September FOMC.

General Verdict :

FOREX MARKETS MONITOR

EURUSD (23.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

The EURUSD pair exhibited a bullish trend, opening at 1.11040 and closing higher at 1.11925, with the day’s peak reaching 1.12000 and the low touching 1.11038.

CRYPTO MARKETS MONITOR

CRYPTO MARKETS MONITOR

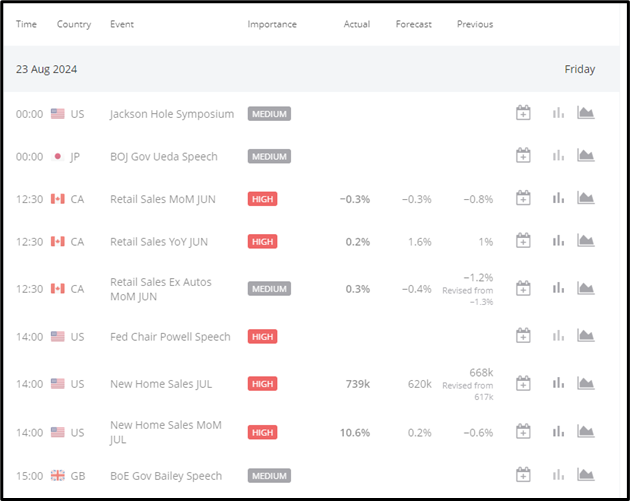

BTCUSD (23.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD exhibited a strong bullish trend, opening at $60,627.48 and rallying to close at $63,669.71. The pair reached an intraday high of $63,861.15 while retracing to a low of $60,280.83.

STOCKS MARKETS MONITOR

STOCKS MARKETS MONITOR

TESLA (23.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Tesla showed a strong bullish trend, opening at $213.86 and rallying to an intraday high of $220.45 before pulling back slightly to close at $219.23, while the day’s low touched $212.25.

INDICES MARKETS MONITOR

INDICES MARKETS MONITOR

NAS100 (23.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

The NAS100 exhibited a bullish trend, opening at 19,551.46 points and closing higher at 19,716.45 points, after hitting an intraday high of 19,841.63 points and a low of 19,523.83 points.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

USOIL (23.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

USOIL exhibited a bullish trend, opening at $72.695 and rallying to a session high of $74.804 before retracing slightly to close at $74.635, while the intraday low was recorded at $72.598.

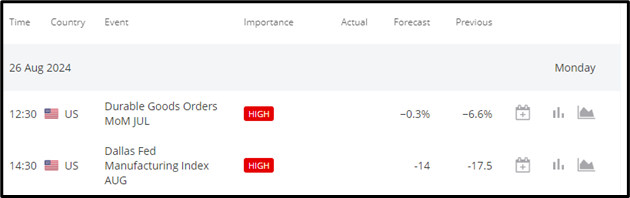

News Reports Monitor – Today Trading Day (26.08.2024)

Tokyo: No Key Data

London Sessions: No Key Data

New York Session:

US Durable Goods Orders MoM JUL:

-6.6% vs. -0.3% forecast.

US Dallas Fed Manufacturing Index AUG: –17.5 vs. -14 forecast.

General Verdict:

Source:

https://www.federalreserve.gov/newsevents/speech/powell20240823a.htm