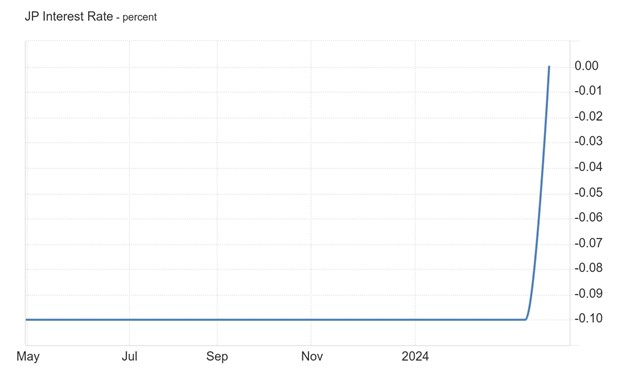

Japan is demonstrating its commitment to both aiding Gaza and bolstering its economy. Foreign Minister Yoko Kamikawa announced Japan’s participation in a maritime corridor initiative to deliver aid supplies to Gaza from Cyprus. Meanwhile, the Bank of Japan took decisive action today, increasing its interest rate from -0.10% to 0.10% at 3:36 GMT, marking the end of the world’s only negative rates regime in a historic move. Japan’s proactive measures showcase its dedication to supporting both international humanitarian efforts and domestic economic stability.

During its March meeting, the Bank of Japan (BoJ) increased its key short-term interest rate to approximately 0% to 0.1% from -0.1%, aligning with market forecasts and ending eight years of negative rates. This marked the first rate hike since 2007, driven by inflation surpassing the central bank’s 2% target for over a year and major companies agreeing to a 5.28% salary increase, the largest in more than 30 years. Two of the BoJ’s nine board members dissented. Additionally, the BoJ terminated yield curve control for 10-year government bonds and halted purchases of ETFs and Japan real estate investment trusts (J-REITS). It plans to gradually reduce corporate bond purchases before discontinuing them entirely in about a year. The BoJ stated readiness to respond swiftly to any rapid rise in long-term rates, including increasing JGB purchases. Japan’s benchmark interest rate currently stands at 0%, with an average of 2.28% since 1972, reaching highs of 9% in December 1973 and a record low of -0.10% in January 2016. The BoJ’s Policy Board sets interest rates during Monetary Policy Meetings, with the discount rate being the official rate. These meetings establish guidelines for money market operations, particularly targeting the uncollateralized overnight call rate.

From a technical analysis perspective, on the 1-hour chart of USDJPY, the exchange rate has experienced an upward trend.

A trendline originating from 148.024 acted as resistance, rejecting the exchange rate at 149.002 after it retraced from 149.329.

Following the rejection, the exchange rate resumed its upward movement, reaching a new March high at 150.678, next resistance, sits at 150.800 and the significant round number at 151.000 with the current rate around 150.600.

If the trendline is breached downwards, there is a higher likelihood of the exchange rate experiencing further declines. However, if the trendline rejects the exchange rate again, there is a greater probability of the exchange rate rallying towards the resistance level. Breaking above the resistance would indicate increased chances of further upward movement in the exchange rate.

Sources :

https://japannews.yomiuri.co.jp/politics/politics-government/20240316-175043/

1HR Chart of USDJPY from the Metatrader 4