Previous Trading Day’s Events (19.03.2024)

This is Japan’s first interest rate hike in 17 years. The shift makes Japan the last central bank to exit negative rates. Fragile economic recovery forces the central bank to go slow on further rises in borrowing costs, analysts say.

“We reverted to a normal monetary policy targeting short-term interest rates, as with other central banks,” BOJ Governor Kazuo Ueda said at a press conference after the decision.

“If trend inflation heightens a bit more, that may lead to an increase in short-term rates,” Ueda said, without elaborating on the likely pace and timing of further rate hikes.

The central bank also abandoned yield curve control (YCC), a policy in place since 2016 that capped long-term interest rates around zero, and discontinued purchases of risky assets.

The Reserve Bank of Australia (RBA) kept rates at a 12-year high of 4.35% for a third straight meeting and said it was not ruling anything in or out on policy.

“The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out,” said the RBA Board in a statement.

______________________________________________________________________

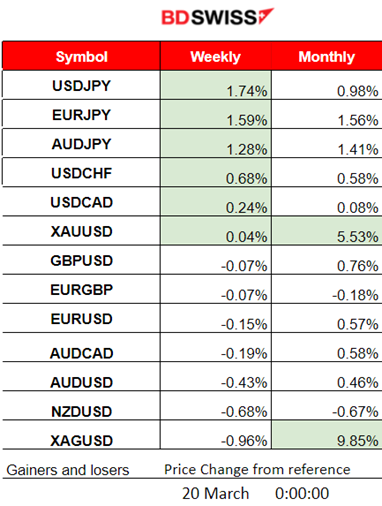

Winners vs Losers

USDJPY currently leads with 1.74% for the week followed by other JPY pairs (JPY as Quote). The JPY is weakening massively as the Bank of Japan decided to proceed with a pivotal change in monetary policy, raising rates. Metals remain the top gainers for this month with Silver (XAGUSD) leading.

______________________________________________________________________

______________________________________________________________________

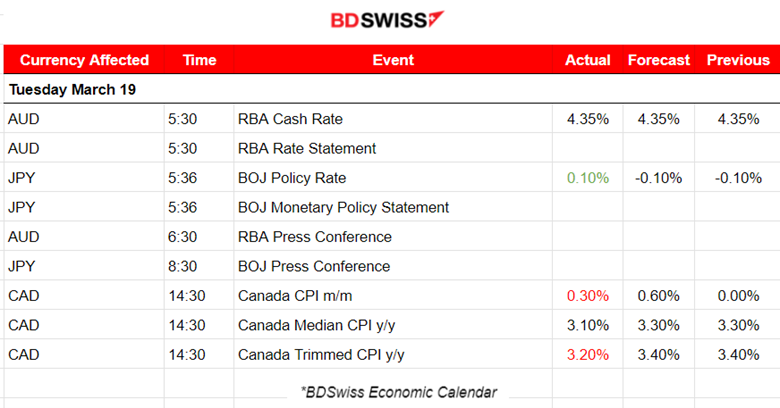

News Reports Monitor – Previous Trading Day (18 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The Reserve Bank of Australia (RBA) decided to leave the cash rate target unchanged at 4.35%. Inflation continues to moderate but remains high, they said in their statement. Recent information suggests that inflation continues to moderate, in line with the RBA’s latest forecasts. The market reacted with strong AUD depreciation at the time of the decision release.

The JPY is weakening as the Bank of Japan raised short-term interest rates within a range of zero and 0.1%, a pivotal change in monetary policy.

- Morning–Day Session (European and N. American Session)

CPI inflation was reported lower than expected for Canada CAD depreciated against other currencies, USDCAD jumped and retracement was roughly instant. Year-to-year calculation actually fell to 2.8%, giving a good explanation of why the market reacted with an instant CAD weakening.

General Verdict:

__________________________________________________________________

__________________________________________________________________

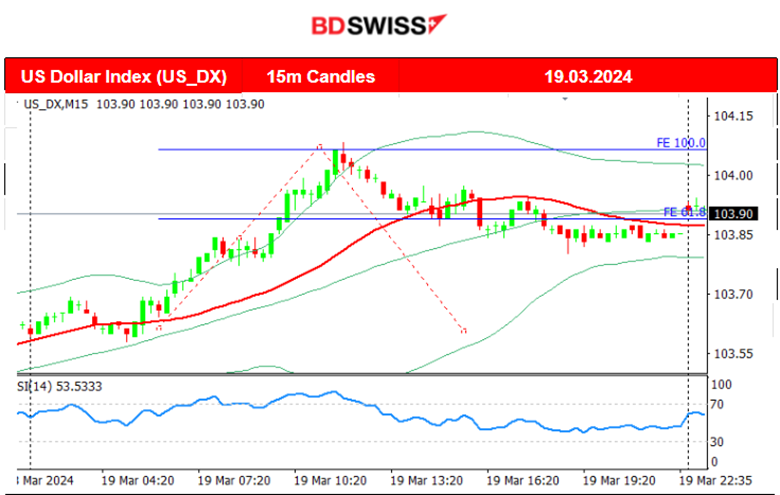

FOREX MARKETS MONITOR

EURUSD (19.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced more volatility after 9:00 and the start of the European session. It moved to the downside rapidly due to USD appreciation but soon reversed to the 30-period MA. A sideways movement around the mean followed, with low volatility.

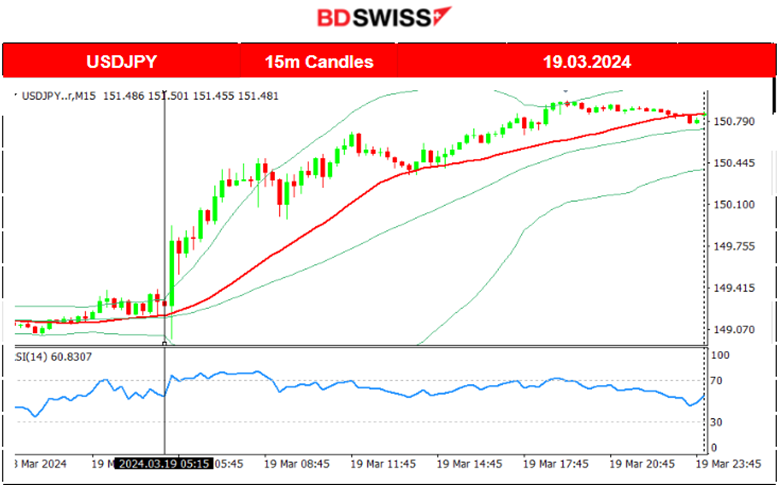

USDJPY (19.03.2024) 15m Chart Summary

USDJPY (19.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved to the upside aggressively after the BOJ’s decision to increase interest rates at 5:30. The market reacted with JPY weakening. With the dollar appreciating early and the JPY depreciating, the pair moved to the upside and remained on the uptrend.

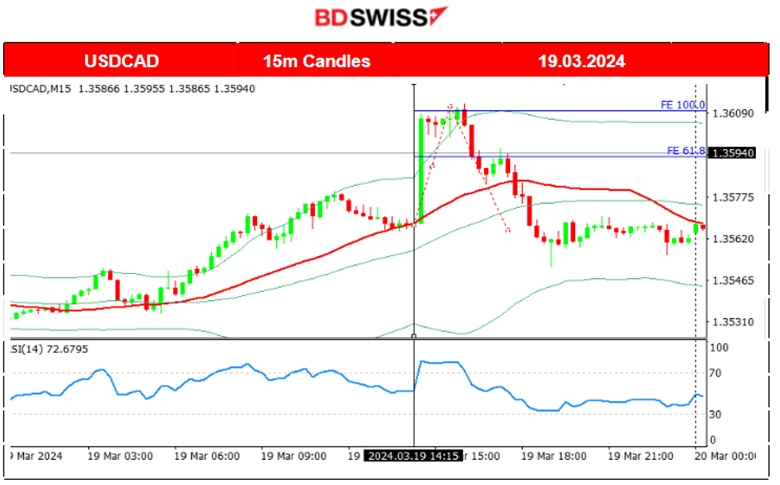

USDCAD (19.03.2024) 15m Chart Summary

USDCAD (19.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Apparently, the early dollar appreciation against other currencies led to the USDCAD to experience an upward movement even before the Inflation data release for Canada. At the time of the release, the market reacted to the lower-than-expected inflation release with CAD depreciation. The market soon reversed to the 30-period MA and moved below the MA on its way down, closing however the trading day at a higher level.

___________________________________________________________________

___________________________________________________________________

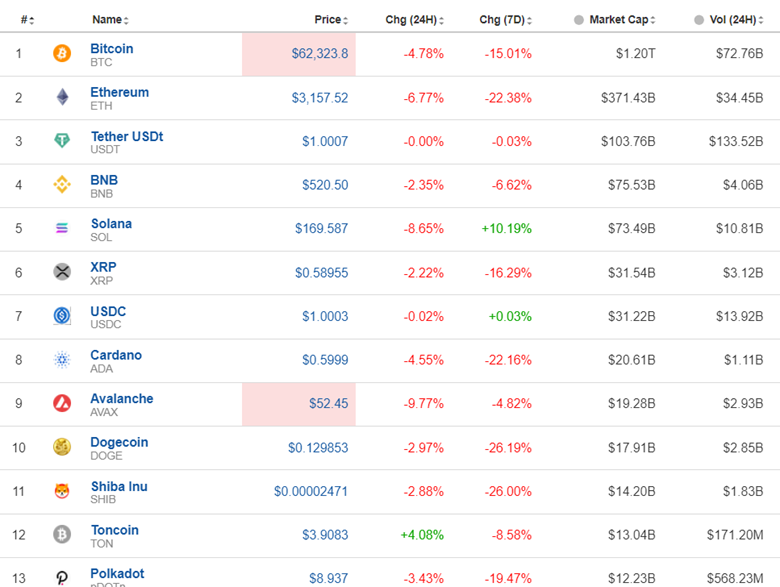

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Spot BTC ETFs witnessed record outflows on Tuesday. Bitcoin fell further and a little below 61K USD which acts as important support at the moment. What about the technicals? Well, there is an apparent downward wedge.

The other important fact is that the RSI is showing higher lows while the price is showing lower lows. We have a bullish divergence and it can only imply the end of a sharp drop and NOT the start of a new uptrend. Considering that the support at 61K USD will remain strong a sideways movement is expected for the short-term.

In regards to the fundamentals at work, FOMC today might push that support to break eventually considering that the impact on the USD will be huge. The Halving event is near as well, scheduled in April, which will cut the daily supply of newly minted coins by 50%—an event that’s historically caused prices to soar.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market suffers ahead of the FOMC report and potential USD strengthening.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

With the dollar appreciating further, the drop continued on the 14th of March reaching the support near 17,950 USD before retracing to MA again. The 15th March noted the confirmation of a downfall for U.S. indices as fears that there will be a cut delay grew, with borrowing costs to remain high in the future, and amid the U.S. dollar strengthening. On the 18th of March though, the index moved rapidly upwards and then retraced again to the MA. On the 19th of March, it moved sideways as mentioned in our previous analysis. FOMC next. Let’s see.

______________________________________________________________________

______________________________________________________________________

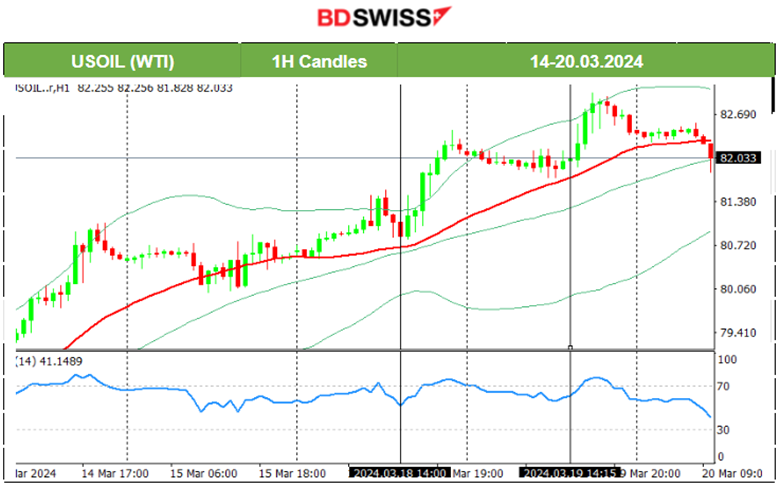

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 13th of March, Crude started to see a price rise that was kept steady for two consecutive days causing the price to reach a peak near 81 USD /b. Retracement followed, back to near 80 USD/b. On the 14th of March, the price continued to show that the trend was likely to continue upward and after reaching the resistance near 81 USD/b it retraced to the 30-period MA. On the 18th of March, the price reached the next resistance at near 82.5 USD/b before retracing again to the MA. As expected and mentioned in the previous analysis, the price slowed after reaching a peak yesterday at 83 USD/b and then dropped. It moved below the MA signalling that the uptrend might have ended. Since the 11th of March, it has been a 6-dollar upward trend (as far as volatility is concerned it might have reached its upward peak). A possible retracement could lead to a price drop at near 81 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

A triangle formation is visible as volatility is lowering for Gold before the FOMC meeting. Despite recent strong USD appreciation, Gold remains high and sees resilience for the downside. It remains in focus especially now that market participants have their eyes on what the Fed will comment on the rising inflation figures. The win-win view for Gold seems to hold as it indeed shows resilience to the downside, and it is apparent, considering that the dollar continues to appreciate ahead of the FOMC meeting. If Powell decides to ignore the inflation data and their statements give even a slight hint that rate cuts will proceed as expected then I see Gold jump tonight. 2170 USD/oz could be the next level or even beyond. This is the case where the USD should logically depreciate (at least as an initial reaction). In the case of a delay in cuts, then the shift in expectations could cause more dollar appreciation. Gold though should remain resilient even in this case.

______________________________________________________________

______________________________________________________________

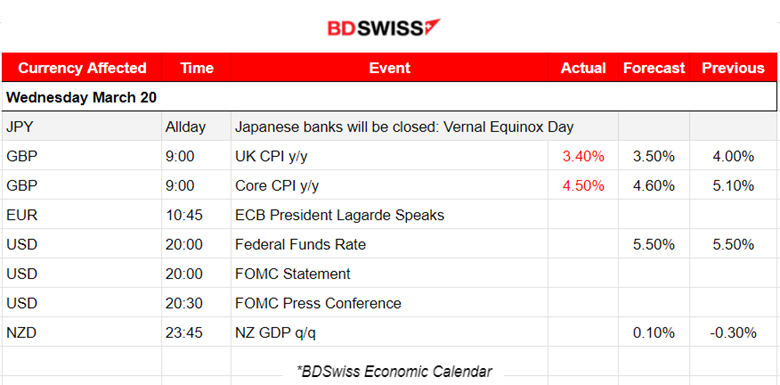

News Reports Monitor – Today Trading Day (20 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

Inflation lowered in the U.K. according to the CPI numbers released this morning at 9:00 and is now closer towards the Bank of England’s 2% target. Closer but again far away just like the U.S. case. Despite the initial GBP depreciation at the time of the release, the market reversed immediately.

At 20:00 the high-anticipated FOMC statement and Fed Rate will be released, shaking the market with expected strong USD volatility. FOMC Press Conference starts at 20:30 and that is when the market could see a more clear direction when the statements start and market participants respond to them.

General Verdict:

______________________________________________________________