Previous Trading Day’s Events (23 Jan 2024)

The central bank also suggested that an end to negative interest rates could take place soon. Negative rates have been in place since 2016.

BOJ Governor Kazuo Ueda: “The prospects of seeing trend inflation hit 2 percent are gradually heightening. That is a desirable development. But it is hard to quantify how close we have come.”

The Consumer Price Index (CPI) inflation rose 0.5% quarter-on-quarter, slowing from the 1.8% growth seen in the prior quarter. On an annualised basis, CPI rose 4.7% in the December quarter, easing from the previous quarter’s 5.6% growth.

Inflation is above the RBNZ’s 1% to 3% annual target range and so interest rates are expected to remain higher for longer until inflation falls within its target range. The RBNZ has not stated anything about trimming rates soon.

Source: https://www.reuters.com/markets/new-zealand-4q-cpi-rises-05-quarter-2024-01-23/

______________________________________________________________________

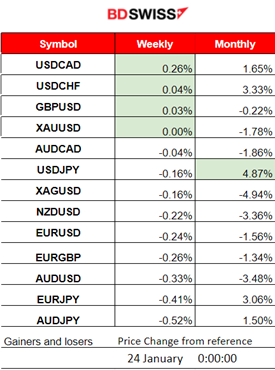

Winners vs Losers

The USDCAD climbed to the top of the week’s winner list with 0.26% gains so far. The dollar strengthened significantly yesterday. USDJPY remains the top winner for the month, with 4.87% gains.

______________________________________________________________________

______________________________________________________________________

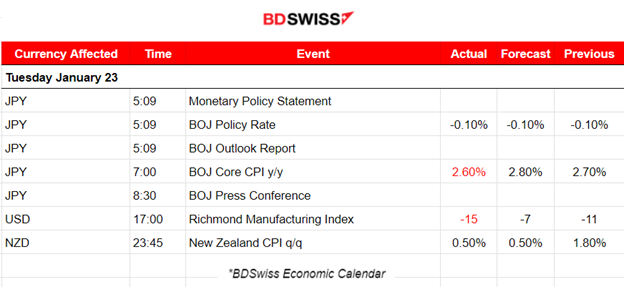

News Reports Monitor – Previous Trading Day (23 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The BOJ keeps interest rates steady, policy rate at -0.10%, ultra-easy policy as widely expected. The central bank noted that the likelihood of the economy achieving durable 2% inflation continued to “gradually rise”. The market reacted with strong JPY appreciation at the time of the release followed by a quick retracement. The USDJPY dropped nearly 60 pips upon policy rate release and more than 100 pips during the press conference that took place later at 8:30 and retraced again quickly.

- Morning–Day Session (European and N. American Session)

In the U.S. the Richmond Manufacturing Index figure was reported more negative than expected for January indicating worse conditions. However, no major impact or intraday shock was recorded for USD pairs at that time.

At 23:45, the NZD pairs could move significantly upon the quarterly CPI change figure release for New Zealand. That inflation measure is expected to be reported lower.

According to the CPI data for the December quarter, annual inflation was reported at 4.7%, its lowest rate since June 2021. But some closely watched measures of underlying inflation pressure were stronger than the Reserve Bank of New Zealand had forecast. The increase in the quarterly figure was as expected 0.5%. NZD however, appreciated moderately at the time of the report release. NZDUSD jumped near 20 pips.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

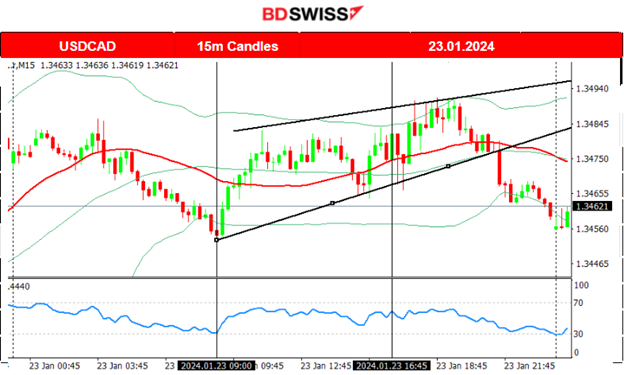

USDCAD (23.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced moderate volatility, remaining sideways around the mean, with CAD losing over USD overall. First, it moved to the downside early during the Asian session while the USD was experiencing depreciation (look at Dollar index) and after it found support at near 1.34530 it reversed to the upside. It was rather a steady path upwards, crossing the 30-period MA on the way up, and finding resistance at near 1.34900 before retracing. An intraday upward wedge was formed and during the N.American session it was broken to the downside with the pair moving fast downwards upon breakout, returning back to the intraday support and closing lower.

NZDUSD (23.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Obviously driven mostly by the USD, the pair experienced moderate volatility. Before the release of the quarterly figure for inflation, it was moving steadily to the downside from the start of the European session at 9:00, until near 20:00 when it started to climb again. At 23:45 the quarterly CPI report caused the pair to jump near 20 pips.

___________________________________________________________________

___________________________________________________________________

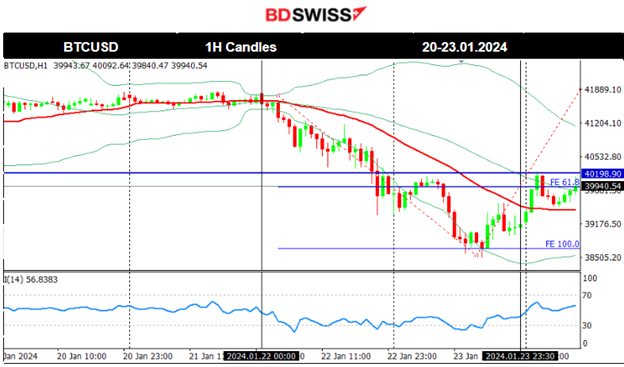

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

After the Spot Bitcoin ETF approval from the SEC, Bitcoin saw an unusual fall in value. On the 18th Jan, it dropped heavily until the support near 40600 USD. Retracement followed but on the 19th it saw another drop to 40200 USD. On the same day, it recovered fully and on its way up it crossed the 30-period MA showing strength, settling at near 41600 USD. On the 22nd Jan, the price dropped heavily again reaching and testing the 40600 USD support once more, breaking that support and eventually falling further to 39400 USD. Bitcoin eventually reached near 38500 USD on the 23rd Jan before bouncing back. From the 22nd Jan, the drop was relatively rapid leaving room for retracement. This happened already since the price returned to the 30-period MA and further back to the 61.8 Fibo level. Which is near the 40000 USD level.

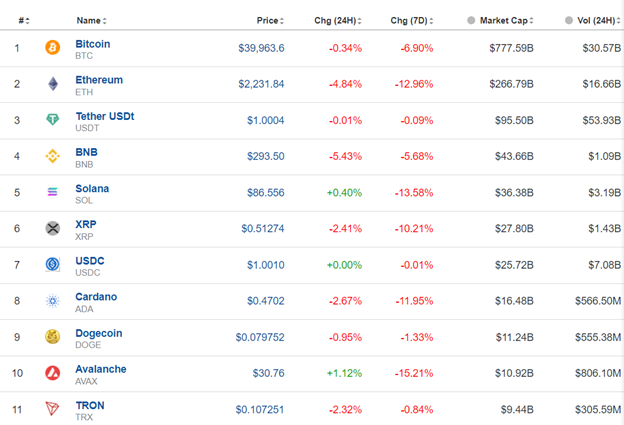

Crypto sorted by Highest Market Cap:

The whole market is obviously suffering as most Crypto show high losses.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

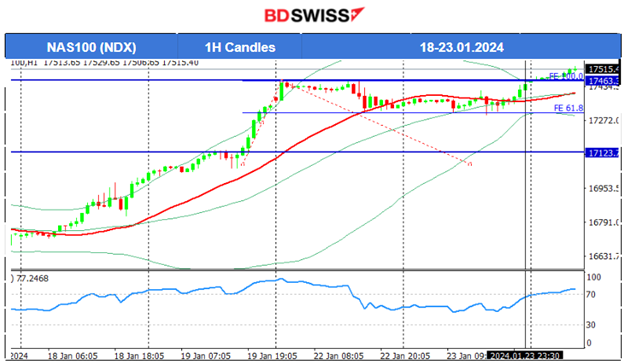

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

All benchmark U.S. indices moved to the upside quite rapidly during the past few days, particularly since the 17th Jan. The uptrend is clear with some retracements taking place every day, however not being complete as the path is quite strong to the upside. On the 22nd the index found resistance that caused it to retrace significantly back to the 61.8 Fibo level. However, this long uptrend continued when, on the 23rd Jan, the index tested the resistance again with a successful breakout to the upside.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

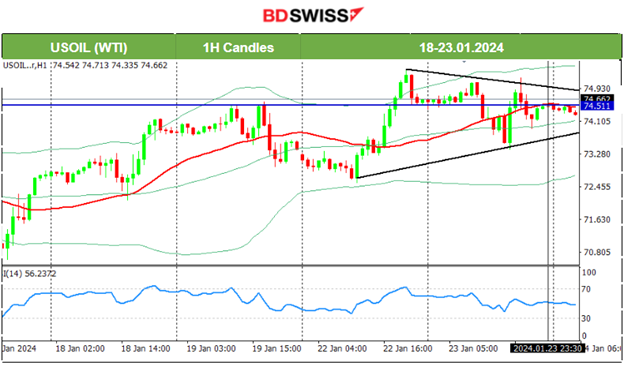

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil experienced a short-term upward trend from the 17th to the 19th Jan. On the 19th it dropped and crossed the MA on its way down showing signs that the uptrend ended and a more probable sideways but volatile movement was following next. 72.5 USD/b served as support and a turning point on the 22nd Jan. The price reversed crossing the MA on its way up, breaking the resistance at 74.5 USD/b reaching the next at 75.5 USD/b before retracing. Volatility seems to have lowered currently with the price forming a triangle as depicted on the chart. Waiting now for a breakout and the following rapid movement to the next support/resistance.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold found support on the 22nd Jan and on the 23rd it jumped higher finding resistance at near 2035 USD/oz. It seems that the recent path for Gold is sideways with significantly higher volatility levels. Currently, it looks like a triangle was formed as depicted on the chart. It is possible that at some point we will see Gold breaking that triangle and eventually settling to a one-side direction path. It could be that the price will deviate from the current 30-period MA greatly as the 31st Jan gets closer when the FOMC statement is released and the decision on the Fed Funds Rate is announced.

______________________________________________________________

______________________________________________________________

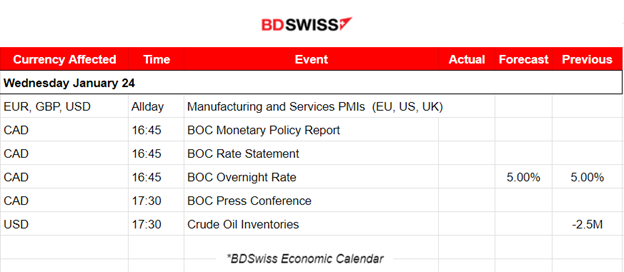

News Reports Monitor – Today Trading Day (24 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no major scheduled figure releases.

- Morning–Day Session (European and N. American Session)

PMI releases today for both the manufacturing and the services sector. Expecting to experience unusual volatility. At the time of the release, we have usually strong deviations from the intraday mean and steady one-side movements. The recent reports show a grim picture of the Manufacturing sector business conditions for all regions and that is not expected to have changed significantly. However, for the services sector, the market could see some surprises causing movement, especially for EUR and GBP.

At 15:30 today, the BOC is going to release the interest rate decision potentially affecting the CAD. Recent data show that the economy has been strongly affected by elevated rates, with the current overnight rate held at 5%. Lower employment change and declines in retail sales have been highlighted. It is unlikely that a change in policy will be implemented currently, however.

General Verdict:

______________________________________________________________