Rates as of 04:00 GMT

Market Recap

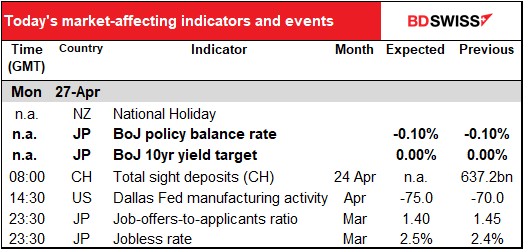

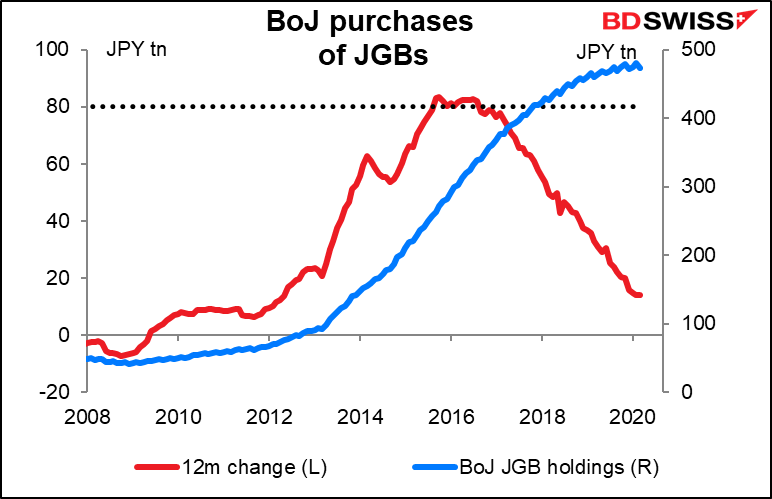

The Bank of Japan (BoJ) met overnight and as expected removed its JPY 80tn limit on annual purchases of Japanese government bonds (JGBs). Nice move except that in fact the measure was instituted in October 2014 and they only hit that limit for the first year it was in place (Sep 2015-Aug 2015). In the latest 12 months it only bought JPY 14tn. So they could’ve increased their bond purchases massively without making any change at all in their guidance.

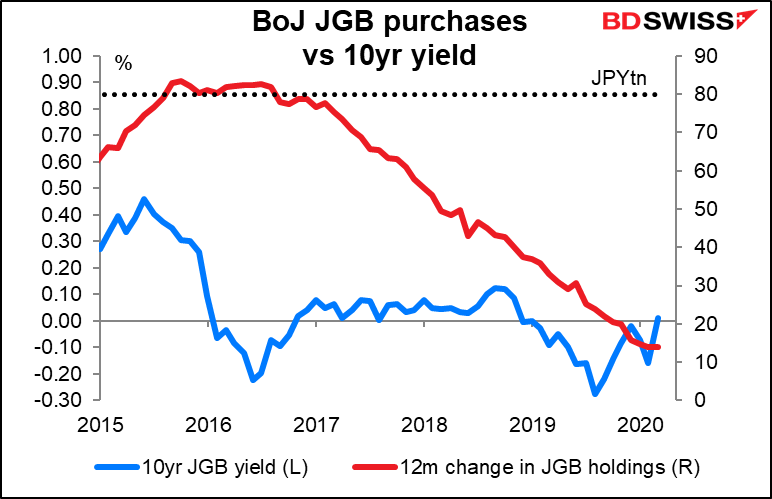

Furthermore, their guidance maintained the statement that they will “purchase a necessary amount of JGBs…so that 10-year JGB yields will remain at around zero percent.” Since 2017, JGB yields have remained between ±0.3% with an ever-decreasing amount of purchases. In the last year or so they were mostly at or below zero with a maximum of JPY 37tn of JGB purchases, tapering off to JPY 14tn over the last 12 months. The BoJ did not explain how they were going to increase their JGB purchases and yet still keep JGB yields at “around zero,” not massively negative as one might expect to happen if they do increase their purchases.

The BoJ also said it would increase its maximum purchases of CP and corporate bonds to JPY 7.5tn each from JPY 1tn each, on top of its existing holdings of JPY 2tn and JPY 3tn respectively, thereby bringing the total up to some JPY 20tn from JPY 5tn. They also asked the staff to come up with “a new measure to provide funds to financial institutions” in line with the government’s emergency financing measures. I think these are more significant and useful changes in that they will funnel money directly to companies.

While it said it would continue with its current policy “aiming to achieve the price stability target of 2 percent,” the BoJ dropped the line about keeping rates unchanged or lower “as long as it is necessary to pay close attention to the possibility that the momentum toward achieving the price stability target will be lost.” This was in the release following their last meeting on 16 March. It seems that the BoJ is gradually abandoning its (seemingly hopeless) 2% inflation target.

All in all, I think the measures were useful for supporting Japanese companies but probably won’t have much impact on USD/JPY. In order to affect the exchange rate, they would have to get rid of the restriction that 10yr JGB yields should trade “around zero.” In that case, they could indeed ramp up their JGB purchases, which would increase the money supply and send JGB yields sharply negative. Without eliminating that restriction though there’s not much they can do that will have a big international effect.

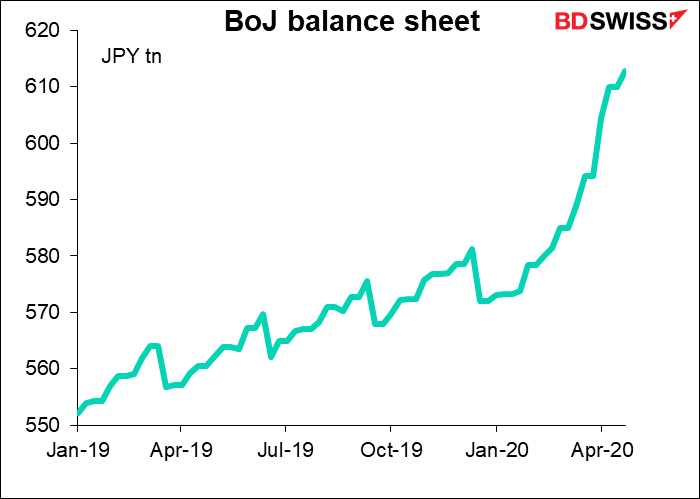

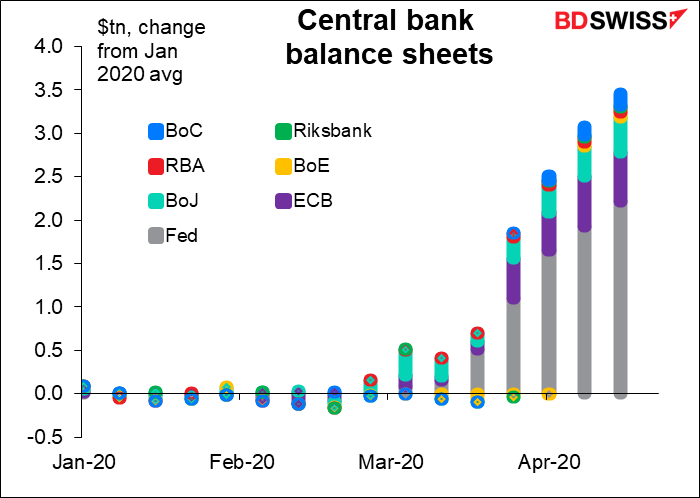

The increase in their balance sheet so far this year has been a little less than the ECB’s (USD 405bn vs USD 568bn for the ECB). At the beginning of the year the BoJ had a slightly bigger balance sheet than the ECB (USD 5.30tn vs USD 5.21tn) but now it has a slightly smaller one (USD 5.67tn vs USD 5.75tn). The Fed’s was smaller than both at the beginning of the year but now is larger than both (from USD 4.17tn to USD 6.57tn). This hasn’t affected the dollar that much – it’s lower vs JPY since then but higher vs EUR.

Other movements

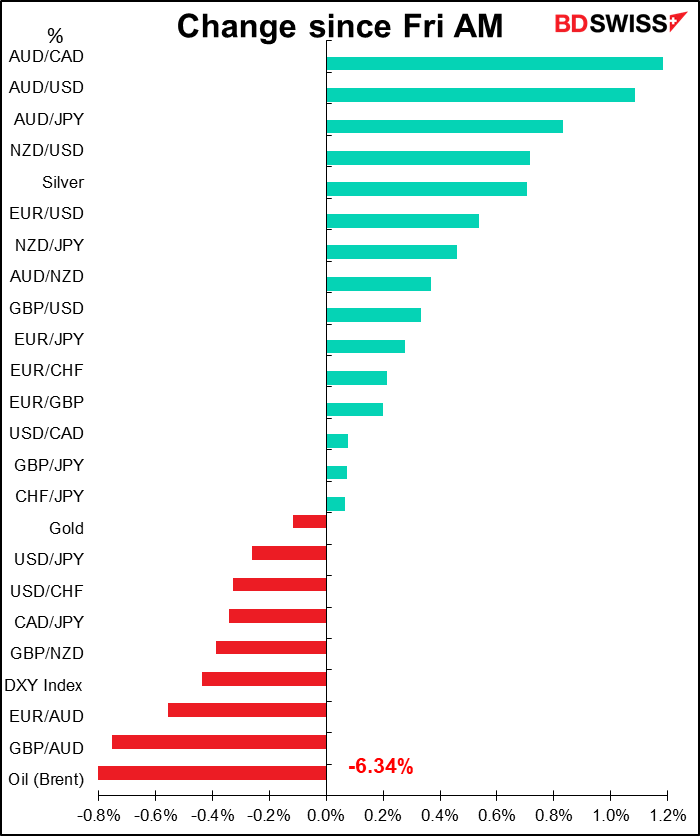

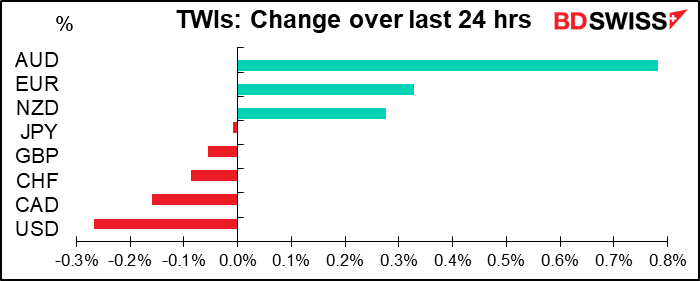

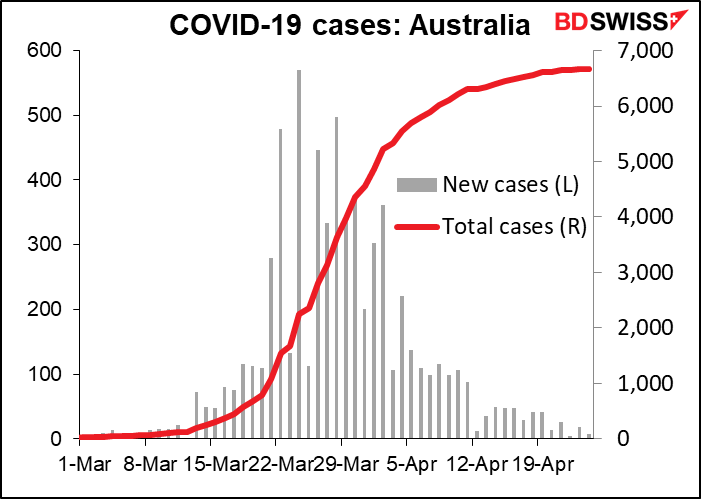

AUD was the big winner overnight after two of its states said they will relax social distancing restrictions. New virus cases in the country have fallen to just a handful (15 per day on average over the last week, vs 42 per day the previous week). However you might want to read an article in today’s Financial Times that says the best way to gauge the impact of the virus is to compare the total number of deaths with the average for this period over the last few years. The article (which is free to read, no paywall) doesn’t mention Australia specifically but it says that “global coronavirus death toll could be 60% higher than reported.”

The rally in AUD shows that investors aren’t so much looking at the data, which documents the past, as they are looking at the progress of the virus and the prospects for a return to normality.

EUR gained after Standard & Poor’s Friday affirmed Italy’s BBB rating, rather than downgrading it as many (most?) people expected. Aside from various nice things they said about the country, they noted that the ECB was “backstopping this additional public borrowing.” Moody’s also reaffirmed the country’s Baa3 rating. The country probably won’t be downgraded to high yield unless the ECB pulls its bid (unlikely) or there’s some other major change in its circumstances, such as a change in government or market-led widening in spreads.

Oil fell yet again – Brent down 6.3% and WTI off 12.8%. The rally was apparently overdone – the supply overhang hasn’t gone away and WWIII hasn’t broken out in the Gulf (yet).

Commitments of Traders report

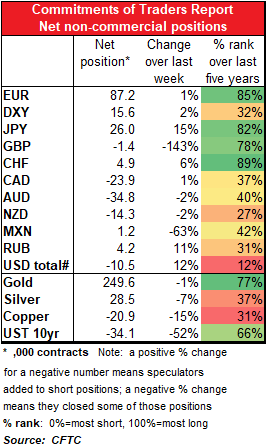

Relatively small changes again, with some conflicting themes.

We still see inconsistency in the data: more DXY longs went along with more USD shorts (or currency longs, whichever way you want to look at it). The main source of the increase in USD shorts was an increase in JPY longs. This outweighed a flip from net long GBP to net short GBP.

The increase in long JPY agreed with the increase in long CHF as a “risk off” trade. But specs also cut short AUD and NZD positions, which is the opposite trade.

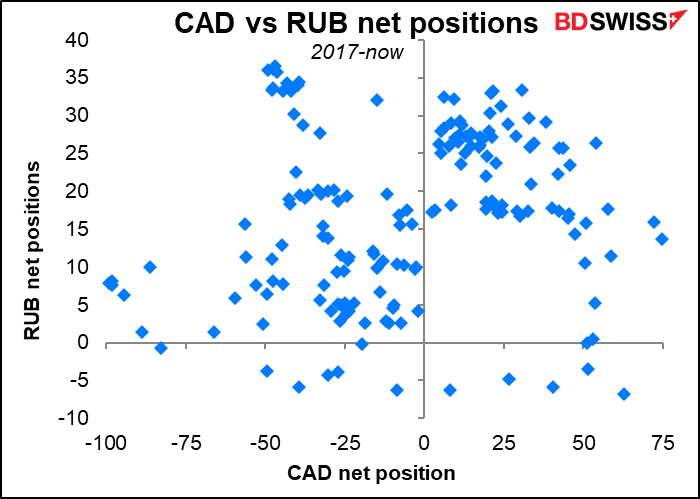

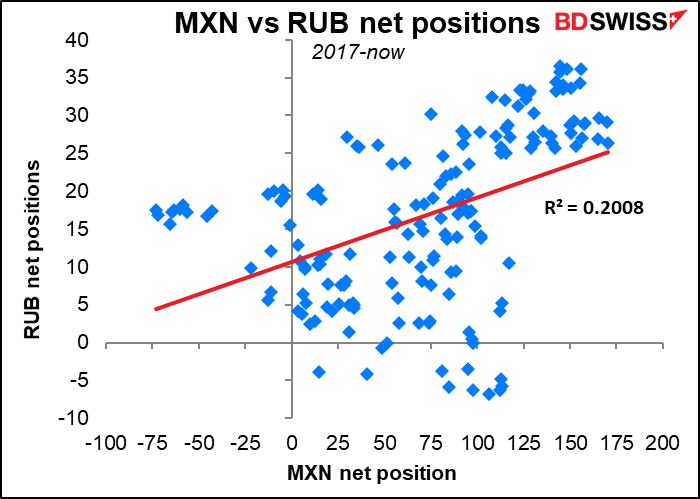

More short CAD positions is a good way to play short oil in the FX world. (I no longer include the net WTI position in this table, because looking at it, they’ve been long every single week since 12 May 2009, which suggests to me that this isn’t a good indicator of market sentiment.) A reduction in MXN longs would also agree with this idea. But then why was there an increase in RUB longs?

I can only quote Ralph Waldo Emerson, who said “a foolish consistency is the hobgoblin of little minds.” Or Sly Stone, who said “different strokes for different folks.” Maybe the people playing each currency are different and have different views.

There seems to be no connection between positioning in USD/CAD and positioning in USD/RUB, whereas there is some (but not a lot) of connection in positioning between MXN and RUB (R-squared of 0.20). MXN and RUB are considered emerging market currencies while CAD is a G10, so probably oil – and attitudes towards EM in general – have more of an impact on the market’s thinking about MXN and RUB than on CAD.

North Korea and the yen

Is Kim Jong-Un dead? No one knows for sure at this point. South Korea Sunday told CNN that he is “alive and well.” I must admit, if he were dead, I would not be among the mourners at his funeral.

If he were to die, I’m not sure the situation on the Korean Penninsula would improve. There is no official succession plan, so there would most likely be a power struggle. The winner might have to prove his or her resolution early on to nip any opposition in the bud. I seem to remember the perhaps-late Mr. Kim eliminating several of his opponents, including one of his uncles, with anti-aircraft guns in the early part of his beneficent rule.

One North Korean expert speculated last year that “there is a good chance that eventually one of the top Party leaders would take over, given that the Party’s superiority over all other institutions has never been questioned. Given that two of the three members of the Politburo Standing Committee are very old, for now it appears to be its third member – Chairman of the Organization and Guidance Department Choe Ryong Hae – who seems like the most realistic candidate to replace Kim.” He described Choe as “a monster,” but noted that a monster could still be a reformer. Being from outside the Kim dynasty, Choe could do things that a Kim successor couldn’t do – like bargain away the North’s nuclear arms in return for economic aid.

Since that assessment was made however, Kim’s diabolical sister, Kim Yo-Jong has come back into favor and is now being tipped as the most likely successor to the Kim throne. She’s supposed to be just as evil as her brother, plus as a Kim would have toe the Kim line of total independence and nuclear arms. It reminds me of a saying about frying pans and fires.

We don’t trade the North Korean currency anyway so what does it matter to an FX columnist?

USD/JPY and USD/KRW are sensitive to developments in North Korea. We can’t trade USD/KRW freely as they have exchange controls, but of course we can and do trade USD/JPY quite actively – in fact the online trading community in Japan is the largest in the world, accounting for an estimated one-third of retail traders.

The impact of North Korean developments on USD/JPY is not as straightforward as one might think. In theory, having a nuclear-powered country run by a crazy person right next door should be negative for a currency (just ask the Canadians and Mexicans), especially when that person tries testing his weapons by firing them over your country. (OK, Japan isn’t right next door to North Korea, but it’s close enough – and many of North Korea’s tests have been either into the Sea of Japan or even over Japan.*) However, JPY normally strengthens during global “risk off” incidents and particularly when the Tokyo stock market falls. This has nothing to do with the Japanese economy but rather is due to the psychology of Japanese investors, who rush to hedge their $2tn in overseas investments whenever they get nervous. Since Japanese stocks are likely to fall if there’s a chance the country will be obliterated, the yen may paradoxically strengthen in such a circumstance. Remember: the currency is not the stock price of the country.

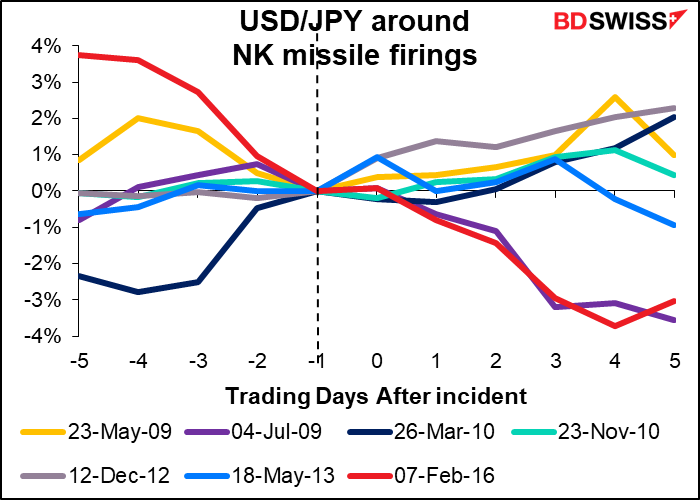

I looked at the movement of USD/JPY back during the days when North Korea was focusing a lot of its hostility at Japan to see how the yen reacted. In this graph, zero is the day that the missile was launched. Answer: USD/JPY usually moved higher (i.e., the yen weakened) on the day of the test and for several days thereafter. But not always.

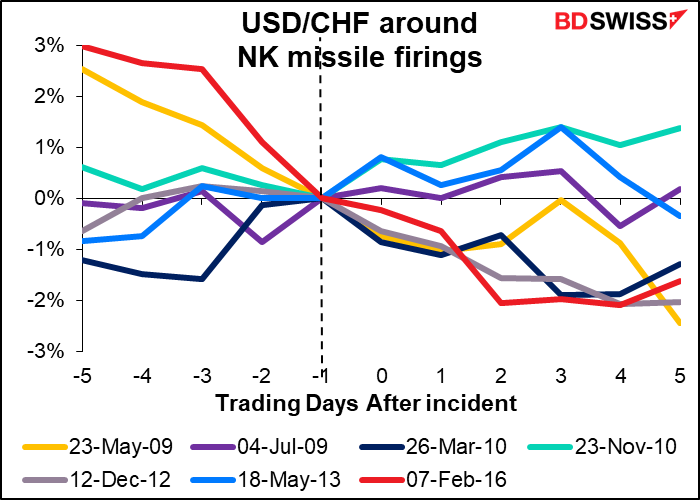

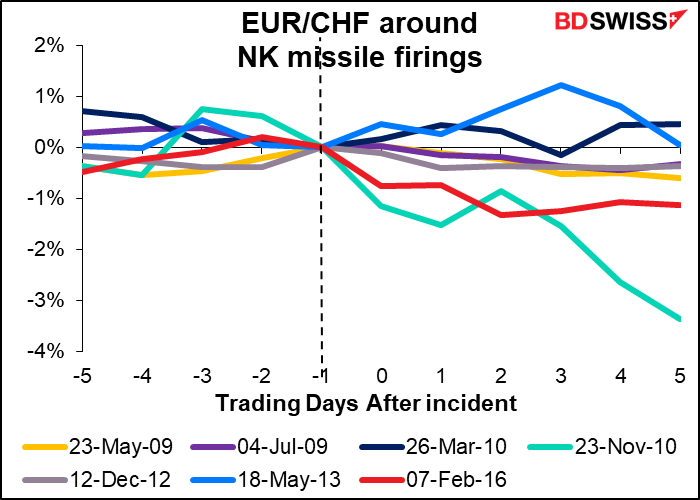

I also looked at how CHF/JPY behaved to see whether the yen’s reaction is unique to Japan because of its location, or whether it’s part of a global “risk off” movement. The two graphs are fairly similar. When JPY weakened vs USD, it also weakened vs CHF, and vice-versa. In fact, the immediate movement vs CHF was greater than the movement vs USD. This suggests that there was a general “risk off” movement due to the event and that JPY was indeed penalized due to Japan’s location, which would explain why it weakened vs CHF.

We can see that from the graph of how CHF moved during these incidents – generally stronger vs both USD and EUR.

*When I was living in Japan up until 2005, we used to joke that the safest place to be during a North Korean missile test was right near the PM’s residence, because that would be what they were aiming at and they were sure to miss. Not any more.

Today’s market

Not much coming out today.

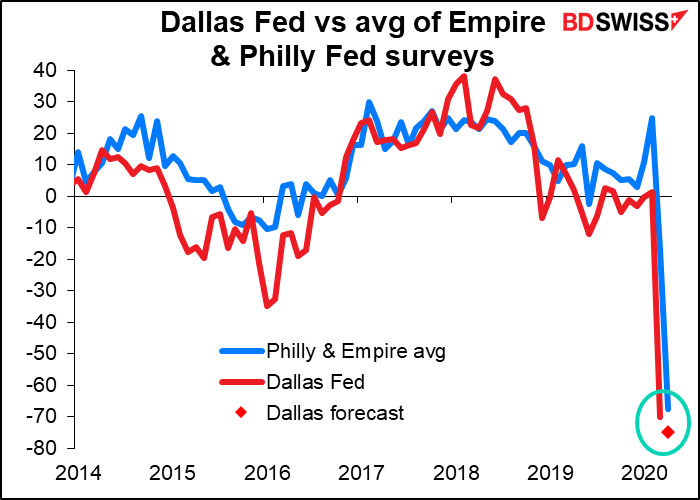

The Dallas Fed survey is the least important of the five regional Fed surveys – it isn’t statistically relevant for forecasting the ISM purchasing managers’ survey and I don’t usually cover it. There may be some interest in it now however as that part of the country is the center of the oil industry. Besides, I’m stuck at home and have nothing else to do, so I might as well write about it.

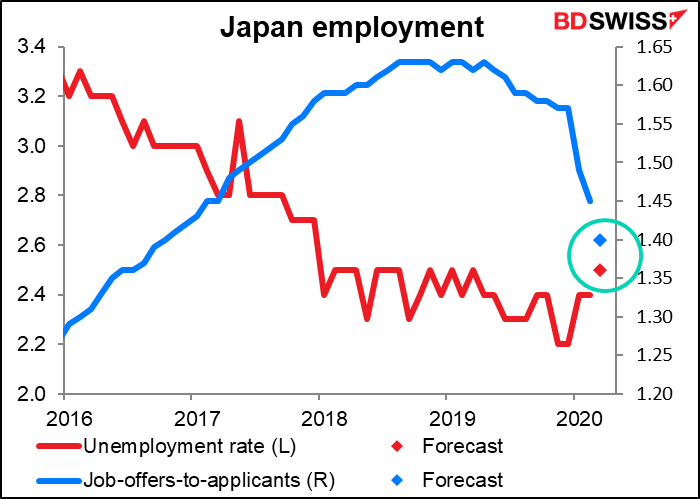

Overnight, we get Japan’s employment data. Japan long ago abandoned its famous “lifetime employment system” (which in any case only applied to people working at large firms). On the contrary, an amazing 32% of the workforce is comprised of part-time workers, who can easily be dismissed at the wave of a hand. The employment situation should therefore be much more responsive to economic conditions than in Europe, although for cultural reasons still probably not as responsive as the US. I think the job-offers-to-applicants ratio is probably going to be a better indicator of the Japanese employment situation than the unemployment rate. That’s because a lot of the people who will lose their jobs will be housewives who will not continue to look for a new job and therefore won’t be counted as unemployed (only those actively looking for work are counted as unemployed). The job-offers-to-applicants ratio peaked in February of last year and has been declining ever since, but the unemployment rate didn’t hit its lowest point until November and December (2.2%).