Previous Trading Day’s Events (14.06.2024)

BOJ is expected to raise interest rates at its next policy meeting on July 30-31. While the BOJ could hike rates in July, the hurdles of doing it simultaneously with bond-buying tapering are “quite high” considering their impact on the market, said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities in a research note on Monday. He projected the next rate hike would come in October.

“Assessments of personal finances dipped, due to modestly rising concerns over high prices as well as weakening incomes,” said Surveys of Consumers Director Joanne Hsu. “Overall, consumers perceive few changes in the economy from May.”

The survey’s reading of one-year inflation expectations was unchanged at 3.3%. Its five-year inflation outlook edged up to 3.1% from 3.0% in the prior month.

______________________________________________________________________

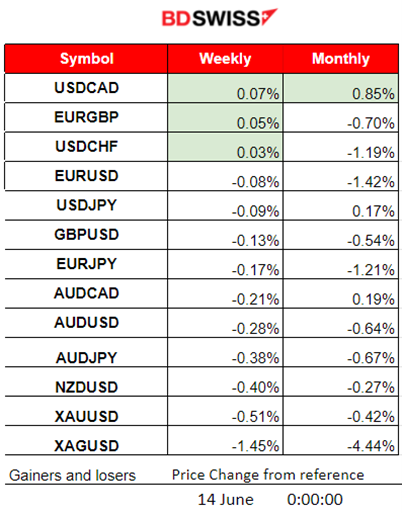

Winners vs Losers

USDCAD is currently on the top this week with 0.07% gains. It is also leading this month with 0.85% gains. The dollar gained a lot of ground lately since an interest rate cut from the Fed is delayed until late this year.

______________________________________________________________________

______________________________________________________________________

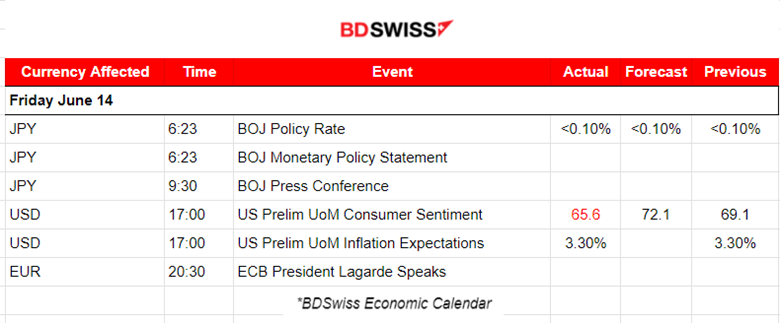

News Reports Monitor – Previous Trading Day (14.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The Bank of Japan (BOJ) decided, by a unanimous vote, to set the following guideline for money market operations for the intermeeting period: The Bank will encourage the uncollateralised overnight call to remain at around 0 to 0.1%. Regarding the purchase of Japanese government bonds (JGBs), CP, and corporate bonds for the intermeeting period, the Bank will conduct the purchase in accordance with the decisions made at the March 2024 MPM. They decided to decrease bond purchases. The market reacted with JPY depreciation during that time. USDJPY jumped over 90 pips.

- Morning – Day Session (European and N. American Session)

At 17:00 the UoM Preliminary U.S. consumer sentiment and inflation expectations reports took place. Consumer Sentiment, the relative level of current and future economic conditions as rated by consumers, declined 5.1% to 65.6 in June. The percentage that consumers expect the price of goods and services to change during the next 12 months remained unchanged at 3.3%. No major impact was recorded in the market, except the fact that the U.S. dollar started to steadily depreciate after the news and retrace from intraday highs.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (14.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to move downwards heavily even before the start of the European session. The EUR weakening in combination with the U.S. dollar strengthening caused the drop and after the pair found support it retraced to the 30-period MA. Later it continued with unsuccessfully testing the support and after the U.S. news at 17:00, the dollar started to depreciate steadily causing the pair to retrace again and stay close to the MA on a sideways path.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After some consolidation that lasted since the 11th of June, the price eventually crashed further, reaching a support near 67,200 USD. The price eventually retraced to the 61.8 Fibo level and settled at near 67.5K USD. On the 12th of June, the U.S. CPI news caused dollar depreciation and Bitcoin jumped to test again the 70K USD resistance. It was however unsuccessful and reversed to the 30-period MA. Volatility levels lowered but the price returned near the 67K USD support. On the 13th of June, the price tested the support without success and it reversed. Currently, volatility has lowered and the price remained close to the 67K USD level. On the 14th of June, after the U.S. news at 17:00, the price dropped and tested the support near 65K USD before it retraced to the 30-period MA. It remained low during the weekend and settled at near 66K USD.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The market is not improving. New week finds Crypto prices low and people have eyes on the dollar as its further strengthening affects crypto prices negatively.

Source:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A consolidation phase was broken to the upside on the 12th of June when finally the index moved higher. At 15:30 the U.S. CPI news caused the index to jump as inflation was reported lower than expected. This gave a hint that interest rates, and borrowing costs, could lower soon. After reaching resistance at near 5,450 USD the index retraced near 5,420 USD and continued sideways. The sideways path continued to the 13th of June as volatility lowered. The U.S. news that day did not have much impact. A triangle formation was broken to the downside on the 14th of June and support near 5,400 USD was reached as mentioned in our previous analysis. The index reversed fully after that and it moved slightly above 5,440 USD, above what looks like to be a channel now. The level 5,445 USD looks like the next important resistance.

______________________________________________________________________

______________________________________________________________________

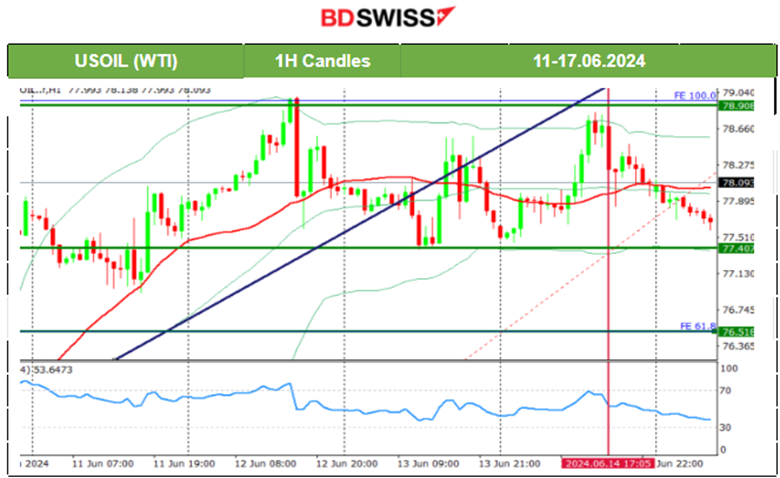

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 12th of June, the resistance mentioned in our previous analysis was broken as predicted and the price moved higher. However, the U.S. inventories report released the same day at 17:30 had a negative impact on the price. Technically, that 79 USD/b level resistance looks like a turning point. On the 13th of June, the pierce remained on a sideways path despite the volatility, forming a triangle. That was broken on the 14th causing the price to jump and reach the resistance near 79 USD/b as mentioned in the previous analysis. The price finally reversed fully and stayed close to the mean, 78 USD/b. After a long-term uptrend, Crude oil is finally in a consolidation phase as it moves sideways in a 1.5 USD range. Why this is important because a breakout of that consolidation could cause the start of a new trend and price rapid moves in the relevant direction. 76.5 USD/b is the retracement 61.8% Fibo level and target if we have a downward breakout which is the logical thing to expect after a long way up that reached a near 6.5 USD move.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 12th of June, the U.S. CPI news caused the USD to depreciate and Gold to jump. After a jump of almost 30 dollars, it reversed when it found resistance at near 2,342 USD/oz. The reversal was quick. The dollar had not yet appreciated enough but the reversal started to happen indicating demand perhaps weakening, keeping the metal lower. On the 13th that view was confirmed as the price moved even lower. After reaching the support at 2,295 USD/oz the price retraced to 2,311 USD/oz, which acted previously as support, and settled there. On the 14th of June, the price reversed to the upside and tested the resistance again, at near 2,340 USD/oz unsuccessfully. It reversed back to the 30-period MA and is on this consolidation path for now with the mean price at near 2,320 USD/oz.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (17.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

China in May managed to beat retail sales expectations, but industrial output and fixed asset investment were missed. The Industrial Production figure was reported as lower than expected. Retail sales were reported higher, up to 3.70% versus the previous 2.3% growth. No major impact was recorded in the market.

- Morning – Day Session (European and N. American Session)

The Empire State Manufacturing Index figure will be released at 15:30. The manufacturers in New York state are expected to report a better business conditions picture that will cause the figure to improve to -12.5. The USD pairs could be affected by a moderate shock at that time, especially if we have a surprise to the upside. In that case, the dollar is expected to strengthen intraday.

General Verdict:

______________________________________________________________