PREVIOUS WEEK’S EVENTS (Week 30 Oct – 03 Nov 2023)

Announcements:

U.S. Economy

According to the reports, U.S. labour costs increased in the third quarter amid strong wage growth. The index was reported with a 1.10% change, higher than the forecast. This increase is a threat to the efforts of the Fed to bring inflation to its 2% target.

The consumer confidence index dropped moderately to 102.6 this month from 104.3 in September.

U.S. job openings increased in September as per the figure to 9.55M, suggesting a persistent labour market tightness that is supporting the economy. The JOLTS job openings report from the Labor Department on Wednesday also showed layoffs dropping to a nine-month low.

The U.S. central bank left rates unchanged on Wednesday as expected. The USD weakened significantly after the news came out.

Demand in the overall economy is not slowing down. The job openings rate was unchanged at 5.7%. Hiring increased by 21K indicating that some companies continued to experience difficulties finding workers. The hire rate was unchanged at 3.7%.

While the JOLTS report suggested labour market conditions remained tight, the ISM said its measure of factory employment declined sharply in October. According to the ISM, responses from companies in the survey “indicate a slowdown in hiring,” and “an increase in staff reduction activity.” It also noted that “attrition freezes and layoffs to reduce headcounts increased during the period, with layoffs the primary tool, indicating a more urgent need to reduce staffing.”

The Jobless Claims in the U.S., a proxy for the number of people receiving unemployment benefits, increased to 1.82M in the week ended Oct. 21, the highest level since April. Initial claims also rose, to 217K in the week ending Oct. 28.

These data suggested that the labour market is softer than it seems on the surface.

Fed Chair Jerome Powell noted this week that some cooling is taking place in the job market but reaffirmed that if evidence suggests that’s no longer the case, that “could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

According to the Job data for the U.S. the employment change slowed in October and the increase in annual wages was the smallest in nearly 2-1/2 years, pointing to an easing in labour market conditions. The unemployment rate rose to 3.9% last month, the highest level since January 2022, from 3.8 in September.

The data suggested that labour market momentum is slowing significantly and strengthened financial market expectations that the Federal Reserve is done raising interest rates for the current cycle and improved the chances of the U.S. central bank engineering a “soft-landing” for the economy rather than plunging it into recession.

The October employment report, with the third-quarter report on productivity and costs, indicates that the economy potentially follows a sustainable path of low inflation and solid potential growth.

New Zealand Economy

New Zealand’s jobless rate rose to the highest – 3.90% – in more than two years in the September quarter, as wages grew by less than forecasted and employment slipped and was reported with a negative figure.

Canada Economy

Job data for Canada were reported worse. Fewer jobs than expected were recorded in October and the unemployment rate rose to a 21-month high of 5.7%, signalling that the central bank may not need to raise rates again.

The employment change was just 17,5K jobs in October. The average hourly wage for permanent employees rose 5.0% from a year earlier, down from 5.3% in September.

The Bank of Canada (BoC) held rates at a 22-year-high of 5.0% last month after having raised them 10 times between March of last year and July to try to bring inflation back to its 2% target. Annual inflation was 3.8% in September.

The softer-than-anticipated jobs report follows data out earlier this week indicating that the economy likely slipped into a shallow recession in the third quarter.

_____________________________________________________________________________________________

Interest Rates

Bank of Japan

The Bank of Japan further loosened its grip on long-term interest rates by tweaking its bond yield control policy again, while keeping ultra-low interest rates steady. As widely expected, the BOJ maintained its -0.1% target for short-term interest rates and that for the 10-year government bond yield around 0% set under yield curve control (YCC).

The BOJ watered down its 1% cap on the 10-year bond yield which it set just three months ago to allow long-term borrowing costs to rise more.

Ueda said the BOJ will no longer forcefully cap long-term rates at 1% but step in to avoid the 10-year yield from sharply moving above that level, adding that the tweak was aimed at making YCC more flexible.

Federal Reserve

The Federal Reserve held interest rates unchanged as expected. Policymakers struggled lately to determine whether the latest economic data are giving enough information regarding the effects of elevated interest rates on the economy.

Fed Chair Jerome Powell said the situation remained something of a riddle, with U.S. central bank officials willing to raise rates again if progress on inflation stalls. In the press conference, Powell said the better course of action for now, given the uncertainties, was to maintain the Fed’s benchmark overnight interest rate in the current 5.25%-5.50% range and see how job and price data evolve between now and the next policy meeting in December.

U.S. stocks rose in value after the release of the policy statement, while the U.S. dollar still weakened against a basket of currencies. U.S. Treasury yields fell and traders of short-term U.S. interest rates added to bets the Fed was done raising its policy rate.

Bank of England

The Bank of England (BOE) kept its main interest rate unchanged yesterday at 5.25% and indicated that borrowing costs will remain stable. Inflation, though, remains high and the target level is 2%.

Policymakers expect that the elevated rates will eventually cause inflation to drop. However, future action will depend on the data and the possibility of further interest rate increases is not to be excluded.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/us/us-labor-costs-growth-beat-expectations-third-quarter-2023-10-31

https://www.reuters.com/markets/us/us-private-payrolls-miss-expectations-october-adp-2023-11-01/

https://www.reuters.com/world/uk/view-bank-england-keeps-rates-15-year-high-2023-11-02/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 30 Oct – 03 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

Manufacturing PMI releases:

Swiss

The Manufacturing sector remains in deterioration as the report shows the devastating figure of 40.6 points which is also way lower than the expected 45 points figure.

U.K.

A downturn in manufacturing continues at the start of the fourth quarter also for the U.K. The manufacturing PMI shows a 44.8 figure, lower than expected confirming that business conditions in that sector remain grim and in contraction.

Canada

The Canadian manufacturing sector downturn was sustained as per the report showing a PMI of 48.6, below the 50 threshold that separates contraction from expansion. Output and orders both fell. Job cuts were sustained. Input price inflation jumped, and concerns that high prices would persist combined with the possibility of recession caused confidence to drop.

U.S.

We see that the business conditions in the U.S. are in a better position. The U.S. manufacturing conditions look stabilised. The PMI for manufacturing was reported at 50. Businesses experienced a back-to-back expansion in output and a renewed rise in new orders. However, demand conditions were historically muted overall, with firms downwardly adjusting their output expectations.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD and DXY (US Dollar Index)

The dollar index dropped overall last week. The EURUSD has started an uptrend since the 1st of November. It is mirroring the dollar index chart since the USD is the main driver. Since then the labour market data released every day has confirmed its cooling with the market participants anticipating that interest rates will probably not change and remain stable. The USD started to depreciate greatly since then. The Fed eventually left rates unchanged. On November 3rd the NFP report and Unemployment rate figure were the factors that caused the USD to depreciate heavily and pushed the dollar index to dive further, with EURUSD climbing higher as a result.

CRYPTO MARKETS MONITOR

BTCUSD

At the beginning of the month, 1st Nov, Bitcoin broke the resistance of 35000 and moved further to the upside while the USD depreciated heavily due to the Fed’s decision to keep rates unchanged. On its way up it found strong resistance again at near 36000 before it retraced back to the 61.8% of the rapid move upwards. It continued with low volatility remaining in the range of 36000 resistance and 34000 support. The employment data releases for the U.S. have not really affected the sideways path of the crypto even though the USD is depreciating heavily against major currencies.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

NEXT WEEK’S EVENTS (06-10.11.2023)

The Reserve Bank of Australia decides on rates this week.

Several speeches from the FOMC members are taking place throughout the week.

China’s Inflation data are to be released, possibly affecting the CNH and AUD pairs.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude oil experienced extreme volatility lately as the fundamentals are causing it to deviate greatly from the mean, sometimes upwards and sometimes downwards. There are forces in place that are offsetting each other, one on the supply side and the other on production. The employment data for the U.S. had an effect on Friday causing the price to drop heavily with Crude testing the 80 USD/b level again. It remained on that level which proved to be strong again and eventually retraced back to the mean soon after.

Gold (XAUUSD)

Gold jumped during the NFP report and immediately reversed to the downside with a mean reversal. During the jump it reached the resistance at near 2004 UD/oz, however, it showed that it remains lower and on the path around the mean.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

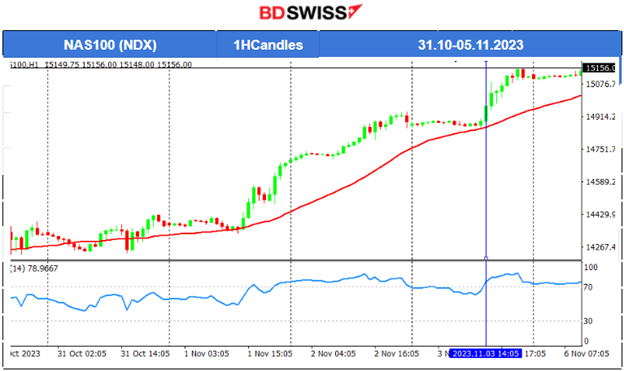

NAS100 (NDX)

Price Movement

After the Fed news and the FOMC statement release, the U.S. indices experienced an upward movement. In fact, the Index experienced a strong reversal after a long period of several drops recently. This upward path now, though, is quite unusual, rapid and strong.

The weak NFP report and Unemployment rate have pushed the index higher after the news revealed that the labour market cooled significantly and that the effects of elevated interest rates are pretty strong. The chance of further hikes is somehow eliminated, the dollar lost strength significantly and stocks are picked up again as risk-on sentiment looks more positive.

______________________________________________________________