Introduction

One of the biggest airplane manufacturers, Boeing, is currently facing issues with their recently produced planes. The so-called 737 Max 9 series had an incident during mid- flight some weeks ago, where an exit-row door was blown out from a plane owned by Alaska Airlines. Following the incident some planes of the same series had been grounded and the investigation is still ongoing. The company share price has fallen over 20% from over $260 in December to close at $205 on Monday (January 29).

Fundamental Data

The Boeing stock price has certainly been on a roller coaster recently, in particular the Covid- 19 pandemic had hit the company hard. Not only had previously confirmed orders been canceled as the entire industry was in turmoil but recovering slowly after strong government restrictions had been implemented. As the company is also involved in the manufacturing process in the military sector, geopolitical tensions globally could further support the development of prices, in particular with the involvement of the US government.

A look at stockanalysis.com reveals that 19 and hence most market analysts would opt for a “strong buy” for the company. Their price target would be $255. However, the current situation might cause investors to be reluctant to invest in Boeing but as the market price has lost over t 20% from recent highs, it might offer a cheaper entry into the company.

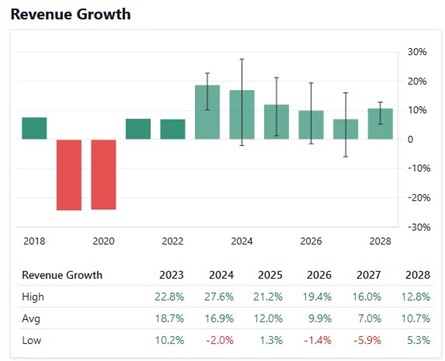

The revenue is expected to reach $21.14 billion and has been on the rise in the last quarters. Earnings per Share (EPS) are expected at 0.70. Boeing does not currently pay dividends to its shareholders.

© https://stockanalysis.com/stocks/ba/forecast/

Technical Levels

Now we should focus at technical levels for the price of Boeing. As we mentioned above the market has fallen substantially after the recent incident with the Alaska-Air plane. The price retraced from over $ 260 down to just above the $ 200 zone, which also marks a psychological support zone. However, the market is currently trading just slightly below the 50- moving average, which could cause prices to weaken further, should the negative trend continue.

On the other hand prices have started to form a bullish turnaround level. With the pinbar candlestick the market could resume its uptrend should we not trade below last week’s lows at around the $ 200 zone.

In general we might get markets to move higher should the uptrend be resumed and start to trade at the $ 220 level. This zone could offer an excellent buy stop area to bet on rising prices.

Sources:

https://stockanalysis.com/stocks/ba/forecast/

https://stockanalysis.com/stocks/ba/forecast/

https://www.earningswhispers.com/stocks/BA