PREVIOUS TRADING DAY EVENTS –02 Nov 2023

Policymakers expect that the elevated rates will eventually cause inflation to drop. However, future action will depend on the data and the possibility of further interest rate increases is not to be excluded.

“We’ve held rates unchanged this month, but we’ll be watching closely to see if further rate increases are needed,” Bank of England Gov. Andrew Bailey said. “But even if they are not, it is much too early to be thinking about rate cuts.”

Source: https://www.reuters.com/world/uk/view-bank-england-keeps-rates-15-year-high-2023-11-02/

The unemployment rate remains low. However, the pace of hiring is losing steam.

“Overall, levels remain low, and businesses have yet to start shedding workers at a rapid pace given economic activity and demand remain strong,” said Rubeela Farooqi, chief US economist at High Frequency Economics. “However, the continuing claims numbers bear watching for signs of a softening in labor demand.”

A more complete picture of the direction the labour market is headed will be reported today with the NFP. Economists project the U.S. to have added some 180K more Jobs in October.

“The modest rise in initial jobless claims, together with the persistent increase in continuing claims, suggests the labour market is softer than it seems on the surface. In past prints, household survey data showed the number of people becoming unemployed is growing faster than the number transitioning out of unemployment — usually a leading indicator of a jump in the unemployment rate.” Eliza Winger, economist

Chair Jerome Powell noted this week that some cooling is taking place in the job market but reaffirmed that if evidence suggests that’s no longer the case, that “could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

______________________________________________________________________

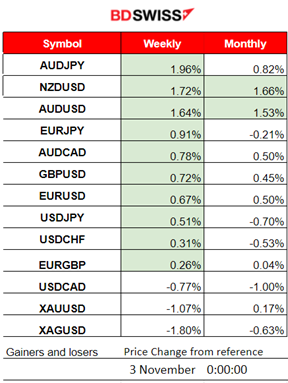

Winners and Losers

News Reports Monitor – Previous Trading Day (02 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

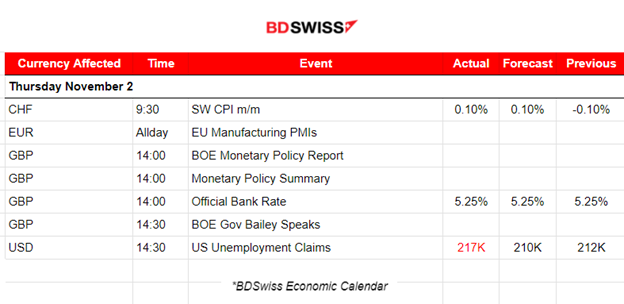

Eurozone’s PMIs for Manufacturing were reported all in the contraction area, showing a very grim picture of what is happening in business. The elevated borrowing costs are now presented to have affected the markets and the economy quite significantly causing further deterioration.

The decline in eurozone factory orders is among the sharpest on record in October. Furthermore, businesses experienced steep and accelerated contractions in new orders, purchasing activity and backlogs, enhancing the fall in factory production. The October survey data also signalled the fastest reduction in factory employment levels since August 2020.

The BOE decided to keep rates unchanged yesterday, as expected. At its meeting, the MPC voted by a majority of 6–3 to maintain the Bank Rate at 5.25%. Three members preferred to increase the Bank Rate by 0.25 percentage points, to 5.5%. Inflation is slowing down according to the data, but it is still too high. The policymakers stated that they would hike if needed or keep the interest rates elevated enough for the 2% target to be reached. At the time of the release the GBP experienced a low level shack with GBP appreciation that soon faded.

U.S. unemployment claims have been reported higher than expected at 217, an increase of 5K from the previous week’s revised level. The labour market is still tight, but the effects of higher interest rates are apparent. Further deterioration in business conditions affects the labour market and as a result, the numbers could change to even higher levels if the same policies are followed.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

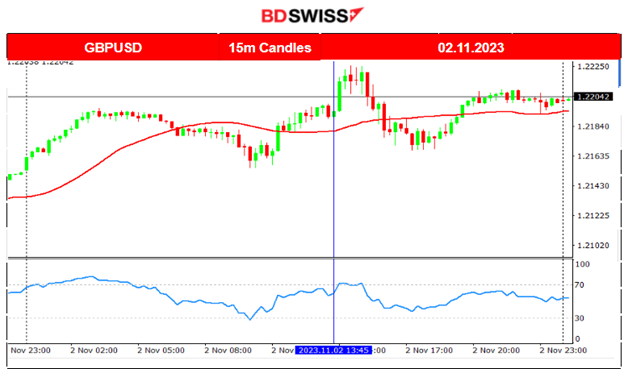

GBPUSD (02.11.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

No significant increase in volatility was observed. The pair moved around the mean almost sideways. The GBP was not significantly affected by the BOE news and the USD was not experiencing any shock. There was the absence of special scheduled releases in general and the market had already acted after the important Fed release by focusing more on stocks and metals amid NFP.

___________________________________________________________________

___________________________________________________________________

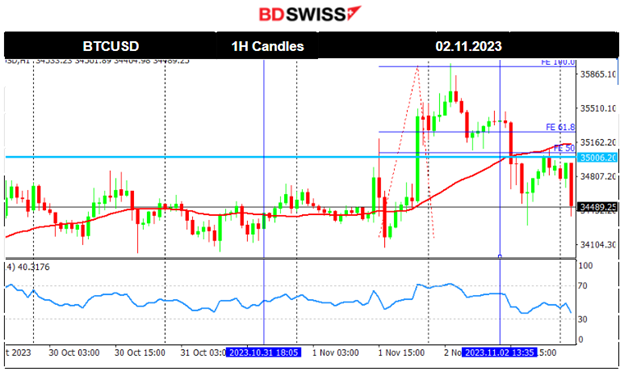

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

At the beginning of the month, 1st Nov, Bitcoin broke the resistance of 35000 and moved further to the upside while the USD depreciated heavily due to the Fed’s decision to keep rates unchanged. On its way up it found strong resistance again at near 36000 before it retraced back to the 61.8% of the rapid move upwards Yesterday it moved even lower, returning back to the low mean level near 34500. It looks like it is testing strong support there currently, let’s see if a breakout will lead to a further drop.

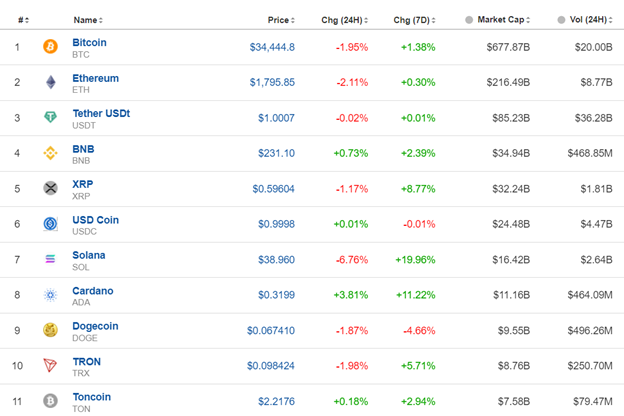

Crypto sorted by Highest Market Cap:

Not only bitcoin but most crypto on this list faced losses. Cardano keeps gains high the last 24 hours with 3.81% gains so far. Solana remains on top for the 7 days period having gains close to 20%.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

After the Fed news and the FOMC statement release, the U.S. indices experienced an upward movement. Wall Street is close to its best week of 2023 in hopes of a halt to rate hikes. We see for NAS100 that the channel was broken to the upside and the index moved rapidly upwards.

The Index actually experienced a strong reversal after a long period of several drops recently. This upward path now, though, is quite unusual, rapid and strong since no retracement has been recorded yet. This might be the opportunity to catch the retracement. The index is expected to return back to the mean and the 61.8% of the move at least, as per the arrow.

TradingView Analysis:

https://www.tradingview.com/chart/NAS100/4Jxko1lS-NAS100-Post-Reversal-03-11-2023/

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

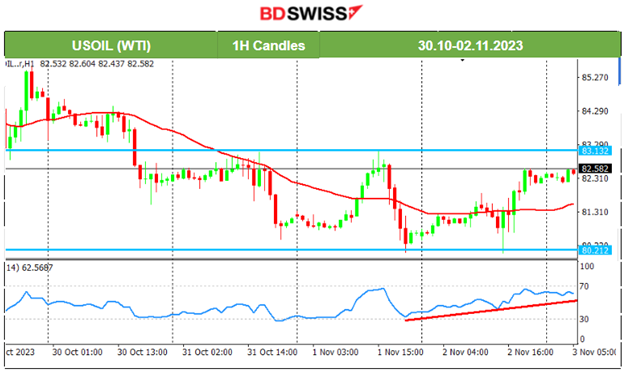

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The downtrend is obviously over for now as Crude moves sideways, confirming the bullish divergence. Support seems to be near 80.2/b and resistance at 83 USD/b. Resistance breakout is a possibility as oil today moves to the upside.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold reversed significantly after testing the strong resistance at 2009 USD/oz. After the Fed decision on rates and the FOMC statement release, it broke important support levels reaching even to near 1970 USD/oz before eventually retracing back to the mean and continuing the path around it sideways. Now 1990 USD/oz serves as an important resistance level part of a triangle formation. Breakout to the upside will lead to rapid movement all the way to the high resistance levels of 2009 USD/oz again. After the NFP today it would be more clear if gold will break the triangle to the downside, or the upside.

______________________________________________________________

______________________________________________________________

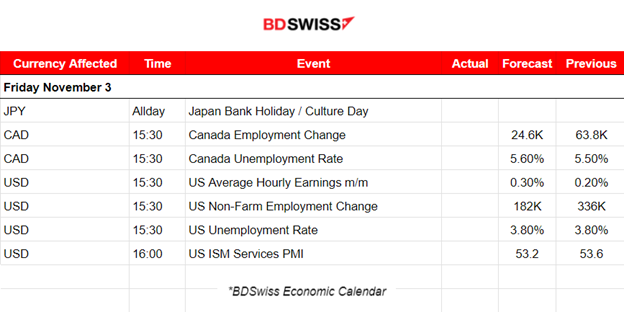

News Reports Monitor – Today Trading Day (03 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

At 15:30 we have the release of the most important news for the month. The NFP report and Unemployment rate for the U.S. The Canada employment change and unemployment rate are released at the same time. We expect to see intraday shocks for the CAD and USD pairs upon release. Canada’s employment change was actually higher than forecast in recent reports. Analysts now expect a drop in employment growth and we might see a surprise again. Note that the BOC kept rates unchanged to 5% since July.

The NFP is expected to be reported lower than last time. According to the recent JOLTS report, the number of job openings changed only a little and according to the ADP report, change in private employment was reported higher. We might see a surprise having a moderate impact, however, the USD will probably be affected greatly.

The ISM Services PMI stays in the expansion area according to previous readings but is expected to be reported slightly lower. The services sector has been stronger than the manufacturing sector instead is in contraction and was lastly reported at 46.7 points. Even though the effects of elevated rates on business conditions are starting to show their impact, we do not expect the PMI to be reported way lower or to have much impact on the USD upon release.

General Verdict:

______________________________________________________________