PREVIOUS TRADING DAY EVENTS – 11 May 2023

Announcements:

Inflation remained above 10% in March as the U.K. experienced unexpectedly big and persistent prices together with stronger wage growth.

“We have to stay the course to make sure inflation falls all the way back to the 2% target,” Bailey said at the start of a press conference before stressing that the BoE was not sending any signals about its next moves, which would depend on data.

“If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required,” the BOE said, maintaining its message from earlier this year.

Energy prices have fallen and the central bank expects inflation to drop to 5.1% by the end of this year from 10.1% in March.

Source: https://www.reuters.com/world/uk/bank-england-raises-rates-45-inflation-slow-fall-2023-05-11/

The Fed has raised its benchmark overnight interest rate by 500 basis points to the 5.00%-5.25% range since March 2022. Last week signalled it could pause any hikes.

Source: https://www.reuters.com/markets/us/us-producer-prices-increase-moderately-april-2023-05-11/

So far, the reports regarding inflation expectations, the Labour market and rate hikes were seen as consistent with most economists’ expectations of a recession in Q4.

“The Fed looks closer to winning the war on inflation today, but it risks losing the war on keeping the economy afloat and away from the shoals of recession,” said Christopher Rupkey, chief economist at FWDBONDS in New York.

Stocks on Wall Street were lower and the dollar gained versus a basket of currencies.

While the monthly inflation rates are positive, it gives the Fed a hard time as it expects lower and lower prices. We might see further hikes and no pause.

“Details imply stable PCE inflation at too-strong levels,” said Veronica Clark, an economist at Citigroup in New York. “We continue to expect further hikes from the Fed in June and July.”

_____________________________________________________________________

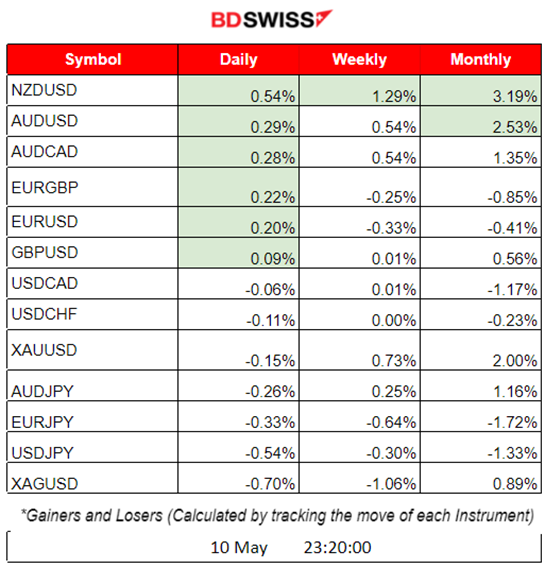

Summary Daily Moves – Winners vs Losers (11 May 2023)

- USDCAD is the top winner for this week with a 0.84% price change.

- NZDUSD and AUDUSD are the top gainers so far this month, with 1.53% and 1.33%.

- Silver is the top loser this month with a -4.44% price change.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (11 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news releases and no major scheduled figure releases.

- Morning – Day Session (European)

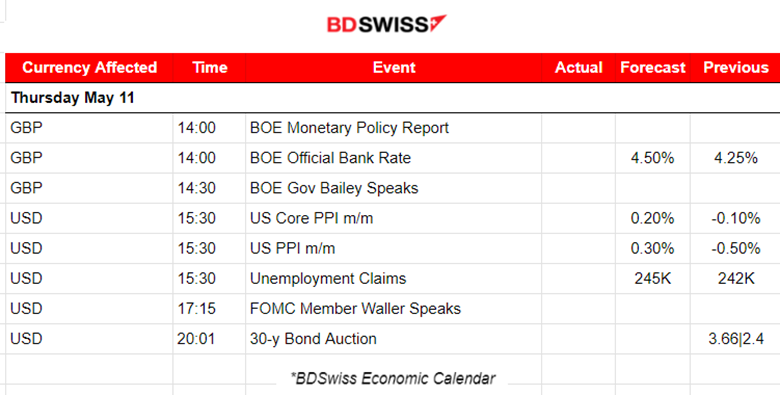

BOE announced its rate decision and monetary policy at 14:00. Due to the 2-digit inflation that the U.K. faces, we were expecting a surprise. However, the central bank decided on an increase of the initially estimated 25 basis points to 4.5%. No surprise here. The GBP pairs experienced a small intraday shock at that time with no significant volatility.

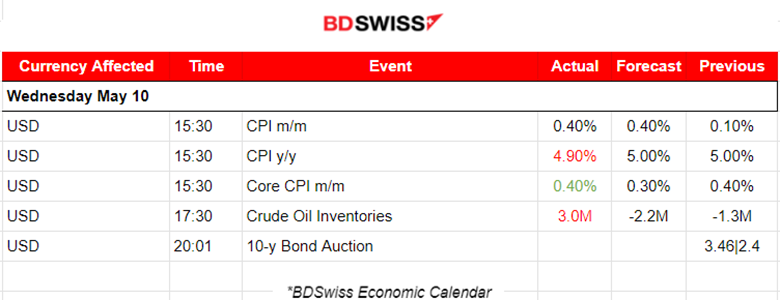

The U.S. PPI reports were released at 15:30. Inflation fell to 2.3% in April as the producer price index shows. It still shows signs of an increase, just less. U.S. unemployment claims were actually reported a lot higher than expected. Although there are more jobless claims, the labour market remains strong. USD experienced a small intraday shock and later moved steadily upwards with appreciation against major pairs.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

GBPUSD (11.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

GBPUSD started moving upwards early, above the 30-period MA and slowing down when the European Session started. The BOE rate decision at 14:00 did not have much impact as there was no surprise; the hike took place as expected. Market reaction was significant after 15:30 with the release of the U.S. PPI and the Unemployment claims figures. The USD appreciated much, causing the pair to dive. It eventually retraced back to the mean and reversed completely with a rapid movement upwards, crossing the MA and deviating significantly from the mean before retracing again.

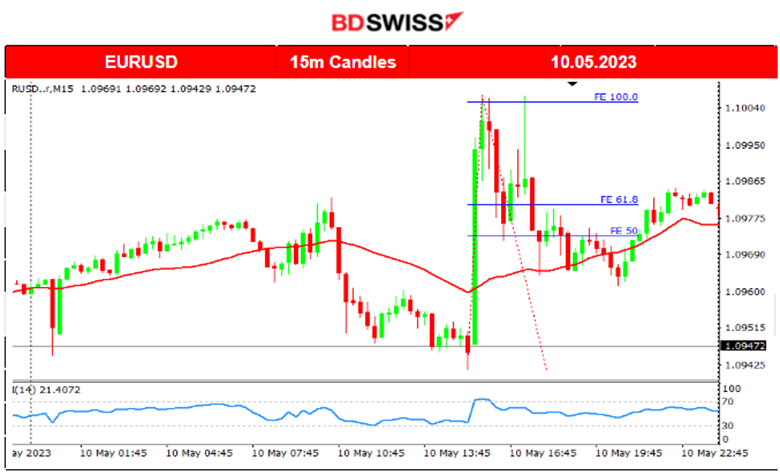

EURUSD (11.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

At around 9:00, while the European session was ready to open, the EURUSD was moving downwards early showing volatility. The same case was with the GBPUSD as the USD was appreciating. The market was adjusting positions early following the previous day’s US CPI data release ahead of the PPI news and Unemployment claims. The chart shows that after the rapid downward movement, the pair found good support levels and showed signs of retracement which eventually happened back to the 61.8% Fibo level.

The BOE rate decision of course had no impact but the news at 15:30 regarding PPI caused the dollar appreciation and the pair to move further downwards.

Trading Opportunities:

After the rapid downward movement and the confirmation of strong support, a retracement opportunity was formed and captured. It was risky to speculate on this one since the news at 15:30 could create a distortion in the analysis and price path.

Related TradingView Analysis:

https://www.tradingview.com/chart/EURUSD/A01VvQN9-EURUSD-Retracement-Upwards-11-05-2023/

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. inflation-related figures this week pushed U.S. stocks higher and created high volatility with mixed price paths for indices as blue-chip stocks moved differently than the rest. Yesterday, NAS100 started with a retracement following the previous day’s price reversal upwards to higher and higher levels. After around 17:30, it started to reverse, moving higher while seemingly being at the start of an upward trend. The expectation is that a pause in rate hikes might play a role in this while it enhances the risk-on mood. The other indices moved slightly lower overall.

Trading Opportunities:

After the high and relatively rapid upward movement, the index found resistance on the 11th of May. It was highly probable that retracement was going to take place after some breakouts of support levels intraday. Eventually, the index moved lower as expected to the 61.8% Fibo level.

Related TradingView Analysis:

https://www.tradingview.com/chart/NAS100/ir50zYF3-NAS100-Fibo-Comeback-11-05-2023/

Another thing to consider is that the RSI slows down again with lower highs while the price is forming higher highs. This bearish divergence signals that the potential uptrend might experience long retracements to the mean, thus the next short-term movement is more to the downside.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

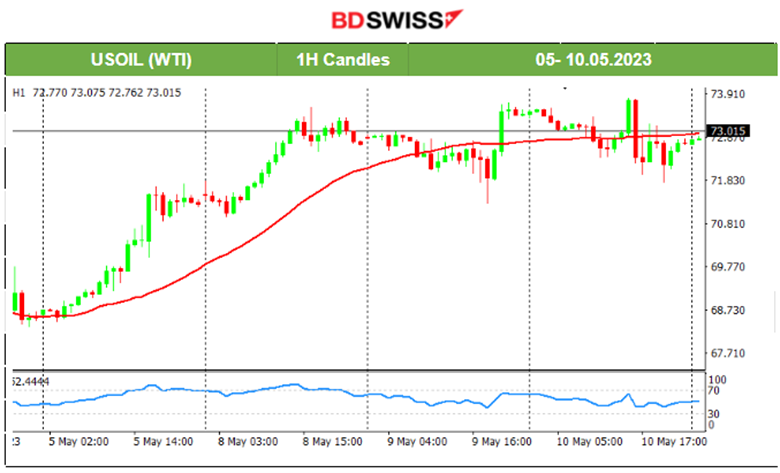

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude was experiencing sideways but volatile moves recently as it settled around the mean near 72.70. The RSI started to show lower highs with signs that the price would eventually drop technically speaking. However, we know that the oil price is greatly affected by the news affecting the US dollar as well. A triangle formation is visible. The oil price started to move significantly downwards after 14:00, breaking the triangle and finding support at 70.6 before eventually retracing back to the intraday mean. It’s also noteworthy that the USD intraday’s overall appreciation makes oil more expensive, another factor explaining the movement downwards.

Trading Opportunities:

After the rapid downward movement and the confirmation of good support levels, a retracement could be captured as the market eventually returned back to the intraday mean level and the 61.8 Fibo level, as per the below 15-minute chart.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was also moving sideways with high volatility this week. Eventually, yesterday, it moved to lower levels as the USD appreciated causing it to fall as the USD became more expensive. It found resistance before eventually retracing. This happened while U.S. stocks experienced an intraday drop too, followed by significant retracements.

______________________________________________________________

News Reports Monitor – Today Trading Day (12 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Expectations for inflation one and two years ahead decreased to 4.28% and 2.79%, respectively. This release did not have much impact on NZD.

- Morning – Day Session (European)

The report at 9:00 showed a negative monthly change for the U.K.’s GDP, estimated to have fallen by 0.3% in March 2023. There was no significant effect on the GBP pairs.

General Verdict:

______________________________________________________________