Previous Trading Day’s Events (08.05.2024)

______________________________________________________________________

Winners vs Losers

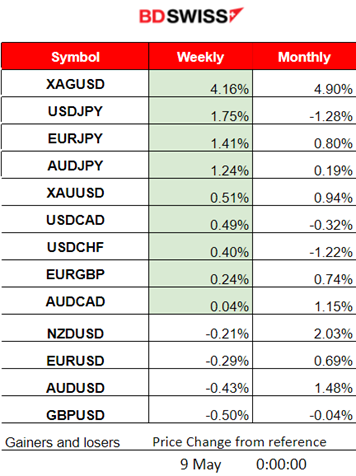

Silver (XAGUSD) is on top of the week’s list and month with a 4.16% weekly performance which is followed by the JPY pairs. Two possible interventions took place last week, Monday and Thursday, causing JPY strengthening and bringing down the pairs (JPY as Quote). Since the 3rd of May, the pairs have been moving on an uptrend again.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (08.05.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

No important news announcements, no special scheduled releases.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (08.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving with low volatility around the 30-period MA. There was an absence of special scheduled releases so the pair was not experiencing any significant deviation from the MA. The U.S. dollar was driving the path mostly sideways.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin remained below 65.5K USD these past days and does not show any significant signs of moving to the upside at all.

A triangle formation was breached on the 7th of May and this caused its price to drop to near 62K. This downside movement was a retracement to the 61.8% of the rapid large movement that started on the 2nd of May and from the support at near 56.5K USD.

A clear downward channel for Bitcoin as it currently continues breaking support levels and moves within a downward channel.

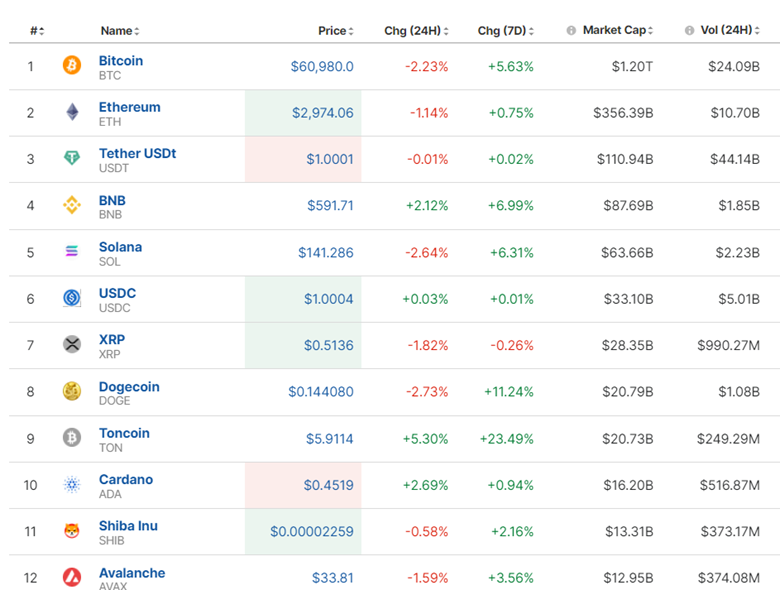

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market does not see improvement. Bitcoin reversed to the upside after a large drop to 56,5K but remained low and moved again to the downside. For the last 24 hours, most Cryptos have shown underperformance.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After testing the intraday highs, the index started to move upwards remaining above the 30-period MA and kept breaking resistance levels. A clear uptrend. On the 7th of May, the RSI indicated a slowdown and bearish divergence. The slowdown was confirmed and the index moved sideways. This could be the end of the uptrend as per the RSI signal suggestions.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 1st of May, the price continued with the downtrend but after breaking the support at 80 USD/b the price dropped heavily to the next support at near 78.7 USD/b before retracement took place. It seems that Crude oil was following a downward channel while moving around the 30-period MA. That channel broke with the next support being reached on the 8th of May at near 76.70 USD/b. The price reversed remarkably on the same day to the upside breaking the channel to the upside this time. The upward movement continues today.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price on the 6th of May jumped until the resistance at near 2,330 USD/oz before eventually reversing to the MA and the 2,305 USD level. A strong consolidation phase is quite apparent, formed by a sideways and quite volatile price movement. The range is between 2,320 USD/oz and the 2,305 USD/oz level. A breakout in either direction could cause the rapid price movement that we look for to take advantage of. The downside breakout could lead to the price reaching the support at 2,280 USD/oz.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (09 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

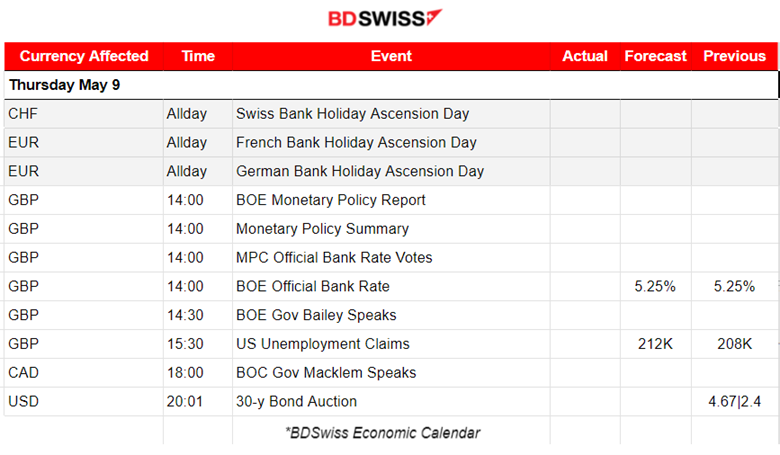

The Bank of England is going to release the interest rate decision at 14:00 and it is expected that they will proceed with no change in interest rate policy. GBP pairs could be affected heavily at that time. The annual inflation figure is on a downward path but the interest rate still remains above 3%, last recorded at 3.20%. Labour market-related data suggest that the labour market is not cooling as expected and justifies the persistence of inflation.

U.S. Unemployment claims are expected to remain stable and near the 210K average. Not expecting any shock affecting the USD pairs at that time but volatility could be higher than typical.

General Verdict:

______________________________________________________________