Previous Trading Day’s Events (06.07.2024)

Governor Tiff Macklem:

“We expect to see further progress but we think it’s going to be slow, it’s going to be uneven …. Fundamentally, we need to see more progress,” he told Reuters in an interview after the rate announcement.

Overall inflation stands at 2.9%, still well above the bank’s 2% target. Shortly after the rate announcement, data showed that Canadian money markets now see a 23% chance of a rate cut in April, down from 43%.

Source: https://www.reuters.com/markets/bank-canada-keeps-rates-hold-says-too-early-consider-cut-2024-03-06/

Federal Reserve Chair Jerome Powell presented the U.S. central bank’s semiannual Monetary Policy Report to lawmakers during that time of the release. Powell said policymakers expected “inflation to come down, the economy to keep growing,” but shied away from committing to any timetable for interest rate cuts.

A separate report from the Fed said “labor market tightness eased further,” in February, but noted that “difficulties persisted attracting workers for highly skilled positions.

“The data are pointing to some rebalancing in supply and demand in the labour market,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics in White Plains, New York.

______________________________________________________________________

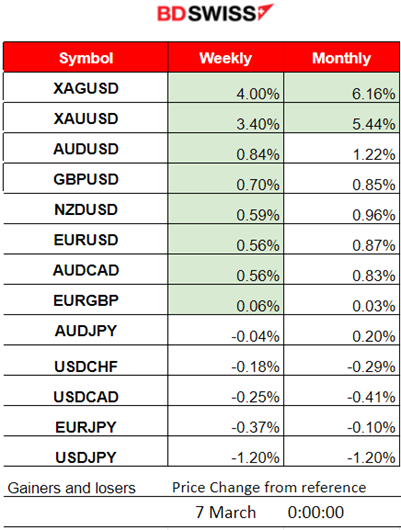

Winners vs Losers

Metals are still at the top of the list. Silver (XAGUSD) is leading for this week and month, 4% gains this week and 6.16% gains for the month. Gold (XAUUSD) follows with 5.44% gains so far this month.

______________________________________________________________________

______________________________________________________________________

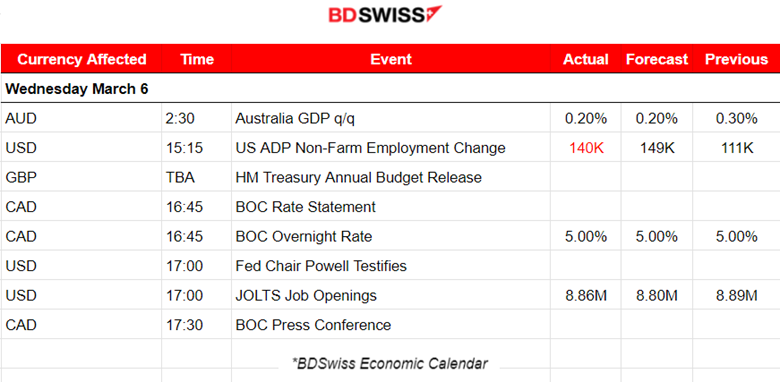

News Reports Monitor – Previous Trading Day (06 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The Australian GDP rose 0.2% in Q4 and as expected according to the report released at 2:30. No major impact was recorded in the market.

- Morning – Day Session (European and N. American Session)

The ADP report at 15:15 showed that private sector employment increased by 140,000 jobs in February, less than expected, and annual pay was up 5.1% year-over-year. Employment growth continues. The market did not react significantly. JOLTS Job openings report showed a slight decrease however not something important to consider.

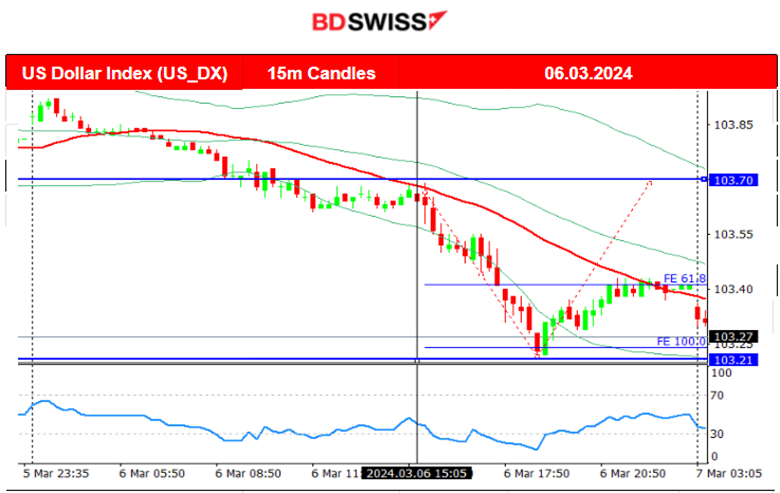

After 15:15 the Fed Chair Powel will proceed to statements that are quite optimistic for the U.S. economy referring to the downfall of inflation, strong labour market and that rate cuts path will be determined by the upcoming data. All eyes on NFP then. During the trading day, the USD was depreciating significantly probably because the Fed has more chances of an interest rate policy sooner than the other Central Banks.

The Bank of Canada (BOC) decided to keep interest rate policy unchanged. This caused the market to react with strong CAD appreciation. The USDCAD fell more than 60 pips since the time of the release and reached support.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

USDCAD (06.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved with low volatility around the 30-period MA before the major news, BOC Rate decision. By 15:00 then the USD had already started to show some weakening. A rapid drop started at 15:00 yesterday with the U.S. dollar weakening. This was the trading consensus and remained such after Powell’s testimony that got out early after 15:31. The notable statement that reassures the view that cuts will likely take place can explain why the dollar loses strength. Not to mention that other Central Banks are far away from cutting rates. BOC kept interest rate policy unchanged, with news released at 16:45 causing a rapid further drop (USD depreciation, CAD appreciation), with these two bringing down the pair further and further with an overall drop near 90 pips until the support near 1.35. Some retracement followed of course soon after touching the 30-period MA.

EURUSD (06.03.2024) 15m Chart Summary

EURUSD (06.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

With the dollar starting to lose strength early and the EUR appreciating slightly, the pair was moving to the upside with volatility rising after the start of the European session. The pair moved rapidly to the upside after 15:00 when the USD experienced more and heavy depreciation after Powell’s testimony causing the pair to reach the resistance near 1.09170. The labour market reports (ADP Employment and JOLTS) showed mixed data but they had no major impact in the market because the overall view that is still tight did not change with the slightly different figures. At around 19:00 the dollar started to gain back strength, retracing to the 30-period MA.

___________________________________________________________________

___________________________________________________________________

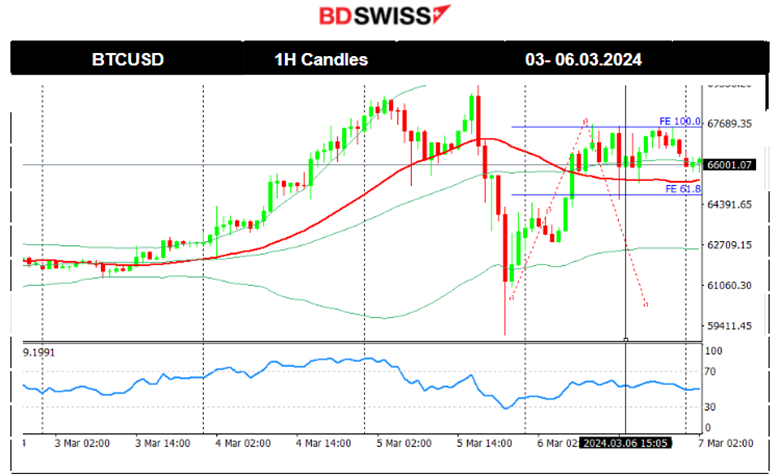

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crazy week for the Crypto market. Bitcoin reached the resistance near 69K USD before reversing aggressively back to the support near 59K. Talking about swings… Reversals of course after rapid drops are common, which is why the asset jumped again high and back to the 30-period MA. It currently settled with lower volatility levels at near 66K USD.

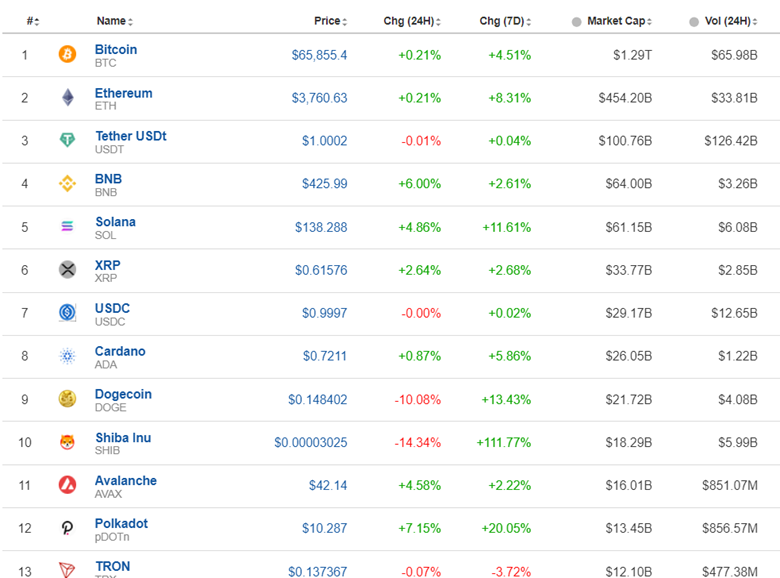

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market saw a surprising uptrend as institutional investors stepped in the markets aggressively. The markets saw a slight correction causing small losses in the last couple of days. However, the overall performance this week was huge.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 4th March, the index retraced to the 30-period MA. Soon after it crossed it on the way down showing signals that the uptrend ended. Before any intraday notable retracement occurred yesterday, 5th March, stocks dropped upon exchange opening. All three U.S. indices retreated more than 1%, with weakness in mega-cap growth companies such as Apple Inc and the chip sector. Retracement to the 18,000 USD level and beyond eventually took place as the market moved to the upside on the 6th March correcting from the rapid drop.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 1st of March, the price jumped high reaching the resistance at 80.3 USD/b before retracing back to 79.3 USD/b. On the 4th of March, it eventually reversed fully back to the support at near 77.9 USD/b. Crude oil price fell further on the 5th March reaching the next important support at 77.5 USD/b as OPEC+ extends output cuts. More supply in place puts pressure on prices to drop further. On the 6th March, a surprise increase of the price took place causing a breakout of the depicted channel with the price reaching the resistance at near 80 USD/b before retracing and back to the 30-period MA.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The surge continued breaking significant resistance and jumping more than 20 USD upwards as expected. Gold reached remarkably the level of 2,140 USD/oz. Will this time Gold experience a significant retracement? It is on an uptrend with the RSI showing a bearish divergence as highs get lower and lower while the price has higher highs. However, the price is still above the 30-period MA. On the 6th March, support remained strong and the dollar depreciation pushed Gold to higher and higher levels reaching over 2,150 USD/oz.

______________________________________________________________

______________________________________________________________

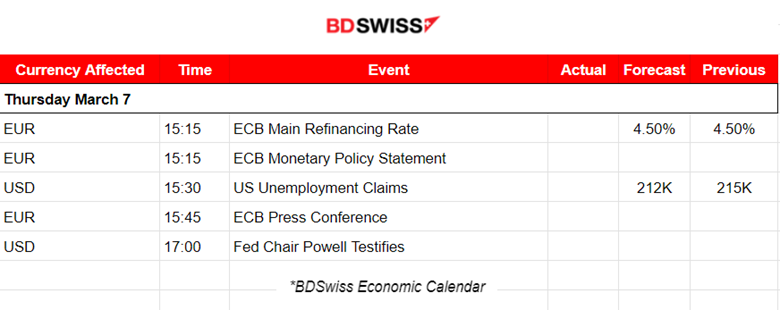

News Reports Monitor – Today Trading Day (07 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

The ECB decides on rates at 15:15. Interest rate policy is expected to remain unchanged and potentially cause an intraday shock to the EUR The press conference starts at 15:45.

U.S. unemployment claims are expected to drop amid tight labour market conditions. However, the drop seems to be only small with the figure remaining close to 200K. Any significant deviation could only mean a light impact on the dollar.

The Fed Chair Powel will testify for the second time at 17:00.

General Verdict:

______________________________________________________________