Previous Trading Day’s Events (05.06.2024)

“Let’s just enjoy the moment for a bit,” said Governor Tiff Macklem at a press conference after announcing the central bank had reduced rates to 4.75% from 5%, the first cut in four years.

Macklem stressed the timing of the next cut would depend on whether inflation continued its downward trajectory.

U.S. inflation is stickier and markets expect the Federal Reserve will cut rates only once this year.

The European Central Bank (ECB) is most likely to follow with a shift in policy as well.

Source: https://www.reuters.com/markets/rates-bonds/bank-canada-cuts-rates-first-time-four-years-2024-06-05/

The overall economic output in the first quarter grew at the slowest rate in nearly two years.

Source: https://www.reuters.com/markets/us/us-services-sector-rebounds-may-2024-06-05/

______________________________________________________________________

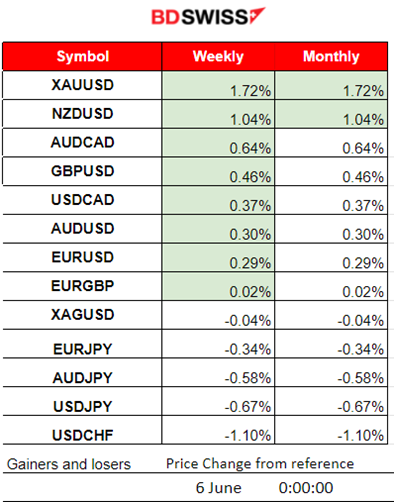

Winners vs Losers

Gold reached the top and recorded gains of 1.72% for this week. The CAD has depreciated heavily after the BOC’s decision to cut interest rates causing pairs (CAD as Quote) to move to the upside. JPY has appreciated lately against other currencies pushing pairs (JPY as quote) to the bottom.

______________________________________________________________________

______________________________________________________________________

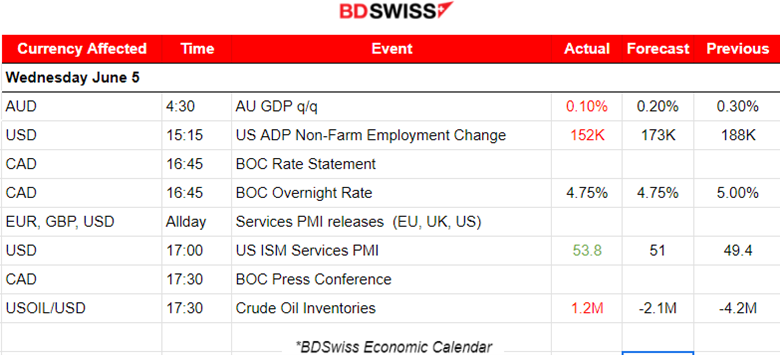

News Reports Monitor – Previous Trading Day (05.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

According to the report at 4:30, the Australian economy grew 0.1% in the March quarter of 2024. Gross domestic product (GDP) rose 0.1%. The figure was reported lower than expected. The initial reaction in the market was AUD depreciation causing a sudden but short drop in the AUD pairs, however, the effect soon faded.

- Morning – Day Session (European and N. American Session)

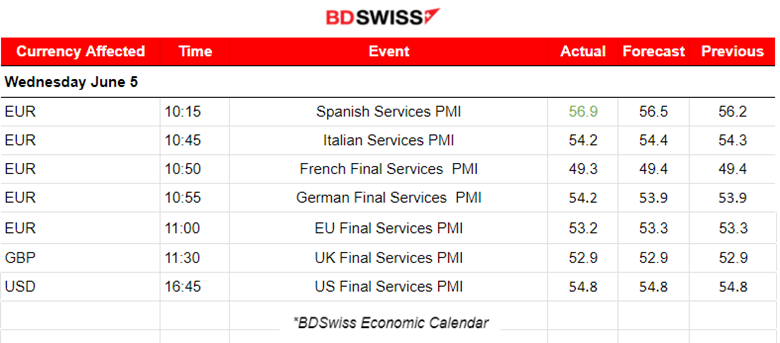

Services PMI releases:

Eurozone PMIs:

The Spanish services sector continued to improve during May, with a recorded PMI in expansion, at the remarkable 56.9 points figure. Activity and new business rose, notable job growth, and strengthened future confidence.

A sustained Italian services economy growth was reported yesterday. The PMI stays in expansion, at 54.2 points. New business and activity growth was maintained. It was also reported that there are signs of optimism among service providers. Business expectations grew, beating expectations and job creation gained momentum.

The French service sector stayed in contraction instead in the second quarter. Reported PMI is in contraction, at 49.3 points, but near the 50-level threshold. Activity levels shrank marginally during May. However, it recorded a sustainable pick-up in sales, driven by domestic demand, while employment continued to rise.

The German service sector saw a rise in business activity in May, with stronger underlying demand. Reported PMI was improved, reaching 54.2 points in expansion. Services firms boosted job creation as they reported increased optimism towards future growth. Inflationary pressures in the economy’s largest sector eased midway through the second quarter.

The Eurozone’s economy recorded a third successive month of rising business activity during May with growth accelerating to a one-year high. Stronger demand conditions, output and hiring, improved business confidence. PMI remains in expansion at 53.2 points and points to economic growth in the Eurozone which is at its fastest rate in a year as inflation cools.

U.K. PMI

The UK services economy grew further. PMI remains in expansion at 52.9 points. However, expansion in business activity and new orders eased from their 11-month highs seen in April. Nevertheless, it experienced job growth and a higher level of business confidence.

U.S. PMI

The U.S. services PMI reported 54.8 points indicating a return to growth. New orders spurred U.S. service providers to increase their business activity at a much faster pace midway through the second quarter of 2024.

The ADP Non-Farm employment change figure was reported lower than expected at 152K versus the previously reported 188K figure. This was in line with the view that the economy is cooling down. The labour market data so far are consistent with cooling. However, expectations regarding the next NFP figure is actually that it will be reported higher, but not significantly higher. The dollar depreciated after the release.

The same day, the BOC decided to cut interest rates as expected, by 25 basis points. At that time the CAD depreciated heavily. USDCAD jumped more than 50 pips before reversing to the intraday MA.

The U.S. ISM services PMI was reported higher than expected and improved, giving a boost to the dollar at the time of the release. It could be the case that the business conditions in the U.S. economy are not cooling as many people think. The next NFP report will definitely provide important data that will shape expectations regarding future inflation direction and the Fed’s future interest rate policy.

General Verdict:

__________________________________________________________________

__________________________________________________________________

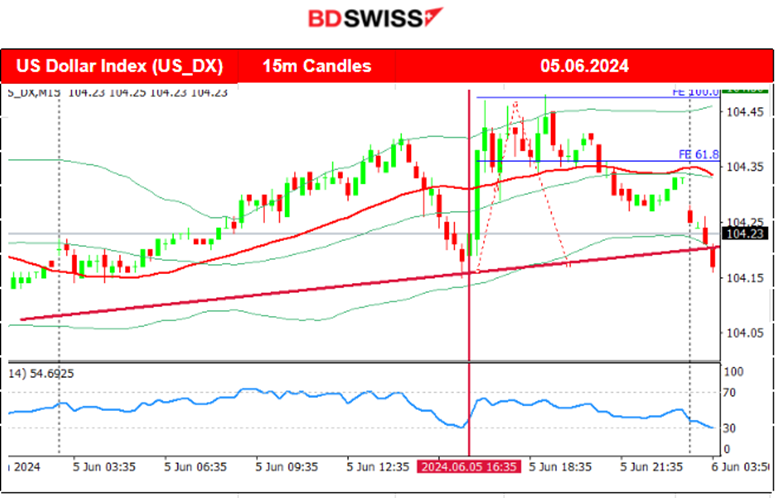

FOREX MARKETS MONITOR

EURUSD (05.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started steadily to move to the downside after the start of the European session and when volatility started to pick up. It was the dollar appreciation however that was driving the pair to the downside. Suddenly the dollar experienced strong weakness and after the U.S. ADP report (Private employment change) the EURUSD moved to the upside until it found resistance. It was the BOC news and ISM services PMI release that pushed the EURUSD to drop heavily as the dollar experienced strong appreciation upon the news release. Volatility levels eventually lowered and the pair returned to the 30-period MA.

USDCAD (05.06.2024) 15m Chart Summary

USDCAD (05.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving sideways as the market was experiencing low volatility. However, after the start of the European session, the USD was affected greatly and the pair started to experience high deviations from the 30-period MA. The market eventually experienced a shock after the news release. The BOC eventually decided to reduce interest rates and the CAD suffered depreciation causing the pair to jump. The upward movement was also supported by the U.S. dollar which experienced appreciation due to the positive ISM PMI figure. A huge reversal took place after the pair hit resistance at near 1.37405.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

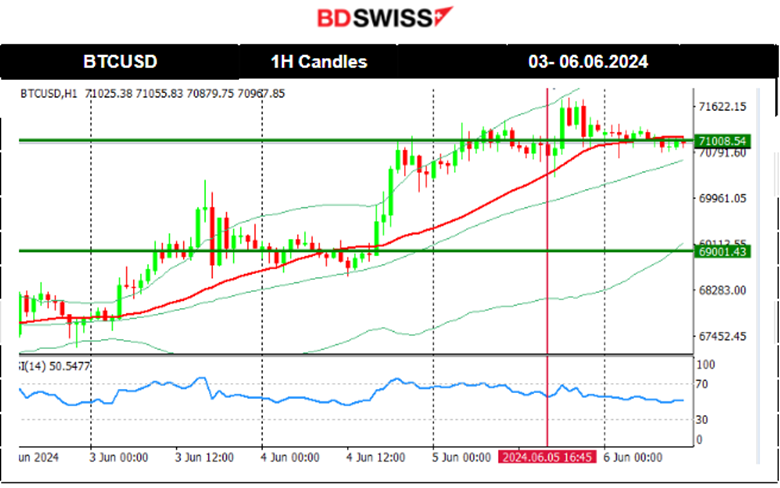

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After a period of consolidation taking place last weekend, the price broke the resistance and moved to the upside. It stalled at the resistance near 69K USD even after the volatile market conditions that took place on the 3rd during the PMI releases. Since the 3rd of June, Bitcoin gained momentum and moved to the upside. It steadily breaks resistance levels, 68K, 69K, 70K and lastly 71K at the level that is currently settled.

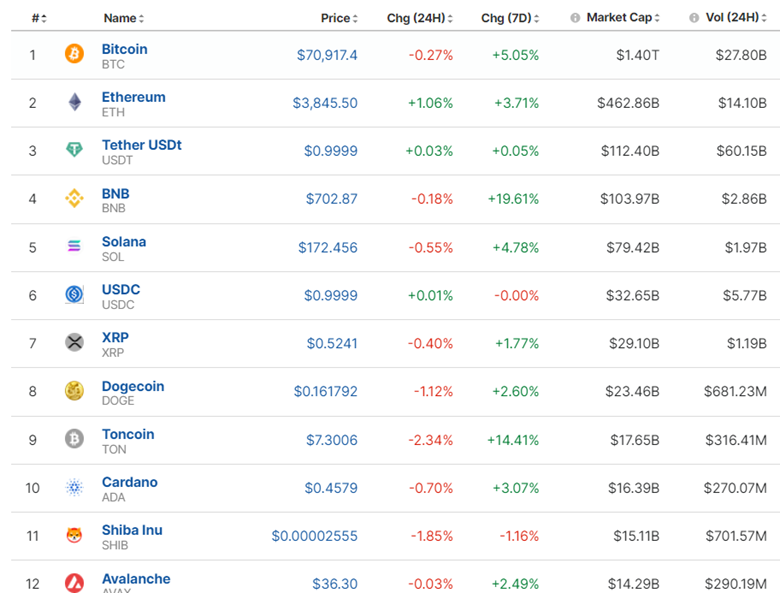

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Apparently, Cryptos saw great improvement this week. The market changed amid major releases this week. Prices remained high and 7-day period gains have been sustained so far.

Sources:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A jump occurred on the 31st of May which was a huge reversal, crossing the 30-period MA on its way up ending the long downtrend. Retracement to the 61.8 Fibo level (back to 61.8% of the total movement to the upside) eventually took place as mentioned in our previous analysis. The index even crossed the 30-period MA on its way down but reversed quite soon. A triangle formation started to form and on the 4th of June, a breakout to the upside took place. The upward movement after the breakout took place and the index reached higher and higher levels. Now we have to have eyes on the RSI and look for bearish signals as retracement is possible after this rapid upward movement.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Hour Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Despite OPEC+ production cut extension oil prices fell rapidly on the 3rd of May. Around a 5-dollar drop was recorded in the price of Crude oil since the drop. However, retracement was only for a little amount, around 1 dollar. It seems that the price reached the 30-period MA and it could be the case that it will not retrace more. The H4 chart shows however that the price currently lies on the lower band of the 50-period Bollinger Bands indicating a strong support there. The price of crude oil eventually retraced as mentioned in our previous analysis. It was a long way down and the RSI indicated a slowdown and possible bullish divergence increasing the chances for retracement.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The level 2,340 USD/oz served as the mean price until the 31st of May with the price deviating around 20 dollars from that mean. The price broke the support at nearly 2,320 USD and with the potential to move further downwards. However, it stalled after the breakout, indicating that there are upward pressures that keep the support strong. On the 3rd of May, the dollar suffered strong depreciation helping Gold to climb. Gold was moving sideways around the mean near 2,340 USD/oz and deviating 20 dollars from the mean. On the 5th of June, it jumped, breaking from the triangle formation as depicted on the chart, and moving upwards, reaching 2,375 USD, before retracement took place.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (06.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special figure releases.

- Morning – Day Session (European and N. American Session)

At 15:15 the ECB will decide on rates and it is expected that the EUR pairs and USD pairs will be affected heavily. Even though expectations will be met with cuts, it is still an important event that could have a huge impact.

U.S. unemployment claims, released the same day are expected to be reported lower, however, the impact on the USD pairs will probably be minimal.

General Verdict:

______________________________________________________________