Previous Trading Day’s Events (09 Jan 2024)

______________________________________________________________________

Winners vs Losers

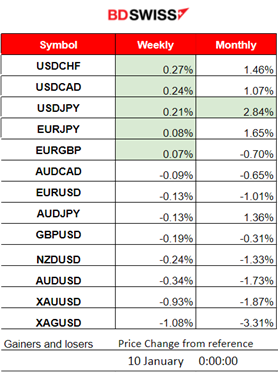

The USD has gained some strength causing the pairs (USD as base) to move to the top of the winner’s list for the week. USDCHF leads for the week and USDJPY continues to lead for the month with near 3% gains.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (09 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Inflation in Tokyo keeps slowing as per the report at 1:30, taking pressure off BOJ as the numbers get lower and lower for the second straight month in December. No major shock was recorded at the time of the release.

An upbeat of Aussie Retail Sales showed the report at 2:30. Retail sales increased by 2% instead of the expected 1.20% indicating improved risk appetite. No major impact on the market was recorded upon release.

- Morning–Day Session (European and N. American Session)

The monthly figure for the unemployment rate in Europe surprisingly fell to 6.4% in November from 6.5%. No major impact was recorded in the market due to this release.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (09.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

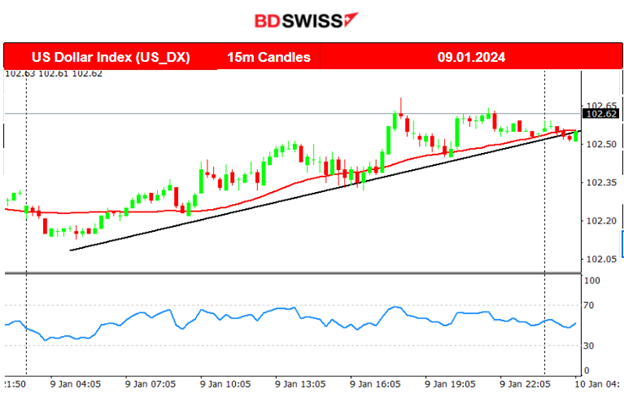

The pair moved steadily to the downside as the USD was steadily gaining strength. This is mirroring the dollar index path as depicted above. No major shocks were recorded since there was absence of very important scheduled releases.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

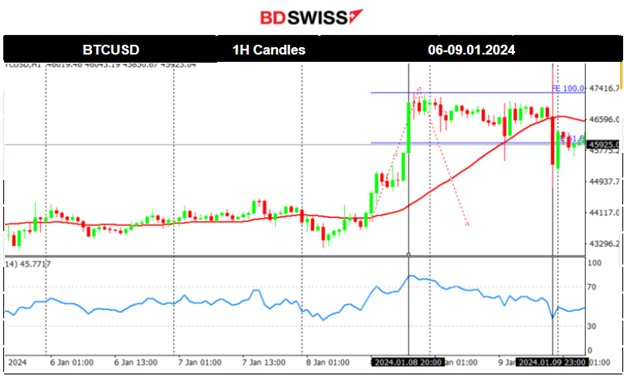

Bitcoin jumped ahead of the spot exchange-traded funds (ETF) approval deadline for the 10th Jan, reaching 47300 USD before retracing to the 61.8 Fibo level. This growing anticipation of imminent approvals of spot Bitcoin ETF was the main driver to the upside. A post sent from the Securities and Exchange Commission (SEC) account on the social platform X/Twitter announced the approval of a long-awaited Bitcoin exchange-traded fund causing a shock in the market and a jump in Bitcoin’s price reaching near to 48K USD. It did not last long though since the SEC said soon after that the post was “unauthorised”, and that the agency’s account had been “compromised”. This announcement caused Bitcoin to fall again dramatically and settle near 46K USD. Why these moves? Why do people care so much? The ETF provides a way to invest in Bitcoin without having to buy the cryptocurrency outright on a crypto exchange such as Binance or Coinbase.

Sources:

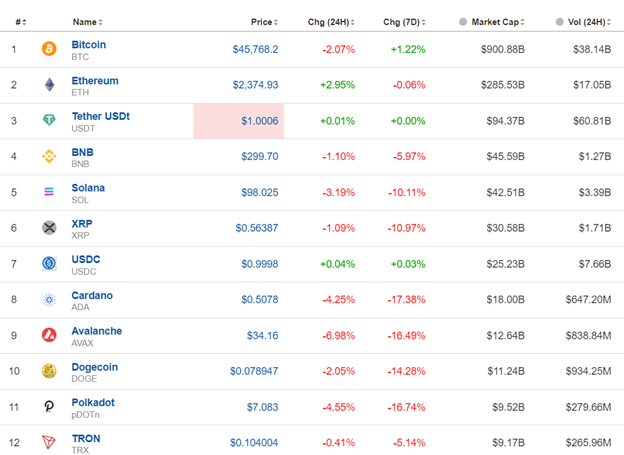

Crypto sorted by Highest Market Cap:

Cryptos experienced gains during the surge caused by the false report but they were soon wiped out after the SEC announcement. Most of them are showing significant losses for the last 24 hours and most mark over 10% losses for the last 7 days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Clearly, the downtrend was interrupted during the NFP report as the index (and the other U.S. benchmark indices) moved to the upside significantly crossing the 30-period MA on the way up and resulting in a rather sideways path after the volatility levels started to fall. A triangle formation formed after the news and the index was signalling that there might be a breakout to the downside. The support however proved to be strong enough. The index ( and all the other benchmark indices) experienced a surprisingly upward and rapid movement upon NYSE opening on the 8th Jan. The index reached the resistance at near 16600 USD before retracement took place. It eventually completed the retracement to the 61.8 Fibo level, as mentioned in our previous analysis, on the 9th Jan, reaching near 16500 USD before bouncing again to the upside reaching 16720 USD and settled near there for now. The RSI is currently showing signs of bearish divergence as highs are lower.

Analysis on TradingView:

https://www.tradingview.com/chart/NAS100/ahYJNRwU-NAS100-Retracement-09-01-2024/

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

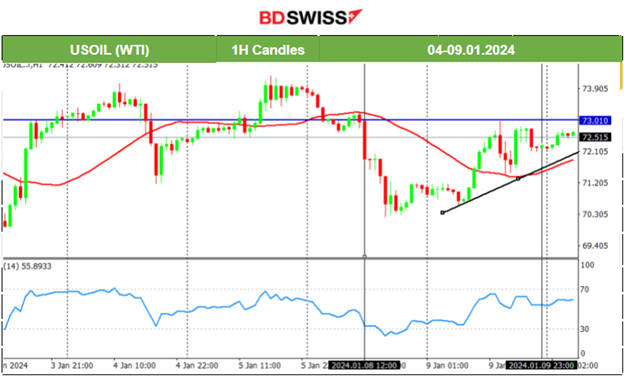

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude Oil moves with high volatility around the 30-period MA in general. On the 8th Jan, the price experienced a downward movement crossing the 30-period MA, a reversal to the downside. The price moved fast and reached the support near 70 USD/b before eventually retracing to the 61.8 Fibo level. The path changed and Crude moved sideways. Volatility levels started to drop for some period of time and the price formed a triangle with resistance now being close to 73 USD/b. Crude tested that several times without success. If there is no breakout to the upside then we should expect Crude to continue with a high drop upon triangle breach to the downside testing again the support at near 71 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold is headed upwards trying to breach the second triangle formation. After the drop on the 8th Jan, Gold found a strong support at near 2017 USD/oz and eventually retraced to the mean. Volatility levels started to lower significantly and as a result it moved sideways forming another triangle. This might now have been breached to the upside but it is not clear. 2040 USD/oz is the next resistance level upon successful breakout and the 2049 USD/oz is the next.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (10 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Inflation in Australia is lowering significantly. The core inflation also eased sharply reinforcing market expectations that interest rate hikes are no longer needed. The AUD was affected at that time negatively with sudden but no strong depreciation that soon faded. No major impact here.

- Morning–Day Session (European and N. American Session)

Bank of England (BOE) Governor Andrew Bailey is due to testify, along with Deputy Governor Sarah Breeden, on the Financial Stability Report before the Treasury Select Committee, in London at 16:15.

No other major scheduled releases for the rest of the trading day.

General Verdict:

______________________________________________________________