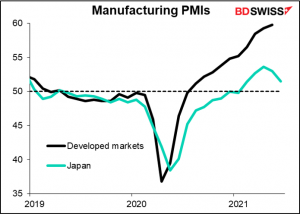

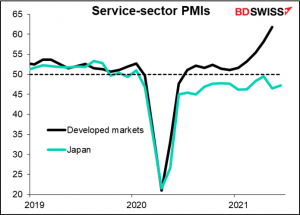

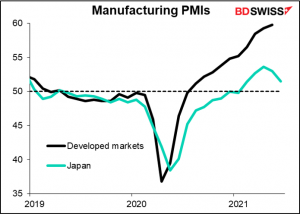

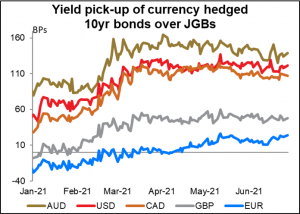

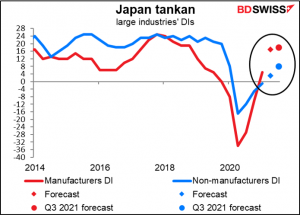

Japan: the outlier

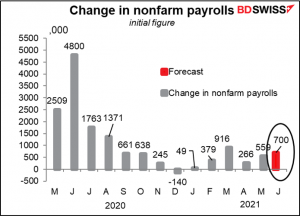

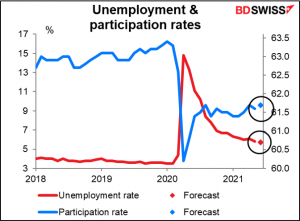

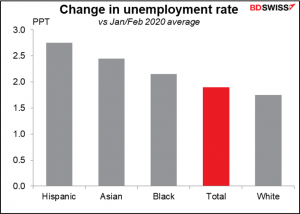

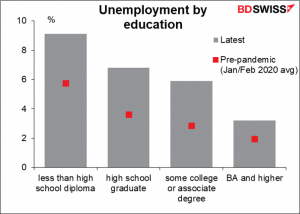

NFP: “progress” but not “substantial”

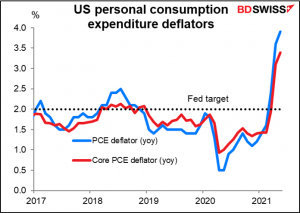

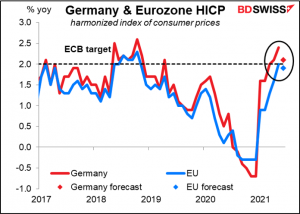

EU: Inflation expected to slow

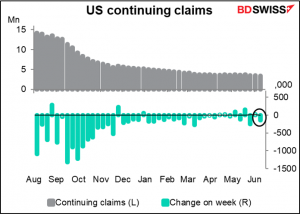

Jobless claims: watch continuing

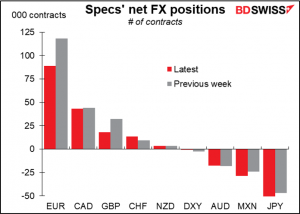

Positioning: reducing USD shorts

- Specs cut long currency positions after FOMC

- Mostly EUR but also GBP, increased short JPY

- Increased long CHF, cut short AUD