Previous Trading Day’s Events (19 Dec 2023)

Bank of Japan governor Kazuo Ueda: “The chance of trend inflation accelerating towards our price target is gradually heightening,” Ueda said in a press conference after the meeting. “But we still need to scrutinise whether a positive wage-inflation cycle will fall in place.”

“Obviously, I am always thinking about various scenarios about how we could change policy when certain conditions fall into place,” Ueda said.

He also said the BOJ won’t rush into raising rates just because the U.S. Federal Reserve could start cutting them soon.

The BOJ kept its short-term rate target at -0.1% and that for the 10-year government bond yield around 0%. It also left unchanged a pledge to ramp up stimulus “without hesitation” if needed.

Source: https://www.reuters.com/markets/asia/boj-focus-japans-progress-hitting-price-goal-2023-12-18/

“(The November release) suggests those rate cuts are still a little bit of a ways off and the market might be getting ahead of itself a little bit,” said Michael Greenberg, senior vice president and portfolio manager at Franklin Templeton Investment Solutions.

On a month-over-month basis, the consumer price index was up 0.1%, compared with a forecast for a 0.1% decline. CPI-median and CPI-trim, two of the BoC’s three core measures of underlying inflation, also held steady at 3.4% and 3.5%, respectively.

The Bank of Canada could start cutting interest rates next year as long as core inflation comes down as predicted.

“Today’s report represents less progress in taming inflation than we had expected … bond yields are rising as some of the most aggressive bets on rate cuts are getting pared back,” said Royce Mendes, head of macro strategy at Desjardins.

______________________________________________________________________

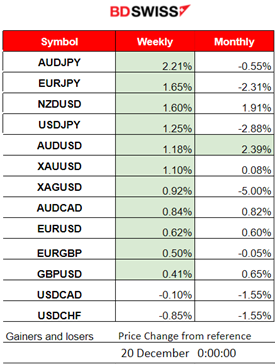

Winners vs Losers

AUDJPY reached the top of the winner’s list for this week having 2.21% gains so far. This month AUDUSD comes first with 2.39% gains. Apparently, the AUD appreciates greatly, while the JPY depreciates instead, against other currencies.

______________________________________________________________________

______________________________________________________________________

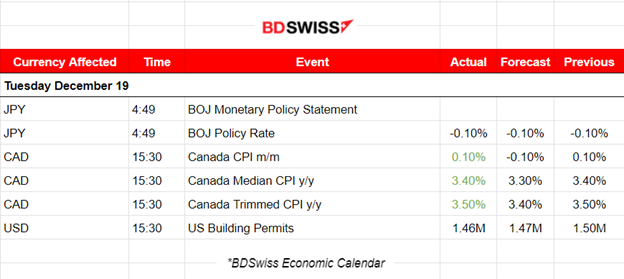

News Reports Monitor – Previous Trading Day (19 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The Bank of Japan (BoJ) decided to keep its policy rate steady at -0.10%. An ultra-loose monetary policy unchanged. The decision was in line with market expectations but the JPY, however, experienced strong depreciation at the time of the release affecting JPY pairs greatly. The USDJPY jumped nearly 100 pips at the time of the release.

- Morning–Day Session (European and N. American Session)

The inflation-related data for Canada, CPI (Consumer Price Index) changes, were released at 15:30. All CPI figures were reported higher than expected. The monthly rate of inflation was 0.1%, also the same as data released in October. Bank of Canada Governor Tiff Macklem said in a speech last week that the central bank needs to see evidence that “inflation is on a sustained downward track” before it can begin discussing cutting its benchmark rate so the market reacted to the news causing appreciation of the CAD at the time of the release. At the same time the USD suffered some weakness causing a sharp drop to the USDCAD. It dropped near 50 pips at that time.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

USDCAD (19.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was experiencing very low volatility levels before the news. It was moving sideways during the Asian session and after the start of the European Session, it started to move below the 30-period MA without deviating much. At 15:30 during the CPI data release, which suggested inflation is hard to bring down in Canada, the market caused a high CAD appreciation against the USD and the pair dropped near 50 pips before retracing back to the MA and the 61.8 Fibo level as depicted in the chart.

___________________________________________________________________

___________________________________________________________________

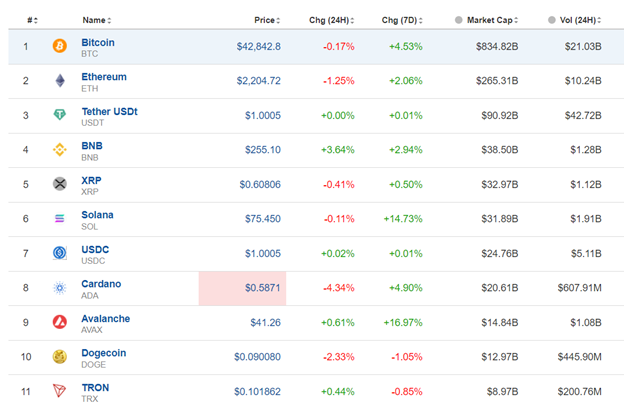

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 18th Dec, Bitcoin’s price reversed remarkably to the upside. Bitcoin crossed the 30-period MA on its way up and moved beyond the 42300 USD resistance reaching eventually the next resistance at 43300 USD. Retracement took place eventually fully and bitcoin settled to a path around the 30-period MA and the mean near 42700 USD.

Crypto sorted by Highest Market Cap:

Mixed performance for Cryptos as the crypto market reversed to the downside. In the last 7 days, Solana managed to reach the top of the winner’s list with 14.73% gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Risk-on sentiment as market participants are pushing U.S. stocks higher and higher. NAS100 and other indices are clearly on an uptrend. This month has been good for stocks especially since the Fed is discussing rate cuts, thus future lower borrowing costs for businesses. During the FOMC news, their statements caused huge volatility in the market causing the indices to jump. Currently, the trend is obviously upwards. All indices experience roughly the same path, climbing while being above the 30-period MA.

______________________________________________________________________

______________________________________________________________________

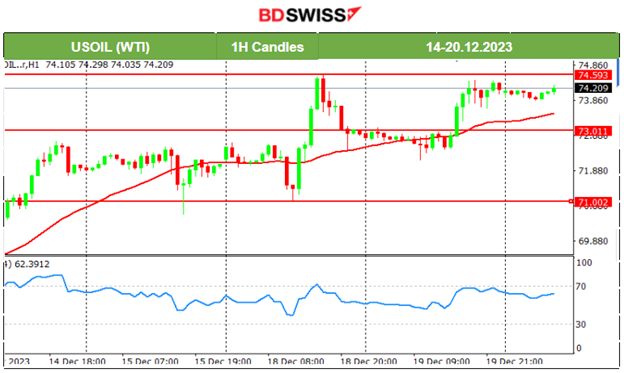

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The price 72.5 USD/b which served as a critical resistance level was broken on the 18th Dec. This level was tested many times without a breakout until that date. The path eventually remained sideways after the breakout and the retracement that followed. The price moved upwards breaking some intraday consolidation on the 19th Dec, testing again the resistance at near 74.6 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold jumped until it reached the resistance at near 2040 USD/oz and remained settled, around that level on the 15th Dec. The RSI signalled a bearish divergence and eventually price fell to 2017 USD/oz. Since the 18th Dec, Gold has experienced an upward movement. It reached the 2046 USD/oz level but could not break it. Today it seems that it will test that level again.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (20 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

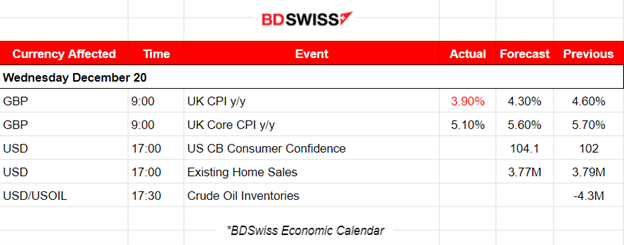

- Morning–Day Session (European and N. American Session)

The U.K.’s Consumer Prices Index (CPI) rose by 3.9% in the 12 months to November 2023, down from 4.6% in October. On a monthly basis, CPI fell by 0.2% in November 2023, compared with a rise of 0.4% in November 2022. Core inflation cooled unexpectedly, falling to 5.1% from 5.7%. This obviously fuels bets on Bank of England interest rate cuts next year. The market reacted with GBP depreciation at the time of the release. GBPUSD sharply dropped more than 50 pips so far.

CB Consumer Confidence report for the U.S. is going to be released at 17:00. Financial confidence is a leading indicator of consumer spending and data that influence central bank decisions. The market might cause USD pairs to move greatly at the time of the release. The index number is expected to be reported higher, let’s see.

General Verdict:

______________________________________________________________