Previous Trading Day’s Events (15.05.2024)

Retail sales were unexpectedly flat last month. The reports suggested that domestic demand was cooling which is favourable data for the Fed.

“The economic data are picture perfect in favour of interest rate cuts,” said Christopher Rupkey, chief economist at FWDBONDS. “The country is not out of the woods from the threat of inflation, but we can start to see the end of the forest.”

The CPI rose 0.3% last month after advancing 0.4% in March and February.

President Joe Biden said prices were still too high. Donald Trump’s campaign blamed inflation on the Biden administration’s policies and touted the former president’s America First agenda of low taxes, lower prices and higher wages.

Annual inflation: In the 12 months through April, the CPI increased 3.4% after climbing 3.5% in March. The annual increase in consumer prices has slowed from a peak of 9.1% in June 2022. Inflation accelerated in the first quarter amid strong domestic demand after moderating for much of last year. Last month’s slowdown was a relief after data on Tuesday showed a jump in producer prices in April.

______________________________________________________________________

Winners vs Losers

Silver remains on the top with 4.76% gains this week and 11.97% for the month. USD pairs (USD as quote) have climbed to the top of the list as the dollar weakens post lower than lower-than-expected inflation figures.

______________________________________________________________________

______________________________________________________________________

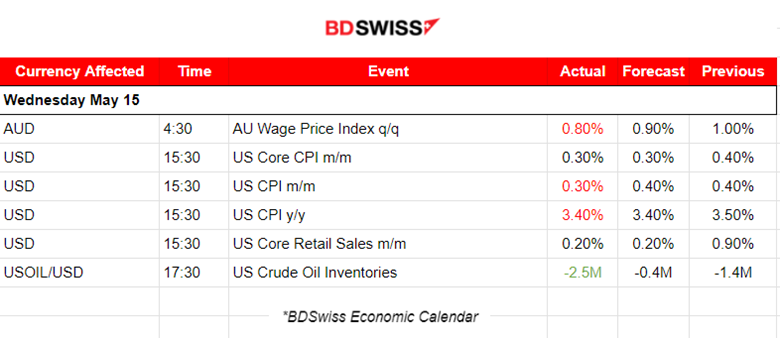

News Reports Monitor – Previous Trading Day (15.05.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

In Australia, the seasonally adjusted Wage Price Index (WPI) rose 0.8% this quarter and 4.1% over the year. The market has not reacted significantly to the news. AUD depreciation was only momentarily. An 8-pip drop in the AUDUSD was observed. The pair reversed immediately to the upside.

- Morning – Day Session (European and N. American Session)

At 15:30: CPI data for the U.S. were released showing that monthly inflation fell to 0.3% and core inflation was reported lower and as expected at 0.3% as well. The annual inflation figure was reported lower as well, at 3.4% versus the 3.5% inflation announced in April. The result obviously confirmed expectations of cooling after the extremely weak and latest labour market data releases driving a weaker dollar and putting a bid on US equities.

The Empire State Manufacturing Index was reported at -15 points, a more negative figure, showing that business activity continued to decline in New York State.

Core retail sales in the U.S., released at the same time came out weaker than expected in April matching the recent data that recorded a fall in consumer sentiment and a rise in inflation expectations amid sticky inflation and higher interest rates.

The USD pairs were affected greatly by an intraday shock as the USD depreciated greatly during the release of these figures. According to CME’s Fedwatch Tool the probability of the Fed keeping a steady interest rate policy comes around 67% while for an interest rate cut in September comes at 53.1%.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (14.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair moved early to the upside as the dollar was weakening ahead of the U.S. CPI report. At the time of the release though the USD depreciated heavily due to lower-than-expected inflation figures causing the pair to jump. It retraced quite soon to the 30-period MA but later continued with its upward path. Now a retracement is quite probable. The Fibonacci setup on the H4 chart shows that the 61.8 level is at near 1.085. The daily chart shows that the pair moved aggressively upwards, exponentially increasing the odds that at some point a reversal should take place. Will the USD weaken eventually further in a way that will break that resistance, triggering a rapid upward movement? Probably this will take place in September… Until then, any aggressive weakening is not expected.

USDJPY (14.05.2024) 15m Chart Summary

USDJPY (14.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving downwards partly due to the USD’s early weakening but also due to the JPY strengthening. At the time of the U.S. CPI news and Retail sales figure releases the USD depreciated heavily causing the pair to drop heavily. If you watch our webinar yesterday at 15:30, you will see that we expressed the view that USDJPY would have a high chance to move lower due to 2 forces taking place; 1) USD depreciation and 2) JPY appreciation. After a long period of JPY weakening it was apparent that early yesterday the JPY started an unusual strengthening, even before the news. The USD on the other hand started to weaken and the CPI news triggered a dive. The probability of USDJPY continuing to the downside was high enough to form a great risk-reward opportunity.

___________________________________________________________________

___________________________________________________________________

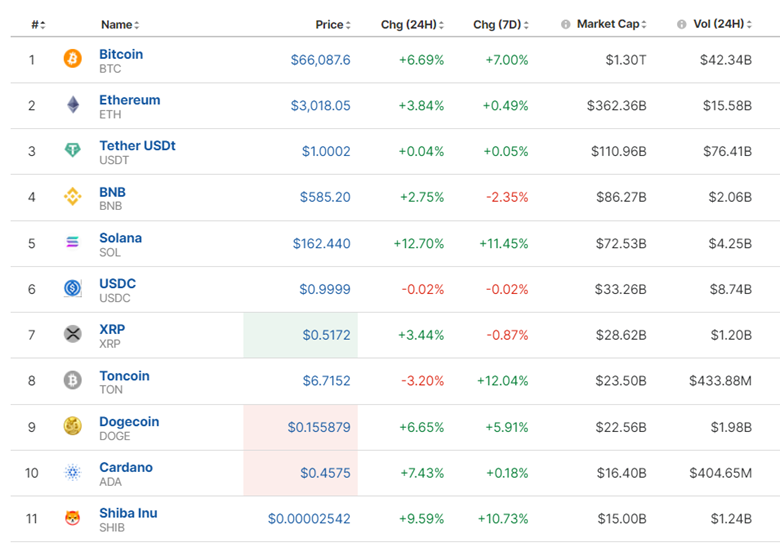

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 13th of May Bitcoin jumped, correcting fully from the drop on the 10th of May. After the price reached the resistance at near 63,285 it retraced to the 30-period MA and the 61.8 Fibo level. On the 14th of May, the price continued with a reversal to the downside, crossing the 30-period MA on its way down and reaching against the support area near the 61K USD before retracing eventually to the MA. On the 15th of May, the U.S. CPI news triggered a jump in the Crypto to just over 66K which has not settled to.

Bitcoin enthusiasts are now gaining confidence that Bitcoin is returning to the upside as it reaches again 66K and settles there. The CPI news obviously triggered the jump. Short-term intraday traders could consider the Crypto’s volatility and think about a potential retracement until the end of this week.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

After the U.S. CPI report showed a slowdown in inflation, the Crypto market saw a boost. Gains were recorded overcoming the losses of last week. In the past 24 hours, most Crypto above showed performance with Solana reaching 12.70% gains, the highest for that period.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The PPI news on the 14th of May caused a breakout of the support near 5,211 USD causing the index to drop to 5,195 USD before it reversed immediately to the upside. This happened due to the dollar effect, we saw that the dollar index reversed immediately as well to the downside at that time. The level 5,240 USD was quite significant for resistance and that was broken on the 14th of May after the index’s continuation to the upside. The other indices experienced similar paths. On the 15th of May the U.S. CPI report caused dollar depreciation and a jump in U.S. stocks.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 14th of May, the PPI news caused its price to drop and test again the support at near 77.40 USD/b before it eventually retraced to the 30-period MA. On the 15th of May Crude oil broke the support at near 77.40 USD/b and moved lower near the support at 76.40 USD/b before it reversed to the upside. During the U.S. CPI news volatility levels grew with Crude oil to experience first a fall and then a full reversal. It crossed the 30-period MA moving rapidly to the resistance near 78.78 USD/b with room for a potential retracement to the mean at near 78.20 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 14th of May, the support held and the price reversed to the upside correcting from the drop. Gold crossed the MA on its way up and moved higher to the resistance at 2,360 USD/oz. The dollar weakening helped gold to stay higher. After the release of the U.S. CPI news on the 15th of May, Gold jumped higher following the USD’s depreciation, reaching the resistance at near 2,397 USD/oz. Retracement followed, however, it has the potential for more until the depicted 61.8 Fibo level. The unemployment claims figures today could distort the retracement analysis so caution is advised.

______________________________________________________________

______________________________________________________________

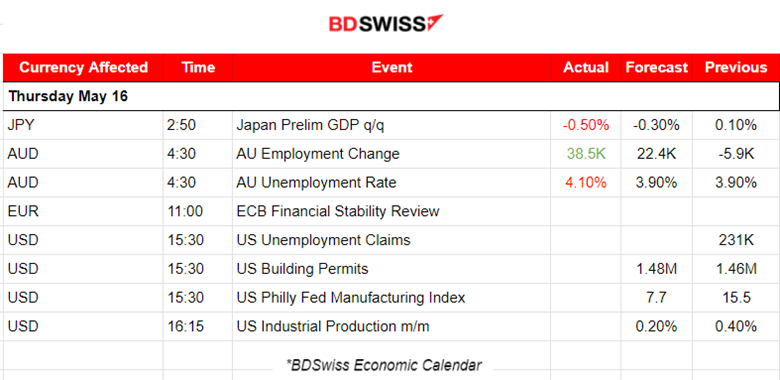

News Reports Monitor – Today Trading Day (16 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Labour market data for Australia were released at 4:30. Employment growth was reported 38,5K stronger than the consensus expectation. The unemployment rate though was reported higher by surprise at 4.10%. Obviously, mixed data here. The news caused the depreciation of the AUD and a drop of the AUDUSD pair to around 23 pips. Retracement eventually took place to the intraday mean.

- Morning – Day Session (European and N. American Session)

At 15:30 the jobless claims figure will be released and USD pairs could be affected at that time with an intraday shock. The previous figure was indeed a surprise as it was reported quite high. We could now see a lower figure reported, however, will that be enough for the USD to stabilise after the weak CPI report?

General Verdict:

______________________________________________________________